guvendemir

The market tends to paint whole asset classes with a broad brush. For example, energy pipeline companies were considered to be risky during most of 2020 through 2021, as reflected by their low share prices during much of this time. This was an error in judgment, as pipeline companies have a ‘toll road’ like business model that’s fee-based and are not subject to the same level of commodity price pressures as upstream producers.

The same dynamic appears to be playing out in the commercial mortgage REIT industry, with names like Ares Commercial Real Estate Corp. (NYSE:ACRE) trading well below their intrinsic values. This article highlights why now is a great time to pick up ACRE’s beaten down shares before the market wakes up to the undervaluation.

Why ACRE?

ACRE is a leading REIT that is engaged in originating commercial real estate loans. It’s externally managed by its “big brother” Ares Management (ARES), a well-known asset manager that also happens to manage Ares Capital (ARCC), the largest BDC by asset size. ACRE benefits from its affiliation Ares Management, as the latter has $50 billion in real estate assets under management, thereby giving deal flow and line of sight that it would not otherwise have.

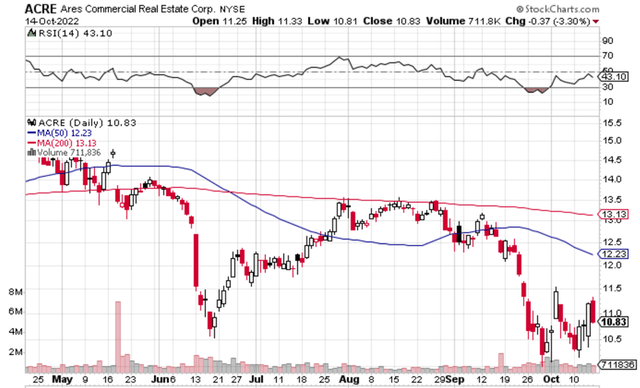

To get a sense for how cheap ACRE has gotten, it’s now trading well below its 200- and 50- day moving averages of $13.13 and $12.23, respectively. As shown below, ACRE is not trading towards its 52-week lows as the bear market rally has largely failed. This appears to be a knee-jerk reaction by the market to sell all assets that are perceived to be risky.

ACRE Stock Technicals (StockCharts)

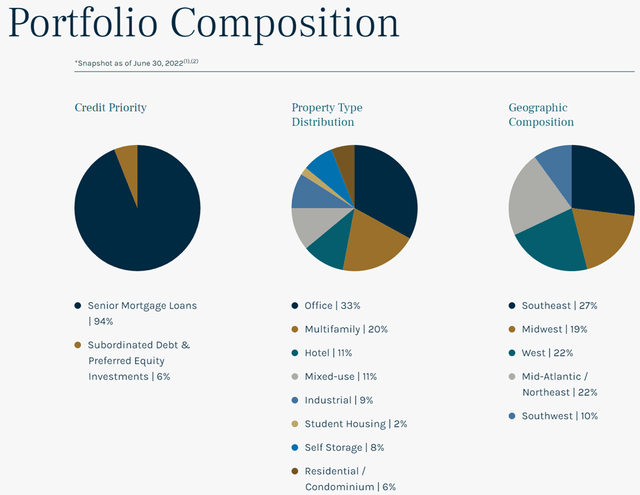

I believe this is an overreaction due to overly negative investor sentiment. ACRE is a rather sizeable commercial mortgage REIT with 78 loan investments comprising a large $2.6 billion principal balance. ACRE carries a diversified portfolio that has lower exposure to the office segment than peer Blackstone Mortgage Trust (BXMT), with 33% exposure as opposed to 41% for BXMT.

ACRE Portfolio Mix (Investor Presentation)

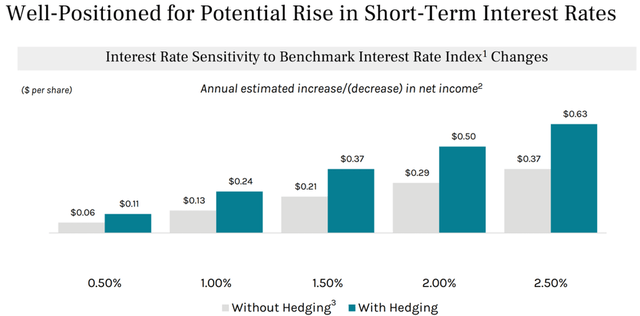

Management has an experienced track record and prizes safety of principal, with 94% of its investment portfolio being senior loans and 98% of its loans are floating rate, while just 64% of its debt is either floating rate or not protected by interest rate hedging. As such, ACRE is benefiting from rising rates, as it enables them to raise interest rates it charges to borrowers. As shown below, ACRE could see a net $0.10 to $0.13 annual EPS boost for every 50 basis point hike in interest rates.

ACRE Interest Rate Sensitivity (Investor Presentation)

Meanwhile, ACRE maintains plenty of balance sheet flexibility, with a 2.3x debt to equity ratio and $190 million of available capital. This gives the company significant cushion against unanticipated credit losses, as noted by management during the recent conference call:

Our strong capital position is supported by the issuance of 7 million common shares raising just over $100 million of common equity at a premium to book value during the second quarter. This healthy level of available capital should benefit us as we selectively invest in an increasingly attractive spread opportunity and maintain a significant level of protection from unexpected credit losses.

We also continue to match funds our assets and liabilities and hedged a significant portion of our floating rate debt through interest rate swaps to fix the interest rates on some of our longer-term liabilities. As a result, our company’s future net interest income is positioned to benefit from additional increases in market rates. Currently, over 90% of Ares’ loans are sensitive to further increases interest rates as loans and LIBOR floors have paid off or current LIBOR rates are above most LIBOR floors.

The recent share price decline has driven ACRE’s dividend yield to a very attractive 12.2%. The $0.35 dividend (including $0.32 regular and $0.02 special dividend) is well-covered by the $0.38 in distributable EPS in the latest reported quarter.

Lastly, ACRE appears to be rather cheap at the current price of $10.83 with a price to book ratio of just 0.75x. As shown below, ACRE is now trading towards its 10-year lows. S&P Capital IQ has a consensus Buy rating on ACRE with an average price target of $14.67, translating to potentially strong double-digit annual returns including the dividend.

ACRE Price to Book ( Seeking Alpha)

Investor Takeaway

The recent selloff in ACRE appears to be overdone as the market appears to be overreacting to negative sentiment. This is considering ACRE’s strong business fundamentals, prudent portfolio structure, and floating rate loans that are positioned to continue benefiting from rising rates. As such, I find the recent market sell off as presenting a solid opportunity for income investors to lock in ACRE’s high and covered dividend.

Be the first to comment