porcorex

It’s not easy to see one’s investments fall in value, especially if one isn’t getting paid a dividend for holding onto them. Layering into non-dividend paying companies can also be tricky, as no one can predict an absolute bottom and when a turnaround may happen. That’s why it pays to hold onto high-yielding stocks whose dividend can be of solace amidst market turmoil.

This brings me to Ares Commercial Real Estate (NYSE:ACRE), which now throws off a 10% yield after falling in sympathy with the rest of the market. This article highlights why now may be a great time to buy into this high yielding name, so let’s get started.

Why ACRE?

ACRE is a leading REIT that is engaged in originating commercial real estate loans. It’s externally managed by its “big brother” Ares Management (ARES), a well-known asset manager that also happens to manage Ares Capital (ARCC), the largest BDC by asset size. ACRE benefits from its affiliation Ares Management, as the latter has $50 billion in real estate assets under management, thereby giving deal flow and line of sight that it would not otherwise have.

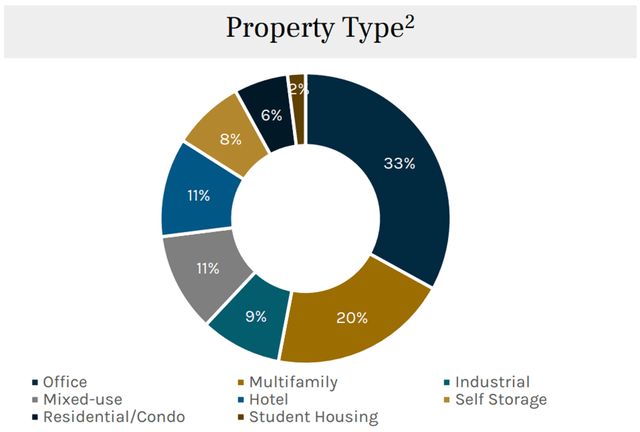

ACRE has a well-diversified loan portfolio that’s secured by properties in different sectors including office, industrial, retail, multifamily, and hotel. ACRE’s focus on middle-market lending enables it to avoid the competitive pressures that larger players face in the CRE lending space.

This, combined with the company’s strong underwriting standards, has resulted in ACRE delivering consistent and strong financial results, enabling over 100% dividend coverage over the past 5 years. As shown below, office and multifamily make up just over half of the loan portfolio, with the other segments comprising the remaining half.

ACRE Portfolio Mix (Investor Presentation)

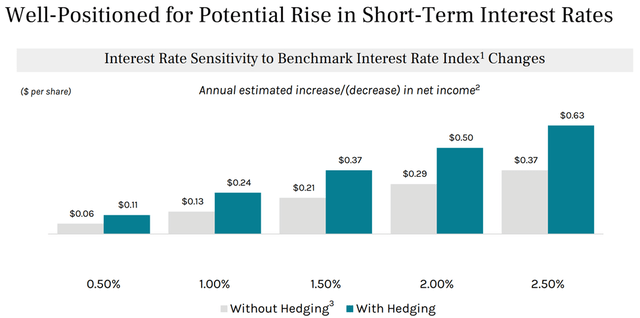

At present, ACRE has 78 loan investments comprising a $2.6 billion principal balance. These loans generate an unlevered effective yield of 6.3%. Moreover, ACRE targets safety of principal, as 99% of its loans are senior loans with 98% of them being floating rate. This makes ACRE well-positioned for rising rates, especially considering the recent hot August inflation report, with the market now baking in a 100% chance of a 75 basis point rate hike by the Federal Reserve this month.

Meanwhile, ACRE continues to generate strong fundamentals, collecting 99% of its contractual interest and generating distributable EPS of $0.38 during the second quarter, which more than covered the $0.33 regular and $0.02 supplemental dividends. Also encouraging, ACRE is shifting towards the healthier multifamily segment. This is reflected by the closing of $356 million worth of senior floating rate loan commitments across 8 transactions, 80% of which is collateralized by multifamily and self-storage properties. Just 2 loans are on nonaccrual status, representing less than 2% of the overall portfolio.

Moreover, ACRE maintains a reasonable amount of leverage, with a 2.3x debt to equity ratio. It also carries 8 different sources of financing and 46% of its debt is non-recourse. ACRE is also well-positioned for rising rates, as more of its investments are interest rate sensitive compared to its debt. This was articulated by management during the recent conference call:

Currently, over 90% of Ares’ loans are sensitive to further increases interest rates as loans and LIBOR floors have paid off or current LIBOR rates are above most labor floors. However, as we have put in place fixed rate financing on our recent $150 million term loan and in 2021, entered into a hedge position that currently has a notional balance of over $500 million and locks in LIBOR at 21 basis points only about 2/3rd of our liabilities are sensitive to changes in LIBOR, putting the company in a very positive position to benefit from further increases in interest rate.

As shown below, ACRE expects to see incremental net income growth with additional interest rate hikes.

ACRE Interest Rate Sensitivity (Investor Presentation)

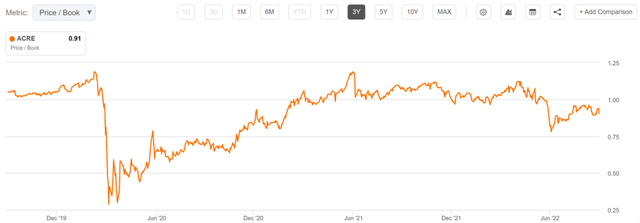

Lastly, I see value in the stock at the current price of $13.26, sitting well below its 52-week high of $16.45 from as recently as April. Also, at 0.91x price to book value, it sits towards the low end of its 3-year range. Sell side analysts have a consensus Buy rating on ACRE with an average price target of $15.08, translating to a potential one-year 24% total return including dividends.

ACRE Price/Book (Seeking Alpha)

Investor Takeaway

Income investors looking for a high-yielding stock that’s well-positioned for rising rates should consider Ares Commercial Real Estate. ACRE has a strong loan portfolio, consistent financial results, reasonable leverage, and sector diversification. Plus, the stock is now well below its 52-week high and pays its investors an attractive 10% regular yield plus supplemental dividends for an added kicker.

Be the first to comment