peakSTOCK

Ardelyx

Our favorite holding period is forever. – Warren Buffett

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 21, 2022.

Whenever your biotech company approaches a binary event, you should pay extra attention to your stocks. After all, a binary event is one that usually “makes or breaks” your stock. The two most common binary events in biotech are an upcoming data release and a regulatory approval decision. That being said, Ardelyx (NASDAQ:ARDX) is experiencing a run-up toward its November Advisory decision for the lead medicine, tenapanor. This one deals with tenapanor’s second label indication (i.e., for high blood phosphate related to chronic kidney disease). In this article, I’ll present a fundamental analysis of Ardelyx while focusing on the upcoming regulatory decision.

StockCharts

Figure 1: Ardelyx Chart

About The Company

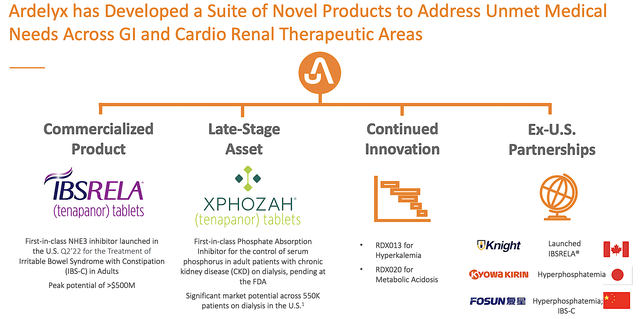

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. Operating out of Waltham, Massachusetts, Ardelyx is focused on the innovation and commercialization of novel therapeutics to serve the unmet needs in diseases relating to the GI tract, heart, and kidneys.

Viewing the figure below, you can see that Ardelyx is marketing tenapanor under the brand Ibsrela for irritable bowel syndrome (i.e., IBS). That aside, the company is expanding tenapanor as a first-in-class drug for hyperphosphatemia. Moreover, there are two additional earlier-stage assets for hyperkalemia and metabolic acidosis.

Ardelyx

Figure 2: Therapeutic pipeline

Market Opportunity & Innovation

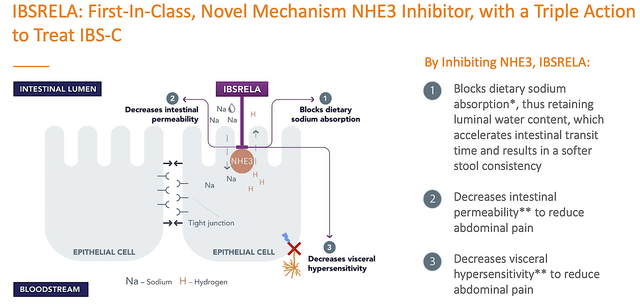

Shifting gears, let us walk through the crucial fundamental developments of Ardelyx. As a first-in-class (NHE3 inhibitor), tenapanor was approved for IBS and thereby launched in the US in Q2 this year. Only three months into the launch, sales tallied at $1.3M for the said quarter. Here, you can appreciate several advantages that differentiated tenapanor from competitors.

That is to say, this drug is the first of its kind. As a general rule of thumb, the first of something usually garners much more success than other “me too” developers. In a market launch, you want to either be the first or be different.

Ardelyx

Figure 3: Tenapanor mechanism of action

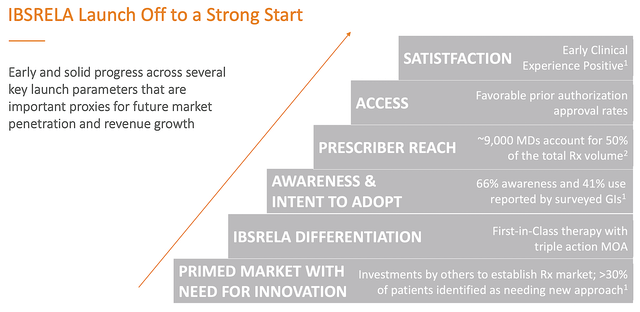

As proof in the pudding of tenapanor’s market success, an independent market survey by Spherix Global Research showed promising early launch results. As shown below, doctors’ satisfaction is quite positive. Moreover, 66% of docs are now aware of the drug with 41% intent to prescribe it later.

Ardelyx

Figure 4: Tenapanor’s encouraging early market adoption

In terms of size, the global IBS market is estimated at $1.4B in 2022 and growing at the rapid clip of 13.2% CAGR. In the USA, there are currently 11M patients afflicted by this condition with 4.9M prescriptions generated. Altogether, there are 9K physicians accounting for half of all prescription volume.

Based on those findings, you can expect sales to ramp up much quicker in the next few quarters. Nevertheless, you should not expect blockbuster results because Ardelyx is “going at it alone” in USA commercialization. Moreover, the market size is a bit small.

Ardelyx

Figure 5: Estimated market size

Label Expansion

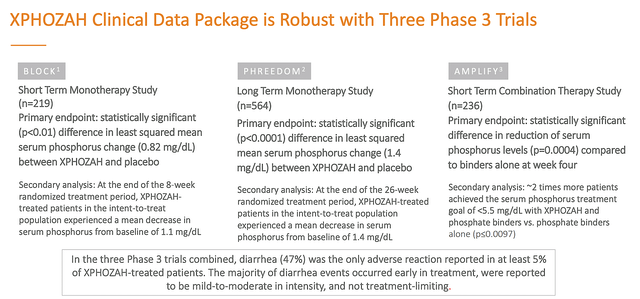

As you can appreciate, Ardelyx is expanding tenapanor’s label for hyperphosphatemia (an abnormal elevation of phosphate) in the blood in adult patients suffering from chronic kidney disease (i.e., CDK) who are on dialysis. For this potential label expansion, tenapanor would be marketed under the brand Xphozah.

Back in July 2021, Ardelyx received a Complete Response Letter (i.e., CRL) from the FDA. The Agency is concerned that the magnitude of the serum phosphate lowering is “too small and of unclear significance.” Seemingly outraged, Ardelyx disagreed with the FDA and filed an appeal. According to the President and CEO (Mike Raab),

We are saddened by this communication from the FDA and what it means for the patients and the physicians who treat them. We continue to believe tenapanor represents an important, first-in-class treatment option for patients with elevated phosphorus. We do not agree with the FDA’s subjective assessment on the clinical relevance of the treatment effect of tenapanor in our studies which met all clinical endpoints agreed upon by the FDA. In our view, the serum phosphorus lowering data generated with tenapanor in all of our clinical studies is meaningful and clinically significant. We will work with the agency to address the issues raised and, to the extent possible, find an expeditious path forward.

It is interesting to note that the supplemental New Drug Application (i.e., sNDA) for tenapanor is supported by data from three Phase 3 studies of more than 1K patients. With the results being statistically significant (i.e., p-value all less than 0.05), the findings are real rather than random occurrences. But the question is whether the phosphate reduction is large enough to have “clinical significance.”

Ardelyx

Figure 6: Strong clinical data

While the FDA believes it was not “clinically meaningful,” other physicians argued other otherwise. Dr. Glenn Chertow (Chief of the Nephrology Division and Professor at Stanford) stated,

Neither peritoneal nor hemodialysis provides adequate control of serum phosphorus, obligating the use of medications. Unfortunately, phosphate binders – individually or in combination – rarely yield consistent control of serum phosphorus concentrations, and persistent hyperphosphatemia leads to dystrophic calcification, accelerated arteriosclerotic vascular disease, fractures, and other complications that profoundly affect patients’ lives. The effect of tenapanor on serum phosphorus observed in the Phase 3 trials is clinically meaningful. Tenapanor would enable a substantially larger fraction of patients to reach target serum phosphorus concentrations and would yield significant clinical benefit to this vulnerable population.

With the appeal in place, the next step for the company is the Advisory Committee (i.e., ADCOM) meeting that is tentatively scheduled for November 16. Depending on the outcomes of the panel’s vote, that can substantially move the needles on your stock. As such, you would definitely want to “read the tea leaves” here. In my opinion, this is a high-risk event that you should tread carefully. More importantly, you need a definitive game plan.

Financial Analysis

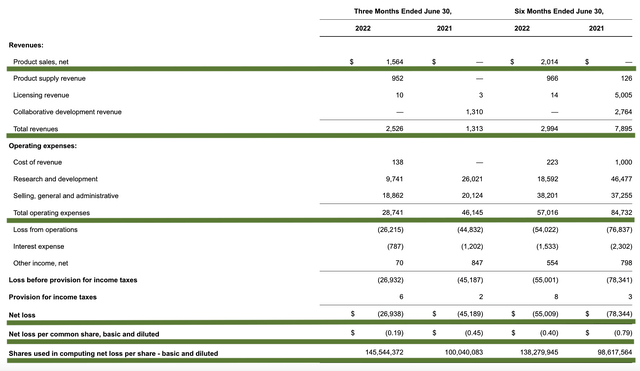

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should assess the 2Q2022 earnings report for the period that ended on June 30.

As follows, Ardelyx procured $2.5M in total revenues compared to $1.3M for the same period a year prior. Of that figure, $1.5M accounts for total product sales. Only three months into the launch of Ibsrela, you can see that’s a promising figure. That aside, the research and development (i.e., R&D) for the respective periods registered at $9.7M and $26.01M.

Ardelyx

Figure 7: Key financial metrics

About the balance sheet, there were $81.0M in cash, equivalents, and investments. On top of the $2.5M in quarterly revenue and against the $28.7M quarterly OpEx, there should be adequate capital to fund operations into 2Q2023 before the need for financing. Simply put, the burn rate is a bit high relative to the cash position. As such, the company is likely to raise capital soon.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Ardelyx is whether tenapanor would receive enough votes of confidence to convince the FDA to reverse its prior decision. I see this as a very high-risk event. A positive event will catapult the shares to a new high. In the case of subpar ADCOM votes, your stock is likely to tumble significantly.

Conclusion

In all, Ardelyx is an interesting company that is in a transitional period in its life cycle. The company already enjoys some level of success in the early launch of tenapanor for IBS. Nevertheless, that indication alone won’t generate blockbuster results. The company needs to gain more success at expanding its label for hyperphosphatemia as well as having more pipeline development. Doing so is easier said than done. But with the right partners and more label expansion, Ardelyx can do it. The first step forward now is that it has to clear the upcoming label expansion of tenapanor for hyperphosphatemia set in November.

Be the first to comment