MagicVova/iStock via Getty Images

Introduction

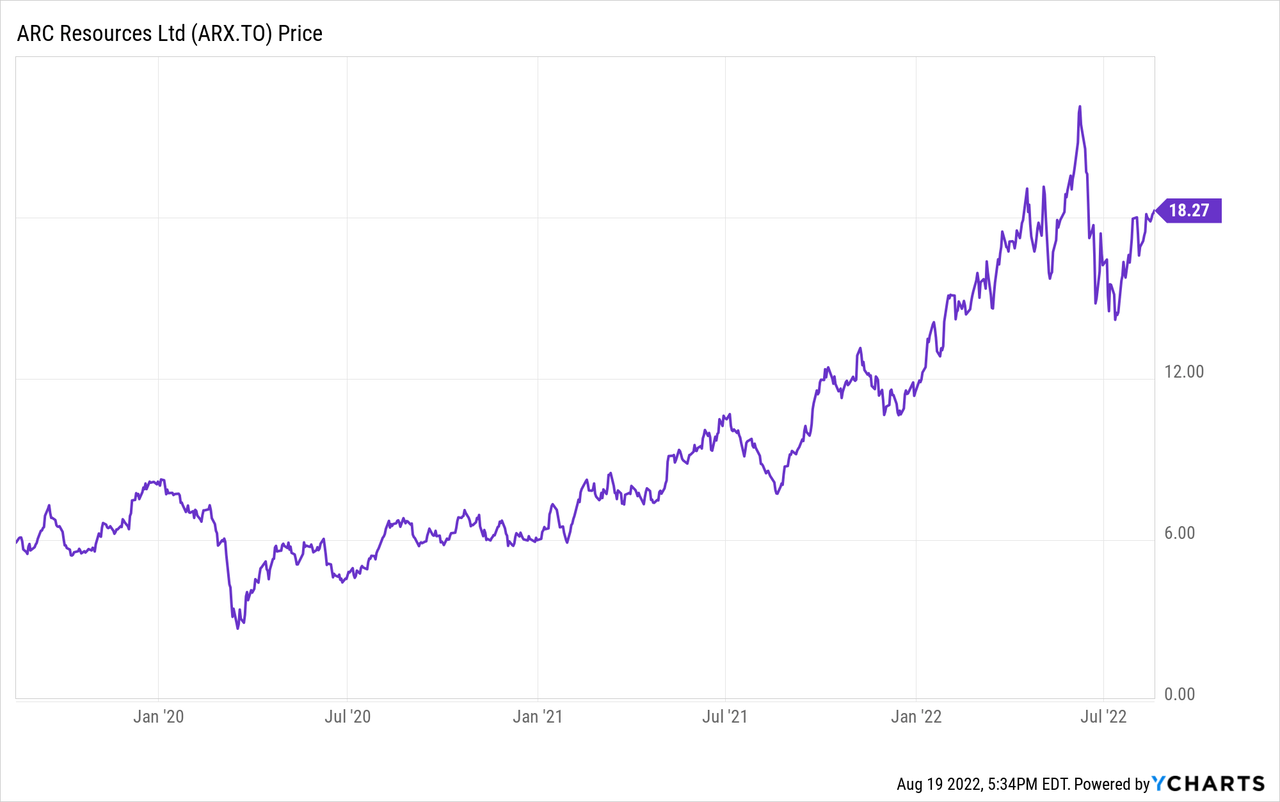

ARC Resources (OTCPK:AETUF) (TSX:ARX:CA) is a large natural gas producer in Canada. Thanks to its diverse points of sale it’s not just depending on the local AECO natural gas price which greatly reduced the risk. Thanks to the very strong cash flows, ARC’s net debt is evaporating very fast and this improves the risk/reward ratio. Back in January I estimated the company would be able to post a positive free cash flow of approximately C$2B, and as we are now halfway to the current financial year, this appears to be a good moment to check if the company is still on track.

ARC Resources is a Canadian company, and I would recommend trading in the company’s shares using the primary listing on the TSX. ARC is trading with ARX as its ticker symbol, and the average daily volume in Canada is almost 5 million shares per day for about C$90M in monetary value. I will use the Canadian Dollar as base currency throughout this article.

The very strong natural gas price provided very obvious tailwinds

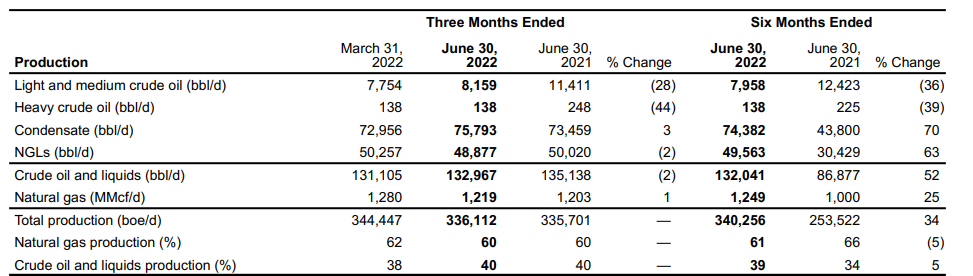

ARC Resources produces in excess of 340,000 barrels of oil-equivalent per day, and as you can see below, the vast majority consists of natural gas which accounted for about 62% of the total oil-equivalent production in the second quarter.

ARC Resources Investor Relations

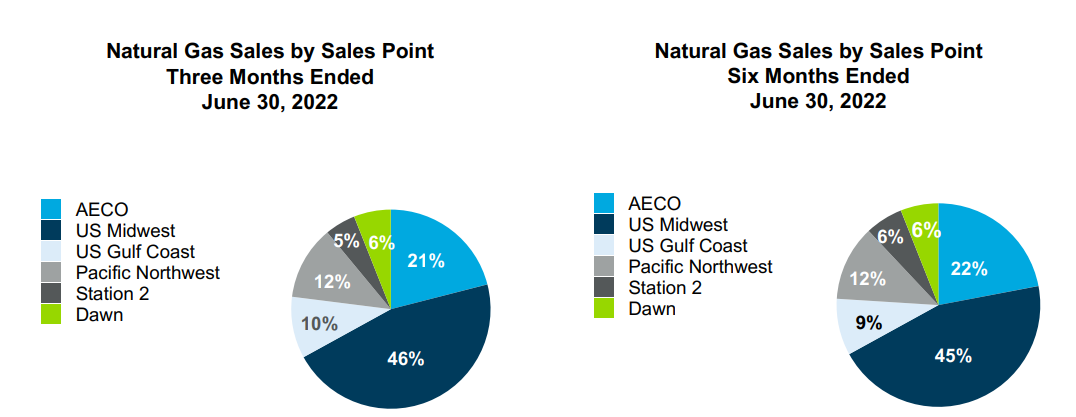

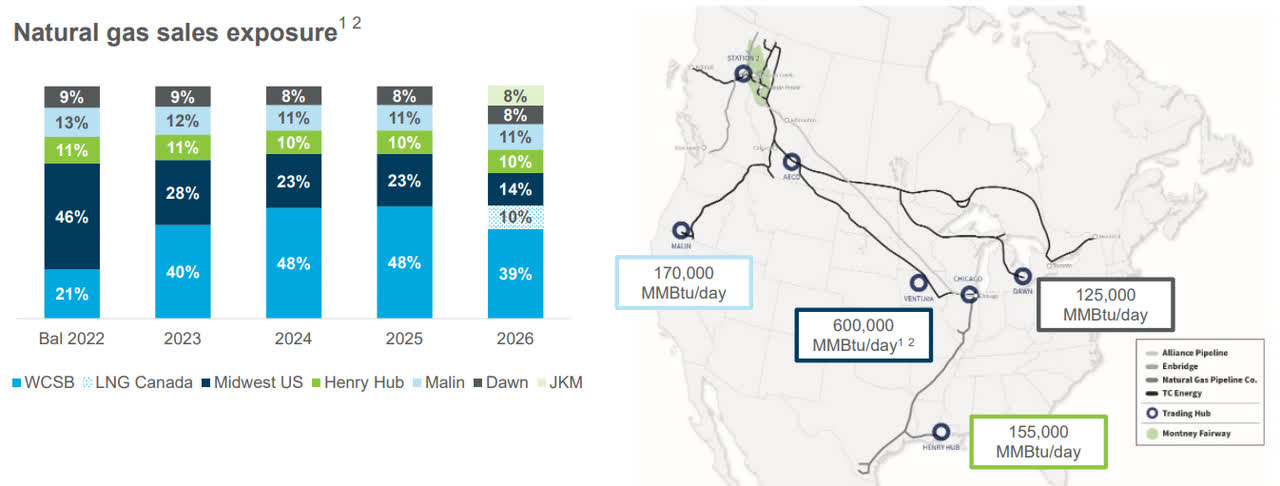

Thanks to ARC’s extensive network and negotiated access to pipelines, the average realized price for the natural gas production is a blend of several benchmark prices. Only 21% of the natural gas was sold based on the AECO price, and as you can see below, the vast majority of the natural gas production gets shipped to the United States.

ARC Resources Investor Relations

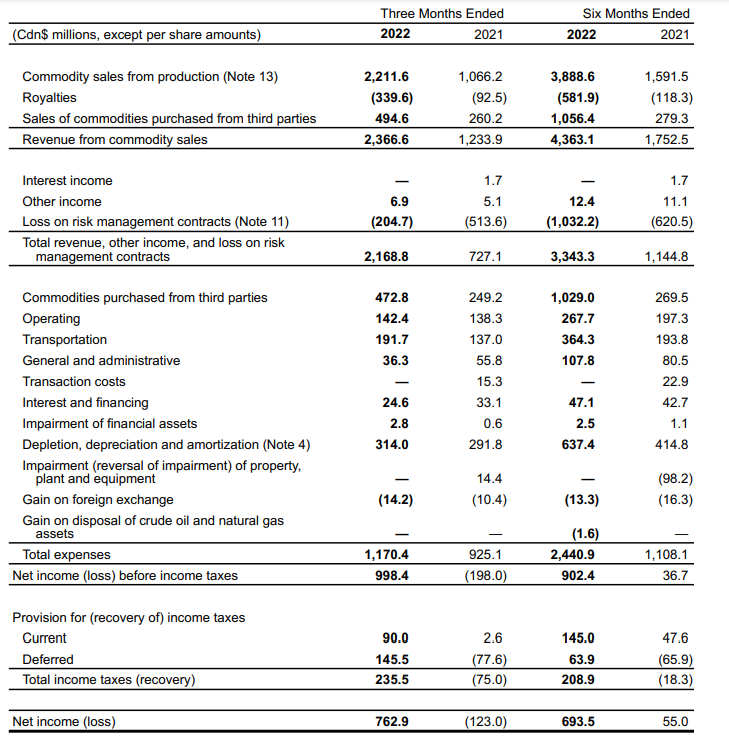

The total revenue in the second quarter was approximately C$2.2B (more than twice the revenue generated in the same quarter last year), and after adding the revenue from the sale of third party commodities and deducting the royalty payments (which almost quadrupled compared to a year ago due to the gliding scale nature), the total reported revenue was just under C$2.4B and just under C$2.2B after deducting the loss on hedges which exceeded C$200M.

ARC Resources Investor Relations

The total amount of operating expenses increased to C$1.17B but that’s also mainly related to the third party commodities. Excluding this, the reported revenue would have come in at almost C$1.7B while the operating expenses would have been just C$700M.

ARC reported a pre-tax income of just under C$1B and a net income of C$763M which equals approximately C$1.13 per share. An excellent quarter despite recording an additional C$200M+ in hedging losses.

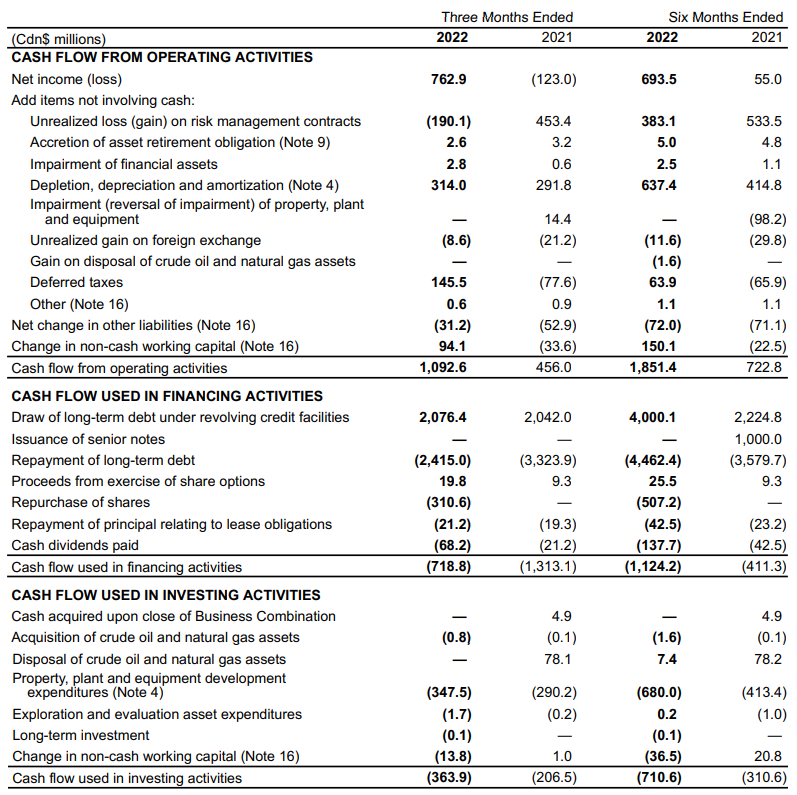

It’s important to understand the hedging losses remained limited to just over C$200M as ARC also included almost C$200M in hedging gains in the total result. That’s clearly visible in the cash flow statement where about C$190.1M in hedging gains are deducted from the result again. Despite this, the operating cash flow was a very respectable C$1.09B, and after deducting the C$94M contribution from changes in the working capital position and the C$21M in lease payments, the adjusted operating cash flow was approximately C$980M.

ARC Resources Investor Relations

You also notice how the Q2 cash flow result includes a C$146M in deferred taxes that are added back to the equation. These deferred taxes are related to the higher income tax pools claimed relative to the DD&A expenses and the unrealized gain on the aforementioned hedges. So in this specific case, I’m okay with not deducting the C$146M in deferred taxes from the cash flows again.

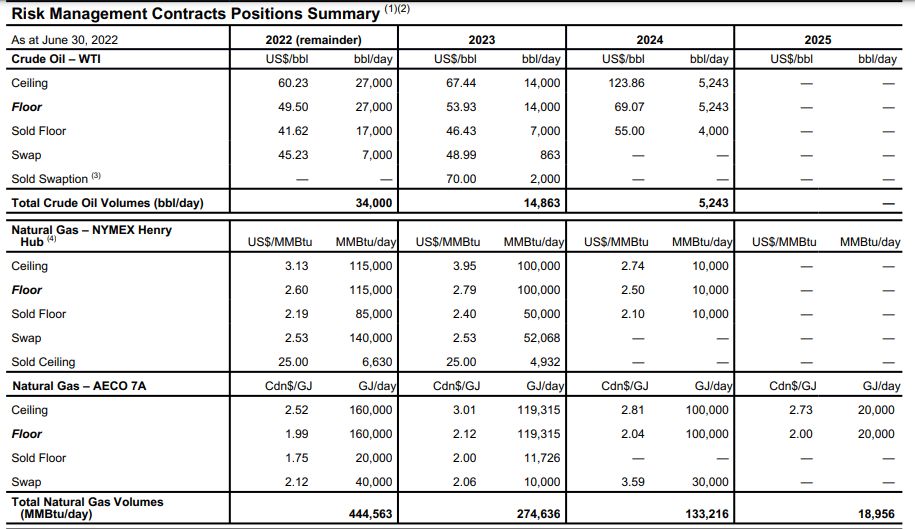

The total capex incurred during the quarter was approximately C$350M resulting in a net free cash flow of C$630M. And keep in mind this includes about C$400M in realized hedging losses. Those hedges will continue to play a role in the next few quarters, but as the oil and natural gas prices have been decreasing again, I expect the wild swings we have seen in the past few quarters to be more moderate going forward.

ARC Resources Investor Relations

Meanwhile, the company continues to focus on selling its natural gas (and oil) in several different markets.

ARC Resources Investor Relations

What’s next for ARC?

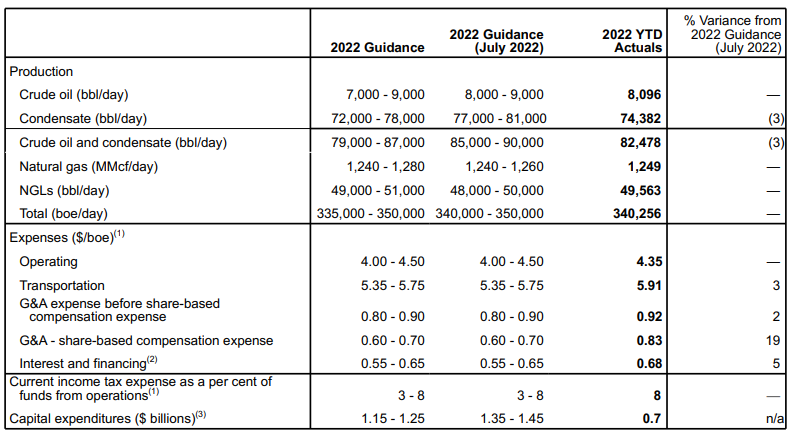

Subsequent to the very strong second quarter, ARC has updated the full-year guidance. The company now expects to produce an average of 340,000-350,000 boe per day which would be in line with the Q2 performance but this also means an important step up from the average production rate in the first quarter.

ARC Resources Investor Relations

We also see the capex has been scaled up to C$1.35-1.45B which means the average quarterly capex bill will be approximately C$350M. This confirms the Q2 capex is very reasonable to use as a longer term assumption: ARC is neither overinvesting nor underinvesting. This also means that based on the Q2 performance the full-year free cash flow result would come in at approximately C$2.5B.

The fact that the natural gas price has decreased is not very relevant here as the Q2 free cash flow result of in excess of C$600M already includes approximately C$400M in hedging losses. So the realized natural gas price was already substantially lower than the market prices.

Investment thesis

Plenty of reason for ARC to continue its very aggressive share buyback program. Since the start of the buyback program in September last year, ARC has already repurchased close to 10% of its share count and has signalled its intentions to extend the repurchase authorization. ARC did warn investors it is basing its buyback pace on the discrepancy between the share price and the intrinsic value which is calculated using lower commodity prices than the forward strip prices. I appreciate that comment as it means ARC is buying back stock when it makes sense and isn’t just buying back shares for the sake of buying shares.

I currently have no position in ARC (as I chose to establish positions in smaller companies), but if I would be looking at a senior producer of natural gas, ARC would be high on my list.

Be the first to comment