NicoElNino

Over recent years, many investors have been on the hunt for ultra-high dividend-yielding investments. Until this year, interest rates were at extreme lows worldwide, making it difficult for investors to find high-yielding investments without inappropriate risk. Today, interest rates are much higher, improving the dividend investing landscape, but still generally low compared to inflation. Further, the U.S economy is now in a technical recession, meaning many at-risk companies may soon see significant declines in earnings and solvency.

Put simply, now is likely not a great time to load a portfolio with riskier stocks. Many sectors have seen valuations that have declined from 2021 levels, but dividend yields have generally not risen with interest rates. This is particularly true for the highest-yielding market segments, such as mortgage REITs. In my opinion, mortgage REITs are far riskier in today’s environment than many investors understand. Many analysts focus on the high dividend yields in the sectors and not the extreme asymmetric risk potential that comes with their immense leverage. These risks are only now starting to surface as higher mortgage rates slow the property market, but I believe most “mREITs” will face steeper permanent losses over the coming year.

The popular mortgage REIT Arbor Realty Trust (NYSE:ABR) is particularly interesting as it recently lost a quarter of its value in a few days, recouped much of those losses, and is potentially declining again. Arbor is different than many mREITs as it focuses on commercial multifamily bridge loans (as opposed to agency securities) and has additional operations in originations and servicing. On the positive, Arbor’s diversified platform reduces its exposure to interest rate risks (a critical risk in most mREITs), but the company has relatively large economic exposure.

There is a lot to like about Arbor, but there are countless articles regarding its virtues and virtually none that examine its ample risks. Many analysts focus on backward-looking data such as dividend increases and its historical dividend coverage, but not the fact that it’s been increasing leverage and has significant macroeconomic risk exposure. In today’s slowing economy, Arbor may be an unsuitable investment for many income-oriented investors.

A Closer Look At Arbor’s Strategy

Arbor operates through two primary businesses, its structured business, which primarily invests in bridge financing commercial mortgage loans, and its agency business which originates and services mortgage products for government-sponsored entities. The company’s structured business offers relatively stable cash flows with ample credit cycle exposure. In contrast, its originating business is highly cyclical, weakening as commercial sales low, but has some resiliency due to its mortgage-servicing counterparts.

Higher interest rates are troublesome for Arbor’s origination platform. Abror’s agency business operates by originating commercial mortgage loans and selling them to a government agency such as Fannie Mae (OTCQB:FNMA) (which packages them into mortgage-backed securities). In many instances, Arbor acts as the servicer for these loans, giving the company some income without taking on financial risk. In general, mortgage servicing rights appreciate mortgage rates because higher rates cause refinancing risk to decline. Surging rates have caused the MSR market to boom as many lenders look to the asset as a rare hedge against mortgage rates.

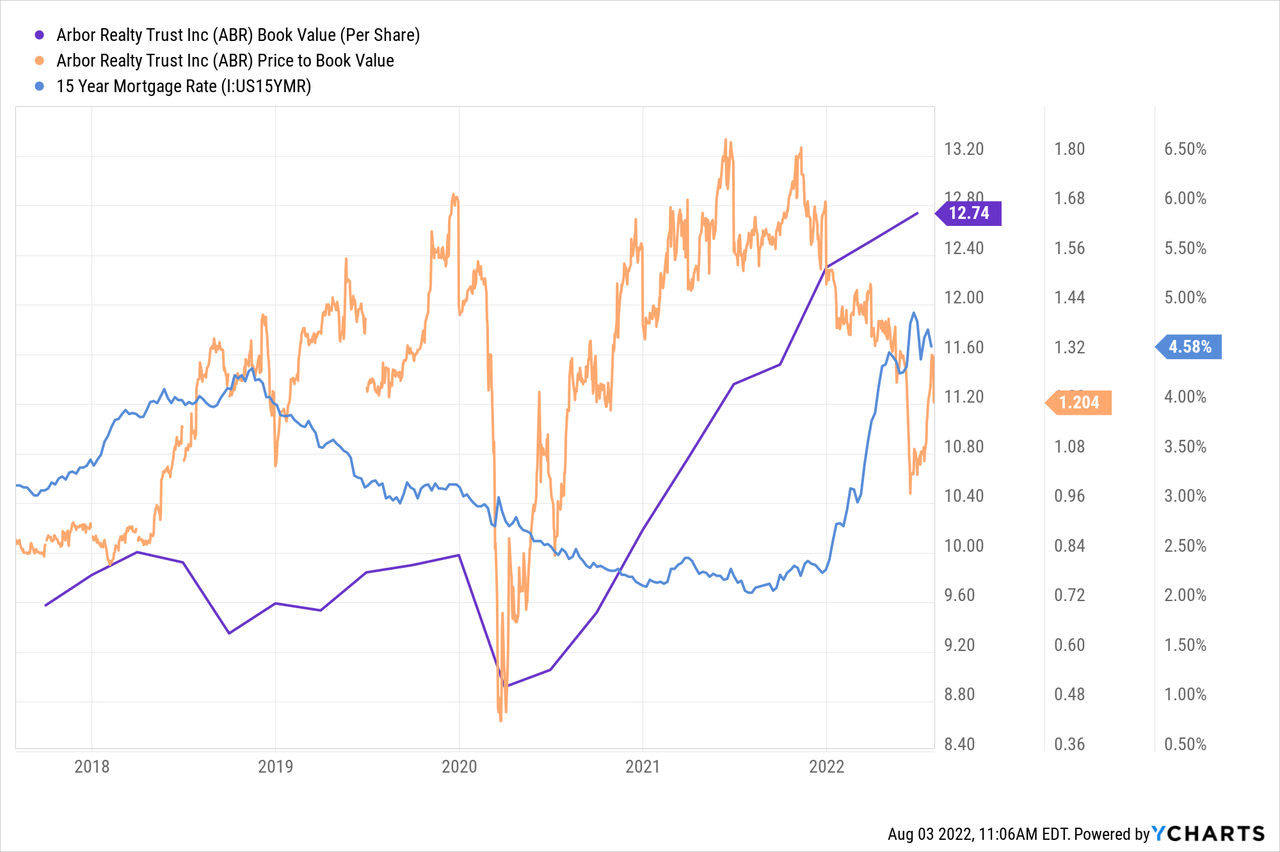

Arbor’s portfolio assets are generally short-term higher interest rate loans to commercial property owners. These assets have minimal direct interest rate risk compared to the portfolios of agency-centric mREITs like Annaly (NLY). As you can see below, the company’s book value has risen overall with the sharp rise in U.S rates:

Higher interest rates can be beneficial for Arbor’s structured business. That said, the firm faces indirect credit risk as a spike in interest costs can increase delinquencies. In Q2, 98% of Arbor’s structured business were bridge loans. Bridge loans are often made to borrowers looking to improve a property over a short period, repaying the bridge loan with a traditional loan after improvements are completed. These loans had a weighted-average yield of 5.47% and weighted-average months to maturity of 23.6, essentially two years.

Slowing CRE Market Burdens Arbor

The chief risk with these loans is a decline in property values since it would make borrowers unable to repay the bridge loan in full since they would not get sufficient traditional financing. The short-term nature of bridge loans exacerbates this risk. This risk has not been seen in recent years as commercial property values have steadily risen due to excessively low-interest rates. The spike in interest rates has caused the trend to reverse as commercial property sales volumes slow dramatically.

Inflation has also increased delinquency risks on bridge loans. During the company’s recent earnings call, its management noted its clients were seeing construction costs rise by upwards of 30% over the past year, causing Arbor to advise construction delays. Prime multifamily capitalization rates were still low at ~4.43% in Q2 but were up a significant 30 bps from the previous quarter. Most commercial real estate deals take many months to broker and close, so the prices and sales figures we’re seeing today are likely based on market fundamentals from early 2022 before rates rose dramatically. Given the degree to which rates have risen, I firmly believe capitalization rates will likely grow much higher and sales volumes much lower.

Inflation is also an indirect risk to Arbor as rising construction costs pinch borrowers. With the slowing sales market and likely rising capitalization rates (lower property values), Arbor’s borrowers will likely see costs grow, and sales decline. Real estate is a “low margin high leverage” business, so it appears likely many borrowers will struggle to repay their short-term bridge loans to Arbor. Arbor has collateral as its loans are generally the first lien, but that collateral may not be worth nearly as much as it was in 2021 as the market slows.

Arbor’s Leverage Compounds Risk

Rising interest rates create solvency risks not only for Arbor’s borrowers but also for the company itself. Arbor recently priced a $250M debt offering at 7.5% to repay a loan due this year at 4.75%. This means Arbor’s borrowing costs on refinanced debt have risen nearly 60%. As mentioned in its “Interest Rate Risk” segment of its last 10-K, the company has almost as much exposure to variable rate assets as it has variable rate debt. Still, its fixed-rate debt will become much more expensive over the coming years. The company’s fixed rate loans will have higher yields, pared by higher interest expense costs.

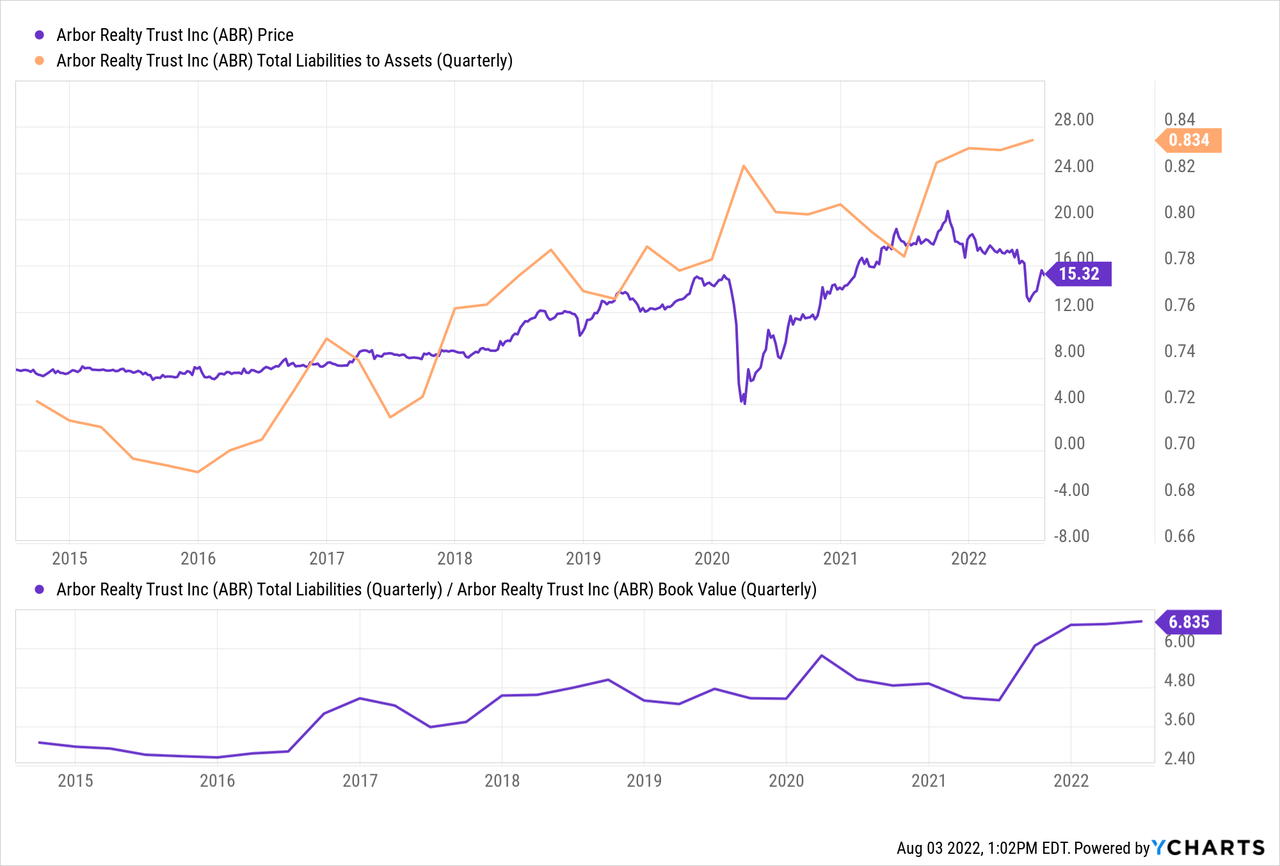

On the surface, the rise in interest rates should not directly negatively impact Arbor’s cash flows as it impacts assets and liabilities. However, more dramatic changes in net revenue and interest costs, combined with high leverage, can create significant income volatility. Arbor is a very highly levered company with a total liabilities to assets of 83.4%. The company also recently issued preferred equity, pushing its total liabilities-to-common-equity ratio up to 6.8X. See below:

Arbor has increased its overall leverage over recent years and has the highest leverage since the Great Recession. For common stock investors, Arbor has significant leverage essentially in a relatively high-risk portfolio. Most of its assets carry high exposure to a slowdown in the commercial property market, with its largest segment (bridge loans) having greater risk due to the downturn in property sales and the construction cost crisis. Before now, Arbor’s high leverage allowed it to deliver strong cash-flow yields on its equity. However, as Warren Buffett said, “Only when the tide goes out do you discover who’s been swimming naked.” In my view, the tide is going out, and Arbor is certainly not positioned conservatively.

The Bottom Line

Overall, I am very bearish on ABR and believe the stock will likely decline over the coming year as its balance sheet risks surface and its originations slow. This downside risk is catalyzed by the negative, but lagging, impacts of rising interest rates on the commercial property market. Given Arbor’s significant leverage, the downside risk on its common shares is quite considerable as it would not take a substantial increase in loan losses (as a percentage of loan values) to destroy much of its common equity. In my view, its current provisions for loan losses are minimal compared to the potential risk from today’s macroeconomic environment on commercial property.

Be the first to comment