jetcityimage

Dear readers/subscribers,

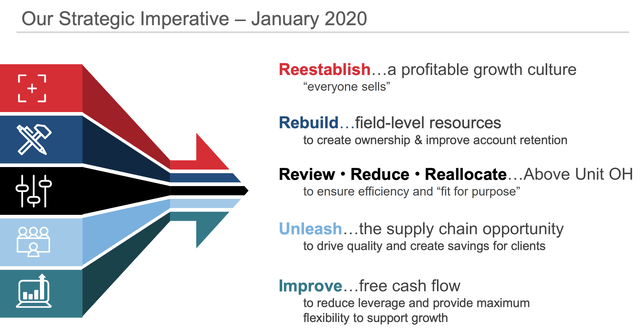

You may recall my article on Aramark (NYSE:ARMK) and how I considered the company in my last article, deeming it to be a hold in the face of some of the major risks to the business and to Aramark specifically. I wasn’t shy with the fact that I did like the plan for value creation though, and called it a “BUY” at $28/share.

However, at its lowest point after my article, it did not drop below $30/share, which meant that I never bought any shares of ARMK – and then came a turnaround in the market.

Let’s see where this puts investors in terms of potential upside.

Aramark – Revisiting one of the largest food service companies.

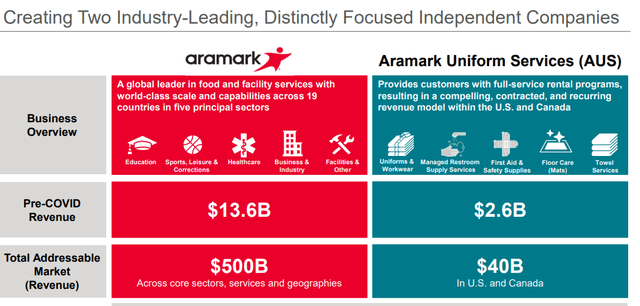

Aramark is far from an unattractive or “bad” company. It’s a world-leading and massive provider of food, facilities, and uniform services to customers typically found in healthcare, business, industry, correctional facilities, sports, and education.

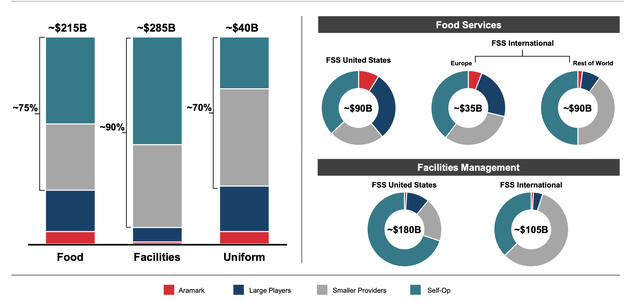

By size, it’s the largest around (by far), and it has international exposure that enhances this appeal, with a top-3 position in foods and facilities, and #2 in uniform services. It employs hundreds of thousands of people and serves millions of guests – many of which are inmates currently part of the correctional services segment.

Because when Aramark is spoken about in Media, this is typically where the highlight goes – the fact that the company does a whole lot of food for prisons and the like. Many investors associate Aramark strictly with food services, without realizing that the company’s uniform services are in reality what provides over half of the annual revenues of the business. With a 60-year history and on a current transformation journey, there is a lot happening to this business.

The company was actually through a management buyout in 1984 when the company management and employees increased ownership to over 90%, which lead in turn to the 2001 IPO. The company was delisted 6 years later as it went private but was re-listed back in 2013. I consider it unlikely that the company would or will go through the same “spin” again.

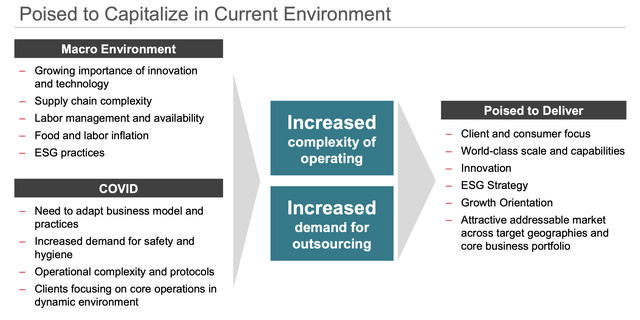

There is only one perspective that you can really hold on Aramark – and that is, that from a fundamental point of view, it’s a very attractive company to look at. This disregards some of its inherent and systemic issues, but from a high level and looking strictly at how it operates, it’s attractive. The company addresses a $540B TAM, with a $215B food market alone and another $285B in Facilities. The company’s current market share is comparatively very small, with room for further consolidation.

The company has a moat. In many of the locations it serves, Aramark has exclusive rights to provide food and beverage services. The company is also responsible for hiring, training, and supervising the majority of the associated personnel, in addition to managing payables and receivables/supplies and management for the items and meals sold. The company also provides plant operation, maintenance, housekeeping, energy management, groundskeeping, and general services.

How can this be anything but extremely attractive?

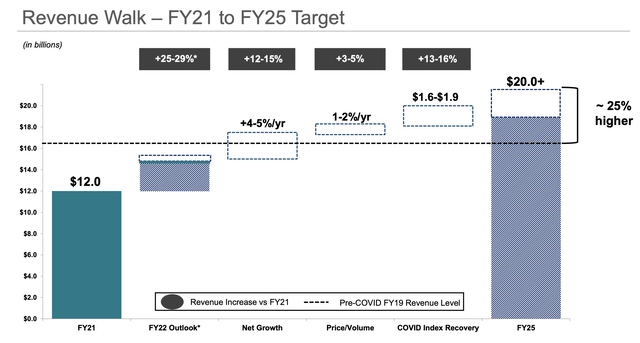

Recent results are published as little as 4 days ago, with revenue growth of 24%, and at 111% of pre-COVID-19 levels, meaning Aramark has fully recovered. It’s driven by pricing, net growth, and base recovery, all of which are working.

Not just the top-line is improving. Operating income is up 50% in 4Q22, and despite ongoing inflation from wages, pricing, and logistical costs, the company saw margin improvements of 136 bps, which when you consider what the company does, is very impressive indeed.

EPS almost doubled for the quarter – up to $0.29 – and is up positive for the full year as well. Aramark, therefore, delivered the highest annual revenue in history. And this is part of what is shaping the current narrative for the company.

The company has very lofty targets for 2025. It’s too early to say whether these will be realized, but I believe the current trends do speak for the market starting to consider them to be close to guidance here. These goals are driven by its organic revenue growth target, which came in close to expectations, margin expansion, which is also working, and recoveries in COVID-19-affected regions – which again, is also working.

When looking at this, the company’s plan does not look unrealistic. The fact that the company is consistently winning new contracts, and despite risks and scandals is retaining accounts, means that investors are prone to overestimating the impact of company risks in this investment.

That includes me.

Because risks to Aramark are neither small nor “silent/quiet”.

Aramark has a long history of controversies – including but not limited to labor law violations, and food safety issues (with substandard food for inmates that literally made people sick and was maggot-infested). Notable school clients include the Chicago Public Schools, various correctional facilities, and the entire Ohio Department of Rehabilitation and Correction.

I said in my first article on Aramark that the company has some work to do with regard to its practices and images, and it pays off to follow this as an investor. I’m all for cost control, but not at the expense of breaking contracts – and serving spoiled food goes right under that sort of issue. Over time though, it seems that both Aramark’s customers and Aramark itself consider these scandals the “price of doing business” – and we can’t really see any visible massive effect on the company’s bottom line.

The company recorded a solid activity increase across the company portfolio, with significant recovery in sports, education, business/industry, healthcare, and in facilities services. Uniforms are up as well, driven by rental revenue increases. The company also seeks to deliver additional value by slicing off the uniform services, which aren’t burdened by the company’s food issues, into its own distinct businesses with separate targets.

I mentioned before that I do like the company’s path to value creation and going forward here. The question becomes, in light of the absolutely solid FY22, if I went slightly too conservative for the company’s targets given how things have performed here.

Aside from COVID-19, which was a massive impact on the business, the company has been absolutely solid over time since its relisting. COVID-19 meant a “reset” for the company’s earnings and expectations, but the fact is that a 2025E EPS of over $3 on an adjusted basis isn’t out of line if we consider where the company moved before COVID-19. Add the value-creation plan to this, and we can start to understand what people see here.

Aramark – Valuation

I have difficulties reconciling the company’s reputation and flows with a premium, which is why I’ve been hesitant to allow for a premium in the forward-looking share price.

However, I’m prepared to state that I may have been too conservative, and assigned the company a too high discount based on trends, which evidently do not bear a material long-term business impact. If Aramark needs to provision a few million when their services, serving tens of millions, don’t reach the quality they’re aiming for, then that is what they will do.

The valuation remains problematic because the company’s trend ignores how far things have fallen even in 2022A when we consider the company on an unimpacted basis.

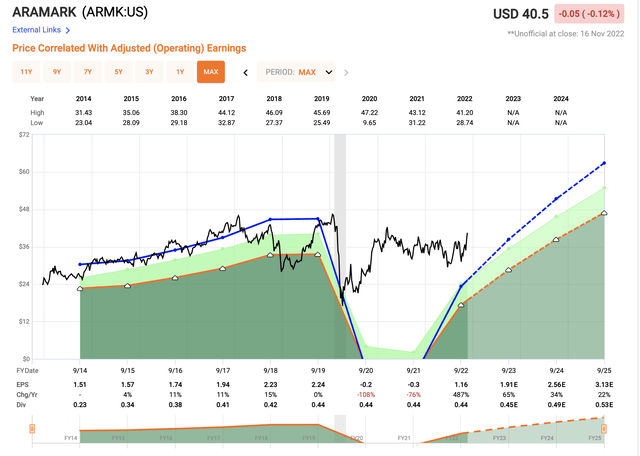

ARMK valuation (F.A.S.T Graphs)

Normalized multiples are currently reaching over 33x, which is well beyond where any company of this sort should be trading. Yes, there’s some upside to be had based on EPS expansion from forecasts. But this does not take into consideration that the company is fundamentally sub-par due to a BB- credit – not even investment-grade, and actually significantly below the level we’re typically looking for.

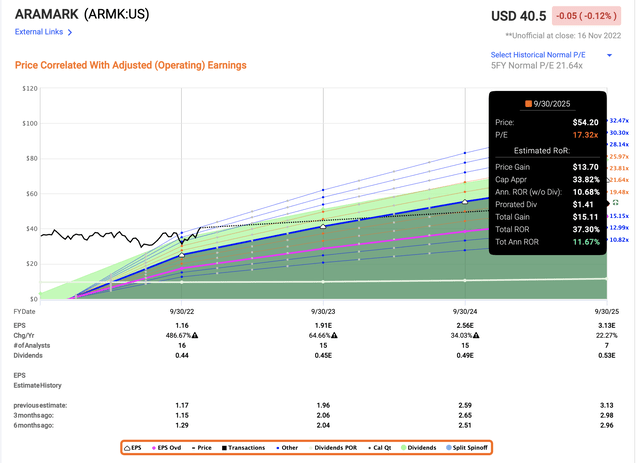

The company, outside of the pandemic, averages an 18-21x P/E range. When we apply this to the current 2023-2024 forecasts, this gives us an upside between 17-20% annually, and even the recent surge has not canceled this upside. We’re still at 20% annually for a 21.6x and double digits for anything above a 17x P/E.

Aramark Upside (F.A.S.T graphs)

The management’s tone is very positive. I also won’t argue that the future is positive.

Based on the company’s recent performance, any EPS growth would be positive – and I do like some of the plans that are being worked for Aramark.

The question remains whether we can accept a 20x P/E premium for a company with BB-, with close to nil in forecast accuracy. My continued answer to this continues to be “no”.

Remember, we’re in a market situation where many things are actually quite cheap. Many quality companies are on sale.

And someone is asking us to consider Aramark in such a situation?

Certainly, I could – but not at this multiple, and we need to see cheaper price here. My previous target was $28/share. I now view this price as being too low. I would bump my price target to $34/share, to better reflect a normalized upside in the longer term.

I view the company’s longer-term trajectory as valid, it’s just a question of how steep this actually will turn out to be in relation the expectations.

We do have some dividend issues. The yield is little north of 1%, which is well below inflation and what you can expect from most other businesses.

To that, we have the fact that dividend growth for this company is very slow. You really can’t expect the business to grow the payout all that quickly. This puts anything except capital appreciation at a secondary importance. Combine this with the credit rating and some of the issues in Aramark, and this is how i justify a price target that’s quite a bit below the standard analyst average.

Thesis

My thesis for Aramark is as follows:

- The company is a theoretically attractive business with an eye for food service, uniforms, and various sorts of services for organizations that are attractive customers (education, sports, corrections, etc.). However, the company is hampered by poor fundamentals and a surprisingly deep reputation for food quality negligence and labor law violations that need to be seriously considered prior to invest.

- At the right valuation, this company can deliver you an upside of no less than 15-20% annually, and even more attractive ones. But this requires you to take a substantial risk at this time, which is not present in more qualitative investments.

- Because of these factors, I consider Aramark to be a “HOLD” at this time, and I go no higher than $34/share in my price target. I have bumped this target though, to reflect the somewhat higher upside.

Remember, I’m all about :

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment