Peter Macdiarmid/Getty Images News

Investment Thesis

When it comes to the future of digital payments, Apple (NASDAQ:AAPL) is positioned to play a critical role in the underlying payment ecosystem. Whether or not Apple is successful in developing a full-scale bank, it will always play a quintessential role in the payments ecosystem because of its widespread distribution of digital devices that support Apple’s operating system.

Introduction

Inevitably, normal people just using their mobile devices will become smarter consumers. For example, customers using their mobile smartphone will automatically know if a retailer has the best products, at the cheapest prices.” – John Sculley, Moonshots

This quote is from Sully’s book he authored in 1997 and Scully was CEO of Apple from 1983 to 1993. The advances of cloud computing, enabled by advances in microprocessors, now allow for more than a billion people to get high-speed internet from the palm of their hand. As technology continues to enable our smartphones to do more and more capabilities with better processing speeds, phones become that much more beneficial for society because of new functionalities. For example, when phones could be used as a GPS and connect to the internet, it changed industries and new companies evolved to reshape better experiences for consumers. Uber did this for taxis and created numerous other ride-hailing services while it also serves a gig economy. Airbnb is another similar example of a marketplace but for vacation rentals.

As instant payments become a reality, made possible by new settlement layers like the lightning network, and digital payments allow for transactional and alternative data to be leveraged into underwriting at the point of sale, there are new opportunities for financial services to evolve the way brands engage their customers through incentives that are based on consumer behavior and real data.

Apple already offers numerous financial services from Apple Cash to the Apple Card, but the tech giant has made the news lately for its plans to bring more of its infrastructure in-house in an effort internally referred to as “breakout”. In this note, we will explore the financial services Apple currently offers as well as its recent acquisition of Credit Kudos, a fintech company with many similarities to Plaid, as Apple looks to have a large impact on the future of open banking.

Apple’s Financial Services Today

Apple.com

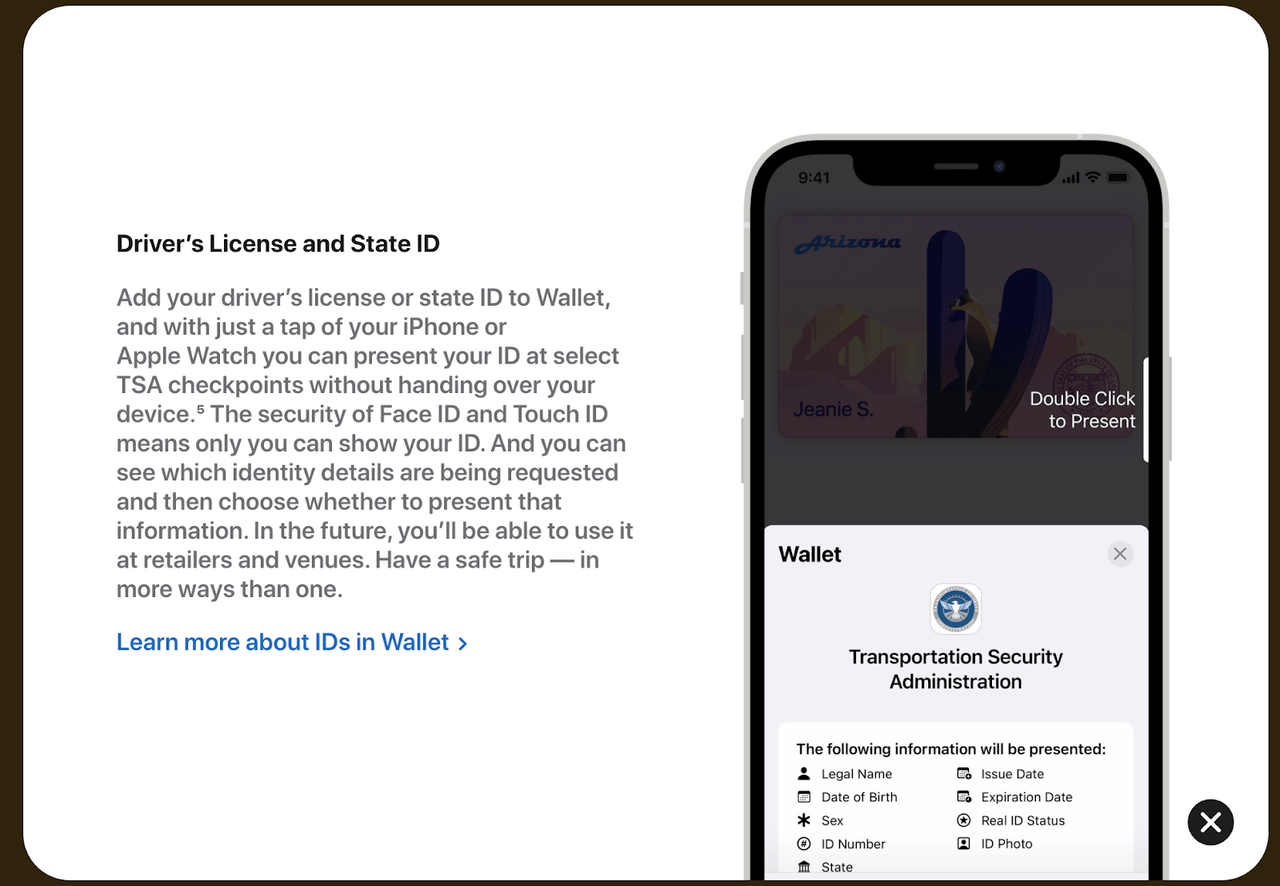

The Apple Wallet was introduced in September of 2012 and is an ideal, secure place to store credit and debit cards as well as other forms of identification, like a driver’s license or passport to tickets for a big event or even car keys. Apple associates one’s Apple Wallet with their Apple ID so that it’s easy to manage and use their payment cards in the wallet across Apple devices. The Apple Wallet is essentially the new app store for financial services as it makes it easy for companies to instantly launch payment services that are issued immediately.

The Wallet app lives right on your iPhone. It’s where you securely keep your credit and debit cards, driver’s license or state ID, transit cards, event tickets, keys, and more – all in one place.”

Apple.com

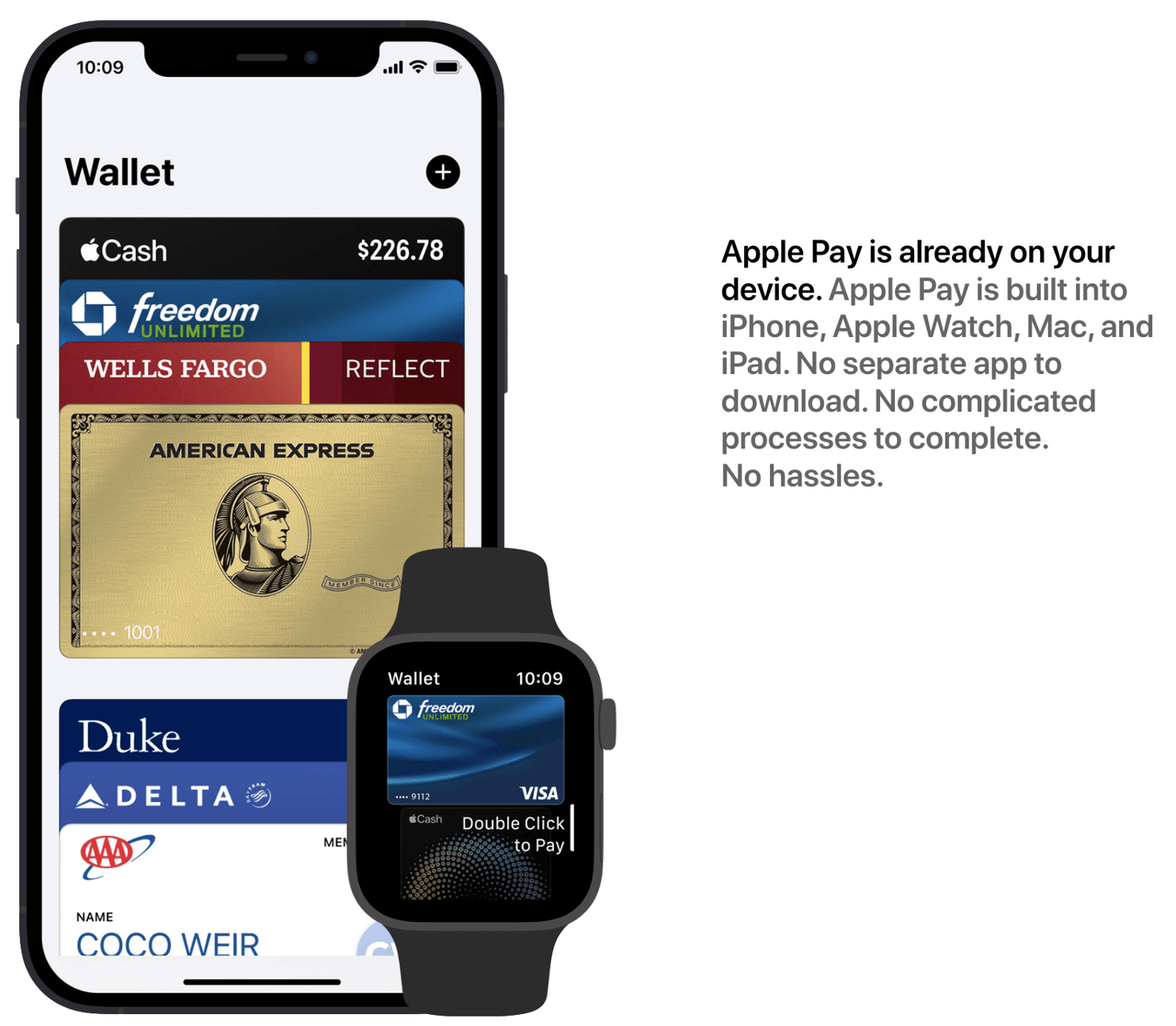

Apple Pay is the way that Apple users actually pay for their purchases seamlessly in-store, online, and in apps. Apple Wallet is just where different cards are stored, while Apple Pay is the component that is actually used when one goes to their Apple Wallet, verifies that they’re the authorized party through two-factor verification, and then the tokenized card is securely processed and sent to the merchant and their acquiring bank. Apple Pay secures the wallet’s information when it’s sent and is stored through an encrypted format on Apple’s servers. Apple Pay is now accepted at more than 85% of retailers in the U.S., highlighting the widespread adoption of digital payments. Currently, Apple charges the issuer of the card a 0.15% fee per credit card transaction and half a cent per debit transaction when somebody makes a purchase using Apple Pay.

Apple.com

Apple Cash is a P2P payment technology that is another way for people to send payments and is similar to PayPal’s Venmo (PYPL) or Block’s Cash App. Apple makes it incredibly simple to send payments through Apple Cash directly through one’s Messaging app or initiate a transfer using Siri. Apple Cash is a simple way for Apple users to send money to other people that use Apple Cash. Apple also uses this feature to offer rewards to people who have an Apple Card.

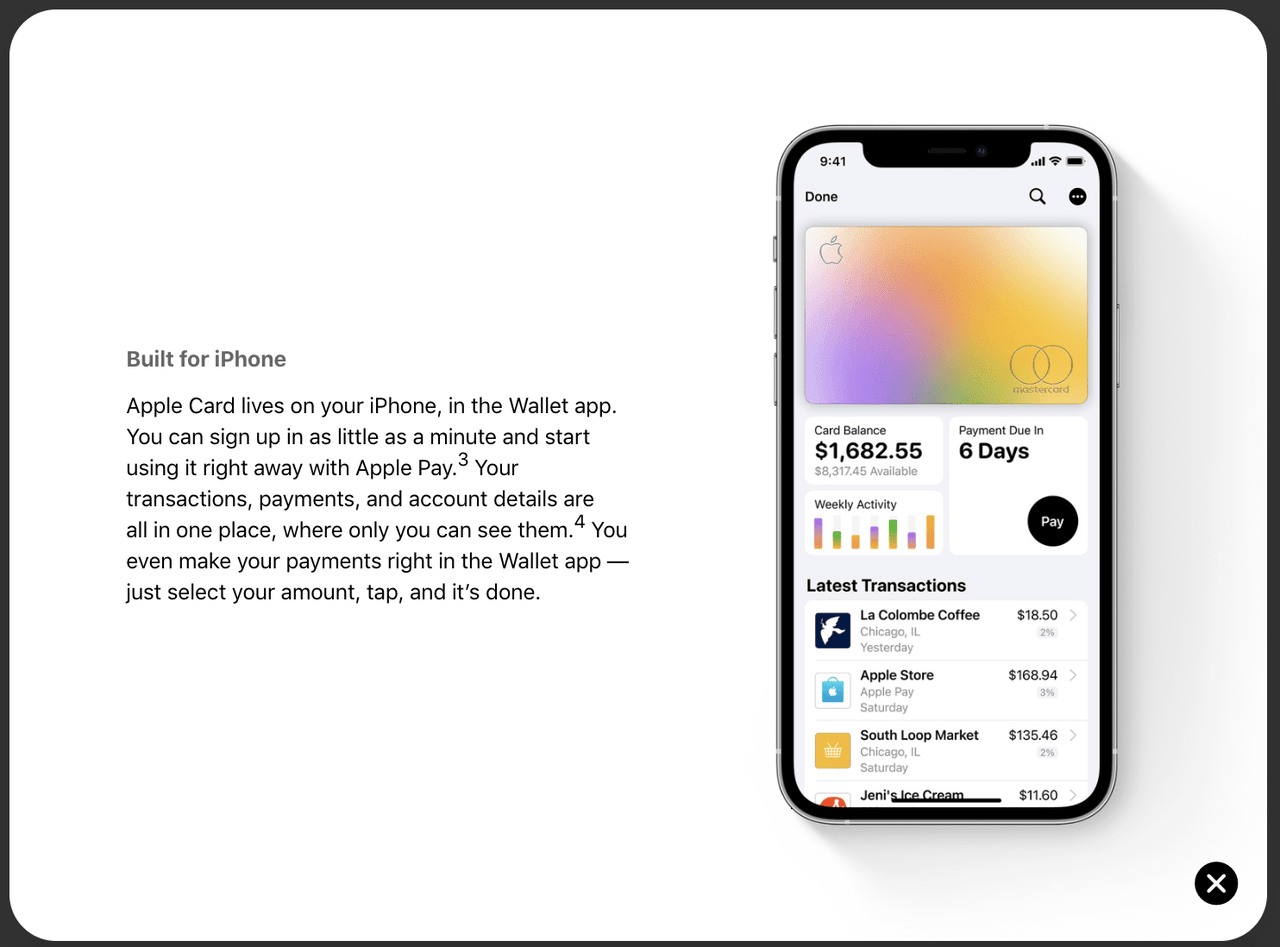

Apple Card

With Apple Card, we completely reinvented the credit card. Your information lives on your iPhone, beautifully laid out and easy to understand. We eliminated fees1 and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score.2 Advanced technologies like Face ID, Touch ID, and Apple Pay give you a new level of privacy and security. And with every purchase you get Daily Cashback.” – Apple Card Description

Apple.com

The Apple Card was launched in 2019 and is a credit card issued by Goldman Sachs while Apple Cash is issued by Green Dot Bank. The Apple Card is sponsored by MasterCard and CoreCard is the core processor. Apple is not offering anything groundbreaking in terms of new payment rails with the Apple Card, but it’s proved an effective means for Apple to get its foot in the door by offering one of the most crucial financial services, the ability to extend consumer credit. Consumer credit is extremely important because it’s how financial institutions or banks lend money and how money is created. At the end of 2020, there were 6.4 million Americans with Apple Pay, which means Apple leads the world in mobile payments volume processed outside of China.

The Apple Card’s been successful for Apple since its launch. The cashback rewards it offers immediately appear in one’s Apple Cash balance when one makes a purchase and is eligible to earn cashback rewards. This is a unique way for Apple to wedge its financial products into the wallets of its cardholders because Apple Card users need to deploy more of Apple’s in-house payment methods to unlock their rewards. As Apple continues to enable simpler ways for the cards in your Apple Wallet to seamlessly appear in apps that require payments, Apple will look to leverage the vast amounts of data within those third-party applications to offer tailored financial services that enable third-party applications to offer better payment experiences in their app, while also leveraging a user’s data within Apple’s operating system (if the user authorizes permission). The Apple Card is a good wedge for Apple to leverage as it’s starting to make a stronger push into offering financial services with more components in-house.

Fintech Acquisitions

During the summer of 2020, Apple announced that it acquired Mobeewave Inc. for $100 million, a technology start-up that enables mobile devices to accept and process payments without the need to connect an external device to swipe a credit or debit card. Last February, Apple announced a Square (SQ) competitor through a “Tap to Pay” feature on iPhones which enables U.S. businesses to accept Apple Pay and other contactless forms of payments directly from their iPhones. Apple announced that Stripe will be the first company to offer the Tap to Pay functionality for its business customers later this year, while more platforms are expected to follow. This will further increase the utility of the iPhone and other Apple products as Apple makes it easier for businesses to accept payments directly from their phones, removing the need for a standard payment processor at the point of sale.

More recently, Apple acquired Credit Kudos, a credit reference agency that was the first agency in the U.K. to combine transactional data (enabled by open banking) with loan outcome data to better understand one’s finances and offer them more appropriate financial services. Some of the information that Credit Kudos accounts for include income verification, affordability insights, risk insights, fraud prevention, and customer management. Credit Kudos uses this information to understand whether or not one should be in a position to pay back a loan at the time it is due. This acquisition will prove beneficial for Apple as it attempts to bring more of its financial services in-house as it currently depends on an issuing bank (Goldman Sachs) to do the underwriting for the Apple Card, while the acquisition of Credit Kudos will enable Apple with the tools to underwrite its financial products in-house, as well as develop a relationship with regulators. As Apple develops its own processing system, it will look to shift its dependence from CoreCard. Credit Kudos is also based in London, which will be beneficial for Apple as it looks to offer financial services in new regions like Europe.

Fair Value and Total Expected Return

To determine Apple’s fair value, we will employ our proprietary valuation model. Here’s what it entails:

-

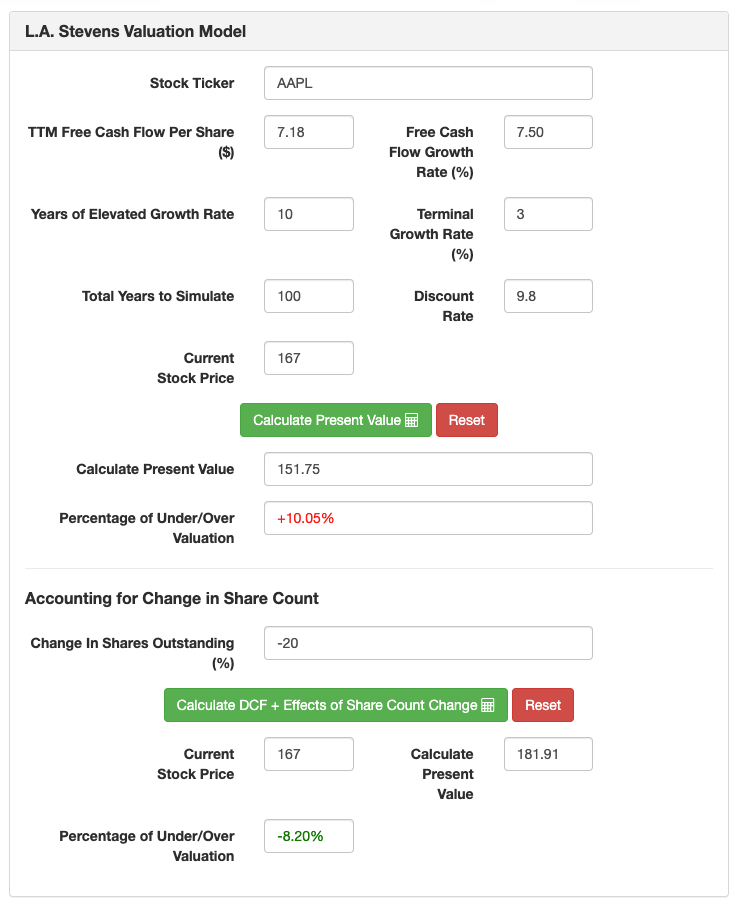

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

-

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

-

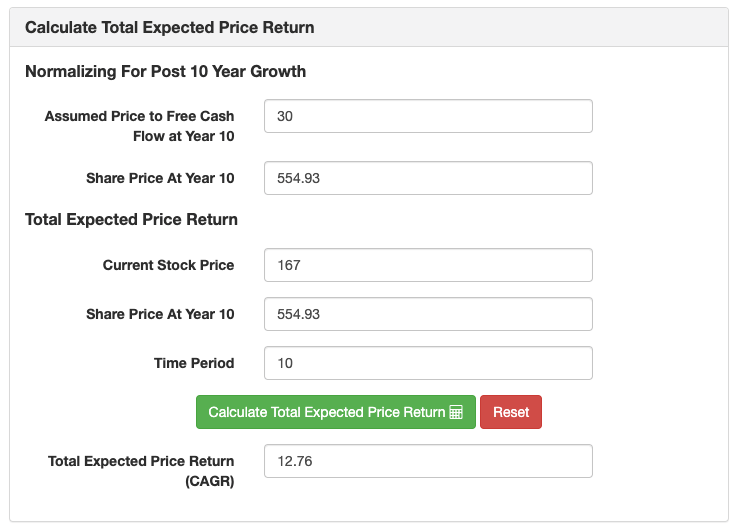

In step 3, we normalize valuation for future growth prospects at the end of the 10 years. Then, using today’s share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

-

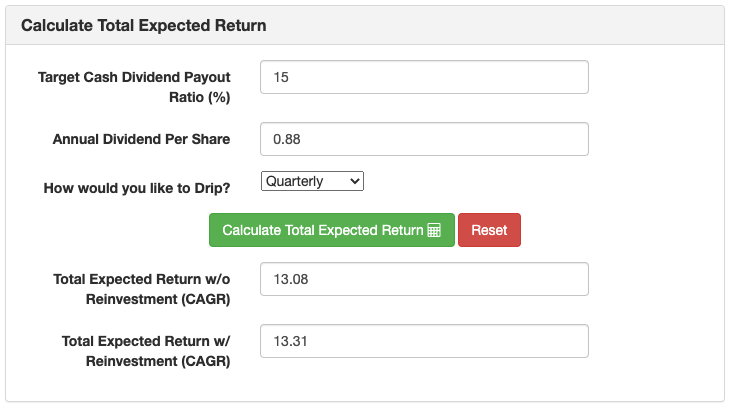

In step 4, the model accounts for the effect of dividends on total returns.

Assumptions:

|

Forward 12-month revenue [A] |

$395 Billion |

|

Potential Free Cash Flow Margin [B] |

30% |

|

Average diluted shares outstanding [C] |

16.5 Billion |

|

Free cash flow per share [ D = (A * B) / C] |

$7.18 |

|

Free cash flow per share growth rate |

7.5% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

L.A. Stevens Valuation Model

According to our valuation model, Apple is slightly undervalued today with an intrinsic value of ~$181.

L.A. Stevens Valuation Model L.A. Stevens Valuation Model

As seen above, Apple is expected to generate a 13.31% CAGR over the next 10 years, which is below our 15% hurdle rate that we use at Beating The Market. Hence, I will label Apple as a hold, but for long-term investors, Apple is not a bad company to own or consider adding to at these levels for someone who is willing to accept somewhat lower returns in exchange for a more mature company in exchange for less volatility.

Risks

The payment rails are highly complex and the global card networks have ingrained themselves as the traditional means for the global movement of money. This makes it hard for companies like Apple to challenge the card networks like Visa and MasterCard because they already have a massive network of both consumers and merchants. Apple already has a massive network of users and now it is already developing solutions that enable merchants to accept payments. Apple will compete with companies like Square, PayPal, Stripe, and many other fintechs like Toast and Shift4. These companies will also look to leverage Apple’s new functionality as Stripe is the first company to feature Apple’s “Tap to Pay” functionality for merchants to accept contactless payments directly from their iPhones.

Competition is a small risk and not one that is too concerning for Apple as it looks to gain market share in a highly competitive landscape. However, Apple is taking a significant risk of bringing its underwriting and processing in-house as it will be a challenge for Apple to offer the full realm of services offered by a bank and carry out the required risk modeling. Apple will need to continue to invest in its underwriting and core financial services to develop payment mechanisms that earn the trust of consumers. The acquisition of Credit Kudos will be extremely beneficial, but there remains a good amount of work cut out for Apple to strengthen its underwriting to a level where it’s no longer dependent on Goldman Sachs or CoreCard to issue the Apple Card.

Concluding Thoughts

As the utility of the Apple Wallet increases and evolves over time, Apple will capitalize on its network effect moats as Apple now enables anything to be stored in its digital Wallet that would be found in a traditional, physical wallet. Apple has billions of users and it controls the toll booth to its operating system, so it only makes sense Apple enables these users to get the most out of leveraging their digital wallet as Apple will improve its Wallet and add new functionalities. Apple is bound to play an increasingly important role in the evolution of the open banking paradigm because Apple’s devices capture transactional data and alternative data are crucial to the democratization of embedded financial services.

While Apple has a lot to offer and a great opportunity to evolve as a key foundational layer to open banking, Apple’s dive into fintech isn’t solely a reason to own the company. They will face challenges from many fintech competitors, but Apple also faces an uphill battle to develop the underwriting and risk modeling that will enable them to offer credit and financial services in-house.

The strength of Apple’s overall business and its ability to offer new products and services will tie well with Apple’s plans to launch new financial services, but at $167 per share, Apple isn’t expected to outperform our 15% hurdle rate at Beating The Market, hence I am neutral at these levels.

Thanks for reading and happy fintech investing!

Be the first to comment