Warchi

Article Thesis

The FAANG stocks have gotten a lot of attention in recent years, and rightfully so. Strong market positions and a history of compelling returns have made them well-liked among retail investors. Due to reader interest in this question, we’ll pit the two of them, Apple Inc. (NASDAQ:AAPL) and Meta Platforms, Inc. (NASDAQ:META) against each other in this article. Both have pros and cons, so which one you prefer depends on your investment goals and approach.

A Big Performance Gap

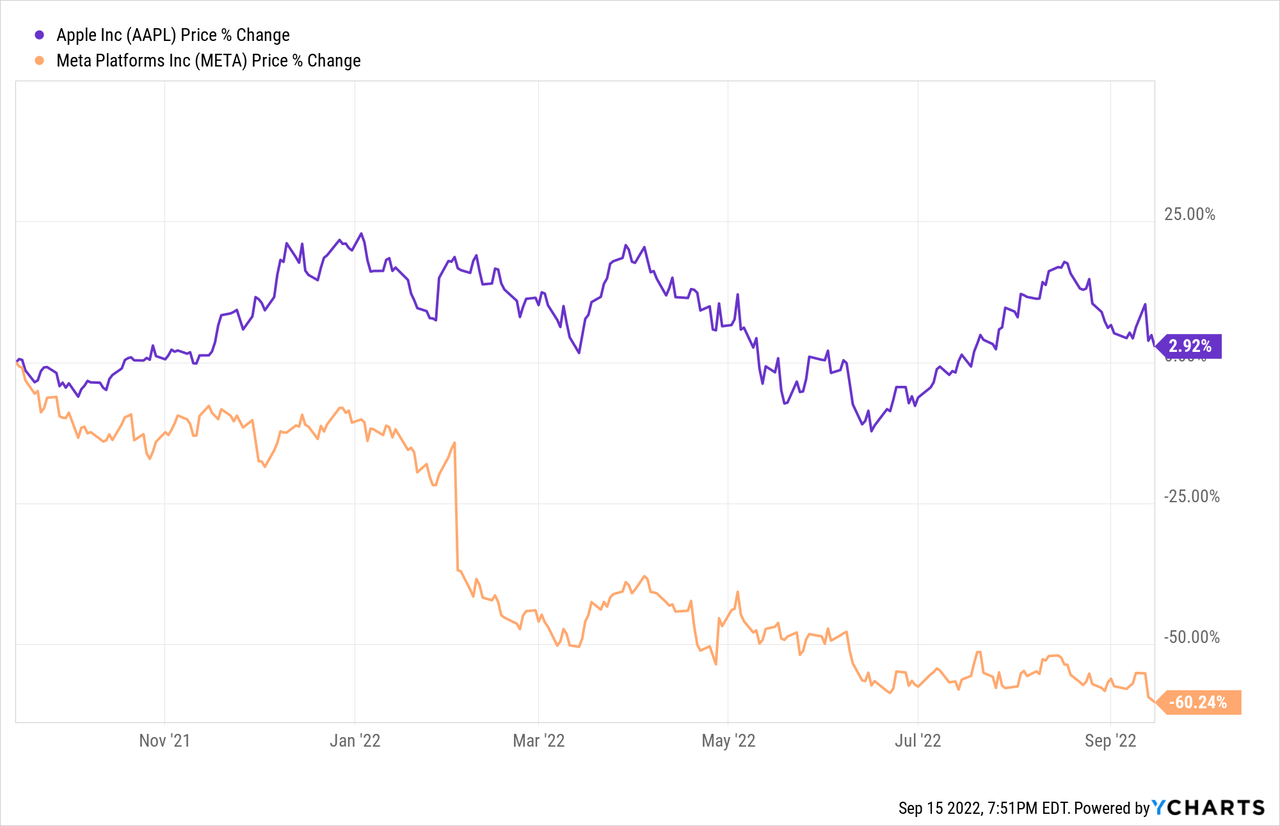

Both companies have been compelling investments for their owners in the long run. But in the more recent past, there’s a wide performance gap between Apple and Meta:

Over the last year, Apple is essentially flat. There were some ups and downs, but no overly dramatic moves. Meanwhile, Meta has dropped by a massive 60% over that time frame, destroying a lot of shareholders’ wealth and seeing its price decline by more than half.

Why did that happen? There are several reasons for that. Valuation is one factor, as Meta was way pricier a year ago relative to its own history and also relative to how the broad market is valued. More importantly, the market is not a fan of Meta’s metaverse approach. The buildout of the metaverse business costs a lot of money in the near term and will not generate any profits in 2022 and the foreseeable future. Some investors believe that the aggressive metaverse spending is a mistake and are thus favoring other stocks that keep closer to their traditional, established businesses – such as Apple.

Last but not least, the market is worrying about what a recession could mean for Meta’s advertising business. I believe the logic behind that is not completely flawed, because during a downturn some companies might scale back their advertisement spending, which would result in lower revenues and profits for Meta. On the other hand, some companies might focus even more on advertisement spending during a downturn, in order to keep their market share and in order to prevent their sales from dropping too much during a recession. I do believe that Meta might perform better during a recession than many investors think, although it seems clear that a recession is not a tailwind for Meta (or other advertisement-dependent companies, such as Alphabet (GOOG) (GOOGL) or Snap (SNAP)). That being said, it also seems reasonable to assume that Apple will see a negative impact from a recession. Consumers might use their old phones a little longer and forego an upgrade, and revenues from Apple’s existing ecosystem could be lower as well, as iPhone users will spend less on apps and digital purchases than they would have in a more welcoming economic environment. It thus is somewhat surprising to me to see Apple stock do so well in recent months, even though many other consumer-facing stocks have dropped considerably on recession worries.

Apple And Meta Stock Key Metrics

As shown above, both companies could feel a pinch from a recession or economic slowdown over the coming months and quarters. It looks like the market is increasingly pricing that into Meta’s stock, whereas Apple’s stock has not yet felt increasing selling pressure. Apart from that, there are other important differences we can look at.

Growth outlook

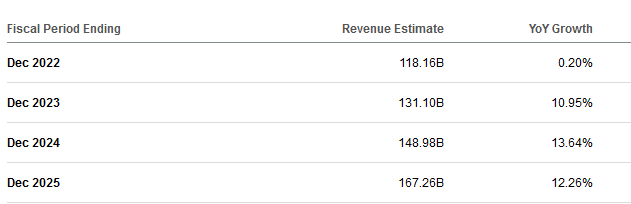

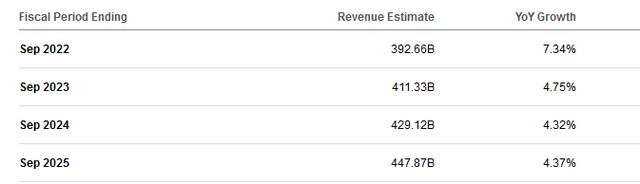

Both companies have grown their business considerably in recent years, with Meta experiencing a stronger growth rate over that time frame. Going forward, both Apple and Meta are expected to grow slower than they did in the past. Apple’s forecasted revenues over the next couple of years look like this:

Growth of 4%-7% a year is far from bad, but it isn’t really spectacular, either. This is a relatively typical growth rate for an established consumer goods company and is fitting for a large and relatively mature enterprise such as Apple. It’s not really fitting for a company that trades at a premium valuation, however, but more on that later.

Apple’s core businesses, such as the iPhone, iPad, and Mac franchises, aren’t active in high-growth markets. Consumers don’t increase the number of phones they own regularly, and most people that want a phone have one already. Apple is thus mostly selling phones as replacements for existing phones. This makes for a strong cash cow, but the growth potential is rather limited. Apple’s services business provides better growth, but due to the fact that the vast majority of Apple’s revenues are generated via its hardware sales, the company-wide revenue growth outlook is far from spectacular. As long as the valuation is right, that isn’t a problem, however.

Meta is forecasted to grow considerably faster, but its future growth rate will in all likelihood also be lower compared to what Meta has done in the past:

Seeking Alpha

2022 will be a weakish year with almost no growth, according to Wall Street. But in the following three years, Meta is forecasted to grow at a double-digit pace. Overall, that makes for an average growth rate in the 9% range, versus a 5% growth forecast for Apple. Meta is thus forecasted to grow at close to twice the rate Apple is forecasted to grow at. It should be noted that both companies have a history of beating estimates, thus actual results could be stronger for both AAPL and META, which have beaten revenue estimates 13 times and 12 times over the last 15 quarters, respectively.

Meta’s higher growth will be driven by several factors. The company is adding new users, although at a slower pace compared to the past, as many consumers around the world are already part of its ecosystem. By increasing the rate they demand from advertising partners, they can grow revenue per user over time. Last but not least, the introduction of new services, such as payments via Instagram allows Meta to add additional revenue sources over time.

Are META And AAPL Stock Overvalued?

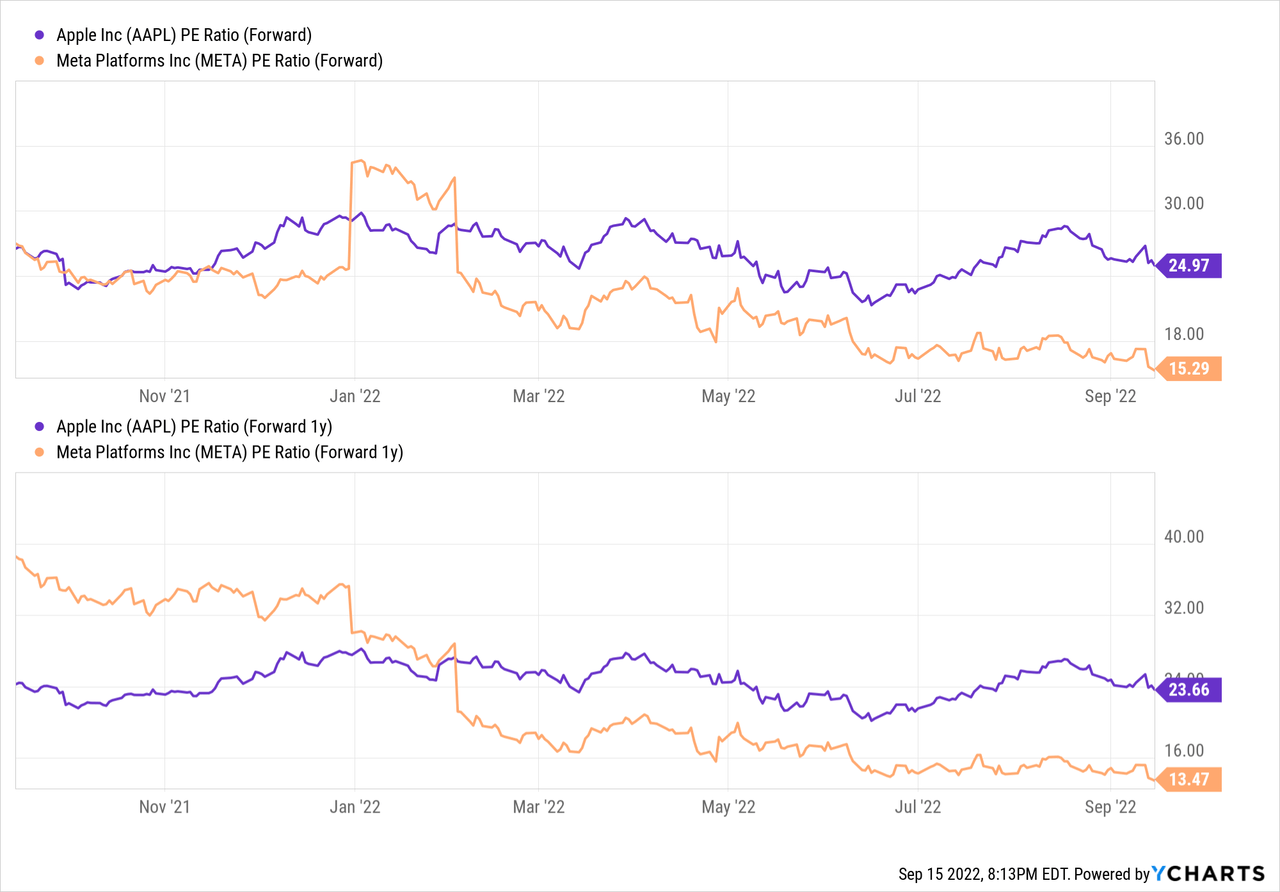

There’s a big difference when we look at the valuations of these two companies. No matter how you slice it, Meta is cheap and Apple is expensive. That holds true when we look at a direct comparison between these two FAANG members, for example:

Apple trades with an earnings yield of 4%, while Meta trades with an earnings yield of 6.5%. Likewise, Apple trades at a mid-20s earnings multiple based on next year’s estimates, while Meta trades at a low-teens earnings multiple, looking one year ahead. Overall, Apple thus trades at a 60%-80% premium relative to Meta, using the net earnings multiple of both companies. Due to the stronger growth outlook for Meta, I do not think that this valuation gap makes a lot of sense, even if one considers that Meta’s metaverse investments add some complexity and uncertainty to the stock.

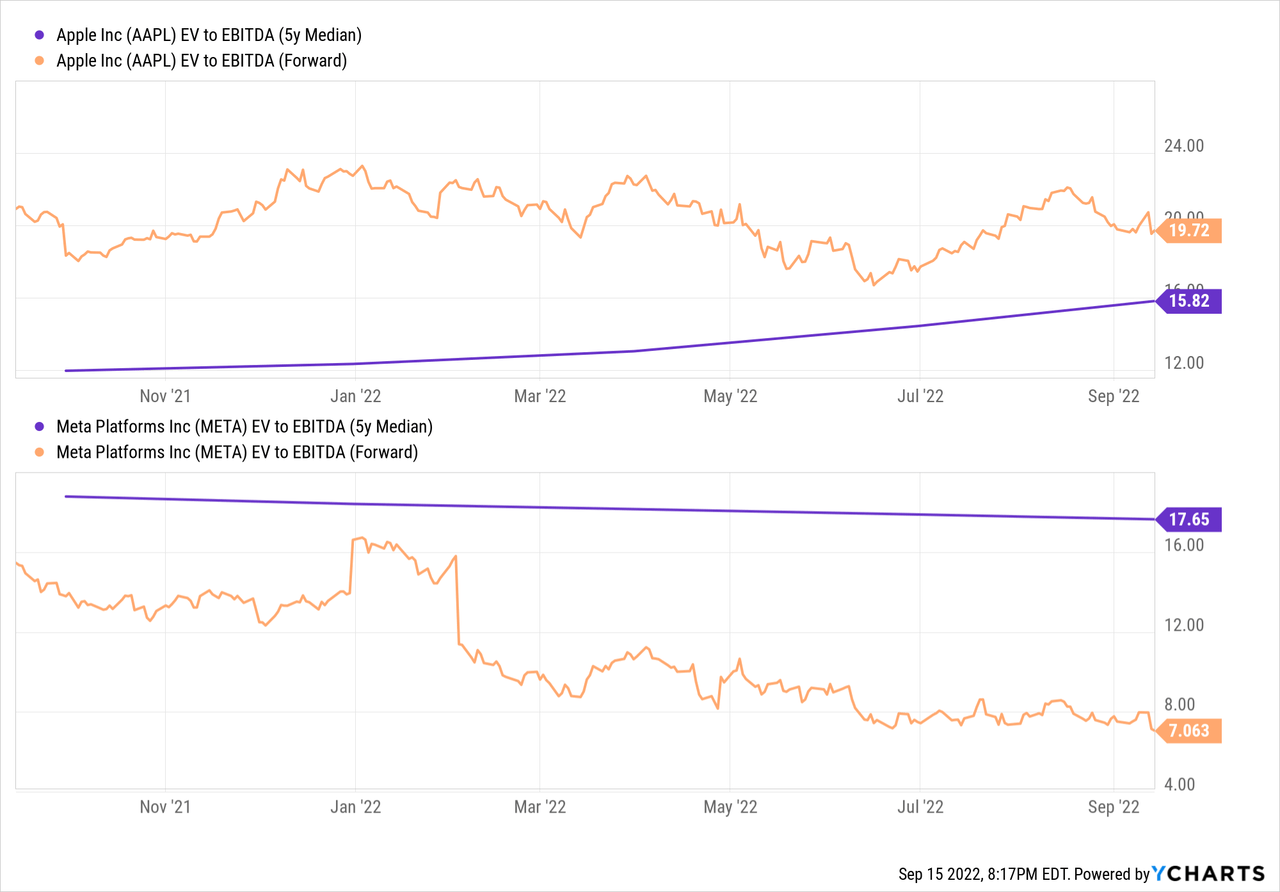

Even more telling, AAPL is pretty expensive relative to how it was valued in the past. At the same time, Meta is pretty cheap relative to how it was valued historically:

With a forward enterprise value to EBITDA multiple of 20, Apple is trading at a 30% premium relative to its “normal” valuation. Meta is trading at a pretty low (in absolute terms) 7x EBITDA multiple. That represents a hefty discount versus its normal high-teens EBITDA multiple. Apple could drop around 25% and it would be trading in line with the historic norm, while Meta could rise by 100% and it would still be trading below the longer-term average. To me, this suggests that the market is overly bearish on Meta today and that the market has bid up Apple too high, making Meta the more opportune choice at current prices.

Balance sheet and shareholder returns

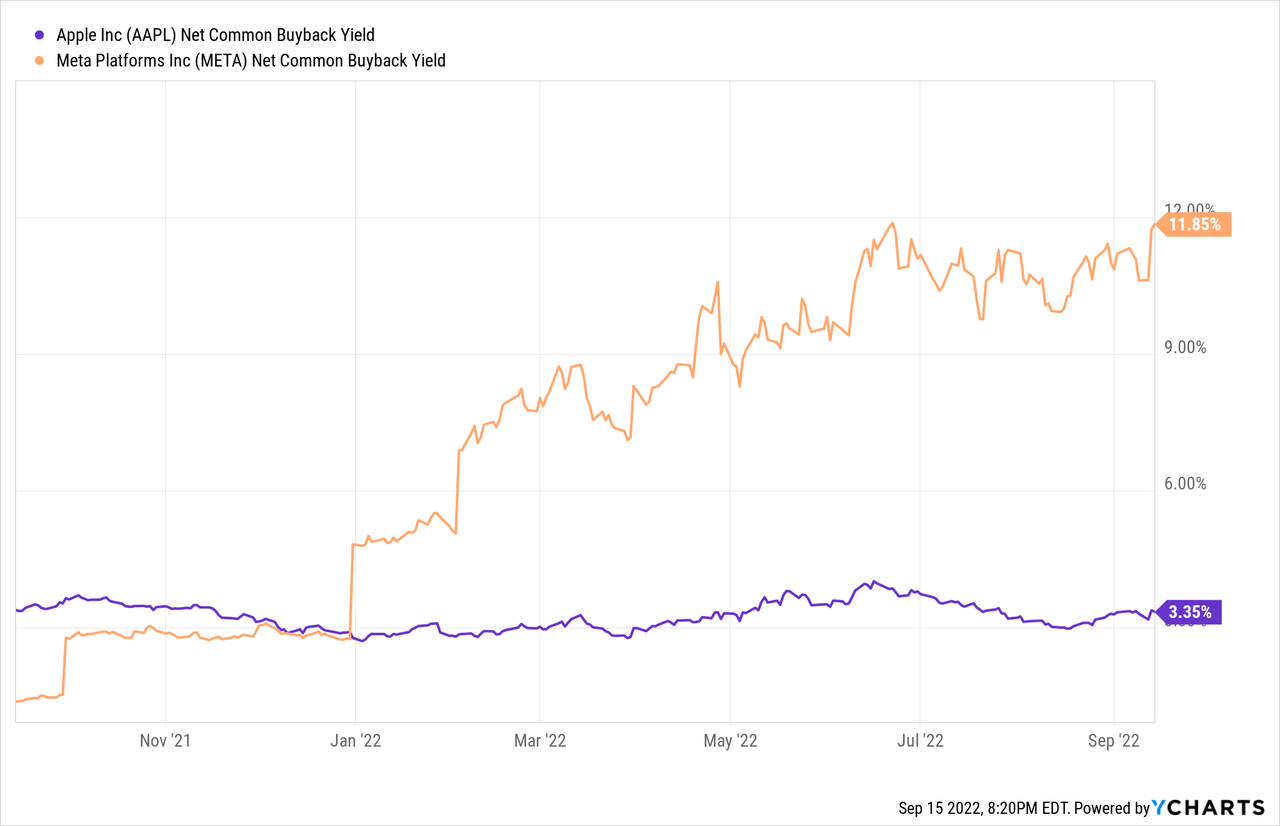

Meta’s management team seems to agree with that sentiment, which is why the company has spent heavily on buybacks in recent quarters. Scooping up shares while the valuation is pretty low could be quite accretive in the long run.

Apple is quite famous for its buybacks, but those were rather unspectacular in the recent past. Apple has bought back just 3% of its shares over the last year, which is below the longer-term average. That’s no surprise – the high valuation means that Apple can’t buy back shares at the rate it did in the past when it was trading at a cheaper valuation. Meta, meanwhile, has bought back a whopping 12% of its shares over the last year. At this rate, no earnings growth on a company-wide basis is needed at all in order for investors to see compelling earnings per share growth over time.

Meta shouldn’t have any problems in keeping this high buyback pace in place. Its free cash flow yield over the last year is 9%, around twice as high as that of Apple. On top of that, Meta has a stronger balance sheet: Its net cash position equals 10% of its market capitalization, while Apple’s net cash position is equal to just 2% of its market capitalization. By putting its much higher free cash flow yield to use, Meta can shrink its share count much faster than Apple, especially if it utilizes its larger (relative) net cash position to take advantage of the low current valuation.

Is Meta Platforms Or Apple Stock A Better Long-Term Buy?

Apple offers some dividends, whereas Meta does not. Apple is also playing it safe by focusing on existing key businesses, while Meta is taking on more risk by putting a lot of money into its metaverse business. That could pay off, and Mark Zuckerberg has proven that he has the vision and execution to build big things. Nevertheless, some investors may prefer Apple for its more predictable business model going forward.

That being said, I believe that Meta looks like the more attractive pick today. It has some vulnerability to a recession (like Apple) but is priced for disaster despite having a better longer-term business growth outlook due to being less constricted to replacing existing hardware. Meta is also pretty cheap, both versus Apple and especially relative to how it was valued in the past. With a lot of balance sheet flexibility and hefty cash flows, management can buy back shares at a massive pace, thereby hopefully creating a lot of shareholder value. Meanwhile, Apple’s buyback pace has slowed down considerably due to its high valuation, which will mean that the impact of its buybacks should be much lower going forward.

Overall, I prefer Meta, which looks undervalued to me. But depending on one’s approach, some investors may find Apple more suitable despite its higher valuation, especially if they feel that the metaverse spending makes Meta too unpredictable going forward.

Be the first to comment