wabeno/iStock Editorial via Getty Images

What happened?

BofA has recently downgraded Apple (NASDAQ:AAPL) from Buy to Neutral and cut its price target from $185 to $160. The firm previously had a 2023 revenue estimate of $406.5B (+4% YoY) and EPS of $6.24 (+3.5%) and has now reduced these figures to $379B and $5.87, which are lower than the current consensus of $412B and $6.46. Let’s go through the thinking behind the downgrade and discuss where things may go from here.

| BofA Estimates | Previous | Current | Diff. |

| 2022E Revenue (mm) | 391,166 | 390,695 | -0.1% |

| 2023E Revenue (mm) | 406,469 | 379,399 | -6.7% |

| 2024E Revenue (mm) | 421,283 | 405,886 | -3.7% |

| 2022E EPS | $6.03 | $6.02 | -0.2% |

| 2023E EPS | $6.24 | $5.87 | -5.9% |

| 2024E EPS | $6.73 | $6.48 | -3.7% |

Understanding the downgrade

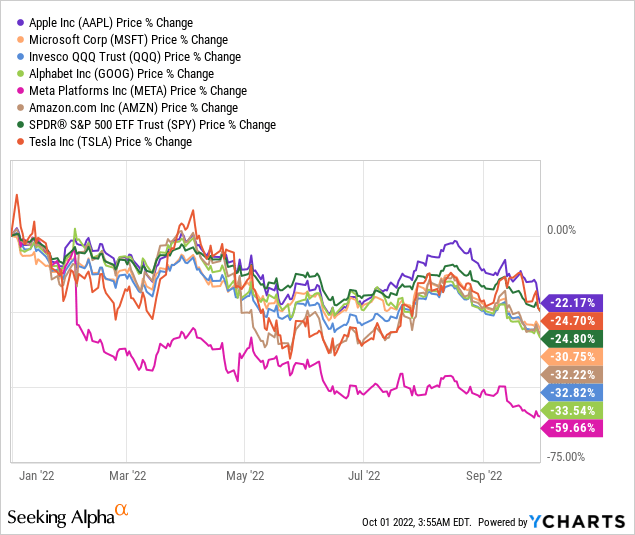

Shares of Apple have outperformed not just most large cap peers but also the broader market. Like many major tech names, Apple is dealing with a slowing demand environment in 2022, yet the stock has received a very different treatment as companies of similar caliber like Alphabet (GOOG) have seen their shares drop more than 30% YTD.

In the last 3-6 months, Apple’s earnings estimates have experienced very little revisions with the consensus being that EPS will grow at ~5.9% in the next 2 fiscal years ending September. Given the current macro backdrop, these projections will likely be put under the microscope.

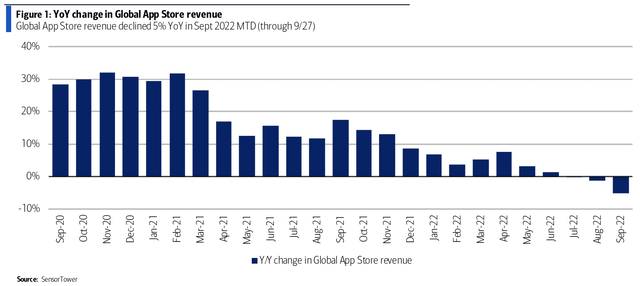

According to data from Sensor Tower, global app store revenue experienced a decline in July and August, and fell by 5% in September (through 9/27). While this may not be representative of a long-term trend, the near-term slowdown indicates that Apple’s Services business may be moderating. Services accounts for almost 1/5 of Apple’s revenue. App Store and Licensing (eg. payments from Google to have Google Search as the default search engine) make up more than 60% of Services revenue.

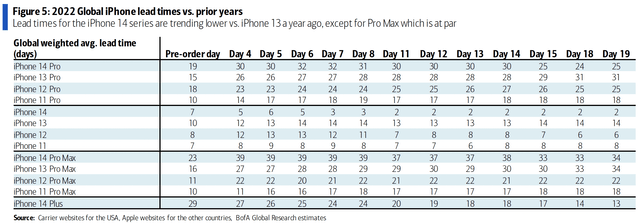

Another major concern is weaker iPhone 14 sales. It’s been widely reported that Apple just canceled its plan to increase its iPhone 14 production and would stick to the original forecast of 90 million units (same as 2021). While this is still a respectable feat considering the smartphone market is expected to decline by 6.5% to 1.27 billion units in 2022 (IDC), it’s difficult to see iPhone 14 sales outperform expectations by a wide margin.

The above table compares the average lead times of the iPhone 14 family to previous models. The key takeaway here is that on average, it doesn’t take as long for consumers to acquire a new iPhone this year. For example, we can see that the average lead times for the iPhone 14 Pro have been trending down from 30 days (on day 14 since launch) to 25 days vs. 31 days of iPhone 13 Pro at the same time last year. Understandably, 2022 iPhone demand is not as strong as 2021 and 2020. For other devices like iPads and Macs, demand is even more likely to experience a reversion to pre-Covid levels.

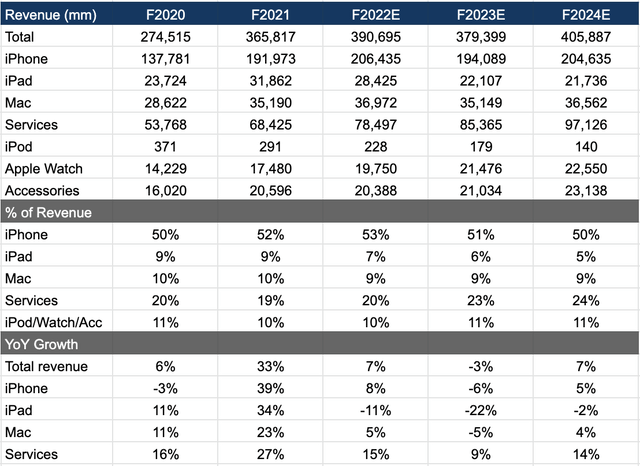

Although Apple has been monetizing its iOS installed base extremely well by growing its high-margin Services revenue by 16% in FY20 and 27% in FY21, any revenue upside from here will still depend heavily on hardware sales as iPhone/iPad/Mac accounts for 53%/7%/9% of total revenue.

Per BofA estimates, Apple’s total revenue will see a 3% YoY decline in FY23 where Services will be the only segment to deliver growth. This seems conservative considering the Street is currently projecting a total revenue growth of 4.9% in FY23. Net-net, I think BofA has well-grounded reasons to believe Street estimates are still too optimistic. Consequently, don’t be surprised to see more analyst jumping on the downgrading bandwagon in the next few weeks or months.

Final thoughts

Apple is not immune to macroeconomic pressures as demand for consumer electronics soared during the pandemic and will likely take the backseat now that everything from rent to food is significantly more expensive. With the stock down 22% YTD vs. ~25% of the S&P 500 (SPY), it’s clear that markets have been treating Apple like a safe haven as no fund managers are likely to be fired for making it the largest position in their portfolios.

In my view, this type of groupthink is just as dangerous as the Nifty Fifty back in the 1970’s when investors believed religiously in the so-called “one decision” stocks like IBM and Polaroid, which led a disastrous outcome in the bear market that followed. As wonderful of a business as Apple is, the stock is not always a no-brainer, and investors should think carefully about piling into the name just because everything else is falling.

Be the first to comment