Dan Kitwood

Thesis

On Tuesday evening, Bloomberg suggested that global demand for Apple Inc.’s (NASDAQ:AAPL) iPhones might be faltering, as Apple reportedly told suppliers to scale back production of smartphones in the 2H 2022. The news stands in sharp contrast to market expectations – namely, that Apple is broadly unaffected by the slowing economic backdrop – and marks the latest episode of a very gloomy global market narrative. Apple shares have lost as much as 4.5% after the news surfaced, and I believe now might be an opportune time to take some profits on Apple’s stock and/or hedge long positions with PUT spreads. After all, Apple shares are trading expensively, and the stock might be more risky than what markets are pricing. I downgrade Apple to “Hold.”

Headwinds To iPhone Demand

On Tuesday evening, news broke that Apple is aiming to scale down production goals for iPhone. This is a sharp change in confidence from what the company expected prior to the iPhone 14 launch, expecting a 7% sales boost in 22H 2022 vs the 1H. Now, Apple aims to produce “only” 90 million smartphones in 2H 2022, versus 96 million previously estimated. This means that versus the same period in 2021 production would be approximately flat – no growth.

In my opinion, this is a major negative for AAPL shareholders who have trusted that Apple would remain relatively resilient amidst any macroeconomic challenges. Even the best and most popular consumer brand starts to stumble. This is contrary to what the market has been expecting and hoping. Notably, only recently Financial Time’s Unhedged claimed that Apple would be the highest-quality stock. And commenting on the June quarter 2022, CFO Luca Maestri said:

Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category.

More Risky Than Implied

So Apple stock is vulnerable to an economic slowdown. But this should not come as a surprise, given that the iPhone maker’s revenue exposure is almost exclusively dependent on consumer discretionary spending. However, also from a technical perspective, Apple is more risky than the market might imply. There are two arguments to the thesis: investor sentiment risk, and political risk.

First, investors should consider that AAPL stock accounts for 7% of the S&P 500 (SPX) and 13% of the Nasdaq 100 (NDX), respectively. As a consequence, if investor sentiment worsens further and the market falls sharply, Apple stock will likely depreciate in value in lock-step with the major indices.

Second, I would like to highlight that Apple stock is susceptible to increasing risks due to geopolitical tensions with China. Specifically, I am worried that at some point, usage of Apple phones and/or services will be restricted by the CCP. This could, in my opinion, be justified by data and security concerns. China might also limit the import of iPhone sales as a response to U.S. sanctions, such as the latest Nvidia chip restrictions. That said, investors should note that China accounts for about 20% of the global iPhone demand and, directly or indirectly, for approximately 90% of Apple’s production supply chain.

Valuation Downside

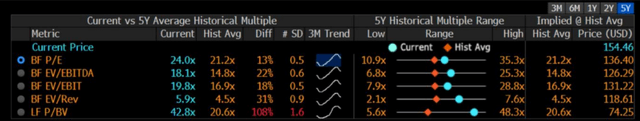

Apple stock’s riskiness is also a function of a rich valuation. AAPL shares are expensive – trading at a 2022E x25 P/E and x6 EV/Sales. Compared to the industry average, and depending on the multiple, AAPL is priced at a 20% – 55% premium (Source: Bloomberg).

True, one could argue that a premium for Apple vs competitors is justified. I think so as well. However, I would like to highlight that Apple is also trading expensively as compared to the company’s own trading average for the past 5 years. This is less justified – especially given the worsening macroeconomic backdrop. If Apple’s multiples revert to the mean, then one should expect ca. 30% downside (Source: Bloomberg).

Conclusion

I have been, and I still am an Apple bull. In my coverage initiation article, I highlighted 3 reasons why Apple stock could trade higher: new market opportunities including (1) VR/AR and the Apple Car, (2) accelerating strength in Apple’s service portfolio, and (3) continued financial engineering. And on a long-term horizon, I am very confident that the bullish thesis will play out.

However, in the short to medium term, I think cautious sentiment is justified – as argued in this article. Investors should consider that investing in Apple is a levered play on the global economy, global investor sentiment and global politics. Arguing that Apple is unaffected by a challenging macro backdrop just does not make sense from an intellectual perspective – given that Apple is selling almost 200 million >$800 smartphones a year to consumers globally.

Reflecting on the news that Apple is planning to cut production by about 7% in the second half of 2022, I downgrade Apple shares to “Hold.”

Be the first to comment