Nikada/iStock Unreleased via Getty Images

Thesis

On July 28th Apple reported Q3 results and I am impressed by what the company delivered. Although being very bullish on Apple (NASDAQ:AAPL) long term (Apple: 3 Reasons Why The Stock Could Trade Higher), I thought the current macro-economic environment would force a slowdown of Apple’s consumer business. However, while other companies such as Walmart (WMT) noted significant business slowdown, Apple continued to perform:

Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category

Apple shares jumped by more than 3% after the earnings announcement, highlighting that the company delivered above buy-side expectations. Given Apple’s strong Q3 results, I reiterate my Strong Buy recommendation for the stock. I continue to claim that AAPL shares are undervalued and confirm a $247.51/share price target.

Apple’s Q3 Earnings Beat

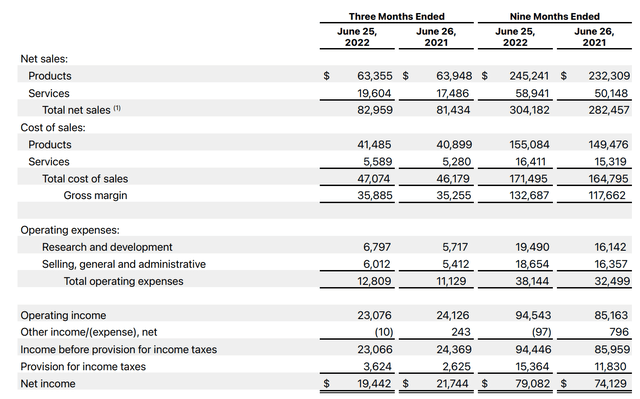

During the period from April to end of June, Apple generated total revenues of about $83 billion, which is an increase of about 2% as compared to the same period in 2021. Apple’s revenues slightly beat analyst consensus estimates which forecasted Apple’s revenue at $82.8 billion. Most notably, despite inflationary pressure on COGS, Apple’s gross profit increased at the same rate as revenues and edged higher from $35.3 billion to $35.9 billion.

Net income, however decreased by about 10% as compared to the same period in June 2021: down to $19.4 billion versus $21.7 billion. This loss in profitability was driven by both higher R&D expenses, which increased by about $1 billion (up about 17.5%) and $600 million of SGA expenses (up about 11%). That said, although Apple’s earnings per share for the quarter decreased by about 8% to $1.2/share, the company’s net profitability is ahead of consensus which estimated EPS of $1.15.

Luca Maestri, Apple’s CFO, highlighted that during the quarter from April to end of June, the company generated almost $23 billion in operating cash flow and distributed $28 billion of cash to shareholders: both in form of dividends and share repurchases.

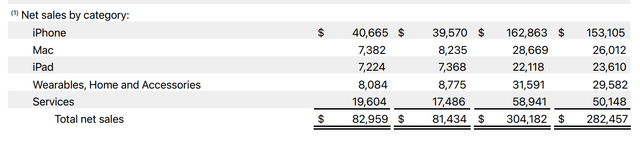

Not all of Apple’s segments performed equally well. The company achieved a solid 3% growth in iPhone sales, which account for approximately half of Apple’s revenue exposure. Luca Maestri claimed that:

On iPhone, we haven’t seen any sign of demand weakness from the macro environment other than foreign exchange. We believe demand continues to be very strong but we don’t have enough supply to satisfy that demand.”

Given “great enthusiasm for our products and services, resulting in an all-time record for our installed base of active devices” (as announced by CEO Tim Cook), Apple also enjoyed a strong 12% growth in services, which now account for about one fourth of total sales.

However, Apple’s remaining business segments showed negative revenues growth: iPad sales decreased by about 2% to $7.2 billion; Mac sales decreased by 8% to $7.4 billion and the wearables, homes, and accessories segment – which includes the Apple Watch and AirPods amongst others – dropped by about 8% as well.

A Few Negatives

Apple’s management team focused on three key headwinds: including a strong and strengthening dollar, supply constraints and incremental business loss due to the company’s exit from Russia. According to Apple’s CFO, the foreign exchange headwind can be quantified by about 300 basis points (3%). The supply constraints will cost the company between $4 billion to $8 billion, depending on the production reboot in China following the Covid-19 lockdowns. Russia’s exit is balanced by a strong performance in other emerging markets, including Brazil and India. Tim Cook noted:

We set June quarter records in the Americas, in Europe and in the rest of Asia Pacific region. We also saw June quarter revenue records in both developed and emerging markets with very strong double-digit growth in Brazil, Indonesia and Vietnam and a near doubling of revenue in India.

In addition, despite Apple’s strong quarter, it is still too early to claim that the company is not vulnerable to a sharp recession. In fact, Apple remains a consumer-centric brand with about 75% of revenues being exposed to discretionary non-recurring spending. That said, a continued worsening of the macro-environment could lengthen consumers device replacement cycles, which would temporarily impact Apple’s business performance.

Reiterate Strong Buy Recommendation

After Apple’s strong Q3 quarter, despite the macro-economic challenges, I am confident to reiterate my strong buy recommendation. I continue to believe that Apple could trade significantly higher in the next 12-36 months due to: 1. New market opportunities including VR/AR and the Apple Car, 2. Accelerating strength in Apple’s service portfolio, and 3. Continued financial engineering. While it is tempting to sell some Apple shares into the stock’s strength, I advise to remain focused on the long-term. Personally, I aim for a $247.51/share target price.

My coverage initiation article on Apple: Apple: 3 Reasons Why The Stock Could Trade Higher

Be the first to comment