PhillDanze/iStock Editorial via Getty Images

Investment Thesis

Apple Inc. (NASDAQ:AAPL) was reported to be considering a hardware subscription service for its suite of products. So naturally, the attention is on its flagship iPhone segment. Nevertheless, nothing has been confirmed, and plans could continue to be developed or even stalled.

However, we believe it could mark a significant pivot in Apple’s strategy to reach further into Android’s (GOOGL) (GOOG) installed base. Apple’s 5G launches starting with iPhone 12, have seen tremendous success in the US and China. Furthermore, iPhone 13 has continued its massive momentum. Recent supply chain checks also revealed that it’s trending ahead of estimates, despite the transitory shutdown by its key contract manufacturer Foxconn (OTCPK:HNHAF).

We discuss why hardware/iPhone subscriptions could be a massive game-changer. We also maintain our Buy rating on AAPL stock. But, we noted a robust recovery from its March bottom, and its price action doesn’t seem ideal to add exposure.

Therefore, if you are not in a rush, you can consider waiting for the recent spike to be digested first before adding.

AAPL Stock Key Metrics

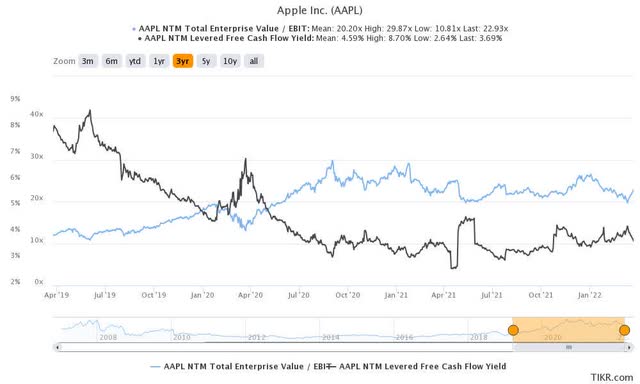

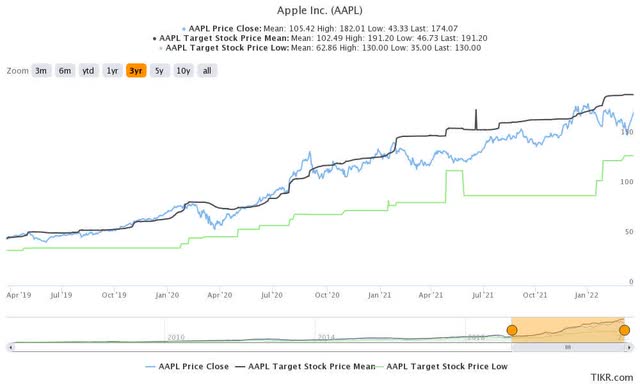

AAPL stock NTM EBIT valuation (TIKR) AAPL stock consensus price targets Vs. stock performance (TIKR)

AAPL stock’s NTM EBIT multiple of 22.9x is trading ahead of its 3Y NTM EBIT mean of 20.2x. So, AAPL stock has moved away from the 20x multiple that has supported its stock over the past year.

Furthermore, the stock has also progressed well ahead of its most conservative price targets ((PTs)) as seen above. Its most conservative PTs have been robust support levels for AAPL stock over time. Therefore, we think the current buy zone is not ideal if you are looking to add exposure. But, if you are not concerned with near-term volatility, its stock is still not significantly overvalued.

Furthermore, we believe that Apple holds several optionalities that could spur the Street to re-rate its stock. These include its Apple Car project, its burgeoning services segment, and its rapidly growing ad business.

Why Apple’s iPhone Subscriptions Could Be A Game-Changer

Bloomberg reported that Apple is mulling a subscription service for its hardware, including its iconic iPhone. Therefore, subscribers would only need to pay a monthly fee. Apple would manage the program through a subscriber’s Apple account, similar to how they have subscribed to other Apple services.

Notably, it’s different from its current installment programs. Bloomberg noted (edited): “The monthly charge wouldn’t be the price of the device split across 12 or 24 months. Rather, it would be a yet-to-be-determined monthly fee that depends on which device the user chooses.”

We believe that this could be a noteworthy development in Apple’s services strategy. Apple has been moving ahead with monetizing its massive hardware active installed base that has exceeded 1.65B. Of these, it reported that 785M have signed up as subscribers for its suite of services in FQ1’22 (CQ4’21).

Apple’s premium smartphone leadership has undoubtedly helped it extend its lead in its segment. For example, Counterpoint Research pointed out that Apple has continued to expand its premium segment market share in China. It accentuated that Apple captured 63.5% in the premium segment share in 2021, compared to 55.4% in 2020. Therefore, Apple has capitalized on Huawei’s demise with incredible “ruthlessness,” despite the best efforts from its Chinese smartphone rivals.

However, according to StatCounter, Android remains the most important mobile OS globally, with a device share of 71%. Therefore, it’s clear that most users are still equipped with much cheaper Android phones, and Apple has yet to penetrate this segment.

While the $429 iPhone SE 5G holds promise, the Street has projected just about 30M units this year. Furthermore, DIGITIMES also reported that Apple shipped about 25M to 30M units of its previous iPhone SE in 2020 in its first year of release. Moreover, Counterpoint Research also highlighted that it accounted for about “12% of Apple’s total iPhone unit sales from its launch in Q2 2020 to Q4 2021 – with Japan and US the biggest markets for the device globally.”

Therefore, if Apple wants to make its mark in the low to mid-segment and gain share against Android, a subscription service makes tremendous sense. China’s 5G smartphone penetration rate has already reached about 80%. But, the opportunities in the rest of Asia and Europe could offer Apple tremendous potential. Notably, Apple needs to make its iPhone more affordable without impinging on its treasured margins. Bloomberg’s Mark Gurman even suggested that Apple launch a $199 iPhone SE 5G to penetrate the low to mid-tier segment more effectively before its Peek Performance event in March. He emphasized (edited):

A device priced at $200 could make inroads in regions like Africa, South America, and parts of Asia that are currently Android strongholds.

That would let Apple sign up more customers for services, potentially making a low-end iPhone quite lucrative for Apple in the long run. But so far, the company has steered well clear of that approach.

In 2013, when carrier subsidies began to disappear and demand for a lower-cost iPhone grew, Apple executives said they wouldn’t release a cheap model just to blindly chase market share. It did put out the lower-end SE in 2016, but the phone was $399-well above the level of many Androids-and the price never came down over the following five years. The company has stuck by Steve Jobs’ ‘don’t ship junk’ ethos. – Bloomberg

Furthermore, the 5G upgrade cycle is still in its early stages and gaining rapid adoption. Counterpoint Research also highlighted in a recent note that global 5G smartphone penetration surpassed 4G for the first time in January 2022.

Therefore, there’s a considerable opportunity for Apple to leverage this 5G wave to encourage switchers from Android to iOS. Hence, we believe a hardware subscription strategy could be massive for the Cupertino company to spur the adoption of its 5G devices.

We believe that Apple can continue innovating and introducing effective ideas to capture the segment Android has traditionally dominated without necessarily sacrificing its brand value and margins.

Is AAPL Stock A Buy, Sell, Or Hold?

AAPL stock is slightly overvalued, but not by much. Therefore, if you need a higher margin of safety, you can consider taking a 10-15% haircut.

Otherwise, if you have a firm conviction of Apple’s execution ability, the current price could offer a suitable opportunity to increase exposure.

Furthermore, we think Apple has several optionalities that have not been factored into its stock price. And the potential hardware subscription strategy adds to its growing list of monetization potential.

As such, we reiterate our Buy rating on AAPL stock.

Be the first to comment