olga_d/iStock via Getty Images

Investment Thesis

It is obvious that Apple Inc. (NASDAQ:AAPL) is riding a massive rally, since hitting the bottom at $132.34 on 13 June 2022. The stock had recorded an impressive 25.5% recovery to $166.13 at the time of writing, with the potential of recording another all-time high by September 2022, similar to that in 2021. That would be the perfect way to celebrate AAPL’s 15th anniversary of the iPhone’s launch, coinciding with the iPhone 14’s launch. Assuming a rather optimistic $200 stock price for APPL ( based on Dan Ives’ price target ), we would see a magnificent 10Y Total Price Return of 963.76% then.

Even if the recession were to occur ( if we are not in the midst already ), we are very confident in AAPL’s capability to weather the temporary headwinds. Though the stock had plunged by 37.8% in February and by 47.2% in October 2008, it had regained all of the losses by October 2009. Additionally, the company continued to post excellent YoY revenue growth of 14.4% and a net income of 34.6% in FY2019, defying the recession then. Therefore, there is absolutely no reason why we should sell now. That is unless one urgently needs the cash.

AAPL Demonstrates Why It Is The World’s Most Valuable Company

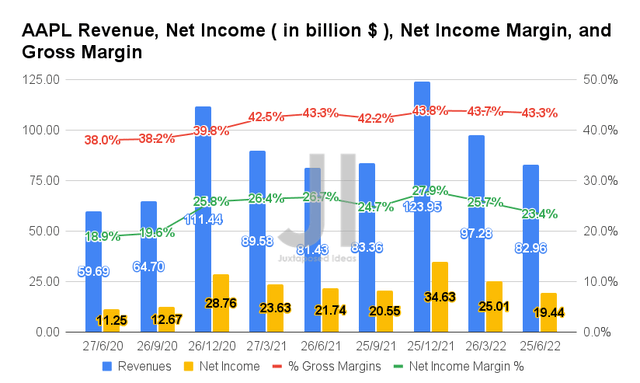

In FQ3’22, AAPL reported revenues of $82.96B and gross margins of 43.3%, representing YoY growth of 1.8% though inline YoY, respectively. In the meantime, its profitability had unfortunately decelerated with a net income of $19.44B and net income margins of 23.4%, representing a decrease of -10.5% and -3.3 percentage points YoY, respectively.

Nonetheless, it is essential to note these margins still represent a notable improvement from FY2019 levels of 37.8% in gross margins and 21.2% in net income margins. Thereby, highlighting AAPL’s prowess in global supply chain and operating costs management thus far. Wedbush Securities analyst Dan Ives said:

We would characterize this quarter as a major bullish statement on iPhone demand and Cupertino’s ability to navigate a supply chain shortage in an impressive performance … with a Top Gun Maverick-like feat. ( Seeking Alpha )

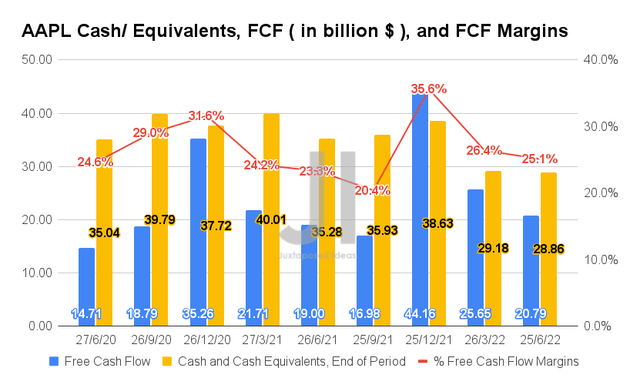

Therefore, it is not surprising that AAPL’s Free Cash Flow (FCF) generation remained excellent, with an FCF of $20.79B and an FCF margin of 25.1% in FQ3’22. It represents an improvement of 9.4% and 1.8 percentage points YoY, compared to FQ’21 YoY growth of 29.1% though a decline of 1.3 percentage points then. Again, the FCF margin still looks stellar compared to FY2019’s 22.6%.

In the meantime, if we were to look at AAPL’s war chest of $28.86B in cash and equivalents on its balance sheet, it is evident that AAPL remains well funded for its upcoming AR/VR glasses and Apple Car moving forward, the latter which we discussed in-depth in our previous analysis.

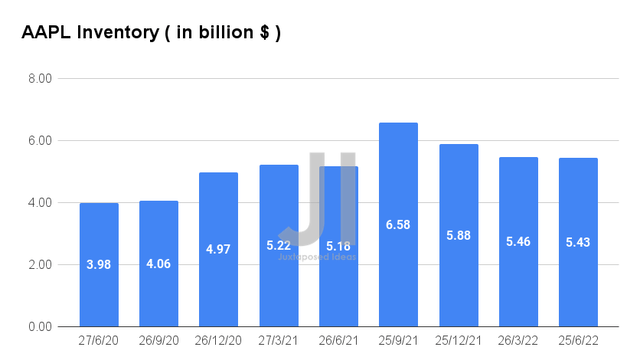

AAPL also remains well poised for growth, given its robust inventory of $5.43B in FQ3’22, which would help accelerate its YoY revenue growth in FQ4’22 with the speculative launch of iPhone 14 then. We expect its release to bring massive global interest, with analysts estimating a target shipment of 90M units for the first wave. The sum is similar to the iPhone 13 released in September 2021, representing a 20% increase from pre-pandemic levels of 75M.

In the meantime, we encourage you to read our previous article on AAPL, which would help you better understand its position and market opportunities.

- Can Apple Be The New Tesla – Smartphone On Wheels By 2025?

- What The End Of The Epic Battle Means For Apple And Google

- Apple: What You Should Know About Its Rumored Subscription Plans

AAPL Continues To Expand Its Profitability

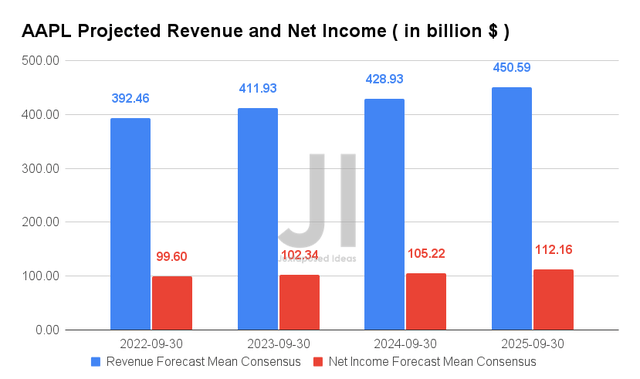

Over the next three years, AAPL is expected to report revenue and net income growth at a CAGR of 5.33% and 4.33%, respectively. For FY2022, consensus estimates that the company will report revenues of $392.46 and net incomes of $99.6B, representing a YoY increase of 7.2% and 5.2%, respectively. In addition, AAPL management guided an acceleration of sales for FQ4’22 with stellar gross margins in between 41.5% to 42.5%.

Therefore, it is apparent that AAPL’s revenue and net income growth has normalized from this year onwards, compared to FY2021’s growth of 33.3% and 64.8%, or an adj. three-year CAGR of 14.6% and 21.71%, respectively. In contrast, the company is expected to report a notable expansion in its net income margins, from 21.2% in FY2019 to 25.9% in FY2021 to settle at an excellent figure of 24.8% by FY2025.

Even if we were to take an average FCF margin of 24.9%, AAPL is set to report $97.72B of FCF in FY2022 and up to $112.1B by FY2025. That is the exact reason why market analysts and bulls still reward the stock with a premium valuation.

So, Is AAPL Stock A Buy, Sell, or Hold?

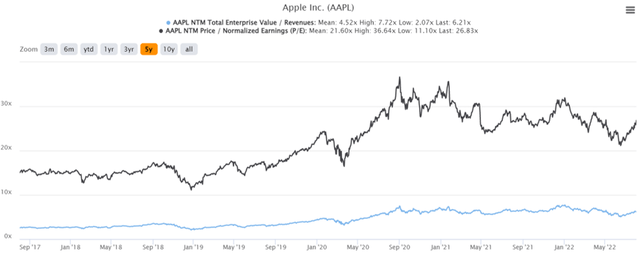

AAPL 5Y EV/Revenue and P/E Valuations

AAPL is currently trading at an EV/NTM Revenue of 6.21x and NTM P/E of 26.83x, higher than its 5Y mean of 4.52x and 21.6x, respectively. The stock is also trading at $166.13, only 9.1% away from its 52 weeks high of $166.13 and at a premium of 28.7% from its 52 weeks low of $129.04.

AAPL 5Y Stock Price

Therefore, despite consensus estimates’ strong buy rating with a price target of $185.05 and an 11.39% upside, we think otherwise. Long-term investors planning for awesome retirements and well-funded trusts would be well advised to hold on to these gains, since these represent a 5Y Total Price Return of 348.9% and a 10Y gain of 783.6%. Assuming a similar growth over the next decade, we could speculatively see a 20Y gain of over 1500%, if not more. Of course, the crystal ball is not always accurate. Therefore, it is also wise to keep your portfolio appropriately sized in the event of the unknown, future risks, and volatility.

In the meantime, those needing some quick cash may sell some of their existing holdings, since AAPL looks ripe for the picking with handsome returns. However, be reminded to get back in again at reasonable lows, since the stock remains a solid pick for long-term growth. In contrast, for those looking to add, this is not a good time since the stock is trading at a premium. Wait for a meaningful retracement ahead. Good luck.

Therefore, we rate AAPL stock as a Hold. Long APPL!

Be the first to comment