ViewApart

Investment Thesis

- Despite Apple’s (NASDAQ:AAPL) current difficulties in China and a challenging macroeconomic environment, I continue my buy rating for its stock.

- The company’s competitive advantages and growth drivers remain intact: Apple is the most valuable brand in the world, has high customer loyalty, has established its own ecosystem, and disposes of an enormous financial strength (Aaa credit rating by Moody’s and EBIT Margin [TTM] of 30.29%).

- I do see several risk factors that Apple investors should take into consideration before taking the decision to invest in the company. However, I see much more risks for short-term traders compared to investors that aim to invest with a long investment horizon.

- I recommend that you don’t speculate on a short-term basis and suggest that you invest with a long-investment horizon of at least 7 years.

- Apple is the largest position of my own investment portfolio. However, due to the risk factors I will describe in more detail in this analysis, I recommend that you invest a limited amount of less than 15% of your overall portfolio into the company.

Apple’s Difficulties in China

On November 6, Apple released a statement, in which it revealed that its iPhone assembly facility, which is located in Zhengzhou, China, currently operates at reduced capacity due to COVID-19 restrictions. This fact has led the New York Times to view Apple’s China dependence as a weakness of the company, which was previously interpreted as a strength:

“It is no coincidence that Apple’s rise from near bankruptcy in the 1990s to the world’s most valuable company has closely followed China’s economic ascent. It pioneered a best-of-both-worlds business model: Products designed in California were assembled inexpensively in China and sold to the country’s growing middle class.”

In addition to the above, the New York Times also made the following statement:

“The abrupt change in its business prospects are the latest reminder of the risks of the company’s concentrated manufacturing supply chain in China. Once an operational strength that afforded Apple the flexibility to have legions of workers crank out iPhones to meet global demand, its reliance on China has become a liability as the country’s commitment to a zero Covid-19 policy has led it to lock down cities, businesses and factories.”

The same newspaper has also revealed that Apple will start to produce a small portion of its latest iPhone in India, interpreting this shift as a response to raising concerns about geopolitical tensions as well as supply chain disruptions caused by the pandemic.

From my point of view, these current difficulties that Apple has in China can definitely have impacts on the price of its stock in the short term, but for long-term investors, I see these difficulties as being less concerning. I don’t currently see Apple’s strong business model as being affected, and with this in mind my investment thesis to rate the company as a buy remains intact.

Apple’s Stock Performance Within the Latest 12 Months

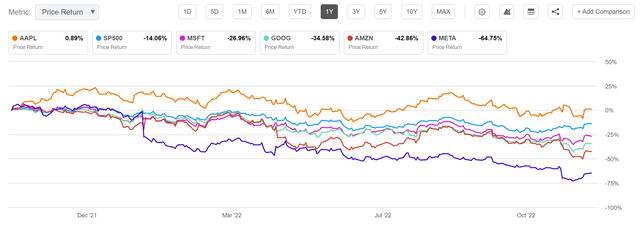

The following will compare Apple’s latest 12 months performance with some of its competitors:

The S&P 500 has shown a performance of -14.06% in the last 12 months. Apple’s performance of 0.89% was significantly better than the one of Meta (-64.75%), Amazon (-42.86%), Alphabet (-34.58%) and Microsoft (-26.96%), indicating that Apple’s business model is more resilient to crises in comparison to some of its competitors.

The Competitive Advantages and Growth Drivers of Apple

In my previous analysis on Apple, I discussed in detail the company’s competitive advantages and its growth drivers. For this reason, I will only briefly discuss this topic in this section of my analysis:

In my view, Apple has very strong competitive advantages that serve as growth drivers for the company: Apple’s competitive advantages include its strong brand image in combination with a high customer loyalty, the successful establishment of its own ecosystem, and the enormous financial strength that the company possesses: Apple’s financial strength is proved by the company’s Aaa credit rating by Moody’s and its high profitability (EBIT Margin [TTM] of 30.29% and its high Return on Common Equity of 175.46%). Furthermore, I see the company’s ability to successfully integrate new businesses into its own as being an additional growth driver. This theory is underlined by the fact that in just the past six years, Apple has acquired about 100 companies and integrated them into its own business.

I expect that Apple’s growth drivers will ensure that the company will continue its successful growth story in the coming years. However, due to the enormous size of the company and a more challenging macroeconomic environment, I expect that Apple’s growth rates will be lower than in the past.

In the following Valuation section of this analysis, I will show you that my DCF Model indicates an Internal Rate of Return of 10% for Apple when assuming a Revenue and EBIT Growth Rate of 7% for the company in the following five years. This demonstrates that Apple can still result in being a successful investment, even if the company was to grow with a growth rate of only 7%.

The Valuation of Apple

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of Apple. The method calculates a fair value of $154.81 for the company. Its current stock price of $148.00 gives Apple an upside of 4.6%. In my DCF Model, I assumed a Revenue and EBIT Growth Rate of 7% in the upcoming 5 years and calculated with a Perpetual Growth Rate of 4% afterwards. I expect the company to grow with a slightly higher Growth Rate than the GDP of the United States (which is 3% on average). This is based on the company’s strong competitive advantages that serve as its growth drivers.

My calculations are based on these assumptions as presented below (in $ millions except per share items):

|

Apple |

|

|

Company Ticker |

AAPL |

|

Tax Rate |

16.2% |

|

Discount Rate [WACC] |

8.5% |

|

Perpetual Growth Rate |

4% |

|

EV/EBITDA Multiple |

17.7x |

|

Current Price/Share |

$ 148.00 |

|

Shares Outstanding |

15,908 |

|

Debt |

$132,480 |

|

Cash |

$23,646 |

|

Capex |

$10,708 |

Source: The Author

Based on the above, I have calculated the following results for Apple:

Market Value vs. Intrinsic Value

|

Apple |

|

|

Market Value |

$148.00 |

|

Upside |

4.6% |

|

Intrinsic Value |

$154.81 |

Source: The Author

Internal Rate of Return for Apple

Below you can find the Internal Rate of Return as according to my DCF Model (for which I assumed a Revenue and EBIT Growth Rate of 7% for Apple). I assumed different purchase prices for the Apple stock.

At Apple’s current stock price of $148.00, my DCF Model indicates an Internal Rate of Return of approximately 10% for the company. (In bold you can see the Internal Rate of Return for Apple’s current stock price of $148.00.)

|

Purchase Price of the Apple Stock |

Internal Rate of Return as according to my DCF Model |

|

$125.00 |

14% |

|

$130.00 |

13% |

|

$135.00 |

12% |

|

$140.00 |

11% |

|

$145.00 |

10% |

|

$148.00 |

10% |

|

$150.00 |

9% |

|

$155.00 |

9% |

|

$160.00 |

8% |

|

$165.00 |

7% |

|

$170.00 |

6% |

|

$175.00 |

5% |

Source: The Author

Please note that the Internal Rates of Return above are a result of the calculations of my DCF Model and changing its assumptions could result in different outcomes.

Apple’s Fundamentals in comparison to its competitors such as Microsoft, Alphabet, Amazon, Meta and Netflix

First, lets have a look at Apple’s EBIT Margin of 30.29% and compare this number to its competitors: Apple has a significantly higher EBIT Margin than both Netflix (NFLX) (18.16%) and Amazon AMZN) (2.58%) and a similar EBIT Margin when compared to rivals such as Alphabet (GOOG)(GOOGL) (27.85%) or Meta (META) (30.09%). Only Microsoft (MSFT) (41.69%) shows a higher EBIT Margin. Apple’s high EBIT Margin is an indicator of its strong competitive position within the Information Technology Sector.

Taking into account Apple’s Return on Equity of 175.46%, it can be highlighted that it’s significantly higher than that of opponents such as Microsoft (42.88%), Alphabet (26.89%), Meta (22.40%), Netflix (28.15%) and Amazon (8.78%), demonstrating Apple’s enormous ability to use shareholder’s equity to generate income and once again strengthening my opinion to rate the company as a buy.

Apple’s 24M Beta of 1.23 is lower than the one of Netflix (1.55) and Amazon (1.33), underlying that the risk of investing in Apple is lower than these competitors. In the Risk section of this analysis I will go into more detail in regards to the risks attached to an Apple investment.

Furthermore, Apple’s EPS Diluted Growth Rate [CAGR] of 27.18% over the past three years is significantly higher than the one of Microsoft (20.57%), Meta (18.29%) and Amazon (-0.47%), proving that Apple is able to raise its profits with higher rates than these competitors. However, it is lower than Alphabet’s at 29.35% and Netflix’s at 52.19%.

At this moment in time, Apple’s P/E [FWD] Ratio of 23.93 is lower than both Microsoft’s (25.88) and Netflix’s (28.31), but higher than Alphabet’s (20.14) and Meta’s (12.47). From my point of view, Apple can be rated with a significant premium when compared to companies such as Meta and Netflix due to its higher brand value (Apple’s estimated brand value is $355,080M while Meta’s is $101,201M and Netflix’s is $29,411M) and its much more diversified product portfolio.

Different metrics have shown that Apple continues to be an attractive investment when investing with a long investment-horizon: Apple’s Profitability metrics such as the EBIT Margin and Return on Common Equity, Risk metrics (the 24M Beta), Valuation metrics (P/E [FWD] Ratio) and Growth metrics (EPS Diluted Growth Rate) all underline my investment thesis to continue to rate the company as a buy.

Risk Factors

There are different risk factors that you should take into consideration as an investor when deciding whether or not to invest in Apple. I consider some risk factors to be more significant than others, as I will explain in this section of my analysis:

One of the risk factors for Apple investors are Macroeconomic and Industry Risks: Apple’s financial results depend significantly on global economic conditions and adverse macroeconomic conditions, such as inflation or a recession, can adversely affect the demand for its products. In addition to that, consumer spending can decline as a response to a decline in customer’s income. Apple investors should be aware of these risks and should expect that the company will probably no longer show such high growth rates in the following years compared to recent ones. I have included lower Growth Rates in my intrinsic value calculations for Apple, for which I have assumed a Revenue and EBIT Growth Rate of 7% for the next five years; while the company’s Revenue and EBIT Growth Rate over the past five years has been 8.74% and 9.66% respectively.

I see an interrupted supply chain due to COVID restrictions and Apple’s dependence on China as another risk for the company. However, I see this risk for short-term traders as being much higher than for long-term investors. Apple’s move to start producing the iPhone in other countries such as India demonstrates that it is aiming to reduce the risk factors that are related to the fact that most of its products are produced in China.

In my view, Apple’s brand image being negatively affected represents the greatest risk for investors. If Apple’s brand image were to be damaged, this could lead to the fact that its customers would no longer pay premium prices for its products, which in my view would have an enormous impact on the company’s financial results and ultimately on the price of the Apple stock.

I continue to recommend that you overweight the Apple stock in your investment portfolio due to the company’s strong competitive advantages that I expect to serve as growth drivers in the upcoming years. In addition to that, with a P/E [FWD] Ratio of 23.93, I see Apple’s valuation as attractive. However, due to the risk factors I have mentioned in this section of my analysis, I would recommend that you do not invest more than 15% of your overall investment portfolio into Apple.

The Bottom Line

I see Apple as an excellent long-term investment: the company has strong competitive advantages that will contribute to its growth in the coming years. To name just a few: Apple’s strong brand value and huge customer loyalty, its own ecosystem, and the company’s enormous financial health (underlined by its Aaa credit rating by Moody’s, its EBIT Margin of 30.29% and its $48,304M in Total Cash & ST Investments).

Although Apple investors should expect lower growth rates in the coming years than the company has shown in the past, particularly due to a more challenging macroeconomic environment, I continue to rate Apple as a buy.

From my point of view, Apple is an excellent buy-and-hold investment, from which you can benefit due to the company’s increasing dividend payments. I expect an annual dividend increase of about 8% on average in the upcoming years, which is in line with the 8.15% average annual dividend increase over the past five years.

At the same time, as an Apple shareholder, you can sleep well in the knowledge that a company with an estimated brand value of $355,080M won’t be destroyed overnight. Furthermore, Apple’s loyal customers will not stop buying its numerous products from one day to the next.

I recommend that you invest with an investment-horizon of at least 7 years and suggest that you benefit from the company’s growing dividend payments. At the same time, I suggest that you don’t speculate over the short-term.

Although I recommend to overweight the Apple stock in an investment portfolio, I would not invest more than 15% of your overall portfolio into the company due to the Risk factors that I have mentioned in this analysis.

Thank you for reading and for any feedback on this analysis!

Be the first to comment