Khanchit Khirisutchalual

With the next earnings report to be released soon, I thought it would be beneficial for me to review again a company I’ve owned multiple times over the past few years but that I have exited when the valuation became insane during 2021. Appian (NASDAQ:APPN) is a software company, provider of a low-code automation platform. The company is operating in an interesting and growing niche, allowing its customers to build custom automated workflows, reports, user interfaces without the need to be proficient in any programming language. That is the proposition for low-code: building applications by writing very few actual lines of code.

Even by stripping out the craziness of the COVID-induced stock market, APPN has been quite a success in the public market, having appreciated nearly 200% since the IPO in early 2017. Management has highlighted in the previous quarter how Appian felt no impact from the macro economy, which is quite a surprising statement considering how many businesses are tightening their budgets, while also other software peers have been warning of slowing growth ahead. After reviewing Appian’s current state, I found too many uncertainties still that need to be addressed before I would feel comfortable becoming a shareholder again. Let’s dive in to see why I think this is the case.

What investors should monitor

Appian is set to report financial results for the third quarter 2022 on November 3. Since the company reported Q2 2022 results on August 3, the stock is down just about 8% despite a generally upbeat report for the previous quarter. Just to provide a recap, Appian recorded 32.6% Revenue growth for the second quarter and a gross profit margin improvement (69.7% from 68.8%), while on the profitability side the company recorded a widening Net loss from -$23.8 million to -$49.4 million.

Going forward, investors in Appian will need to closely monitor a few key factors that will potentially drive future growth for the company.

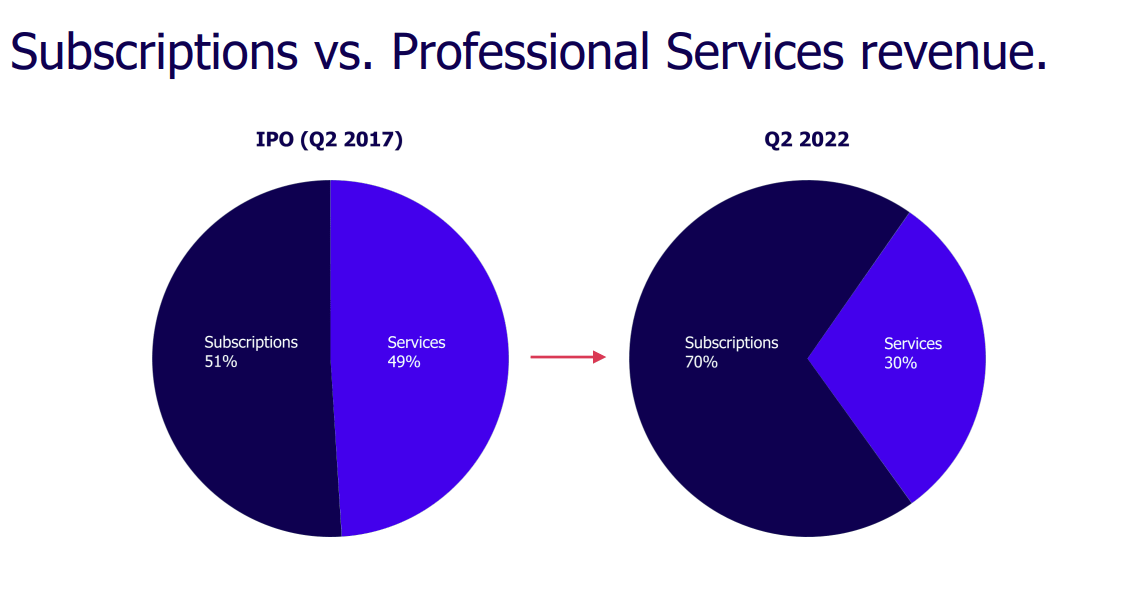

First and foremost, since 2017 Appian managed to reduce its reliance on Professional Services revenue in favour of Subscriptions revenue. This is very much normal for software companies, which usually offer these professional services at very low gross margins as a means to entice customers to finalize the purchase of the contract. This revenue comes from the sale of services such as support and training provided directly to the employees which will ultimately use Appian’s software. In 2017 the revenue mix was split pretty much in half between Subscription and Services, which is not very healthy for a software company and it effectively meant that Appian was operating at much lower gross margins compared to its peers. As of today, the revenue mix is much more promising with 70% coming in from high-margin Subscriptions and only 30% is from Services. Appian will need to show much higher growth in subscription revenue as it would demonstrate that the company is indeed achieving meaningful economic scale.

Appian Q2 2022 Earnings Report

Appian seems still quite far from reaching sustained profitability. Recent performance has actually shown how operating leverage is trending in the wrong direction, with operating expenses still growing faster than revenue which is the opposite of what investors like to see. This has been ongoing for many years and at some point Appian needs to show that it can manage to grow meaningfully without spending as much as 77.84% of revenue for SG&A expenses as in the last quarter. Even by stripping out the effects of stock-based compensation and other non-cash expenses, the company is still losing cash quarter over quarter from its operations. Personally I like to see at least a glimpse of improvement from the companies I invest in; however, Appian is actually trending in the wrong direction. Moreover, due to constant shares issuing the company has diluted shareholders by about 4% to 5% yearly for the past few years, albeit during 2021 total shares outstanding grew only 1.11%. Investors should keep an eye if Appian can manage to maintain shares dilution under control now that the stock is much less valuable than a year ago.

I personally find Appian’s balance sheet a bit shaky. Although the company has no debt, in the past year the cash position went down by about $107 million. Considering that Cash from operations has always been negative for every quarter in the past few years and only $135 million are currently held in liquidity, it seems to me that the company might need to raise more money in a moment when the cost of capital is much higher compared to just 12 months ago. It is important to note however that the recent victory in court against Pegasystems (PEGA) has in theory awarded Appian over $2 billion in damages. Should the ruling be confirmed after Pegasystems’ appeal, Appian’s cash position would obviously be in a much better state. However, management commentary during the earnings call cautioned that the company might need to wait 2 to 3 years in order to see the initial verdict confirmed. Therefore, despite the potential tailwind provided by the victory in court, the balance sheet in the short term does not appear fully sustainable in my opinion. Investors will need to monitor Appian’s cash flow for signs of a more sustainable operation.

One rather bold claim from management last quarter was how Appian is actually seeing no impact from the macro economy whatsoever:

Appian is not seeing any evidence of a downturn. […] We saw some deals slip out of the second quarter, which could be taken as a sign that deal cycles are lengthening but we always see a few deals slip, and Q2 wasn’t unusual. Of course, we’re still affected by FX rates, as you’ll note in our results and forecast.

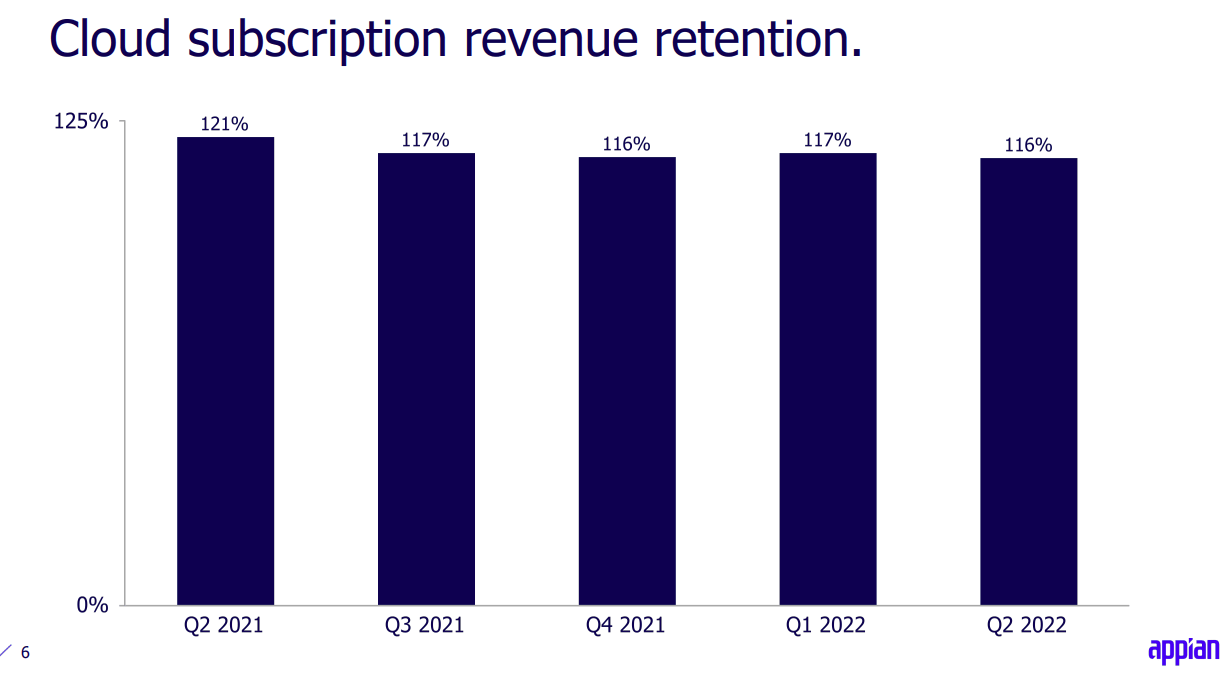

CEO Matt Calkins in the last conference call explained how Appian is providing quick return on investment for its customers, and in case the economy will take a turn for the worst, Appian will still be able to sell its products as its software is helping customers save time, save money and cut costs, which are all appreciated prospects during a downturn. A key metric to monitor on this is customer retention: Any sign of progressively worse retention could indicate that Appian customers are considering its software more as discretionary spending, which during recession could therefore more easily be cut. Since 2021 revenue retention for the Cloud subscription segment has indeed slightly trended down as shown in the below chart. Not yet a red flag but definitely something to monitor.

Appian Q2 2022 Earnings Report

What to expect in the current quarter?

The company has guided for 30-31% of Cloud revenue growth in Q3 2022 quarter, while for the full fiscal year the same should grow a total of 32-33%. When considering all types of revenue (professional services, cloud subscriptions and on-premises subscriptions), total revenue is expected to be between $115 and $117 million, representing year-over-year growth of about 24-27%. Revenue for the full year is projected to be between $466 million and $470 million, a growth of about 26-27%.

The guidance provided in the last quarter was overall quite positive as it implied no impact from the macro environment. However, the economy is rapidly changing for the worst, with the Federal Reserve raising interest rates at a speed not seen since many decades and many economists are warning that it might trigger a recession. As mentioned before, any drop in revenue retention could be an indication that Appian is experiencing some churn in the customer base. I will closely monitor management’s commentary for any sign of that happening, which could spell trouble if budgets are being cut from the business clients.

As of now, the stock is still trading at Price to Sales of about 8.57, which is rather upbeat in the current market. The valuation seems reasonable to me if Appian can maintain growth of about 30-35% in the subscription segment; however, there are uncertainties that need to be addressed first. After so many years, I would like the company to show signs of operating leverage as the times of cheap money to be used to supercharge growth has probably ended. Related to operating leverage, Appian’s balance sheet at the moment does not seem to offer a big cushion to soften the blow of potentially tough times ahead. Finally, I would not be surprised if a souring economy will take a toll on Appian’s guidance for the future despite management’s commentary three months ago. For these reasons, I will remain on the sideline for the time being but will nevertheless keep monitoring Appian’s performance ahead as it is still an interesting play in a growing market.

Be the first to comment