Diego Thomazini

Thesis

Apollo Tactical Income Fund, Inc. (NYSE:AIF) is a closed-end fund focused on leveraged loans and U.S. high yield bonds. As per the fund’s literature:

Apollo seeks to generate current income and preservation of capital primarily by allocating the Fund’s assets among different types of credit instruments based on absolute and relative value considerations and its analysis of the credit markets. Under normal market conditions the Fund invests at least 80%of its managed assets (which includes leverage) in credit instruments and investments with similar economic characteristics.

Source: Fund Fact Sheet

The fund’s collateral is composed of leveraged loans mainly, which account for over 75% of the portfolio. The low standard deviation of its collateral has allowed the CEF to layer in a high amount of leverage, which currently clocks-in at 37%. The fund is down year to date, driven by higher risk free rates and much wider credit spreads:

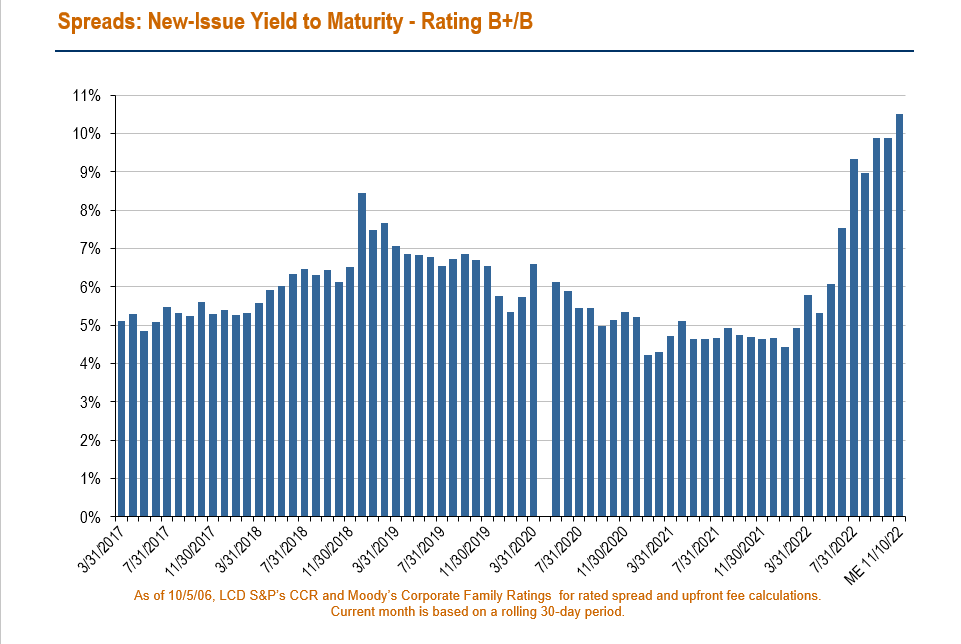

New Issuance Yields (LCD)

We can see from the above chart, courtesy of LCD, how single “B” new-issue yields to maturity have moved up substantially, basically doubling from March 2022. To note that these are all-in yields (Libor/SOFR plus spread) and thus represent an encompassing reflection of the new cost of funds faced by companies. At the current levels for interest rates it is much more useful to talk about all-in yields, since they are a true reflection of the actual cost (i.e. dollars out the door) for a company.

Despite the violent rise in rates and all-in yields, AIF is down only -13% this year, and has not seen its drawdown exceed -20%. For a highly leveraged fund that is a fairly impressive result, especially when benchmarked against investment grade fixed income. As a comparison, the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), which is an ETF composed of investment grade bonds with no leverage on top, is down over -18% in 2022.

Floating rate debt has been one of the safest places to be in fixed income this year, and even a high leverage ratio has not torpedoed results. The results speak to the resiliency of leveraged loans and the fact that CEFs that are based on this asset class should be preferred in a rising rates environment. We are talking here about “clean” leveraged loans CEFs, not structures that contain CLO bonds in them, CLO tranches being inherently leveraged within the structure, thus presenting higher risk levels.

Performance

The fund is down year to date, but has managed to keep a fairly shallow drawdown in light of the violent rise in rates:

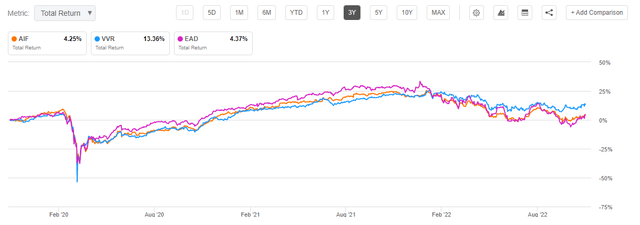

Currently down only -13% in a year with a substantial widening in credit spreads and increase in rates, AIF never had a total return exceeding -20% this year. The fund outperforms versus EAD, but underperforms versus VVR.

The picture is similar on a 3-year basis, with VVR the clear outperformer, while AIF and EAD post positive similar total returns:

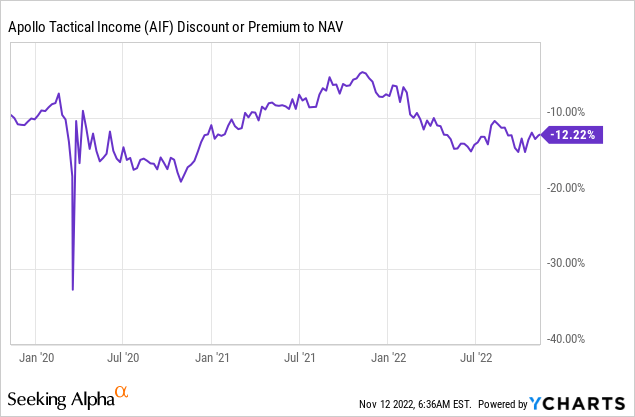

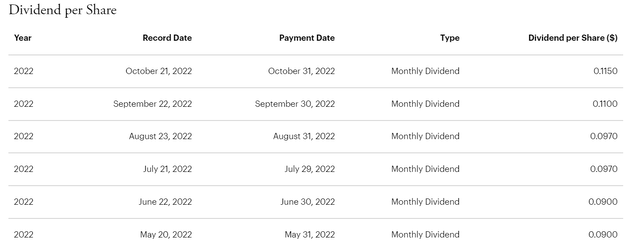

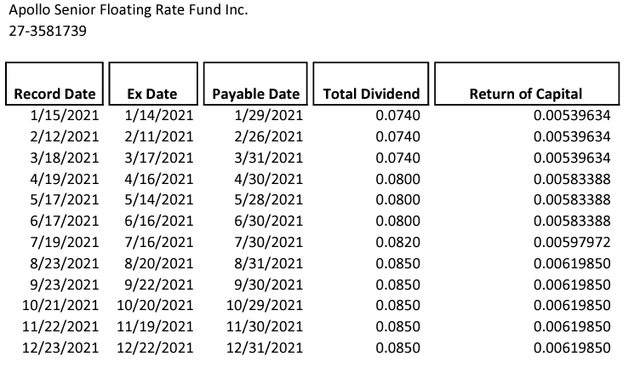

Total Return (Seeking ALlleverage can work favorably for an asset class if it layered correctly for low standard deviation fixed income instruments. Leveraged loans are usually senior in the capital structure, thus they represent a first lien on a company’s estate. This high recovery feature makes leveraged loans fairly stable from a pricing perspective, which in turn generates positive long term results even when leverage is added on top throughout multiple credit cycles. The fund is still trading at a discount to net asset value: As it became clear in 2022 that rates are going up substantially and we might have a bear market on our hands, the fund moved to a wider discount to NAV. This CEF has a low premium beta to risk-on/risk-off environments, with virtually no movement in the discount as the markets sold off or rallied. As interest rates and all-in yields rose, the fund increased its dividend: Dividend (Fund) Most of the distribution is covered, with the fund exhibiting de-minimis return of capital usage, as observed in their filings for 2021: Distributions (Seeking Alpha) The advantage of having a collateral pool composed of floating rate loans, is the fact that as rates rise the holder gets a direct benefit via higher cash-flows. Even after the payment on the leverage portion is settled, the structure will benefit from an increase in the amount of cash received, and thus is able to increase its dividend. We expect higher rates to persist for longer, thus we believe the dividend hike is here to stay for the next year. AIF is a closed end fund focused on leveraged loans. Given the asset class’ low standard deviation, the managers have layered in a 37% leverage ratio. Although risk free rates and credit spreads have increased substantially this year, AIF is down only -13% on a total return basis, underlying the advantages of a floating rate asset class in a rising rates environment. The fund has also managed to increase its distribution rate, given higher amounts of net cash coming into the structure. The current dividend yield is 11%, and it is largely supported through interest income. Apollo is a robust platform and the CEF benefits from the asset manager’s experience and track record in the space.

Premium / Discount to NAV

Distributions

Conclusion

Be the first to comment