EXTREME-PHOTOGRAPHER/E+ via Getty Images

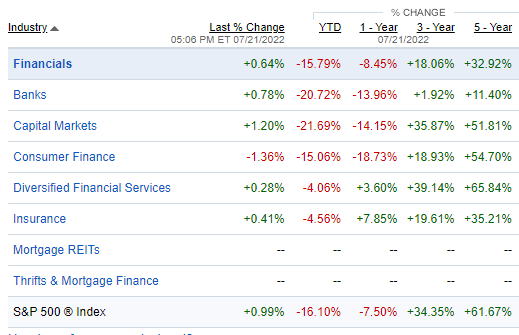

Diversified financial services stocks have performed relatively well so far in 2022. Also, many insurance niches are safer areas of the Financials sector, less prone to downturns in the credit cycle, and feature more predictable cash flows. Apollo Global Management (NYSE:APO), while known as a major private equity firm in the credit and real estate markets, sports a sizable insurance business. Still, its dreadful year-to-date return looks more like that of a risky asset manager, relying on market returns to grow.

Financials Sector Returns: Industry Breakout

Fidelity Investments

According to Bank of America Global Research, Apollo is one of the largest alternative asset managers in the world and offers investment solutions for institutions and individual investors across the risk-return spectrum in yield, hybrid, and equity. Apollo has offices worldwide and is headquartered in New York. Apollo was founded in 1990 and publicly listed on the NYSE in 2011.

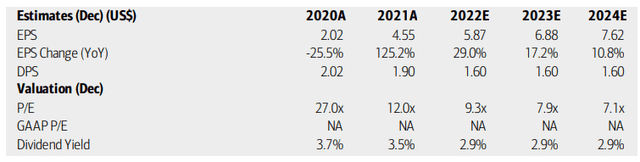

The $31 billion market cap stock in the Financials sector features a market multiple just below 17-times last year’s earnings. It has an above-market dividend yield of 2.93%, according to The Wall Street Journal. BofA sees solid earnings growth through 2024, which suggests its P/E ratio is attractive here. A yield near 3% should persist for the next two years, per BofA analysts.

Apollo Earnings, Valuation, Dividend Yield Forecasts

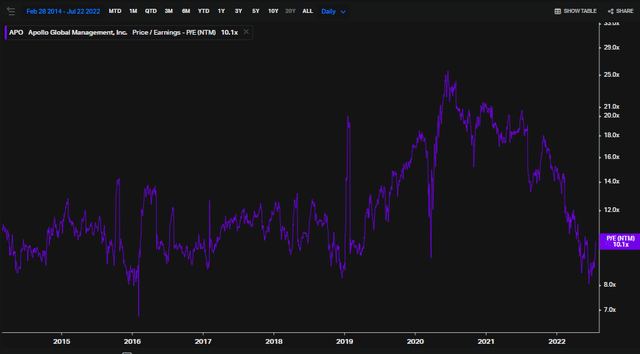

On a forward twelve-month basis, Apollo’s valuation looks good relative to history. We will know a lot more about the firm’s profit situation following its earnings report due out in less than two weeks. Right now, the stock trades at just 10.1-times forward earnings, according to data from Koyfin Charts. That’s well below the 2020-21 range, but about where it was valued from 2014 through 2019. On a fundamental valuation basis, APO might be worth a shot here given its growth projections.

APO Forward P/E Ratio History: Back Down To Attractive Levels

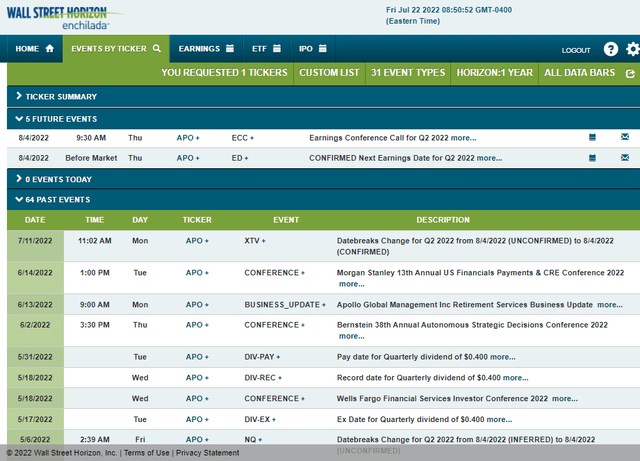

Apollo’s Q2 2022 earnings date is confirmed by Wall Street Horizon for Thursday, August 4, BMO with a conference call to follow. The company recently spoke at the 13th Annual Morgan Stanley U.S. Financials Payments & CRE conference.

Apollo Corporate Event Calendar: Earnings Aug 4 BMO

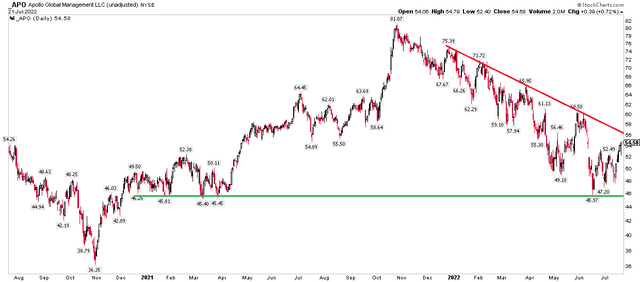

The Technical Take

Shares of APO sunk more than 40% off the November 2021 peak as speculation and trading activity in financial markets began to wane last year. The asset manager no doubt feels the brunt of the current bear market. The chart does show, however, some support in the mid-$40s. There remains much work to do in order to break the downtrend from the all-time high notched in 2021. Bulls want to see a move above $61 for better signals of a bullish trend change. Further downside can be anticipated should APO fall below $45 – look to the 2020 low near $36 as next support.

APO: Firm Downtrend In Place, $45 Support

The Bottom Line

The Financials sector has been tough this year, but not all areas are created equal. Apollo’s 40% drawdown leaves the stock with a better valuation today which may be attractive for long-term investors. Short term, the stock encounters resistance, so selling the rallies makes sense for now.

Be the first to comment