DNY59

Investment thesis

Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI) will likely have great third-quarter results due to the aggressive rate hikes both in the U.S. and in the UK. Their portfolio consists of 90%+ floating rate loans which will take advantage of the increasing interest rate environment and the company’s NII will likely increase by $0.11 – $0.14 per share in the next quarter. However, the question remains: what will happen after inflation normalizes, interest rates stabilize and asset valuations start to drop due to a recession in the UK and possibly in the U.S.? The short term outlook for ARI is positive and stable but I am not so sure about the long term outlook just yet.

Apollo Commercial’s business model

ARI is a mortgage REIT that invests mainly in hotel, office, and retail center loans. ARI is the 12th largest publicly traded mREIT in the U.S. Approximately 55% of its loan portfolio consists of these 3 types of collateral. The company’s main focus has been on New York City and London. About a month ago the company closed 2 financing facilities secured by two assets. The construction loan in New York and the repurchase agreement in London are worth approximately $520 million which will further diversify ARI’s portfolio and enhance the balance sheet.

Interest rates and the mortgage market

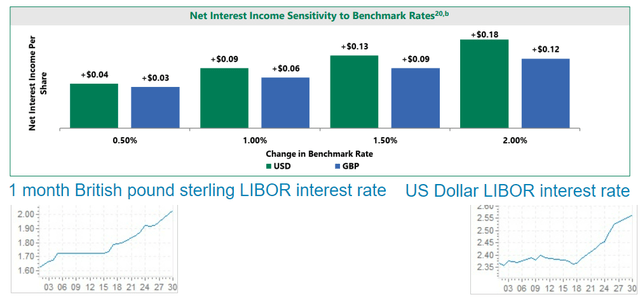

LIBOR rates have been steadily climbing which will help the company’s NII in the third quarter. In the second quarter presentation, the management calculated an additional net interest income of $0.09 per share in case of a 100-basis point jump in U.S. 1-month LIBOR rates.

Their benchmark rate was 1.713% and this figure has been steadily growing since and jumped to 2.633% by the beginning of September. This means we can realistically expect an additional $0.07 – $0.09 NII per share for the third quarter results. A similar trend has been unfolding in the British pound sterling LIBOR market. From 1.22% at the end of June, the rates have risen to 2.1% by the beginning of September which will likely add another $0.04 – $0.05 per share net interest income to ARI’s Q3 results.

ARI is not heavily involved in the residential real estate market, only 16% of their total loan portfolio is connected to this market (10% is residential-for-sale assets and 6% is residential-for-rent assets). However, the tightening mortgage market and the slowing housing market will affect ARI’s residential portfolio assets. I believe the impact will be mainly on asset valuations which could be bad news for the residential-for-sale assets. The prepayments will likely decline as they always decline in a rising interest rate environment however this statement is more applicable for residential mREITs. The 30-year fixed mortgage rates have been climbing aggressively for months now and due to further FED interest rate increases, the mortgage rates will keep climbing which means the pressure on the residential part of their portfolio will increase.

Valuation

ARI is fairly valued at the moment; some analysts think it is slightly undervalued based on traditional valuation metrics such as the price-to-book ratio or P/E ratio. The company is trading at 0.69x its book value which is relatively fair taking into consideration the potential long-term risks and the possibility of a drop in asset valuations in the near future. Its P/E ratio is approximately 17% below the sector median however the sector includes a lot of different companies not only commercial mREITs.

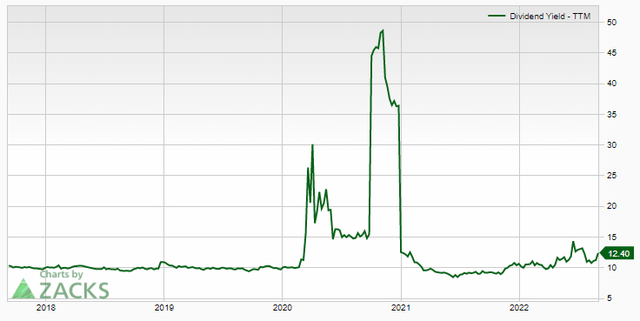

In terms of its dividend, the company looks more undervalued. Investors could not have bought ARI on a better than 12.4% forward dividend yield in the past one and a half years (except for the short yield spike in June because all markets tanked).

Company-specific risks

I expect ARI to report a great third quarter NII after a bit disappointing one in the second quarter. The short-term external factors are in the company’s favor. However, there are some risks worth taking a look at. The company is externally managed and advised by an indirect subsidiary of Apollo Global Management. This might not seem like a great risk factor but according to my experience internally managed mREITs and REITs perform better over the long term. The other major risk factor is connected to its net interest income. As I stated previously, I expect great third-quarter results with relatively high NII. The question is what happens after? The UK is facing a major economic crisis, record inflation, and slowing investments. This will have an impact on asset valuations all over the country, even in London as well (however, I expect this impact to be less severe). The dropping asset valuations will cause a decline in NAV and that might have an impact on NII when the interest rate increases stop or slow down.

ARI’s dividend

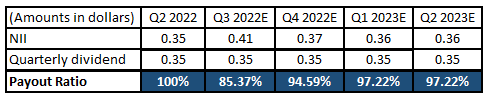

The company has been a stable dividend payer since its IPO. The management has been paying dividends for 11 consecutive years however we saw some dividend cuts over the years, especially after the covid crisis. But investors saw relative stability since then, the management has not changed the $0.35 per share quarterly dividend. The payout ratio might seem high and almost unacceptable but keep in mind that ARI is one of the few mREITs that pays the dividend exclusively from its NII.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

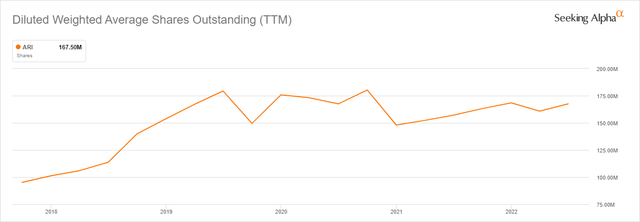

Its number of shares outstanding has not changed much in the past 3 years while a lot of its competitors usually dilute shares to be able to pay dividends to shareholders. On one hand, it is great news because it suggests that the underlying investment business is stable but it also means that if for some reason the NII and asset valuations significantly drop the management will very likely cut the dividend just as they did previously a couple of times. At the moment it seems that thanks to the floating rate portfolio and constantly rising interest rates the NII will remain high and will be able to support the dividend even in case of a drop in asset valuations due to a recession.

Final thoughts

In the short-term income investors can feel safe investing in ARI as an income source but bear in mind that the company pays its dividends from its NII. At the moment the rest of 2022 seems stable from a dividend point of view but the drop in NAV might affect NII and eventually the dividend as it happened before. ARI is a risky mREIT but the next couple of months look great because the external factors are in their favor.

Be the first to comment