imaginima

Anywhere Real Estate (NYSE:HOUS) is the leading owner/franchisor of residential real estate brokerages in the US, with most of its revenues and profits derived from its Anywhere Advisors brokerage segment. Amid a deteriorating property backdrop, it was perhaps no surprise that HOUS has withdrawn its full-year EBITDA guidance on account of worsening transaction volumes in the September to October period (down >25% YoY).

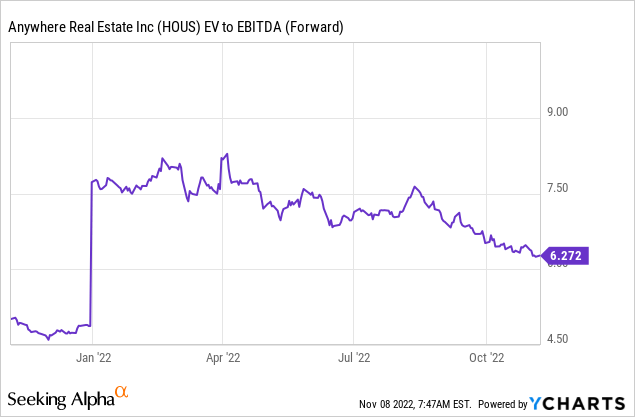

The headwinds will undoubtedly continue for the next few quarters as well, but I suspect most of the negative impact has already been priced into the stock here. Importantly, HOUS has a demonstrated track record of generating free cash flow through the cycles (including the ’08 crisis), and I see no reason why this time will be any different. As the real estate brokerage market shakes out, HOUS’s strong cash buffer could instead see it coming out of this downturn with a larger share of the market. Relative to cyclically low numbers, HOUS is trading at a compelling ~6x fwd EV/EBITDA.

An Unsurprisingly Below-Par Quarter

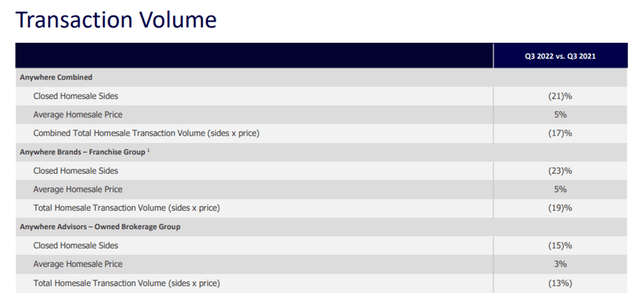

HOUS posted a Q3 update that was weighed down by a weakening for-sale housing market, as adj EPS of $0.58/share and reported operating EBITDA of $166m (down 39% YoY) missed consensus expectations. Driving the P&L result was a ~17% decline in total transaction volume, led by a 23% YoY decline in the franchise segment despite a 5% higher price contribution. The company’s brokerage segment (the highest revenue and EBITDA contributor to the group) also saw a 15% YoY decline, as a steep drop-off in volumes outweighed the 3% YoY price increase.

While the Q3 earnings missed expectations across the board in a very difficult quarter, I would point to HOUS’s continued cash flow generation at +$99m of FCF as a silver lining. Additionally, the company has also made headway in building out its owned brokerage agent count (up ~7%), a positive signal that its competitiveness on the recruiting and retention fronts are improving.

Guidance Withdrawal Implications

In light of the macro challenges, Q4 volumes are tracking down 25%, well below management’s prior expectations of -10% to -20%. Management has reacted by removing its full-year EBITDA guidance for now. On the quarterly call, HOUS was less pessimistic, though, noting signs of competitive pressure easing as small brokers drop out of the market and the agent split % moderates in a lower volume environment. As a result, management sees some relief from splits coming down in a tough market, which could provide some margin insulation against further volume pressure in the quarters ahead.

HOUS also has levers on the cost side – management noted it remains on track to achieve ~$140m in previously targeted savings. Only a third of these savings are expected to stick, though, with the remaining being temporary measures to address the weak housing market. Beyond the headline targets, I suspect the company could go even further on costs should the property market continue to weaken – for instance, the integration of title/mortgage into the owned brokerage system presents one potential area where efficiency gains remain on the table. With management having done a stellar job of managing costs over the last few years, HOUS could well deliver some upside surprises down the line.

A Strong Liquidity Position Ensures Ample Runway

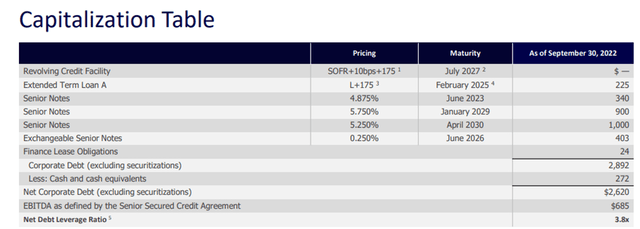

HOUS closed out the quarter with a solid ~$1.3bn liquidity position, of which ~$272m is cash on hand. Post-Q3, management followed up with the redemption of the remaining $340m of 2023 notes using a combination of revolver borrowings and cash, leaving no significant maturity until the 2026 converts.

In essence, the debt stack is termed out, and the liquidity available should provide a more than adequate buffer as long as HOUS stays positive FCF. The latter seems likely, in my view, given the HOUS cash flow/EBITDA machine continued to chug along even through the bottom of the 2008 financial crisis. In a worst-case scenario, the company still maintains access to a revolving credit facility with somewhat generous terms (a 4.75x net senior secured leverage maintenance covenant threshold), so I feel comfortable underwriting HOUS’s through-cycle resilience. Management seems to agree – the company bought back and retired 4.9m common stock for a total of $52m (implying a $10.61/share price) during the quarter, highlighting their confidence in the outlook.

Navigating a Real Estate Downturn

With mortgage rates spiking to >7% and increasing the overall stress on the property market, HOUS’s underwhelming quarterly result and withdrawn full-year guidance came as no surprise. Transaction volumes could still see more downside from here, though, so HOUS will need to lean on its cost structure to preserve profitability and cash generation.

The good news is that HOUS has a track record of through-cycle cash generation, riding out even the ’08 crisis with positive cash flow. This time around, the company is even better positioned to weather a downturn, in my view, given its liability management activity, which provides the company with a long runway (no maturities until the 2026 converts and limited credit facility utilization). On cyclically low forward numbers, HOUS is worth a look at the current ~6x fwd EBITDA valuation.

Be the first to comment