imaginima

(Note: This article was in the newsletter on September 13, 2022 and has been updated as needed.)

Antero Midstream (NYSE:AM) has long been under scrutiny for the thinly covered dividend. Yet the company just announced the dividend was maintained. The company has just as long been one of the financially strongest midstream companies that I follow. Strong financial companies can choose their distribution options almost at will. It is the highly leveraged ones that usually have footnote issues as well where the dividend and principal are in considerable danger.

A financially strong company can cut the dividend to grow or fix problems before they become apparent to the market. Financially weaker companies often have fatal or near-fatal problems that a company like Antero Midstream can easily surmount. More importantly, a strong balance sheet allows a company like this one to take advantage of bargains that appear.

One such bargain was the announcement that led to an acquisition increasing future free cash flow. Antero Midstream picked up a pipeline with excess capacity of more than 50%. There were some associated facilities as well that had excess capacity.

The reason this happened was an unforeseen strategy change that happened a few years back to more liquids as the natural gas prices declined to levels that were uneconomic for dry gas wells. This was accompanied by a determined strategy to get the production to some of the stronger markets in North America and elsewhere that led to some of the best-realized prices in the Appalachian basin. The acquisition continues to the strategy of multiple ways to the marketplace to keep that flexible marketing policy that has led to decent profitability.

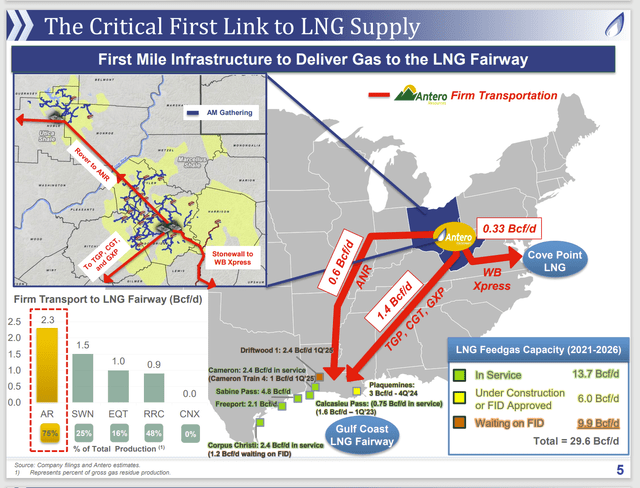

Antero Midstream Map Of Transportation To Better Pricing (Antero Midstream September 2022, Investor Presentation)

So much has been made of the current natural gas situation as well as the effect upon world pricing. But many managements generally sell natural gas wherever they produce it. Not many consider the flexibility of incurring extra transportation charges to achieve superior pricing. The result is that a lot of companies will benefit indirectly from strengthening North American natural gas prices as more natural gas is exported to a very strong world pricing market.

This company combined with parent company Antero Resources (AR) is one of the few (operating in the Marcellus) with the ability to send significant amounts of natural gas to the export market. The ability to redirect production to take advantage of higher prices in different places has long been a hallmark of this company. That ability has benefited Antero Resources tremendously. I previously covered how this company (one of the very few upstream companies) took advantage of storm Uri, at the time, to redirect natural gas to some sky-high prices far away from the Appalachian basin that eventually resulted in a tremendously huge quarterly cash flow.

Generally, upstream companies that benefit from sky-rocketing natural gas prices that happen during a crisis are the ones in the area of the crisis. Antero Midstream connections make it possible to benefit from a crisis elsewhere due to connection abilities to various markets. The parent company Antero Resources has reported strong quarterly results in the past because of that ability.

Now the export market has very strong prices and the organization is again in a position for Antero Resources to receive that strong world price (or at least as much as it can get). The company is likely to again report some of the best-realized prices in the basin. But it has been transportation planning over the years (because midstream businesses generally have long-term contracts) that allows that choice to be made in the first place.

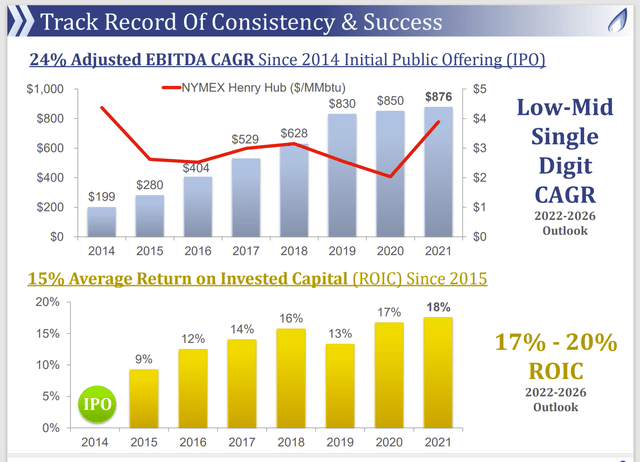

Antero Midstream Growth And Profitability Record (Antero Midstream September 2022, Investor Presentation)

One of the concerns that the market has had for some time is the tight dividend coverage combined with the slow EBITDA growth shown above. However, financially strong companies like this one can change the future expectations on fairly short notice. In this case, management expects to increase the free cash flow projection significantly as a result of the acquisition.

But the market does not factor in these types of opportunities until they actually occur. This provides investors an opportunity to wait for superior management to benefit from that superior management. Good management tends to surprise to the upside.

In this case, investors have a dividend that yields in the neighborhood of 9%. That yield slightly exceeds the long-term record shown time and again by researchers of most long-term investment returns. The very strong balance sheet leverage of 3.7 increases the safety that comes with a midstream investment.

Both the parent company and the midstream company have experienced financial strength upgrades periodically as public companies. While the ratings companies have at times put out a watch for a possible downgrade, neither Antero Resources nor Antero Midstream has ever had their debt ratings downgraded despite some of the challenges of recent years.

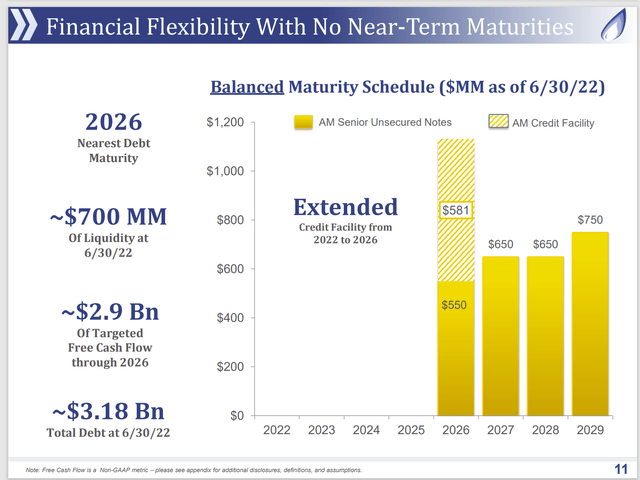

Antero Midstream Financial Strength Summary (Antero Midstream September 2022, Investor Presentation)

The company has access to the debt markets as needed. The current leverage ratio is among the lowest of the midstream companies that I follow. Therefore, as Antero Resources continues its strategy to upgrade the financial ratings, the midstream company, as a very financially strong midstream company, will benefit from continuing parent company debt rating increases.

Antero Resources has stated they are not going to grow production right now except for some technology advances that should lead to low-single digit production growth. Instead, the company is focused upon free cash flow generation. Similar reasoning has led management to state that they are not playing the acquisition game either. Yet, there is a joint venture to be serviced that will provide some extra production growth that is relevant to Antero Midstream.

There is also the possibility that the midstream company will look for more attractive acquisitions as such options become available.

The Future

The market is worried about a dividend cut. Yet the financial strength of Antero Midstream with that relatively low midstream debt ratio suggests that there are no long-term worries here. The last time the captive midstream group cut dividends, that same money was redirected to stock repurchases which will benefit shareholders in the long run.

Earnings are coming out. The important thing to watch is that the free cash flow projection will stay on course. That is far more likely with the acquisition.

A financially strong company that cuts the dividend will have very different implications than a dividend cut from a financially-leveraged company. Oftentimes, the strong company will at some point return the dividend and more because finances generally offer that flexibility.

In the case of Antero Midstream, money saved from the reduced dividend has enabled an opportunistic acquisition. That money has also been used to repurchase stock from time to time. The total effect of these transactions will likely benefit shareholders in the long run.

No matter the outcome of the tight dividend coverage (that management has defended), the outlook of this financially strong company remains good. Good management has surprised to the upside with an opportunistic acquisition. Look for that good management to find more decent opportunities in the future that the market will not value until they happen.

Be the first to comment