onurdongel/E+ via Getty Images

Antero Midstream Corporation (NYSE:AM) may have disappointed the market by forecasting little to no real growth at the current time. But this management of this energy infrastructure company has long conservatively guided the market. What got lost in the presentation is that the management of Antero Resources (AR) recently inched up the production guidance into low-single-digit range after stating this would be a maintenance year. Antero Midstream shareholders receive a generous distribution while waiting for the lure of very strong prices to take effect. That patience is likely to be rewarded.

In addition, management briefly mentioned the lottery ticket the company holds that could result in a considerable cash bonanza. Court cases can go “either way” so this lottery ticket has both negative and positive possibilities. Should management win, there is a good possibility for a significant deleveraging that could well result in the midstream company meeting its leverage goal a few years early. When combined with the possibility of some growth during this period of great commodity prices, a raise in the quarterly distribution could be “in the cards” sooner than the current conservative guidance would have shareholders believe.

This court case goes back to the water plant that really never operated. Management tried to begin the operations, but eventually shut down the plant and went to court to recover its costs. A judgement will likely be known sometime in the second quarter. Of course, there could be appeals and it may take years to sort out the situation. Therefore, shareholders need to watch for management to either record a liability or (hopefully) a receivable as the case proceeds.

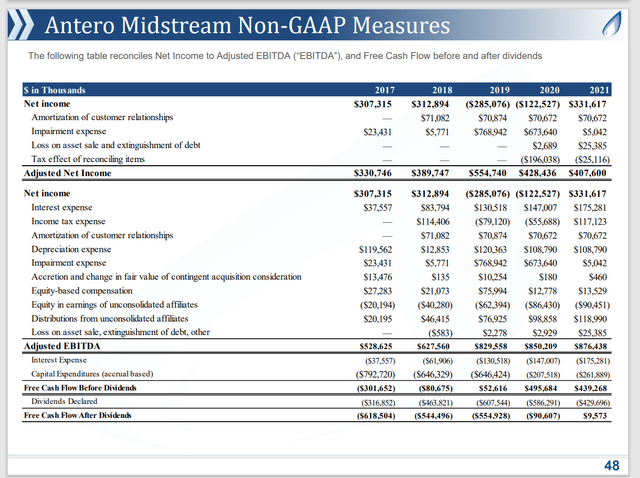

Antero Midstream Five Year Financial Results Summary (Antero Midstream Presentation At Scotia Howard Weil 50th Annual Energy Conference March 22, 2022)

In the meantime, EBITDA is clearly growing, and with it, free cash flow. Mr. Market was concerned by the thin distribution coverage. But that thin coverage was caused by a management election to fund the capital budget from cash flow. That conservative strategy is rarely matched in the midstream industry.

This (former) partnership (now a corporation) is known for its low debt. Therefore, management could have elected to allow the debt ratio to increase while waiting for the inevitable production growth that characterizes the industry during periods of robust pricing.

Investors need to remember that free cash flow is non-GAAP. Therefore, companies are free to define free cash flow in any way they deem appropriate as long as management discloses the calculation. There are a lot of companies that use “maintenance capital” as defined by management (and that measurement is real subjective) to calculate free cash flow. In this case that would result in better distribution coverage than management showed above.

Most of the industry regularly finances the capital budget at least partly through borrowing. This company has conservative enough finances to fund the whole budget through borrowing if management ever chose to do so. Not many midstream companies can say that. It also points to the weakness of comparing distribution coverage without considering related evidence in the calculation.

Since management does run the midstream company conservatively, the distribution is likely to remain at conservative levels in the future. Management has stated that they have a goal to get the key debt ratio to 3 before they raise the dividend. That goal is unlikely to change. Such a conservative ratio though is rare in midstream.

Note that the midstream company seldom receives the benefit of the conservative ratio because financial strength ratings are “capped” by the financial strength of the main customer, Antero Resources. Management has long stated a goal to increase the financial strength ratings throughout the organization. This company is able to take advantage of any increase in Antero Resources’ financial debt ratings immediately. That probably makes this investment safer for investors than many midstream competitors.

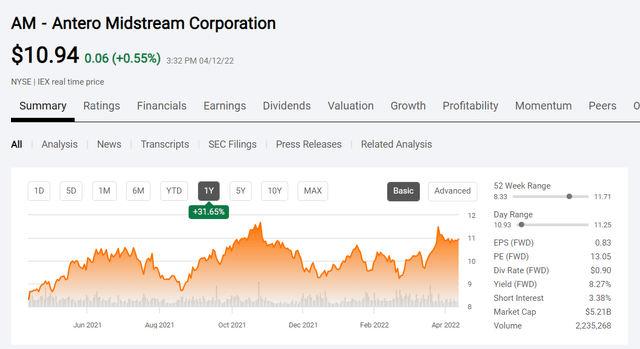

Antero Midstream Common Stock Price History And Key Valuation Metrics (Seeking Alpha Website April 12, 2022)

The stock market clearly reacted to the low growth news by dumping the stock on February 17. Just as quickly, sanity returned the next day to raise the stock price both during trading and after hours. This momentum-based market is clearly losing steam to the reality that a company like this one regularly produces above-average returns.

That yield is backed with a low debt ratio as well as distribution coverage if one considers maintenance capital rather than the whole capital budget. Now should Antero Resources decide to acquire another company (or merge with a competitor), there is a chance that more capital would be required to fund such an increased demand for midstream services. Given the management history, that could result in a dividend cut to keep the balance sheet strong.

But that would mean a growing business with a good chance of future dividends that exceed the current rate. Similarly, as management showed in the slides during the conference call, this company is fairly profitable. So, the reinvestment of cash rather than paying the cash out to shareholders is likely to result in distribution growth in the future.

In the meantime, shareholders receive a largely tax-free distribution (so far, but that could change in the future) that generally exceeds the long-term rate of total returns for many investors. Midstream companies are generally considered the utilities of the oil and gas industry. The additional balance sheet strength from the low debt ratio lowers any future risk of principal loss even further. For that reason, this company can be considered by a wide variety of investors.

Good managements tend to surprise on the upside. Here, the downside risk is reduced considerably because investors are “paid” generously to wait. That makes for an asymmetric return that so many investors claim they are looking for. The time to get in on good management is when “nothing is going on” because that is unlikely to last.

The big deal here is that the initial capital investment needed to service Antero Resources is likely over for the time being (unless there is an acquisition). Therefore, free cash flow is likely to grow in the future even if it is uneven growth.

In the same presentation and conference call, management mentioned that the debt ratio of Antero Resources is now 1.3. That is the lowest that ratio has even been. Management will initially use the currently strong commodity prices to drive the ratio lower. For Antero Midstream shareholders that means more free cash flow in the near future. The outlook here is actually pretty good and fairly safe. Rarely does an investment promise a low-double-digit return (with the possibility of more than that) with such low risk.

Be the first to comment