Tinnakorn Jorruang/iStock via Getty Images

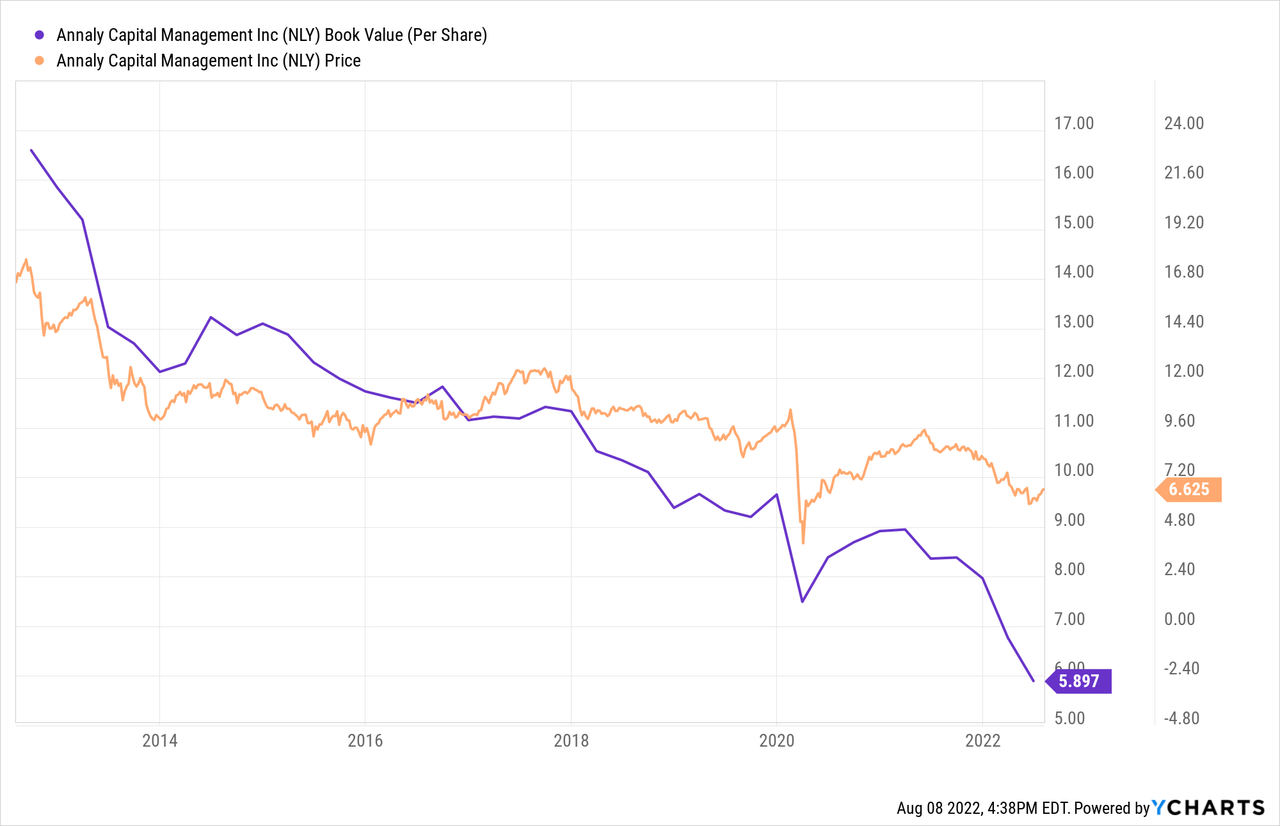

Mortgage real estate investment trust yields are a red flag. Annaly Capital Management Inc. (NYSE:NLY) trades at a yield of 13.28%, which is higher than its historical average, and the stock trades at a 14% to book value ratio, despite the fact that the trust’s book value fell 13% in the second quarter.

Annaly’s book value had already dropped by 15% the previous quarter. Because the short-term interest rate path is becoming riskier, and Annaly’s book value has declined three times in a row, the mortgage trust’s high yield should be avoided.

Annaly’s Book Value Is Dropping Like A Rock

Short-term interest rate volatility and rising sector funding costs did not help Annaly in the second quarter. In 2Q-22, the mortgage trust reported its third consecutive decline in book value. Annaly’s book value fell to $5.90 per share as of June 30, 2022, a 13% decline QoQ, and the trust’s book value fell by the same percentage as Annaly’s competitor AGNC Investment Corp. (AGNC).

Annaly’s book value has dropped three times in the last three quarters and is down 30% since 3Q-21, when it was $8.39 per share. This is a significant decline in book value, raising concerns about the company’s ability to maintain its book value in a difficult market.

The long-term trend in Annaly’s book value is also not encouraging, implying that the mREIT industry’s much-touted double-digit yields are significantly riskier than the market is willing to admit.

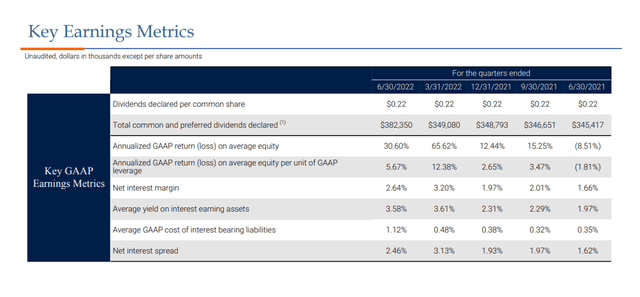

Annaly was hurt not only by a declining book value in the second quarter, but also by a significant contraction in its net interest spread, due to interest rate volatility at the short end of the yield curve and higher overall interest rates.

However, the decline in profitability/net interest spread was fairly predictable. In June and July of 2022, the central bank announced two major 75 basis point interest rate increases, bringing the new interest rate range to 2.25-2.50%.

The problem with rising short-term interest rates is that trusts like Annaly, which rely heavily on cheap debt to buy mortgage securities for yield, are seeing the spread between yield and costs narrow, lowering profits.

Annaly’s net interest spread fell by 67 basis points in 2Q-22 to 2.46%, a rather steep QoQ decline. Of course, the decline can be traced back to the central bank raising short-term interest rates, making borrowing more expensive for mortgage trusts.

Annaly’s funding costs rose 64 basis points to 1.12% in the second quarter. Consistently high inflation will continue to put pressure on the central bank to steepen the interest rate path, weighing on Annaly’s net interest spread.

Key Earnings Metrics (Annaly Capital Management)

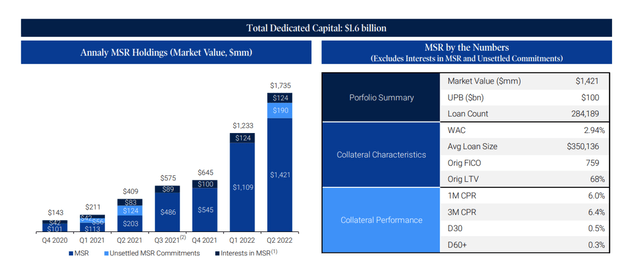

While Annaly’s agency portfolio is shrinking as the trust reduces risk, the company’s mortgage servicing rights investments are promising.

Mortgage Servicing Rights are complementary investments for Annaly because they are positively correlated with interest rates. In a rising-rate market, an increase in interest rates raises the servicing value of Mortgage Servicing Rights, creating profit potential for Annaly.

Since the end of 2021, the market value of Annaly’s Mortgage Servicing Rights has increased by nearly 170%, owing primarily to higher short-term interest rates.

Total Declared Capital (Annaly Capital Management)

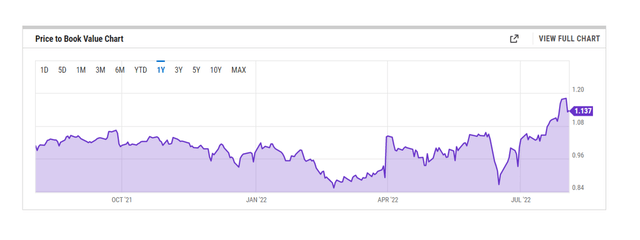

Annaly’s P/B-Multiple Is Too High

Annaly’s 13.28% stock yield is trading at a 14% premium to its $5.90 per share 2Q-22 book value, which is more than a stretch given that the mortgage trust recently lost 13% of its book value. Given the uncertainty surrounding short-term interest rates and ongoing market volatility, I believe the risk outweighs the potential reward at this time.

Price To Book Value Chart (YCharts)

Annaly’s dividend yield of 13.28% is also higher than the historical average, suggesting that the market overvalues the trust’s earnings potential in relation to its risk.

Why Annaly Capital Could See A Higher Valuation

A continued contraction in the trust’s net interest spread and persistent interest rate volatility at the short end of the yield curve indicate that mortgage trusts are in trouble.

The increase in capital costs in the second quarter suggests that Annaly’s inflated net interest spread, which has resulted from low interest rates, is unlikely to be sustainable.

With inflation remaining high, the Fed may have to continue dealing with market-wide rate hikes. If it does not, Annaly may face an inflated net interest spread for some time.

My Conclusion

A whopping 30% of Annaly’s book value has vanished in the last three quarters, and as a result of the decline in 2Q-22 book value, Annaly’s stock now trades at a premium to book value once more.

Paying full book value when the stock is trading above a 13% yield suggests that the risk/reward trade-off is out of balance. Given that Annaly’s book value has fallen in each of the last three quarters, investors cannot be certain that the company’s book value declines have ended.

Furthermore, Annaly’s long-term trend in book value growth is dismal, and the 13.28% yield is a red flag in and of itself.

Be the first to comment