Andrii Yalanskyi

Thesis

Annaly Capital Management’s (NYSE:NLY) stock has recovered remarkably from its dislocated October lows as significant market pessimism, coupled with record market volatility, pushed NLY investors off the edge.

As such, the market forced a steep capitulation move in NLY through its October lows. Accordingly, the selloff nearly wiped out 45% of NLY’s value at its October bottom since we cautioned investors in early September.

However, NLY has recovered nearly 44% from its recent lows, as astute mREIT investors positioned for a mean-reversion rally from its previous collapse. Relative to its 5Y and 10Y total return CAGR of -3.5% and 1.7%, respectively, we believe NLY should be consolidating before a pullback to digest its recent gains.

Investors should continue to expect volatility in Annaly’s distributable EPS, as the company is cautiously positioned, given market volatility. Furthermore, interest costs have crept up, impacting its cost of financing. As such, it could continue to be a headwind driving its EPS growth recovery moving forward.

However, we postulate that the collapse in Annaly’s book value per share (BVPS) should subside as market volatility could potentially move lower in the equity and fixed income market. In addition, with the Fed likely slowing down its rate hikes from its upcoming December FOMC meeting, we could also be looking at a potential pause by the end of H1’23.

Therefore, Annaly could potentially capitalize on the investment opportunities in the Agency MBS market subsequently, leveraging on attractive yields and boosting its distributable EPS moving ahead.

Notwithstanding, we postulate that the recent sharp mean-reversion rally from its October lows could face intense selling pressure at the current levels. Furthermore, NLY remains in a medium-term downtrend, suggesting caution as the dominant bias remains on the downside.

Hence, investors are encouraged to be wary of picking its “highly attractive” yields. As such, we believe the discount to its peers’ valuation is appropriate to account for its execution risks.

Maintain Hold.

NLY: Need To Stabilize Its Potential Earnings Decline

Annaly’s Q3 portfolio comprises 67% of agency mortgage-backed securities (MBS), 15% of mortgage servicing rights (MSR), and 18% of Residential Credit.

The Agency MBS space was hit by significant value compression as institutional investors backed off due to record market volatility. As such, it caused spreads to widen considerably (25 to 30 bps), reaching levels usually seen “during periods of crisis.”

Given its significant Agency MBS exposure, Annaly saw a substantial markdown in its BVPS on YoY and QoQ terms, underperforming the previous Wall Street consensus in Q3.

Also, the impact of the higher repo rates caused Annaly’s financing costs to rise sharply, impacting its earnings power, as CFO Serena Wolfe articulated:

We experienced the beginning of the moderation in [distributable earnings] that we discussed on our recent earnings calls, with [distributable earnings] per share reduced by $0.16 compared to last quarter. [It’s] primarily related to the continued rise in repo rates, causing repo expense to more than triple during the quarter. Given the challenges in the current environment and the impact on [distributable earnings], we currently expect Q4 earnings to be roughly in line with the third-quarter dividend [of $0.88 per share]. (Annaly FQ3’22 earnings call)

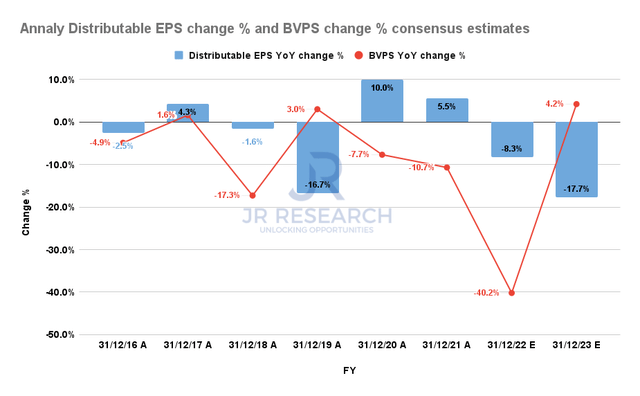

Annaly Distributable EPS change % and BVPS change % consensus estimates (S&P Cap IQ)

Annaly distributable EPS is expected to decline 8.3% in FY22 and down a further 17.7% YoY in FY23. Therefore, we postulate that the market needs to be confident in Annaly’s earnings recovery before a material re-rating could follow.

While we think NLY has likely bottomed out in its recent October lows, the housing market correction could continue to impinge on buying sentiment unless another market dislocation event occurs, like in October.

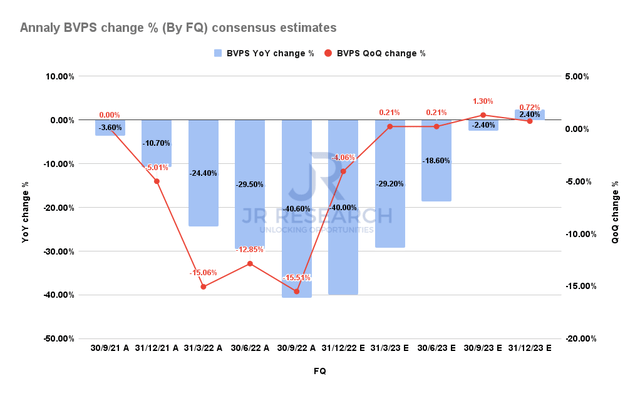

Annaly BVPS change % consensus estimates (S&P Cap IQ)

However, with the Fed’s rate-hike headwinds likely slowing moving ahead, we are confident that the destruction in Annaly’s BVPS over the past year should subside.

Therefore, it should improve the spreads in the market while stabilizing its BVPS through FY23. As such, we believe it’s increasingly likely that NLY has bottomed out in October.

Is NLY Stock A Buy, Sell, Or Hold?

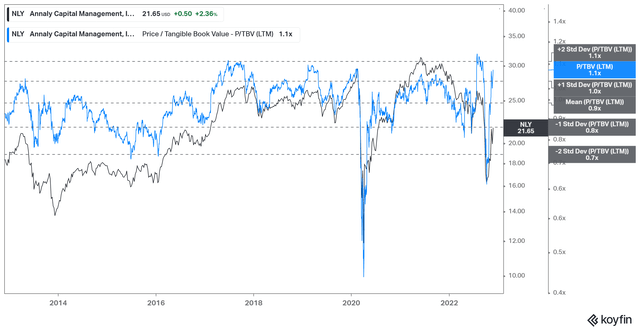

NLY TTM TBV multiples valuation trend (koyfin)

With the remarkable recovery from its October lows, NLY’s TTM tangible book value multiples have also normalized accordingly. Hence, we postulate that the opportunity to add exposure at the current levels is no longer attractive.

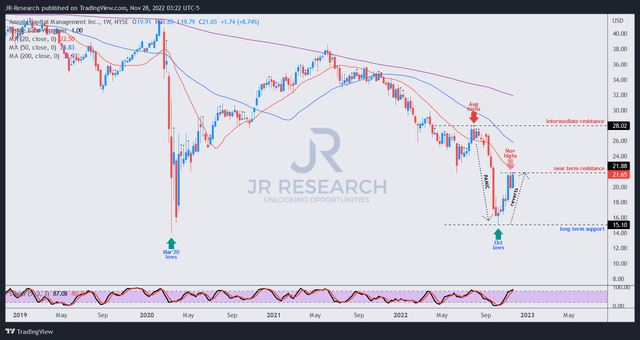

NLY price chart (weekly) (TradingView)

NLY remains in a medium-term downtrend, despite the recent mean-reversion rally.

Therefore, the momentum remains with the bears, and we believe the recent recovery has likely reached a point of significant resistance. Hence, we expect a pullback to follow.

Maintain Hold.

Be the first to comment