Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 2.

An unusually fast pace of interest rate hikes by the Fed has scrambled the preferreds market, creating large jumps in yield for preferreds switching to a variable-rate coupon and generating sizable alpha opportunities for well-informed investors. In this article, we discuss the Annaly (NYSE:NLY) preferreds suite and highlight our recent rotation to Series G (NYSE:NLY.PG) from Series F (NYSE:NLY.PF) despite its lower stripped yield as of today. We also highlight a few myopic tendencies of the retail preferreds market that continues to offer opportunities for investors.

Soon-To-Float Preferreds Are Kings Of The Hill

Investors who have been following the preferreds market have likely noticed an interesting pattern where the market can take some time to catch on to an upcoming yield change for a preferred that is approaching its first call date.

For a Fix/Float preferred, the arrival of the first call date means its coupon will switch to a variable rate. And because current interest rates are elevated relative to their 5-year history (non-call periods tend to be 5 years at issuance), the variable-rate coupon will in nearly all cases be well above the previous fixed-coupon, resulting in a big jump in yield for the stock on the first call date, unless it is redeemed.

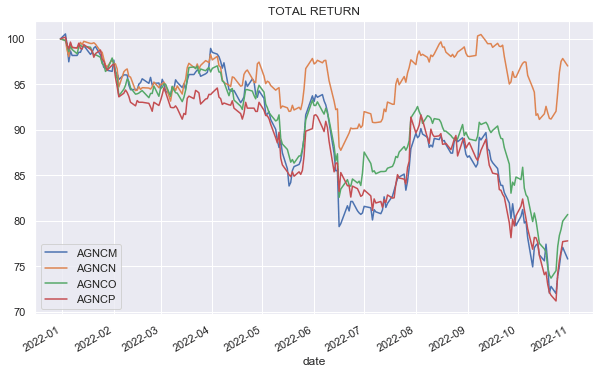

The following chart shows the AGNC preferred suite, clearly highlighting that AGNCN, which switched to a variable-rate coupon in mid-October, has remained much more resilient than its counterparts which have first call dates in 2024-2025 (we exclude the recently issued AGNCL as it didn’t trade at the start of the year but which has also sold off sharply).

Systematic Income

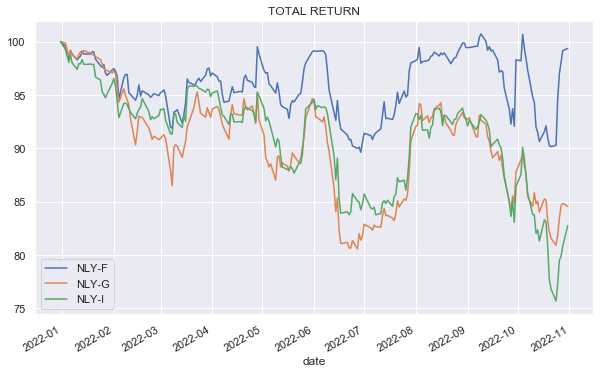

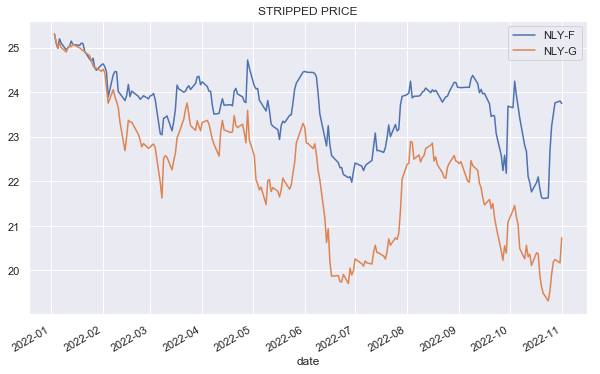

The NLY suite of preferreds where NLY.PF has recently switched to a variable-rate coupon shows much the same pattern.

Systematic Income

We started highlighting these two preferreds in April when the market was not doing a good job of differentiating them from the rest of the pack. As the first call date approached, the market started waking up to the fact that AGNCN and NLY.PF were going to not only sharply increase their yields but would also boast the highest yields in their respective suites. The small likelihood of redemption also tended to anchor their prices closer to “par”.

The key takeaway here is that the market can take time to catch on to the variable-rate switch on the first call date. This is because most preferreds investors don’t have the full picture in front of them and are not forward-looking. Specifically, most investors allocate to preferreds based on the yield they see from their brokerage which is backward-looking. This yield is not relevant for preferreds that will switch to a variable-rate coupon in the medium term. In order to gauge this forward yield, investors need to not only know the first call date and the details of the variable-rate coupon but also the forward rates on the first call date in order to make an informed yield calculation. This is frankly beyond the ability of most income investors, and it is why the retail preferreds market is rich in alpha and value opportunities. Below we discuss how we adopt this pattern in a rinse-repeat fashion in the NLY suite.

Why We Favor NLY

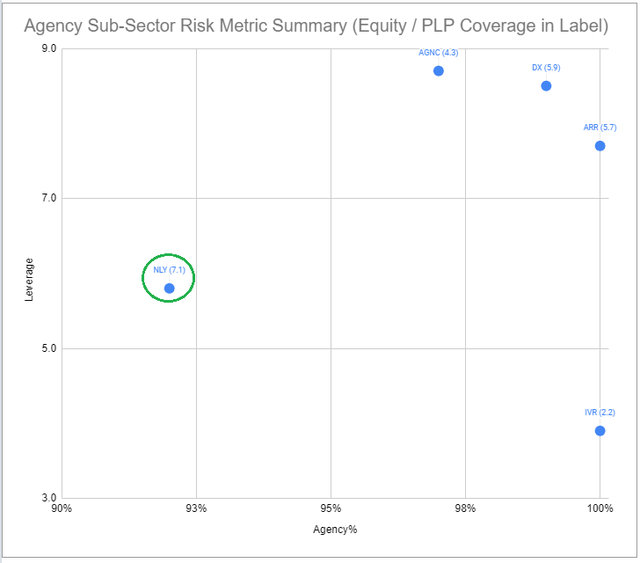

Apart from highlighting this interesting pattern in the retail market, this article is also about our allocation to NLY preferreds within the broader Agency mREIT sub-sector. We find the sector attractive due to the unusually cheap level of Agency MBS. Apart from NLY, it also contains such mREITs as Dynex Capital (DX), AGNC Investment Corp (AGNC), Armour Residential (ARR) and Invesco Mortgage Capital (IVR). All these companies are primarily focused on Agency MBS in their portfolios.

There are two reasons why we tilt to NLY preferreds in the sub-sector. First, we like the convex behavior exhibited by NLY with respect to its preferreds. This has to do with how it responds to large book value drops. In Q3, the company issued 16% more common shares in response to its book value drop. The net result is that while book value fell 15%, equity, which is the thing that actually matters to preferreds, fell only 1.2%. As the book value has been falling this year, the company grew its common shares by a huge 29%.

AGNC and DX have also issued new common shares but not nearly in as large amounts. In other words, a large book value drop causes NLY to issue common shares, softening the impact on preferreds. And if we see a big rise in book value, NLY will likely do nothing (i.e. they won’t buy back 29% of their recently issued shares), leaving preferreds much better off from an organic rise in equity.

This convexity of little equity coverage loss to the downside and a big potential equity coverage gain to the upside is a nice profile for preferreds to have. In this sense, NLY preferreds offer much higher convexity than its counterparts in the sector. There is no guarantee NLY will keep being so bold with common equity issuance to the downside but the fact is they have been so far, leaving their preferreds much better off than others in the sector.

The other reason we like NLY in the sub-sector is because NLY tends to be somewhat more conservative. For example, while DX and AGNC increased their leverage levels in Q3 (to 8.5x and 8.7x), NLY actually moved it lower substantially from 6.6x to 5.8x.

A higher level of leverage is more attractive for investors in common shares who are bullish Agencies. However, preferreds holders are much more interested in downside risk than upside gains so, all else equal, they prefer lower leverage levels.

The net result of these two factors is that NLY not only has the highest equity / preferred coverage (shown in parenthesis in the label below) and also the lowest leverage in the sub-sector outside of IVR. Using the combination of both metrics, it is well ahead in the sub-sector.

Systematic Income Preferreds Tool

Switching To Series G

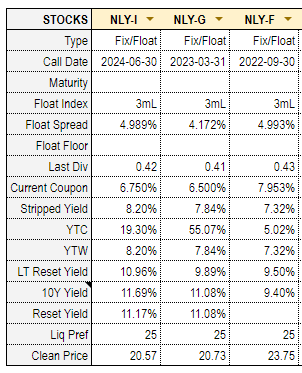

In this section, we discuss our thinking behind the recent switch to NLY.PG from NLY.PF.

This is how the NLY preferred suite looks.

Systematic Income Preferreds Tool

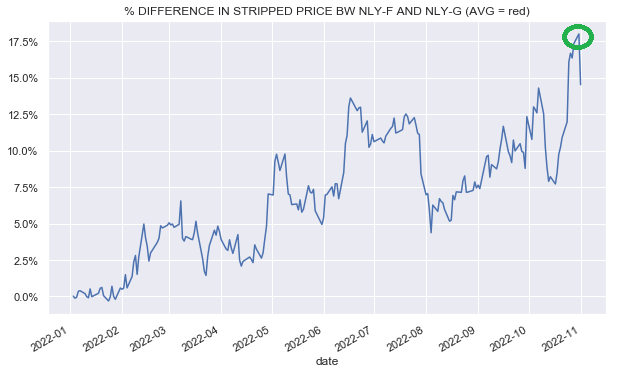

Since the start of the year, the price differential between NLY.PF and NLY.PG has continued to grow.

Systematic Income

As highlighted above, this is because more and more investors have become aware of the approaching sharp jump in the yield of NLY.PF as well as a small likelihood of redemption of NLY.PF. After the price differential reached close to 18%, we pulled the trigger and rotated into NLY.PG in our Income Portfolios as highlighted by the green circle.

Systematic Income

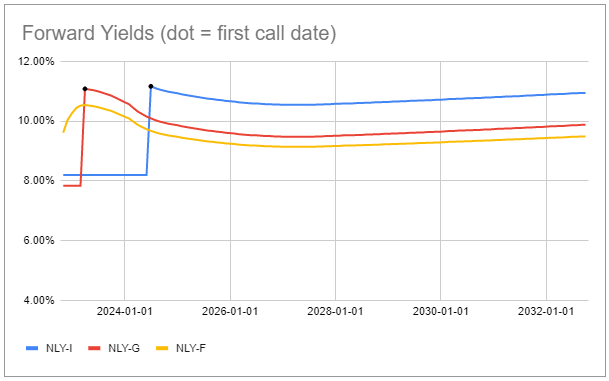

Let’s look at the yield picture of the suite. What it shows is that after its switch to a variable-rate coupon, the yield of NLY.PF (yellow line) has jumped to close to 10% and will rise towards 10.5% in the coming months as short-term rates continue to rise on the back of continued Fed hikes. The yield of the stock will continue to be around 2-2.5% above that of NLY.PG for a number of months and above that of NLY.PI until mid-2024.

Systematic Income Preferreds Tool

However, notice that when the first call date of NLY.PG arrives on 31-Mar-2023, its yield will jump above that of NLY.PF and remain above it in perpetuity. This is why we have chosen to rotate to NLY.PG from NLY.PF. We are willing to sacrifice 2% in yield terms for 5 months but gain a yield pickup of around 0.7% (at the time of the switch) for a much longer period.

And as we highlighted above, we also expect the market to start catching on to this dynamic over the coming months just as it caught on to the NLY.PF switch to a variable-rate coupon and its jump in yield to the highest level in the suite. Eventually, if NLY.PI remains at an attractive price, it will make sense to switch to it in a rinse/repeat fashion, taking advantage of the market-lagged reaction to coupon switches.

Clearly, these preferreds can be redeemed, however, this seems unlikely, particularly in the case of NLY.PG as it’s trading at a stripped price of around $20.70. However, if it does happen, it will be a gift to investors as NLY.PG also enjoys the highest yield-to-call in the suite.

The key takeaway here is that a focus on forward yields is an essential component of preferreds investing, particularly in an environment where short-term rates are moving quickly and are expected to end up at a very elevated level. This, plus the fact that the retail preferreds market tends to be slow in this respect, continues to offer alpha and value opportunities for investors.

Be the first to comment