NicoElNino

The upgrade thesis

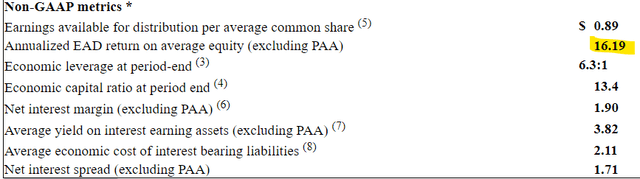

Annaly Capital (NYSE:NLY), despite operating intelligently, is stuck in a pattern of perpetual dividend cuts as there is an adverse interaction between leverage and moving parts. It is generating a phenomenal 16.19% earnings on book equity, but with low risk instruments like the RMBS market the only way to get an ROE that high is significant leverage. When this high leverage is combined with moving parts in the market as interest rates bounce around, it results in losses being incurred as it repositions to maintain spreads. As long as we live in a world where interest rates fluctuate, dividend cuts will be a consistent threat at Annaly and other mortgage REITs.

I propose a better way to extract income out of these vehicles. A higher tranche with billions of dollars of equity cushion beneath it: the Preferreds. Preferreds of stable mREITs like Annaly offer fairly large yields and when bought at discounts to par one can get capital gains on top of the yield.

The common dividend cut

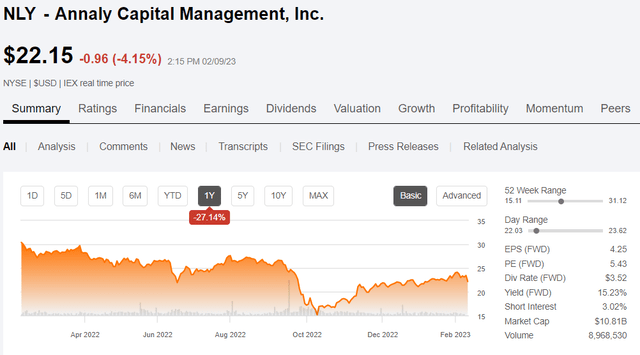

In the 4Q22 Annaly earnings call on the morning of 2/9/23, NLY’s David Finkelstein announced another dividend cut.

“Subject to determination by our Board, we expect to reduce our quarterly dividend in the first quarter of 2023 to a level closer to Annaly’s historical yield on book value of 11% to 12%, which compares to the approximately 16% yield on book we’re paying today. We believe this decision allows us to appropriately manage the portfolio within conservative risk parameters while also delivering a more sustainable yield that is competitive with the peer set and broader fixed income benchmarks, which has always been our objective.”

Somehow the dividend cuts seem to always shock the market resulting in a >4% drop on what was otherwise a good quarter.

While perhaps the exact timing of the cut is an unknown, I view such cuts as more of an inevitability. This cut won’t be the last cut nor will the dividend cut be unique to Annaly. There have been and will be more cuts across the mortgage REIT spectrum because they all fall victim to the same source of imbalance.

Inevitability of dividend cuts for mortgage REIT commons

So let me begin by pointing out the scenario in which this cut is happening. As of 4Q22, Annaly is generating earnings on equity of 16.19%.

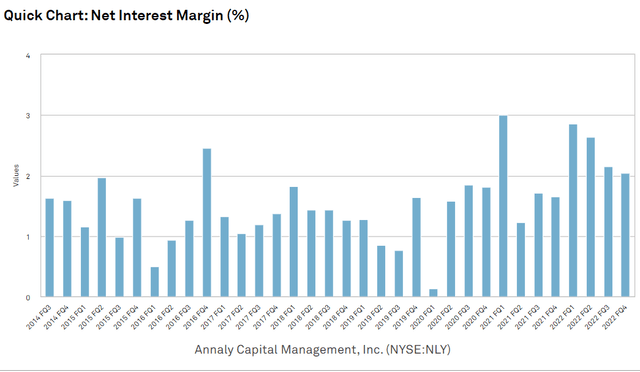

Which is made possible by net interest margin that is slightly higher than normal.

S&P Global Market Intelligence

Thus, it is not an unusually bad operating environment forcing the dividend cut, but rather dividend cuts are part of the business model.

Allow me to explain. The logic consists of the following steps:

- Mortgage REIT assets are low return assets by nature. RMBS and other low risk financial instruments simply come with low base returns.

- Equity investors demand a return that is significantly higher than that provided by RMBS or similar assets.

- Thus, to achieve the return demanded by the market, mortgage REITs have to lever up substantially with their net return on equity being the base return of RMBS + the spread between that base return and their cost of capital multiplied by the number of turns of leverage. With about 6X leverage, NLY is presently able to generate ROE of about 16%.

- Leverage introduces risk into what would otherwise be a very low risk asset class

- The leverage risk manifests when various parts of the system get jostled around causing losses on hedging costs, mark to market, or prepayment.

- REIT laws cause the mortgage REIT to have to pay out about 90% of their earnings as dividends, which leaves very little capital for a rainy day fund.

- Thus, such losses directly hit book value.

- With a reduced book value, the same 16% ROE produces less revenue, earnings decline.

- The lower book value cannot sustain the same divided that was supported by the formerly higher book value.

- Dividend must be cut.

This is just the basic business model so I always find it a little odd that the market is so shocked when a dividend cut happens. It has happened so many times that is should just be viewed as routine.

Let’s take a look at some long term charts.

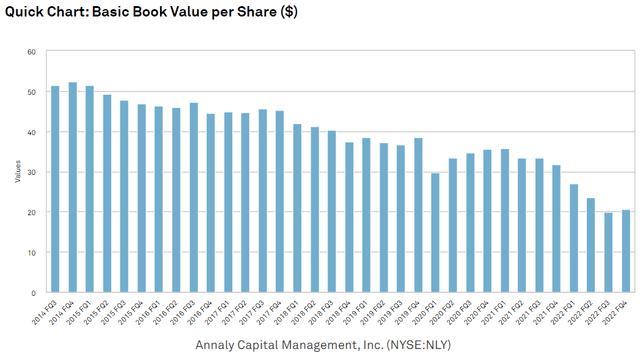

High prepayments caused book value erosion as RMBSs were purchased at a premium to par and then rising interest rates caused mark to market losses.

S&P Global Market Intelligence

Over this time period, NLY was actually profitable overall, but those profits were not retained because they have to pay them out as dividends.

Thus, any losses hit the book value and as the book value dropped so did earnings which inevitably forced dividend cuts.

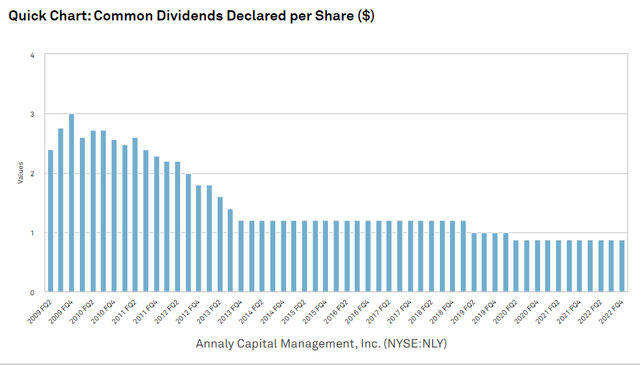

S&P Global Market Intelligence

The latest cut is not yet on the above chart as the new lower dividend has not yet been declared.

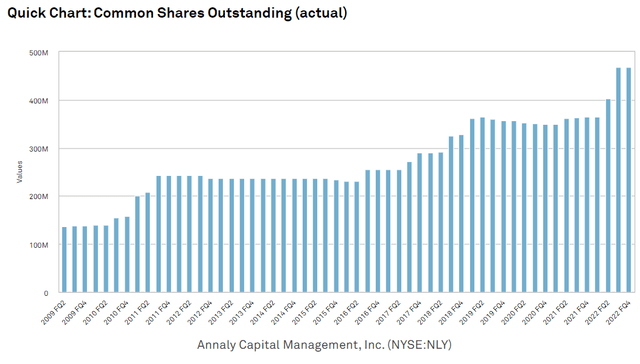

With this pattern it would seem the mortgage REITs would shrink into nothingness, but they actually manage to maintain their size by issuing tons of common equity.

S&P Global Market Intelligence

It is this equity issuance that presents the opportunity as it builds up the cushion underneath the preferreds.

The opportunity

I think preferreds are just the superior tranche for agency mREITs. The key thing to note about the business model is that book value erodes but in a slow manner. The underlying assets are backed by the Federal government so all they can really do is return to par value which hurts book value when they were bought at 103% of book, but in no way threatens preferreds.

This makes these highly reliable sources of dividend income. The preferreds also provide capital appreciation potential when bought at discounts to par. Back in July of 2022, I wrote about the opportunity in Annaly preferreds.

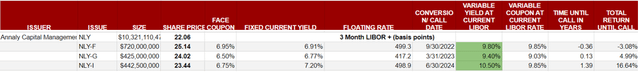

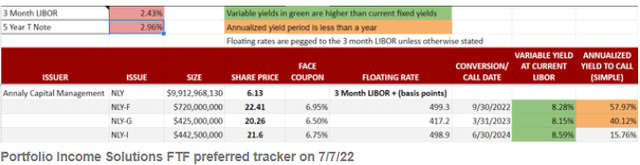

We also created a spreadsheet of Annaly’s preferreds along with all the other mREITs and maintain it on Portfolio Income Solutions. At that time, the preferreds looked like this.

Each of course has a $25 par value but market dislocations often cause preferreds to sell at wild discounts to par so they could be had for as little as $20.26 on NLY-G.

Many people thought I was crazy buying preferreds with coupons in the 6s when the common yield was so high but there are three key differences between the commons and the preferreds.

- Common yields get cut but preferred yields are steady based on coupon and then potentially raised when it hits the variable rate conversion date.

- The common had negative capital appreciation reducing one’s effective return while the preferreds pulled back up toward par.

- The preferred dividend payouts have risen with interest rates as each is indexed to LIBOR or soon SOFR (on 6/30/23) with each preferred converting to variable in the near term or already.

Here is how the Annaly preferreds look today.

Portfolio Income Solutions preferred tracker

At prices approaching par they are far less exciting. So while I think they are fine and probably still better than the common, there are even better opportunities elsewhere.

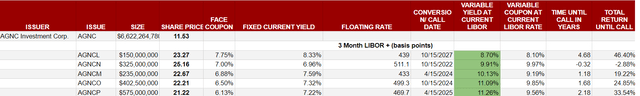

AGNC Investment Corp (AGNC) preferreds still trade at a significant discount to par.

Portfolio Income Solutions preferred tracker

I particularly like AGNCO and AGNCP as they have greater than dividend 11% yields upon conversion to variable in 2024 and 2025, respectively. (Assuming current level of LIBOR/SOFR). They also trade at significant discounts to par which affords capital appreciation upside.

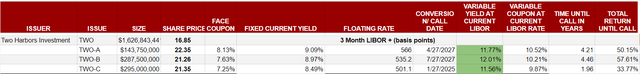

Two Harbors (TWO) is a smaller company which makes it slightly riskier, but its preferreds look quite opportunistic as well.

Portfolio Income Solutions preferred tracker

Wrapping it up

Agency mortgage REIT fundamentals look healthy right now. Net interest margin is strong and volatility in interest rates seems to be lessening. I think the best way to capture a dividend stream from this sector of the market is to own high coupon preferreds at discounts to par attached to stable issuers with large equity cushions underneath the preferreds.

Be the first to comment