Schroptschop

Following our first impression of the second quarter operational performance by Rio Tinto (RIO) and BHP Group (BHP), today we comment on Anglo American plc (OTCQX:NGLOY; OTCQX:AAUKF) which just released its production update. Here at the Mare Evidence Lab tower, we intensively cover the mining sector, but it is the first time that we’ve written about Anglo. The global mining company owns a diverse portfolio that combines production in platinum, iron ore, diamonds, copper, diamond, base metals and nickel.

Why are we positive?

- Despite the lower expectations following the Q1 production report, our internal team is confident in higher realization prices from the Anglo American commodity basket;

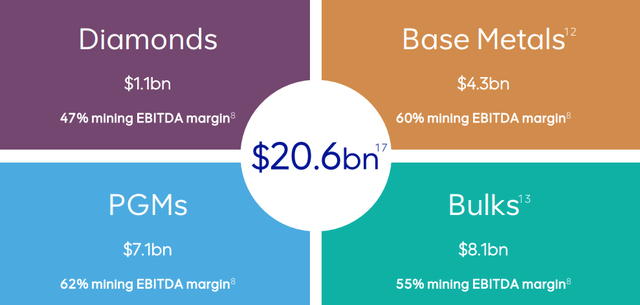

- We pretty much like the fact that Anglo offers a more diversified EBITDA mix compared to Rio Tinto and BHP;

- We are confident in the Quellaveco Copper mining project that is expected to start production by the end of the year;

- Given the ongoing Russia/Ukraine conflict, Anglo American offers a unique exposure to PGM and the diamonds division.

Q2 Production Results

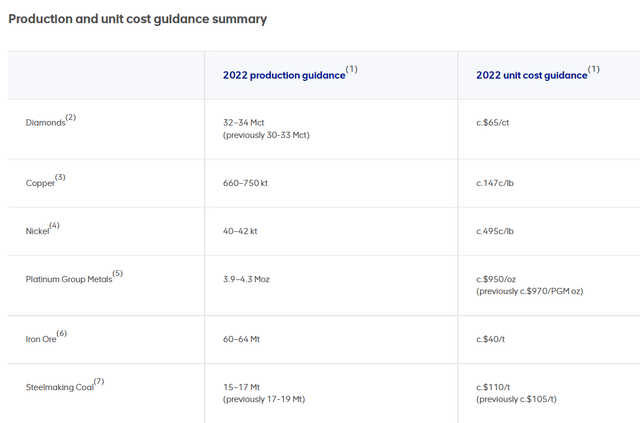

As already mentioned for the Q1 results, Anglo American operational performance continues to be soft. Looking at the company’s guidance, met coal production was cut by almost 11%, whereas diamond production is forecast to be 5% higher.

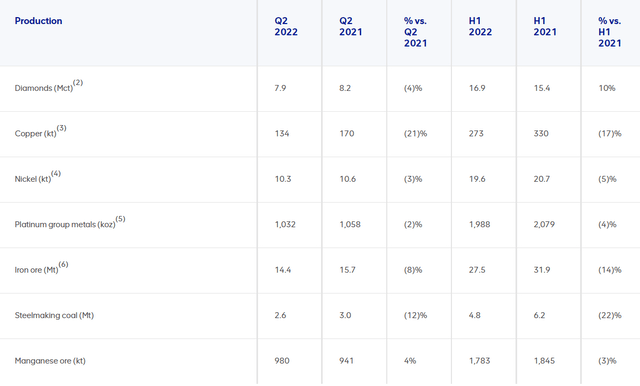

Anglo American production output

Concerning the specific commodity results, here below our main key takeaway:

- Diamond’s production was 3% above Wall Street analysts’ expectations. The company recorded a higher realization price, confirming the strong De Beer’s output. As already mentioned, diamond production guidance was increased to 32-34mcts from 30-33mcts.

- Copper’s output was almost 10% below consensus. This was the result of the lower water levels in Chile. CEO is emphasizing that Anglo is currently working to improve water efficiency for better production output.

- PGM’s production was a 15% beat. Despite inflationary pressure, unit costs were decreased thanks to a weaker FX in the ZAR currency assumption.

- Met coal’s output missed expectations by almost 25%. This was due to adverse weather conditions and COVID-19 absenteeism (as already noted in our update in BHP and Rio Tinto). Future guidance production was also cut and unit cost increased to $110 per ton from $105 per ton.

- Iron ore’s production was in line with the company’s estimates. This was achieved despite planned safety maintenance in a few mines.

Conclusion and Valuation

Adjusting our internal model with the latest company indications, we decide to initiate Anglo American with a target price of £35 per share, confirming a buy rating. We based our valuation in line with its peers using an average model between the net present value and the 2023 EV/EBITDA of 4x.

Be the first to comment