Sunshine Seeds

Mining stocks have taken a beating this year as cyclicality played its hand. In addition, a bear market and various global systemic catastrophes haven’t made matters easier for the platinum group metals space. Recession risk remains high going into 2023, meaning that it is critical to choose your basic material stocks wisely.

Today’s article discusses some of our most recent findings on Anglo American Platinum (otherwise known as Amplats) (OTCPK:ANGPY) stock. We believe the stock is a “best-in-class” asset within the precious metals space, given its low-cost, vertically integrated business model, among various other features.

Here are a few factors to consider!

Operational Update

Upstream

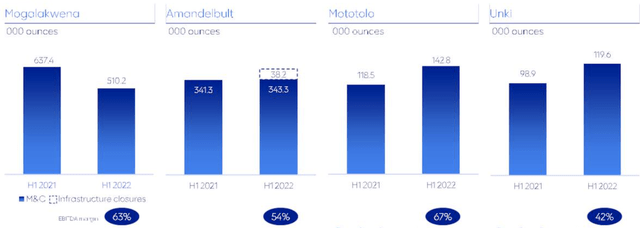

The company recently unveiled its third-quarter production report, and it’s clear that Eskom’s power outages have posed an influence. Anglo American Plats’ self-managed mines experienced a 3% year-over-year output decrease to 587,200 ounces. Additional factors, such as Amandelbult’s infrastructure closure and lower throughput at Mogalakwena, also played a significant role. However, some of the damage was phased out as production from Unki and Mototolo recovered by 19% and 41%, respectively, after the completion of maintenance construction.

Anglo American Platinum has a significant advantage as a low-cost producer. Its upstream operations are significantly assisted by Mogalakwena, which is an open-cast PGM mine with one of the highest margins in the PGM industry (63% EBITDA margin).

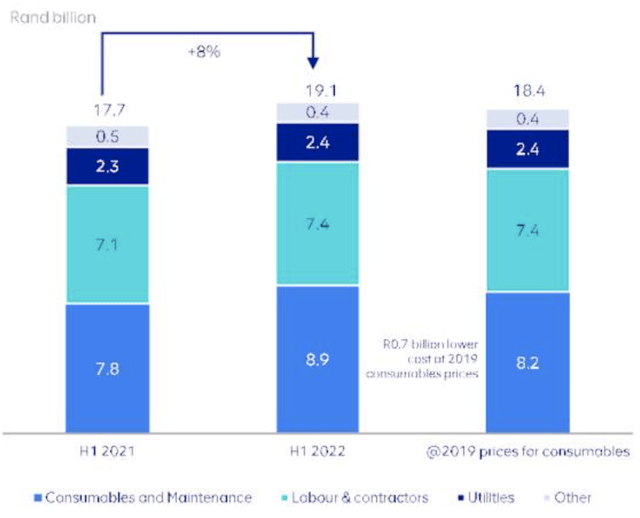

Furthermore, Amplats has managed to hedge and dissolve some of the rising input costs the mining industry recently incurred. The company’s H1 input costs rose by merely 8%, far less than the industry average of 10.2%. As would be expected, maintenance activities felt most of the brunt. In addition, a new 5-year wage agreement elevated fixed costs.

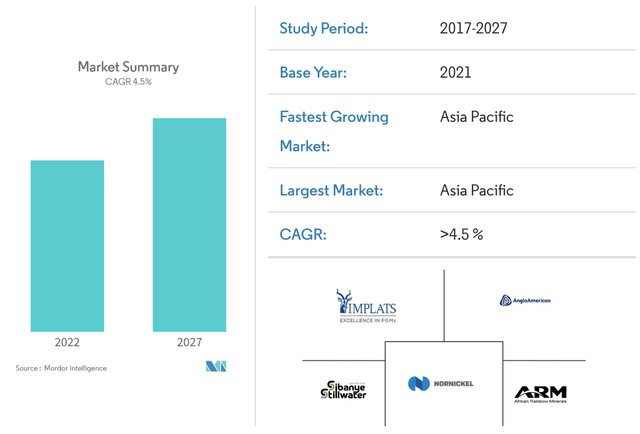

Despite a slightly disappointing H1/Q3, Anglo American Platinum is in a prime position to benefit from the fast-growing PGM market. The company is the world’s largest platinum producer, with a significant cost advantage. We fully believe Amplats could grow exponentially in the coming years.

Midstream

Anglo American Platinum’s midstream operations suffered losses of 30% year-over-year as refinery output slumped to 994,800 during its third quarter amid the rebuilding of its Polokwane smelter. It’s the smelter’s first rebuild in twelve years. Thus, we consider it an abnormal event and don’t consider the 30% drop in production as an influence on core earnings. The smelter’s maintenance is due to be completed by the end of Q4, which could cause a sudden rebound in Anglo’s bottom-line earnings.

Anglo American Platinum’s vertically integrated business model is highly lucrative as its refinery business allows it to reduce downstream costs.

Guidance

The company’s total PGM production settled at 1,046,000 ounces during its third quarter. Looking ahead, Amplats left its full-year guidance unchanged after its latest earnings release, anticipating upstream output to reach 3.9 to 4.3 million ounces. In addition, the company expects refining production to settle between 3.7 to 3.9 million ounces.

Risks

In our opinion, Anglo American Platinum’s two primary risks relate to South African energy/infrastructure and potential demand destruction from a global recession.

The prior presents serious challenges. South Africa’s state-owned utility company, Eskom, is in shambles. In fact, the nation spends nearly a third of its day in darkness amid stage-6 load shedding.

The load-shedding program has been placed in effect due to the fragility of the nation’s utility infrastructure. Miners, including Anglo American Platinum, are being impacted severely by the rise in electricity costs due to the need for self-generation.

According to Anglo American Platinum CEO, Natascha Viljoen:

“Eskom power outages have affected both concentrators and smelters, resulting in a loss in production, as well as a build-up in work-in-progress inventory of 40,400 PGM ounces. We maintain our guidance for 2022 and are carefully monitoring the continued impact of power outages on our operations as we progress through Q4.”

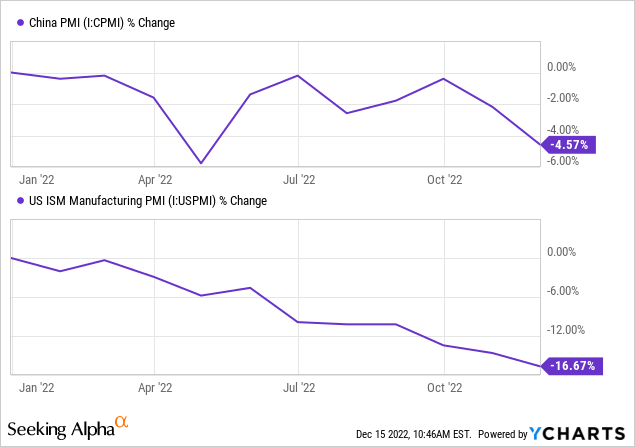

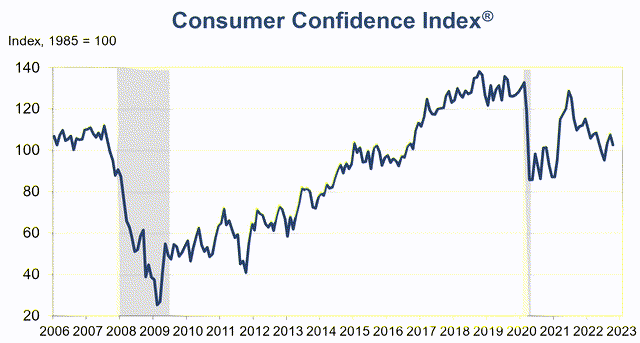

As previously mentioned, the second noticeable risk that we see for Anglo American Platinum relates to demand destruction. The PGM industry is reliant on global industrial production, which is influenced by consumer sentiment. Both factors are poorly aligned at the moment, and the risk of a recession in 2023 could cause investors to opt for risk-off assets, subsequently leaving Amplats’ stock up against it.

U.S. Consumer Confidence (The Conference Board)

Valuation & Dividends

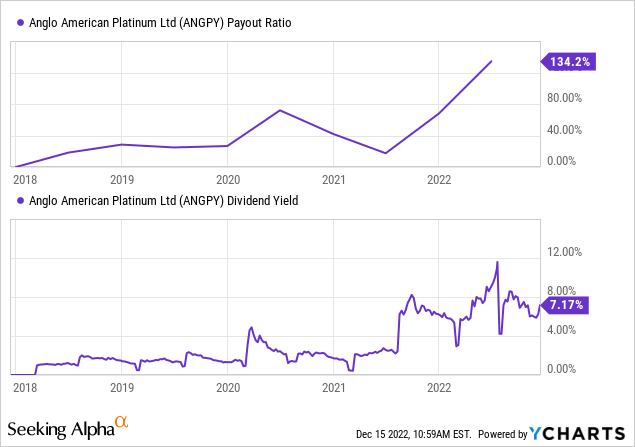

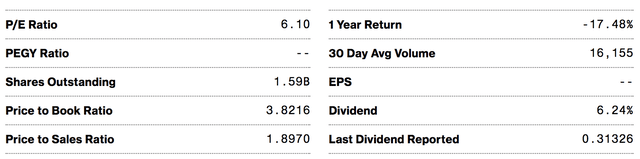

At face value, Anglo American Platinum stock is trading at a premium to book value. However, its price-to-earnings seems respectable. Despite trading at a premium to book, its “best-in-class” status could phase out much of its price risk.

On top of that, the stock’s price-to-sales ratio of 1.9x could ease off once maintenance and other idiosyncratic risks lessen.

Furthermore, the stock presents a sound dividend with a yield of 7.17%. However, investors should note that its latest quarterly dividend was a special interim dividend. Thus, the stock’s dividend yield might not be sustainable as special dividends usually occur during cyclical peaks or whenever companies divest segments.

Nonetheless, the company has a history of paying lucrative dividends, which adds to shareholders’ total return prospects.

Concluding Thoughts

Lower throughput at key assets such as Mogalakwena and maintenance disruption at the Polokwane smelter dented Anglo American Platinum’s recent results. In addition, challenges related to Eskom are posing a severe threat. Nevertheless, Anglo American Platinum has maintained its incredible low-cost business model, and the rejuvenation of its Unki and Mototolo assets has phased out recent production setbacks. We believe increased refinery capacity and better luck with throughput could cause the company and its stock to rebound in 2023.

Although Anglo American Platinum’s latest dividend was declared as a “special interim dividend”, the company has a history of rewarding its shareholders with attractive compensation packages. Additionally, the stock’s valuation multiples could align once Amplats’ operating capacity improves.

We assign a strong buy rating with a 12-month horizon.

Be the first to comment