ErikMandre/iStock via Getty Images

Investment thesis

I like writing about companies that lack coverage on SA and today I’m taking a look at Anghami (NASDAQ:ANGH). It’s a Middle Eastern music streaming platform that was listed earlier this month through a merger with a special purpose acquisition company named Vistas Media Acquisition. The trading activity has been volatile, with the stock dropping over 43% on Friday. Yet, the market valuation is still up by over 60% compared to February 3, when the merger was closed.

Looking at the business, I’m bearish as redemptions for the SPAC deal reached 98% and Anghami has been missing growth targets. According to a corporate presentation from March 2021, subscription revenues for 2021 were projected to soar to $37 million and the company was expected to become EBITDA positive. Now, preliminary figures show that Anghami closed the year with subscription revenues of just over $26 million and adjusted EBITDA was deep in the red. Let’s review.

Overview of the business and financials

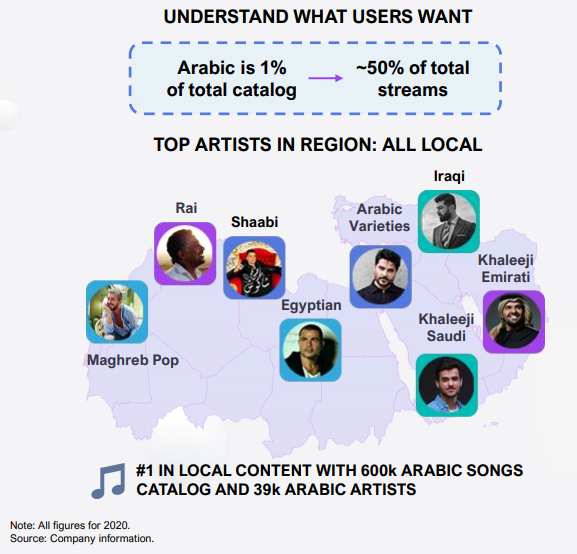

Anghami was launched in Lebanon in November 2012 and describes itself as the first legal music streaming platform in the Middle East and North Africa (MENA) region. Today, it has over 75 million registered users across the world and its catalog features more than 57 million songs. Looking at the Arabic catalog, the company’s platform has over 600,000 songs from more than 39,000 artists. It’s available in Arabic, English, and French, and content and campaigns are customized for each of the 16 countries in the region.

Anghami

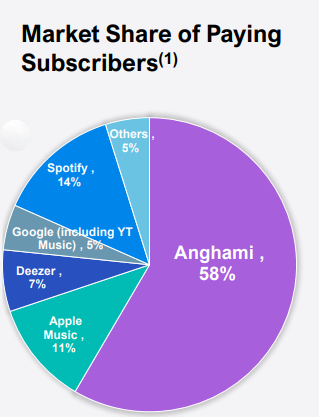

Anghami has the first-mover advantage on global players thanks to a 6-year head start and has amassed a database of over 50 million user data points that are updated daily. As of 2020, the company had 18.4 million active users. Paying subscribers are 1.4 million and Anghami’s market share of paying subscribers in MENA is 58%.

Anghami

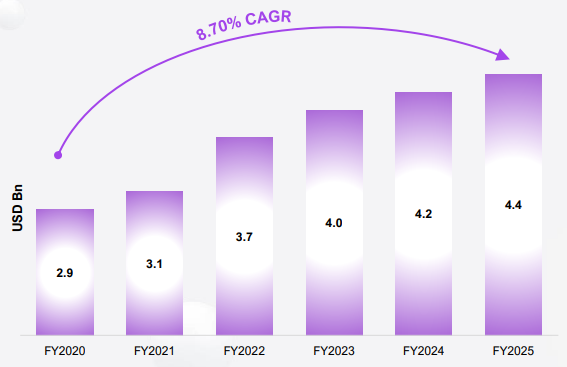

In my view, the MENA music streaming market looks attractive as the region has almost 600 million people and is among the most youthful regions in the world, with a median age of 22 years. In addition to this, penetration rates among most countries in MENA are well below 10%, which means there is a lot of room for growth. According to Anghami, its addressable market is expected to grow by 1.5x to $4.4 billion by 2025.

Anghami

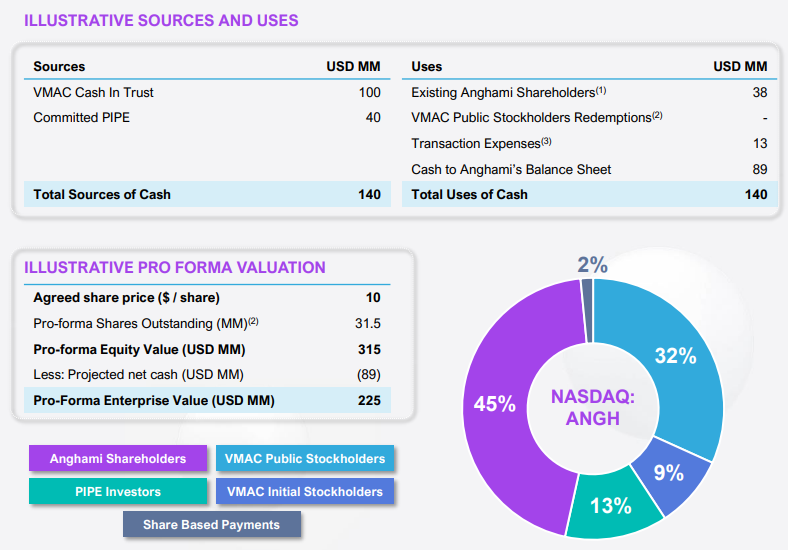

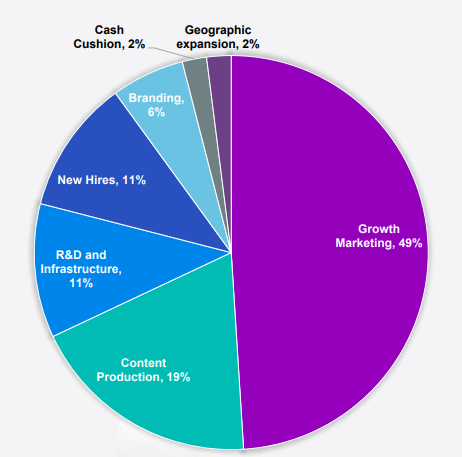

Looking at the SPAC deal, Anghami was supposed to have up to $89 million in cash, around half of which was earmarked for marketing spending with the objective of boosting growth across the region.

Anghami Anghami

However, the owners of 9.8 million of the 10 million shares of the SPAC chose to return them for cash which means that Anghami needs to rely mainly on the $40 million of private investment in public equity (PIPE) to fund its growth. In my view, the amount of the redemptions is not surprising considering that the average redemption rate from SPAC deals soared to 75% in January 2022 from 14% a year earlier, according to data from Boardroom Alpha.

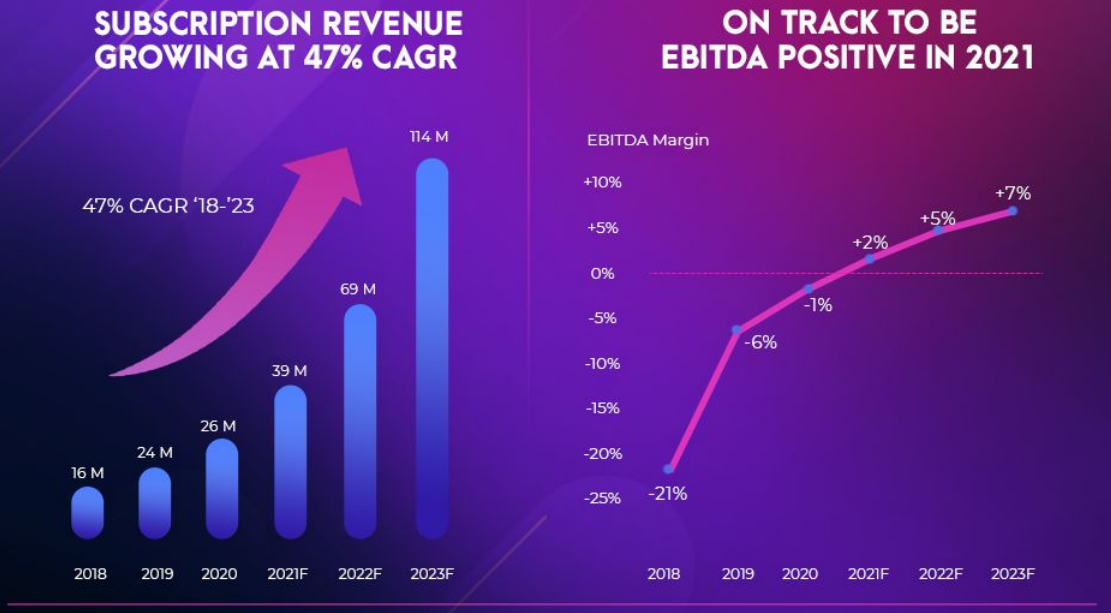

It seems that SPAC deals are no longer popular among investors. In the case of Anghami, I think that another major reason redemptions reached almost 100% was that the company has been missing growth projections. You see, Anghami’s March 2021 corporate presentation showed forecasts of subscription revenues jumping by close to 50% to $39 million in 2021. The company was also set to become EBITDA positive last year.

Anghami

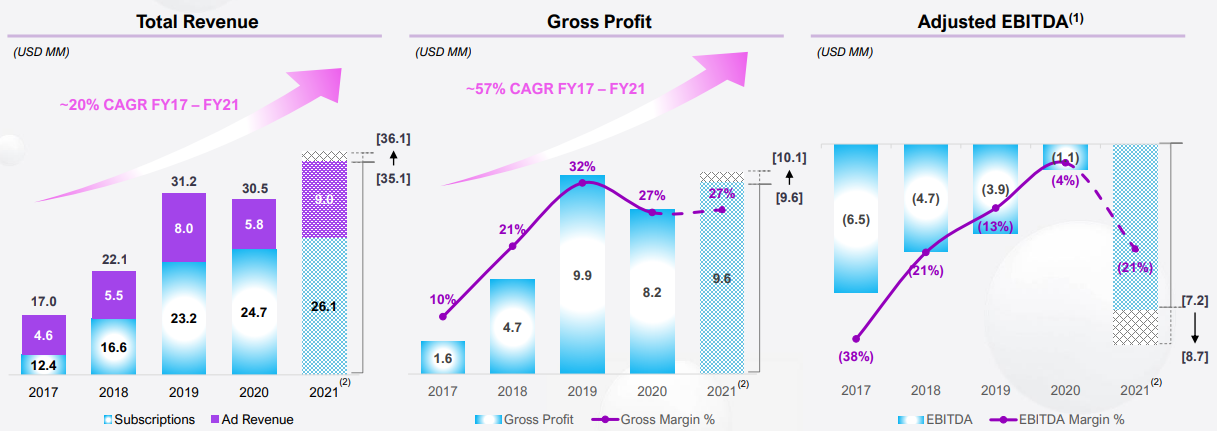

Flash forward just 10 months, and the January 2022 corporate presentation showed that subscription revenues barely grew, and adjusted EBITDA was deeper in the red than in 2017.

Anghami

The EBITDA figures included a $3.1 million add-back of one-time transaction expenses that included advisory fees and $0.45 million of legal fees. However, Anghami is far from becoming profitable even without them.

In my view, such a large miss creates significant doubts about the company’s financial performance forecasts for the coming years. Especially now that the SPAC deal ended with a 98% redemption rate and Anghami doesn’t have that much cash that it can invest in marketing activities. I think that the business of Anghami shouldn’t be worth much in its current state and the company looks overvalued based on the fundamentals. Unfortunately, there are no shares available for borrowing as of the time of writing, according to data from Fintel. Also, there are no put options.

Looking at the risks for the bear case, I can think of two major ones. First, it’s possible that the revenue growth of Anghami picks up in 2022 despite the lower than expected marketing budget and the company finally achieves positive EBITDA. I’m skeptical about this happening in view of the weak 2021 results. Second, the company could become an acquisition target due to its leading market position in MENA and its large Arabic catalog. In this case, I find it difficult to forecast how much a global player like Spotify (NYSE:SPOT) would be willing to offer.

Investor takeaway

Anghami had a lackluster listing and I’m surprised its share price has been doing well considering the company missed 2021 financial forecasts and now it doesn’t have much cash to fuel its growth in the future.

Overall, I’m not impressed with what the company has achieved so far. It had a first-mover advantage and has been around for over nine years, yet it has only 1.4 million paying subscribers. Also, revenue growth has stalled, and adjusted EBITDA is still negative.

However, there are no shares available for borrowing and there are still no options on Anghami. This could change in the near future so I’m keeping a close eye on the situation. In my view, it could be a good move to open a small short position and combine it with call options to insure against potential takeover offers.

Be the first to comment