Sean Gallup/Getty Images News

George Soros is quite possibly best known as the “man who brought down the Bank of England” due to his famous 1992 trade in which he shorted $10.00 billion worth of British Pounds, ultimately leading to the collapse of the currency price which earned him a $1.00 billion gain on the trade. For decades, Soros Funds represented one of the most well-known and successful hedge funds. They managed to bring in a 20% annual rate of return for their investors. Back in 2011, due to issues surrounding transparency with the introduction of the Dodd-Frank act, Soros closed down the operation and announced that he returned funds to investors. The entity was subsequently restructured and has been operating as a family office. Due to his philanthropic efforts and sometimes aggressive and transparent political beliefs, he was often made the target of multiple conspiracy theories and remains a highly controversial figure in his home country of Hungary, as well as much of Europe.

The investment philosophy of the fund is built on the back of a theory brought forward by George Soros himself, which he referred to as the “General Theory of Reflexivity“. There are two fundamental principles that drive Soroses’ theory of reflexivity: a) market prices are able to distort the underlying fundamentals, and b) financial markets play an active role, often affecting the said fundamentals that they are supposed to simply reflect. These ideas find themselves in contradiction to the “Efficient Market Theory“, which states that market prices accurately reflect all of the available information and that consistent outperformance is not possible.

The principles of the investment approach are well defined in two books written by Soros himself, “The Alchemy of Finance” and “Crash of 2008 and What It Means”. He has been a very fruitful author with a legacy of more than a dozen books concerning various topics, sometimes even venturing outside of the world of finance. This article is only going to cover its US-based public equity holdings, but it is important to keep in mind that the fund is extremely active in investing and trading instruments beyond stocks and stock derivates, including commodities, forex, bonds, and others assets.

This information from this article is based on the 13F filing by Soros Fund Management in which it is obligated to disclose its US-based equity positions no more than 45 days after the end of the quarter. We scrape SEC 13-F filings to find newly disclosed portfolio position changes by institutional investors, along with their most recently reported holdings. While not a reason by itself to enter the same positions given large institutional investors buy into and exit positions for various interests not necessarily aligning with the average investor, newly open positions represent a useful source for investment ideas and potential due-diligence targets. This is especially true when combining the information from these disclosures with the information from the 13D filings, which sometimes tell a much clearer story.

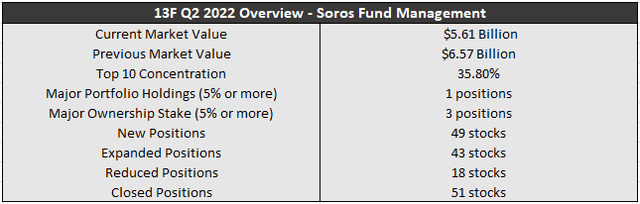

Fund Quarterly Overview

Soros Fund Overview Q2 2022 (Author Spreadsheet)

While it’s true that the fund’s US-based assets under management shrunk to $5.61 billion from the $6.57 billion they reported last quarter, Soros Fund Management was in fact a net buyer for Q2 2022. Over the last two quarters, the funds US-based AUM decreased by 23%, but only decreased 5% when compared to Q2 of 2021. The family office established 49 new positions during the time, with many of them seemingly focused on ongoing arbitrage opportunities and “distressed” sectors such as the technology sector. The fund currently has only one major portfolio holding in Rivian Automotive (RIVN), having reduced its outsized Liberty Broadband (LBRDK) position. The fund reduced 18 positions while abandoning its stake in 51 stocks. Soros Fund Management expanded on 44 positions during this quarter, establishing a 38.5% concentration in the top ten fund holdings. This is a significant decrease when compared to the last quarter when the fund concentrated 48.93% of the AUM in the top ten holdings. The fund currently has only 3 positions with an ownership stake higher than 5%.

New Positions

American Campus Communities (ACC): is the fourth largest holding as of the end of the second quarter of this year. This is a merger-arbitrage play by the Soros Fund, considering the fact that the student housing properties developer was acquired by Blackstone (BX) earlier in the month. The deal represented an all-cash $12.8 billion acquisition that saw ACC bought out for $65.47 per share. As of the end of the second quarter, the $201 million position amounted to 3.59% of the fund.

Biohaven Pharmaceutical Holding Co (BHVN): has been another interesting merger-arbitrage play this quarter. The pharmaceutical company has been acquired by one of the industry titans, Pfizer (PFI), for approximately $11.6 billion in cash. The $148.50 cash represents a premium of approximately 33% to Biohaven’s average selling price of $111.70 in the three months prior to the announcement of the transaction. The fund acquired 1.25 million shares between the prices of $83 and $145, indicating significant upside potential with the price currently around $150 per share. It represents the 6th largest holding taking up almost 3.26% of the fund portfolio.

Alleghany Corp (Y): is another large addition to the Soros Fund portfolio and represents yet another brilliant merger-arbitrage play. The fund established a position worth $168.25 million which is makes up 3.00% of the portfolio. Alleghany is predicted to be acquired by none other than the U.S. equity conglomerate Berkshire Hathaway (BRK.B) for $848.02 per share in a deal worth $11.6 billion. Soros Fund Management purchased shares in the range of $830 to $854 during Q2.

In a similar manner, the fund established merger-arbitrage positions in companies like GCP Applied Technologies (GCP), Duke Realty (DRE), Meritor Inc, Welbilt In, and Turning Point Therapeutics, all upcoming or already completed mergers-arbitrage opportunities. Unrelated to the this kind of potential, Soros Funds have opened positions in Tesla (TSLA), Albertsons Companies (ACI), and various other companies.

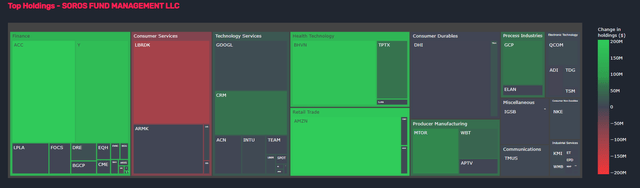

Soros Fund Heatmap (Quiver Quantitative)

Expanded Positions

Amazon (AMZN): represented one of the more headline-worthy purchases this quarter. The fund’s Amazon position increased by 41% with the quarterly allocation growing to 3.79% from 3.51%. The position in the e-commerce and cloud computing giant is now worth $212.89 million. Soros Funds bought 590,000 more shares of the FAANG stock, increasing its share count to slightly more than 2 million shares and making it the second largest holding of the fund. The company is currently trading at around $135.12 per share.

Alphabet Inc. (GOOG): is the tenth largest holding within the Soros Fund’s portfolio, now representing 2.06% of the US equity-based assets under management. The position increased by 10% this quarter, with the fund adding 100,000 shares. Soros Fund’s now own slightly more than a million shares of the FAANG stock worth around $115.88 million. The advertising giant is currently selling at $115.63 per share.

Salesforce (CRM): the position in the cloud-based software company, which was built over the course of the past several quarters, was doubled down upon in Q2. The fund expanded the position by 138%, ultimately reaching about 627,000 shares. They acquired shares this quarter for prices between $155 and $218. The position today represents the 18th largest holding and is worth about $103.5 million. Salesforce is currently trading at $180.37 per share.

Other smaller positions that were expanded upon during the second quarter were: Bowlero Corp (BOWL), indie Semiconductor (INDI), T-Mobile US (TMUS), NIKE Inc (NKE), Accenture Inc. (ACN), FIGS, Inc. (FIGS), and Qualcomm (QCOM), among others.

Reduced Positions

Rivian Automotive Inc: has been the largest bag that the fund has held. Proving itself to be a very problematic IPO, the fund decided to trim its exposure by 10% according to the latest 13F release. The position in the EV manufacturer used to represent 15.16% of the portfolio and was worth close to a billion dollars last quarter, but has recently decreased to only 8.18% and is now worth less than half of that. The fund entered the position during Q4 2021, paying anywhere from $89 to $172 per share. The stock of the EV company is currently trading at around $33.35 per share.

D.R. Horton Inc. (DHI): is one of the major portfolio holdings that also saw a very small reduction this quarter. DHI’s position was only trimmed by 1%, with the fund disposing of 37 thousand shares. The $197.06 million position in the home construction company is currently taking up 3.51% of the fund as of the latest quarterly report. The company is trading at around $75.50 per share.

Other smaller positions that were trimmed during the second quarter were: Analog Devices (ADI), Proterra (PTRA), SPDR S&P 500 ETF (SPY) PUTs, American Airlines (AAL) PUTs, Taiwan Semiconductor Manufacturing (TSM), Opendoor Technologies (OPEN), Airbnb (ABNB), and others.

Closed Positions

MGM Growth Properties (MGP): is one of the more interesting assets that were disposed of in the second quarter. The REIT, VICI Properties (VICI) has acquired MGM Growth Properties through a $17.2 billion deal that made the casino owner the largest landowner on the Las Vegas Strip. The fund established its position in the first quarter of this year, after the announcement of the acquisition. However, 13F filings this quarter indicate that they have sold out of their position entirely.

Cerner Corp: is another interesting merger-arbitrage that ended up being fully finalized during the quarter. The fund first entered the position during the last quarter of 2021, ultimately not staying around for long as the health care company got bought out by Oracle (ORCL) in a $95 per share all-cash deal, leaving the fund with no distributed shares.

Zynga, Inc: has been yet another successful merger-arbitrage deal that wrapped during the last quarter. Take-Two Interactive (TTWO) has completed its $12.7 billion acquisition of mobile games giant Zynga, having agreed to buy out the mobile gaming company for $9.86 a share. The fund acquired a stake in the company during Q1 2022 for share prices between $6 and $9.

Other smaller positions that were closed during the second quarter were iShares Investment Grade Corp. Bond ETF (LQD), Lucid Group (LCID), TJX Companies (TJX), DiDi Global (OTCPK:DIDIY), ZIM Integrated Shipping (ZIM), Eldorado Resorts (CZR), among others.

You can see the full filings for Soros Funds and additional 13F filers here.

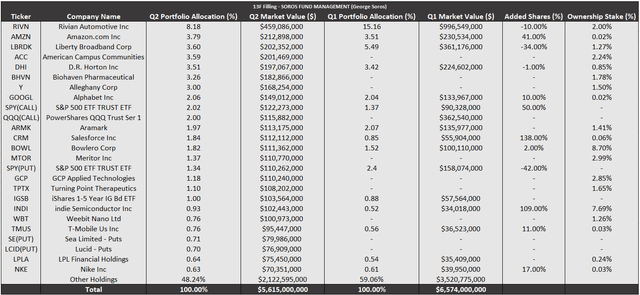

Final Overview

Soros Fund Holdings Q2 2022 (Author Spreadsheet)

Instead of pursuing traditional defensive-oriented companies that are supposed to weather the ongoing storm in the markets, Soros Funds utilized the ongoing liquidity crunch to double down on their tech-oriented positions, lowering their average cost basis. At the same time, the fund seems to have significantly increased its efforts to pursue attractive risk-reward, positive merger-arbitrage opportunities that are supposed to bring “fixed” returns in the face of the increasingly degrading macroeconomic situation.

Be the first to comment