Solskin/DigitalVision via Getty Images

The market has appeared to lose interest in telehealth stocks and that’s likely a mistake. Amwell (NYSE:AMWL) is still struggling to build out the business model, but the market shouldn’t lose interest. My investment thesis is still more Neutral on the telehealth provider due to ongoing larger operating losses, but the technology remains promising.

Disappointing Business Model

While telehealth advancements drastically improved healthcare during COVID-19 lockdowns and mass fears, telehealth providers such as Amwell didn’t exactly benefit financially. The stock once surged over $40 after going public right before the covid boosts and Amwell now trades below $4 with the stock valuation hardly above the massive $750 million cash balance.

The problem with Amwell and competitor Teladoc Health (TDOC) is that a lot of the business is reliant on minimal subscriptions and monthly fees for access to the telehealth platforms. A big problem with Amwell is that the business model has the costs as if the company was collecting $100 fees for every doctor visit on the platform.

The company offers up the following mission statement:

To define the fundamental infrastructure that connects providers, payers, patients and innovators and enable them to deliver on the promise of greater access to affordable high-quality care. We are transforming care delivery from in-office to integrated in-person, virtual and automated care modalities.

Amwell has a promising business concept of connecting healthcare providers and patients with tools to realize better health care experiences and outcomes. The company just doesn’t collect much money for providing this service, especially in comparison to the cost.

Going back to Q4’21, subscription revenues were only $30.1 million, up only 14% from the prior year. Amwell generated the largest portion of revenues from visit revenue of $31.2 million based on $80 per AMG visit.

The subscription revenues come from Health Plans only paying an average contract value of $723K and Health Systems paying just $356K now. With millions of patients in these plans and systems, Amwell isn’t obtaining a large value for these highly important customers. The total subscription revenues didn’t even top R&D expenses of $33.8 million during the quarter.

The visit revenues comes with high costs leaving the company with meager 44% gross margins. So Amwell wants to focus on the infrastructure to make telehealth work, but the company doesn’t heave the typical technology type of gross margins in the 80%+ range due to the visit revenue elevated from Covid.

The limited revenue boost Amwell obtained during covid was mostly related to visit revenue not forecasted to grow much during 2022. The company guided to 2022 AMG visits of ~1.45 million, slightly up from ~1.4 million in 2021.

The 2022 guidance of $280 million suggests ~$121 million for visit revenue and subscription revenues seeing ~$20 million growth this year. The subscription levels will still sit at relatively low levels.

The guidance is highly disappointing considering the addition of Conversa. Analysts had forecast revenues topping $310 million. In addition, the suggestion Amwell is spending 1 million additional shares to accelerate the integration of their business isn’t positive for the legacy business.

A Lot Needs To Go Right

Despite the most ideal climate for telehealth services since covid fears started in early March 2020, Amwell hasn’t produced impressive results. The company just guided to 2022 EBITDA losses of up to $200 million, along with limited revenue growth.

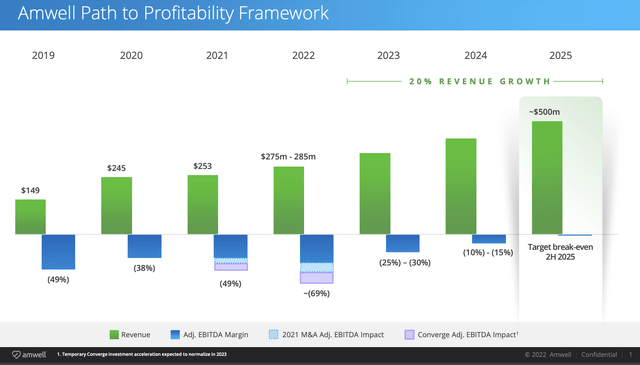

The company is spending aggressively on R&D in 2022 along with absorbing some higher costs from the acquisitions of SilverCloud and Conversa. Amwell needs a lot to go correct in 2023 and into 2024 for the telehealth provider to reduce EBITDA losses down to a possible low of 10% of revenues.

The new CFO forecasts a 50 percentage point improvement in the EBITDA loss margins in 2023. A big part of the forecast is a cut to R&D expenses (not always ideal), though spending in 2022 is elevated to complete the Converge platform. The long-term target is for R&D expenses to dip to 30% of subscription revenues, down from over 100% now.

Either way, Amwell only targets a 20% annual growth rate on the path to profitability in the 2H’25. Revenues are forecast to reach a $500 million run rate in four years.

The issue doesn’t appear reaching the revenue target, but one has to question whether Amwell can cut the ongoing EBITDA losses via only 20% revenue growth. The market wants revenue growth in the 40% to 50% range to warrant funding large EBITDA losses. A reasonable 2026 revenue target of $600 million with 5% EBITDA margins amounts to EBITDA profits of only $30 million about five years from now.

Takeaway

The key investor takeaway is that promising telehealth technology isn’t leading to strong financial results. Amwell still has a long pathway to profitability and the company has limited growth to warrant taking a risk in owning the stock. Investors are best to continue watching from the sidelines.

Be the first to comment