Extreme Media

In the last month, I wrote about Amphastar Pharmaceuticals (NASDAQ:AMPH) and its growth strategy. Since then, my opinion has become very strong about the stock. Although the stock has not appreciated considerably, the business has improved significantly.

For the pharmaceutical company, acquiring new patents and successfully marketing the drug is a significantly important strategy for growth. Over the period Amphastar has brought in new patents which have resulted in high growth in revenue.

In my view, there is a significant growth opportunity for the business to grow, but due to the recent adverse conditions the stock has remained significantly undervalued, I remain intact on my buy ratings.

Third-quarter result

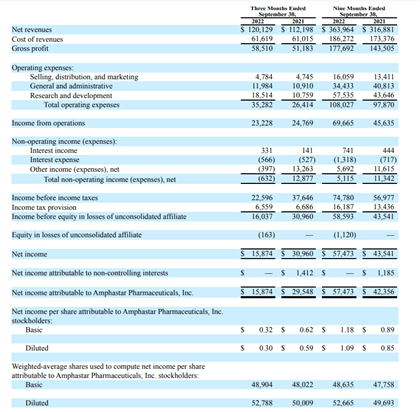

Quarterly financial (quarterly report )

In the latest quarter, revenue grew from $112 million in the same quarter last year to about $120 million, but as a result of higher research expenses and lower other income net profit dropped from $29 million to $15.8 million. But the overall profitability in the last nine months has improved significantly compared to the last year.

Also, the company ends the quarter with current assets of over $384 million, with considerably low debt, which shows that the business has a substantially stronger financial position and going ahead company could easily obtain debt financing for growth purposes.

With the significant growth in profitability in the last nine months, cash flow from operations has also grown significantly to $73 million. Also, the management has allocated the generated money for share buyback purposes, which shows that the management is relentlessly working to create value for the shareholders.

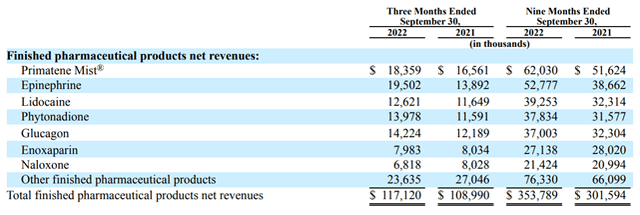

Product pipeline (quarterly report )

Recent growth in the revenue is led by a significant rise in the sales of Primatene mist, glucagon and epinephrine, but as most of the old drugs are facing a significant backdrop, the company will have to bring new drugs to its portfolio to grow its business.

As I have discussed in my previous report, if the company fails to market new products, the overall profitability might get hurt severely.

Improvement in the business model

Our balance sheet is stronger than ever and provides us the flexibility to continue investing in our robust pipeline. Therefore, R&D investments, as seen in the third quarter, continue to be a priority for us as we remain committed to advancing our pipeline toward approval and launch of special regard to our inhalation, internasal and insulin products.

The management is focusing extensively on research and development to bring new products to its portfolio, although the high research expenses are putting pressure on the profitability, but in the long run, it will bring substantial cash flows for the company.

Furthermore, in the last month, AMP-008 inhalation has received CRL, and the management believes that the issue raised is addressable and simple, if the company could get approval for this inhaler along with the teriparatide which is being in the process, the revenue will grow significantly.

Also, by the end of the year, Eli Lilly along with Novo Nordisk and Boehringer Ingelheim are planning to discontinue the operation of the glucagon business, therefore there is a significant opportunity for the company to expand in that area, and the management has filed for the FDA approval to increase the production capacity for glucagon, which will bring significant profitability in the upcoming quarters.

Risk factors

If the products in the development stage fail to get approved by FDA, the company will have to incur significant losses because the company has been spending a large amount of money on product development.

Also, as the company operates majorly in the generic product segment, failure to launch new products might affect the company’s revenue significantly. As a generic manufacturer, the company has to bring in new products because due to the high competition over the period sales from the old product pipelines might decline significantly. Therefore, the company’s overall profitability is significantly dependent on the new FDA approvals.

Why do I think the company will grow?

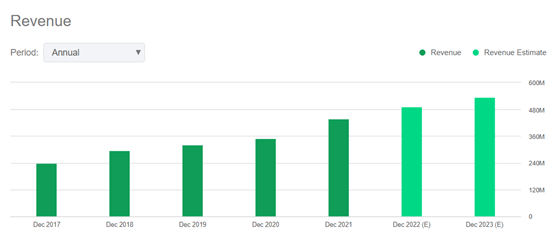

revenue growth (seeking alpha )

Quarter-over-Quarter growth in revenue has persisted due to the consistent launch of the new product pipelines.

I believe the company has a significant number of drugs in the development process along with that the company has been spending heavily on research, which will bring significant growth in the business in the upcoming years.

Also, the overall financial position is substantially strong, which offers significant flexibility for the company, along with the recently dropped in glucagon capacity and higher chances of new drug approvals will bring substantial value in the upcoming quarters.

The company’s market capitalization has remained at $1.37 billion despite the cash flow from operations of over $78 million in the last nine months, which shows that the stock is trading for about 18 times its last nine months CFO, despite strong growth prospects. I believe Amphastar is a buy.

Be the first to comment