bermau

The Story

AMMO Inc is an American designer, producer, and marketer of ammunition products. It first began trading OTC in 2017 and later became listed on the NASDAQ in 2020.

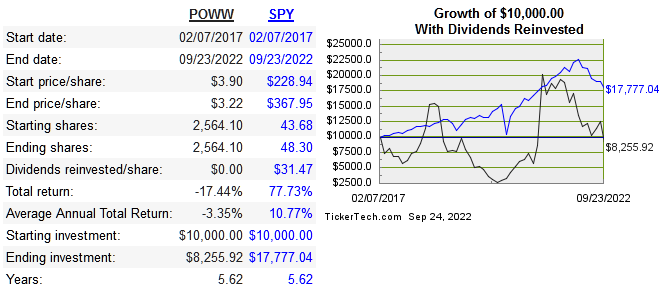

POWW is much smaller and younger than any of their publicly traded peers. They have two operating segments, an online marketplace known as gunbroker.com, and a manufacturing side. Last month, the company announced that it would split each segment into two independent public companies. This is the key factor for investors who are looking to get in now. If you want to invest in both segments, do you buy now before the separation and receive shares, or do you wait to see what happens afterwards and then buy each at the right price? Below is the share price performance:

dividendchannel

The major firearm companies can be broken down into gun manufacturers (SWBI and RGR), retailers that sell firearms (AOUT, BGFV, CAB, and SPWH), and bullet manufacturers (VSTO, OLN, and POWW). POWW is more narrowly defined than these others, and they split revenue between the online marketplace and manufacturing. VSTO also manufactures various other outdoor equipment, while OLN generates 17% of revenue from its Winchester segment, with the rest coming from chemical manufacturing. So none is currently a pure play on ammunition.

Below are the return on capital metrics:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

10-Year CAGR EPS |

10-Year CAGR FCF |

Capital Intensity Ratio |

|

POWW |

7% |

15% |

n/a |

n/a |

1.7 |

|

VSTO |

7.6% |

5.5% |

47.6% |

17.5% |

0.78 |

|

OLN |

10.9% |

5.7% |

10.3% |

50.4% |

0.96 |

Below are margins and revenue growth:

|

Company |

6-Year Revenue CAGR |

TTM Gross Margins |

TTM Operating Margins |

TTM Net Margins |

|

POWW |

149.2% |

36.9 |

15.4% |

13.8% |

Industry Growth

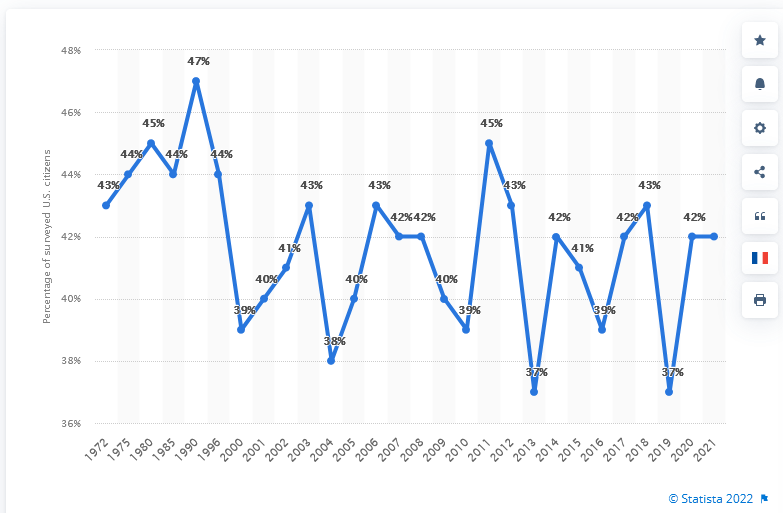

The chart below shows the % of US households that own one or more guns.

Statista

As the chart shows, overall ownership is only 1% lower than in 1972, and the population obviously grew which brings unit volume higher in the industry. The growth of the global ammunition market is estimated to grow at around 3% until 2030.

Capital Allocation

The company is clearly in growth mode, and just reached the important milestone of reaching positive operating income, free cash flow, and net income. While there is almost no debt, they have used equity funding extensively, and share count has grown at 34% CAGR. It’s not clear how much growth will cost once the segments are split.

Risk

The biggest secular risk is political. While gun and ammo sales typically rise right after a tragic mass shooting, the amount of regulations also rise over time. Even though the industry is poised to grow only around 3%, POWW can achieve a much higher growth rate due to being so much smaller than the big players.

The other risk lies in the upcoming spinoff. The online marketplace is only 26% of overall revenue, but has better margins. Much of the synergies that will supposedly come from splitting the company in two parts can be avoided by allowing more autonomy in each segment. This split is not necessary, especially for a company this small. The reasoning lies mostly in the marketplace being higher margin, and capital light compared to the manufacturing segment.

My main concern is that such a small company splitting in two will only bring about more costs in the form of two separate listing fees and two sets of board and executive compensation. With current revenue of $240.2 million, these costs are significant and not worth the expected advantages of separation.

Valuation

As stated earlier, POWW is similar to VSTO and OLIN in scope more than in size. Keep this in mind with the multiple comparisons.

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Market Cap |

|

POWW |

1.4 |

7.1 |

119.3 |

1 |

376.6 mil |

|

VSTO |

0.6 |

2.6 |

5.4 |

1.1 |

1.38 bil |

|

OLN |

0.9 |

3.1 |

4.9 |

2.4 |

6.39 bil |

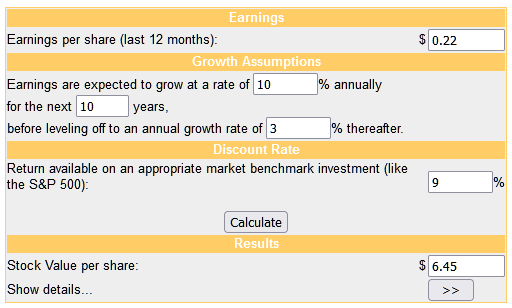

Below is the DCF model:

moneychimp

I definitely like the growth prospects of the company in current form, and current share prices offer a discount at 3.22. The problem is what might happen when the one stock becomes two. Undervaluation now doesn’t guarantee shares will pop once the separation is complete. With such a small market cap already, there won’t be a ton of analyst coverage, and the chance for even more mispricing is very possible. I’ll be waiting to see what each stock trades at once independent, and then see if either is still undervalued.

Conclusion

POWW has had terrific top line growth so far. Last month, the company announced that their two operating segments will be split into two separate publicly traded entities. The key question is whether to buy now or wait to see how the market reacts to the split up. The secular trends behind this industry aren’t great, but the chance of serious decline is not very likely. POWW is the closest thing to a pure play in ammunition, and the new business will become even more so. Even though I like the valuation here, I’ll be waiting to see how prices are affected when this stock becomes two independent companies.

Be the first to comment