Mikhail Mishunin

Since my last article on the ALPS Alerian MLP ETF (NYSEARCA:NYSEARCA:AMLP), which was released on 3/2/22, AMLP has appreciated by 5.76% while having a total return of 9.99% when dividends are factored in. AMLP has outperformed the S&P 500 as the S&P declined by -5.9% in this period. In my previous article on AMLP (can be read here), I discussed the benefits of investing in AMLP rather than Master Limited Partnerships (MLPs) directly and outlined many points about the K-1 package. The energy landscape has significantly changed over the past 6 months, and I am writing a follow-up article on AMLP as I believe energy infrastructure companies are positioned to outperform for the remainder of 2022 and 2023, making AMLP an interesting opportunity.

MLPs haven’t recovered since their downward descent in 2014, but it’s a new day in 2022, and I tend to look toward the future and not backward. The energy infrastructure industry looks to have put a long-term bottom in, and it’s clear oil & gas are not disappearing from the global energy mix over the next several decades. AMLP is a collection of MLPs rolled into a single ETF that focuses on energy infrastructure. There are two schools of thought around MLPs as they issue a K-1 package during tax season, some don’t mind as there are arguable benefits to the structure, and some investors hate K-1 packages due to the tax implications. The benefit of investing in AMLP is that the income generated is classified as either qualified dividends or return of capital rather than a distribution, so a K-1 is not issued for tax purposes. I have owned AMLP in addition to several individual energy infrastructure companies for some time, and I believe AMLP is still a good investment for income investors to consider to generate reliable income from their portfolio.

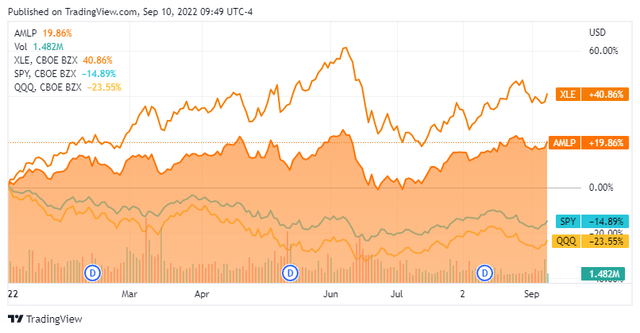

AMLP is outperforming the major indices in 2022

It’s not a secret that energy companies have outperformed the markets in 2022. While companies such as Exxon Mobil (XOM) and Chevron (CVX) have led energy higher, and the Energy Select Sector SPDR ETF (XLE) has appreciated by 40.86% in 2022, energy infrastructure companies that are not in the spotlight have also been doing well. After this week’s rally, where the Nasdaq increased by 4.02% and the S&P 500 increased by 3.33%, the Nasdaq is still in a bear market, down -23.55% YTD, and the S&P is in the red by -14.89%. The XLE has been a bright spot throughout the volatility of the market, increasing by 40.86%, but AMLP has also outperformed the markets as it appreciated by 19.86% in 2022.

Not only is AMLP outperforming the markets, it also produces an annual dividend of $2.94, which is a 7.28% yield. In 2021, AMLP generated an annual dividend of $2.78 per share; in 2022 it produced $2.18 from its first 3 dividends. In a down market, AMLP has appreciated by 19.86%, is on track to generate a yield that will exceed 7% from its dividends, and shares haven’t needed to be sold to produce this income.

There is a time and place for everything, and in investing, there are different types of investments for different investment goals. While AMLP has outperformed the markets, I am not expecting AMLP to outperform the S&P indefinitely, and this is not a fund I would pick for long-term capital appreciation. From an income and diversification perspective, AMLP fits into my investment methodology. Energy infrastructure companies are next to impossible to replicate, and I believe they are undervalued, especially as the political noise starts to diminish. I think AMLP could present an upside capital appreciation opportunity while generating much larger than average yields.

The details about AMLP

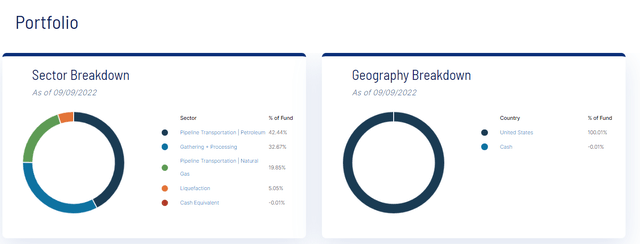

AMLP was created on 8/24/10 and had $6.67 billion of net assets as of 9/9/22. AMLP charges 0.87% in total operating expenses, which comes from a 0.85% management fee and 0.02% other expenses. As of 8/31/22, AMLP TTM yield was 7.43%. AMLP has 15 holdings, with most of its investments covering pipeline transportation (42.44%) and gathering & processing (32.67%). 100% percent of AMLPs investments are held within the United States, and over 30% of its fund assets are invested in Plains All American Pipeline (PAA), Western Midstream Partners (WES), and Energy Transfer (ET).

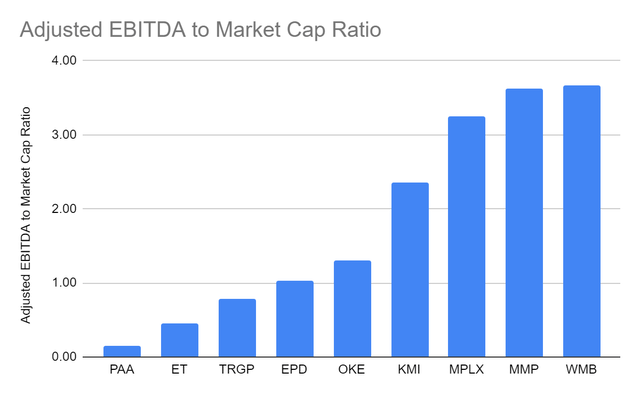

I track 9 energy infrastructure companies for my Barbell Capital Marketplace, which include MLPs and LPs. 5 of AMLPs holdings are on my valuation sheet, and looking at AMLPs top holdings, I would agree with their positioning. PAA and ET are the two most undervalued MLPs or energy infrastructure companies that I track. Below is a picture of the metrics I track, including Adjusted EBITDA to Market Cap, EV to Adjusted EBITDA, and Distributable Cash Flow (DCF) to Market Cap. The tickers highlighted in yellow are holdings within AMLP.

Steven Fiorillo, Seeking Alpha

I always like looking at the adjusted EBITDA to market cap ratio because Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) basically tells you how much cash is left over after paying the business operating costs, excluding one-time charges. ET and PAA trade at the most attractive Adjusted EBITDA to Market Cap ratios from the companies I track, indicating they are undervalued. As AMLP’s top holdings, this aligns with my research.

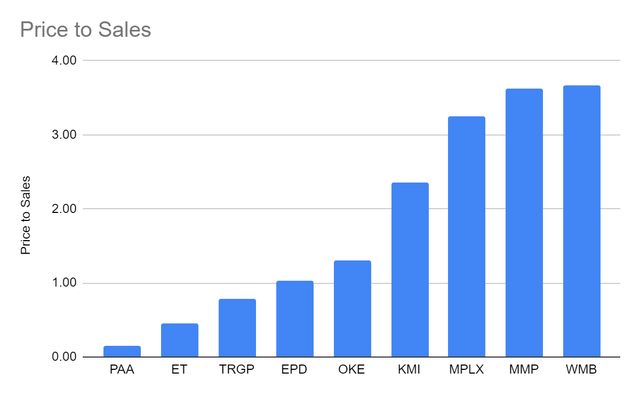

Steven Fiorillo, Seeking Alpha

Price to Sales isn’t a typical metric used in MLPs, but it is interesting to see the multiple Mr. Market has placed on the group. PAA and ET trade at less than 1x sales, where several MLPs trade for more than a 3x P/S multiple.

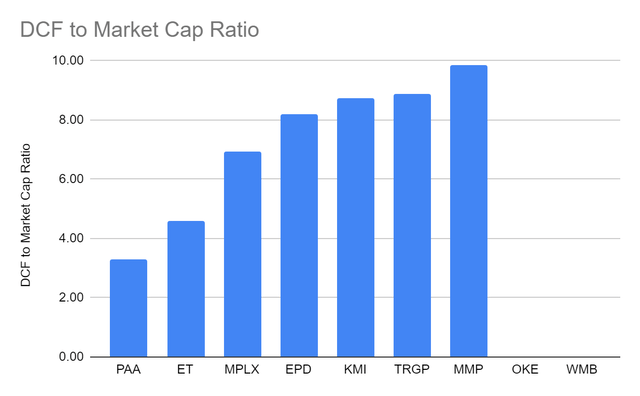

Steven Fiorillo, Seeking Alpha

When you’re investing in pipeline companies, it’s important to look at the DCF, as this is the pool of capital distributions are paid from. DCF is the equivalent of funds from operations (FFO) from REITs. Today PAA and ET trade at a discounted DCF to Market Cap ratio, which also indicates that Mr. Market has discounted their prices.

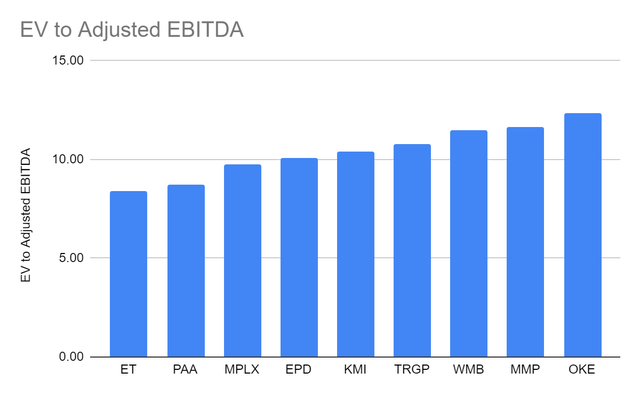

Steven Fiorillo, Seeking Alpha

I have also incorporated the Enterprise Value (EV) to EBITDA ratio, as many readers in other energy articles have asked me to include this metric. The EV/EBITDA metric is a popular valuation tool that helps investors compare companies as EV calculates a company’s total value or assessed worth, while EBITDA measures a company’s overall financial performance and profitability. As a point of reference, Investopedia indicates that “when evaluating a company, an EV/EBITDA value below 10 is seen as healthy.” ET and PAA once again have the lowest EV/EBITDA ratios in their peer group.

Steven Fiorillo, Seeking Alpha

Generating income from AMLP vs. selling shares of appreciating investments

I dislike selling shares to generate income, as decreasing an investment’s total share count goes against many investment principles I believe in. When I look for income investments, I want to generate a 5-6 percent yield while keeping my asset base intact. MLPs are popular income investments as they tend to generate larger than average distribution yields as a large portion of their distributable cash flow are distributed to shareholders. Many of AMLP’s top holdings generate a 7%+ yield, allowing AMLP to have an annual dividend of $2.94 or a forward yield of 7.28%.

There is an investment theory that investing in funds such as the Invesco QQQ ETF (QQQ) and tracking the Nasdaq or the SPDR S&P 500 Trust (SPY), and selling shares periodically to generate income is a better option for producing income than allocating capital toward higher yielding investments. I disagree with this methodology, as SPY has a yield of 1.48%, and QQQ has a yield of 0.61%. Hypothetically, if you own 100 shares of SPY ($40,660) and are looking to generate $1,500 of income annually, you will need to sell 3.69 shares at today’s prices. SPY only generates $6.01 in annual dividends. If you were to sell off $1,500 worth of shares, you would be left with 96.31 shares, and your annual dividend would decline from $601, allowing you to purchase 1.48 shares of SPY to $578.83, allowing you to purchase 1.42 shares of SPY. You would be selling off more shares than your repurchasing through the dividend and put yourself on a path of depleting your total share count.

Investments such as QQQ and SPY are great long-term investments for capital appreciation. I love index funds, and any investor can find a place for them inside their portfolio. If you’re an income investor, the idea is to generate sustainable income from your investment, not deplete your investment’s asset base for income. AMLP allows you to gain exposure to the MLP sector and generate a large yield that overshadows many dividend yields found in the market.

Even if you missed out on 2022s gains in AMLP, I am still bullish on AMLP

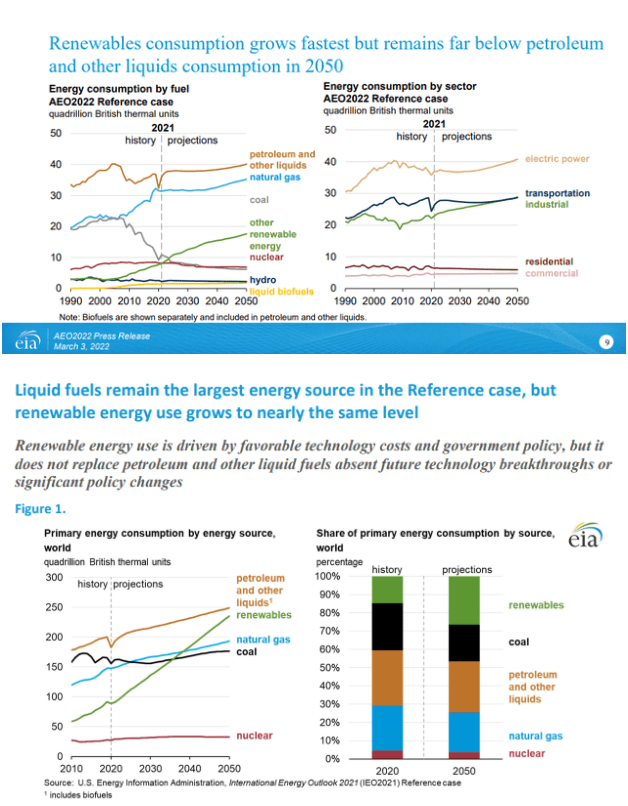

On 3/3/22, the EIA released its 2022 Annual Energy Outlook and concluded that petroleum and natural gas remain the most consumed sources of energy in the United States through 2050 (1st slide below). The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. In 2021, on a global scale, the natural gas consumption rate will increase by roughly 18% by 2050 per the EIA’s projections (2nd slide below). Their next report is slated for 2023, and it will be interesting to see how things have changed due to the growing demand for natural gas overseas.

EIA

I can’t predict what the markets will do tomorrow, next week, or next year, but the data indicates petroleum and natural gas will remain the largest consumed energy source in the United States in 2050, and petroleum will remain the largest consumed energy source globally. Renewables will continue to increase their position in the global energy mix, but the utilization of oil and gas will continue to increase. When I look at these data sets from the EIA, my speculation is that as more energy is consumed, more energy will need to be produced. If more energy is produced, increased capacity in storage, transportation, and processing will be needed. In a society where the demand for energy is increasing, and the projections are that fossil fuels will continue to grow, it’s hard for me to discount the relevance for energy infrastructure companies. Energy has done well in 2022, but energy infrastructure companies are still trading at interesting valuations, and there could be more future upside in AMLP.

Conclusion

Every investor has different reasons as to how they allocate capital. I have been an investor in AMLP for years as it fits within my overall investment thesis. AMLP provides exposure to an industry that I believe is underappreciated and undervalued while generating a dividend yield that exceeds 7%. When it comes to income investing, I would rather allocate capital to investments that generate larger yields than invest in index funds and sell off shares to generate income. AMLP provides an easy way to gain exposure to energy infrastructure and generate large dividends without the headaches of K-1 packages. I believe there are many undervalued companies within the oil patch, and if the EIA’s projections are correct, then many of these companies are undervalued, which should create future appreciation for AMLP.

Be the first to comment