vzphotos/iStock Editorial via Getty Images

Introduction

I am always looking for more additions to my dividend growth portfolio. While sometimes all I do is just add more shares to attractive positions I already own, I am always on the lookout for new opportunities. In this article, I will analyze a company I analyzed once in 2021 and have put it on my watchlist yet didn’t pull the trigger just yet.

In 2021 I found Amgen (AMGN) to be a decent addition to every dividend growth portfolio. Since the article was published the stock remained flat compared. When I look at the entire year, shares were down 3%. However, the company’s outlook has improved since, and I believe that this is a good time to take another look at the company.

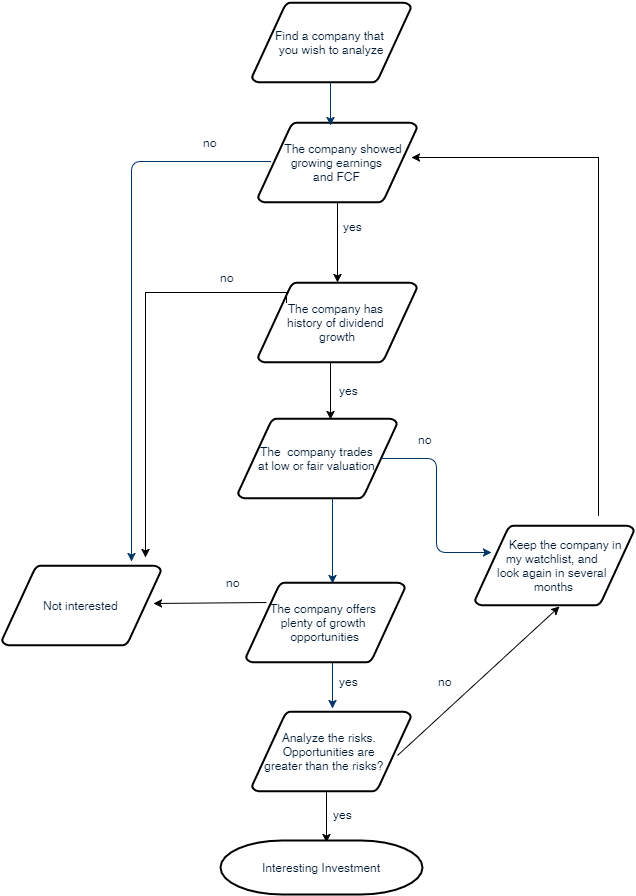

I will analyze the company using the graph below, which represents my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

(Graph made by author)

(Graph made by author)

According to Seeking Alpha’s company overview: “Amgen discovers, develops, manufactures, and delivers human therapeutics worldwide. It focuses on inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology, and neuroscience areas. Amgen serves healthcare providers, including physicians or their clinics, dialysis centers, hospitals, and pharmacies.”

(Source: Wikiepdia.org)

Fundamentals

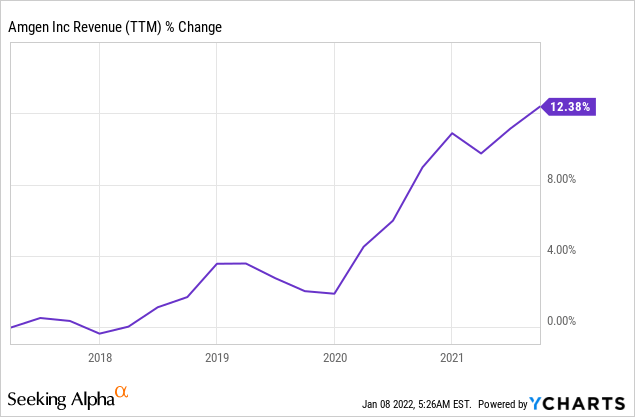

Revenues have been climbing slowly over the last five years. While 12% is not very impressive for a five-year period in this sector, the pace has increased over the last two years. Amgen grows its revenues both through organic growth and its pipeline of drugs and using M&A to buy drugs and companies that fit and complement its portfolio. According to Seeking Alpha’s company overview, investors should expect mid to high single digits revenue growth.

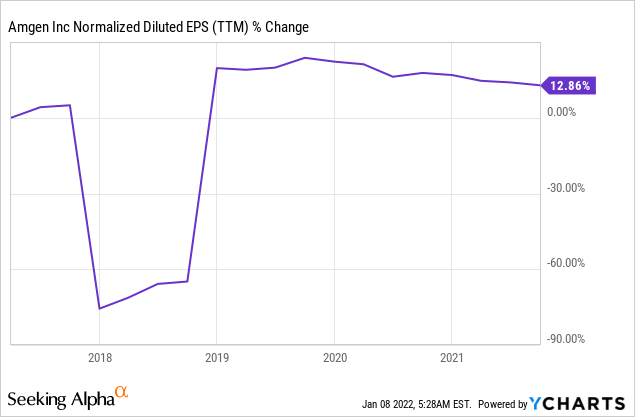

The GAAP EPS has moved together with the revenues over the last five years. However, when looking at adjusted EPS, the earnings have grown by over 40%. The company’s EPS is growing due to organic growth, acquisitions, and aggressive share repurchases over the last five years. The company also improved its margins in the last five years. According to Seeking Alpha’s company overview, investors should expect mid-single digits EPS growth.

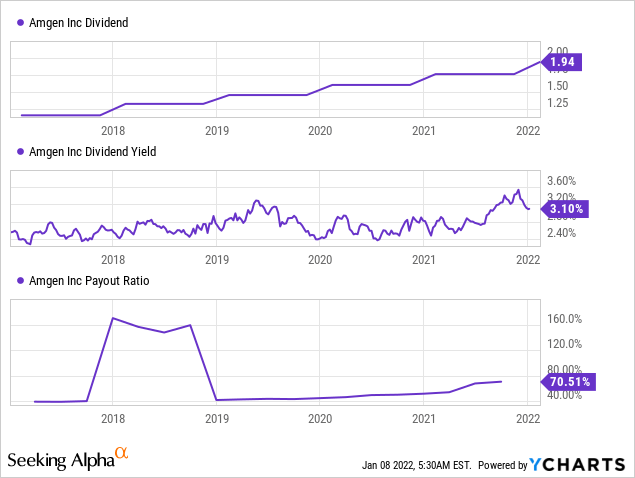

The dividend that Amgen is paying is relatively new. It was initiated in 2011 as the company matured and had significant cash reserves and FCF. The current yield is attractive at 3.1%, and the company has just raised the distribution by 10% last month, more than enough to deal with the inflation. The dividend is safe as the company is paying 70% of its GAAP earnings. When using less conservative non-GAAP earnings, the payout ratio is very manageable at less than 50%.

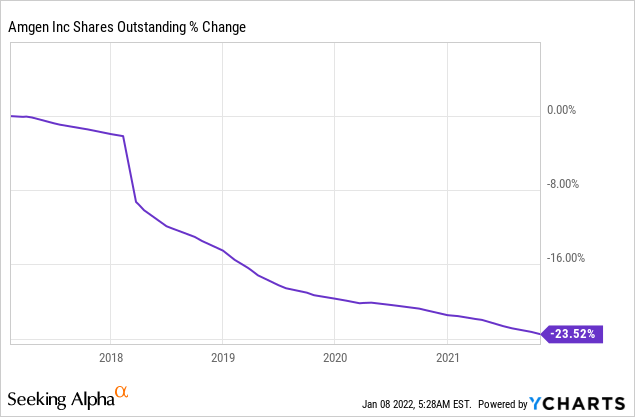

In addition to the company’s generous dividend, the management is also using some excess cash flow to significantly reduce the number of shares outstanding, taking advantage of what it believes is a low valuation. The company’s share count has been reduced by almost 25% over the last five years, and the company is aiming to keep buying back shares to increase shareholder returns.

Valuation

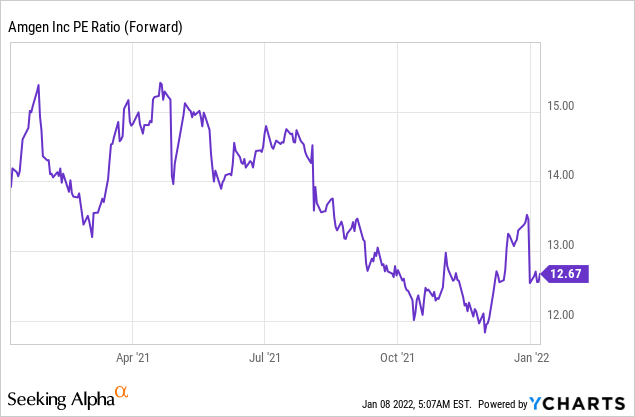

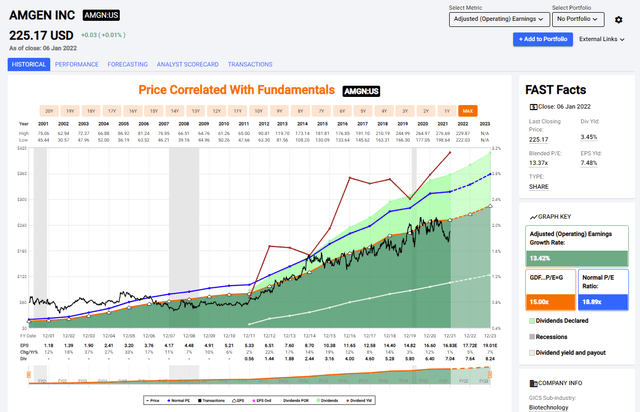

The P/E ratio has declined over the last several months since published my article on Amgen. This is the result of the share price staying stagnated while the company’s fundamentals and forward outlook have been improving. In my opinion, 12.67 times earnings for a reliable company, with a decent growth track record, and a positive outlook is a fair valuation.

The graph below from Fastgraphs emphasizes the valuation story. The company is trading for a valuation that is lower than its historical valuation. The company’s average P/E is almost 19, and the current P/E ratio is 30% lower than the historical valuation. Therefore, despite a growth rate that is slower than the historical 13% growth rate, the shares are fairly valued.

(Source: Fastgraphs.com)

To conclude, Amgen offers its investors strong fundamentals, shareholder-friendly management, and a fair valuation with some signs of undervaluation. Growth in revenues will lead to EPS growth that leaders to dividend growth similar to the generous 10% raise we just saw. This entire package comes at a fair valuation. If the company has strong growth opportunities, and limited risks, it will be a good candidate for dividend growth investors.

Opportunities

The company enjoys demand growth in its drug portfolio. Prolia is just one example of a core drug in Amgen’s portfolio which enjoyed last quarter a 15% YoY growth in sales. Repatha, another prominent core drug in the portfolio, has enjoyed an even more impressive 33% growth, but from a much lower basis. Amgen manages to increase sales of current drugs while developing new ones.

“We think we’re in a position to deliver attractive results for the long term and that we expect will be built off the strong base that we’ve established now for Repatha, Otezla, our bone health franchise, which, of course, comprises Prolia and EVENITY. “

(Robert Bradway, CEO & President, at Goldman Sachs 14th Annual Healthcare CEOs Unscripted Broker Conference Call, 01/06/2022)

Another growth opportunity is the robust pipeline of Amgen with several promising drugs. AMGEVITA for example is a very promising drug, as it intends to be a biosimilar version of Humira once the patent protection is off in 2023. Humira is the highest-selling drug in the world, and this is a prominent opportunity for Amgen in addition to other drugs in its pipeline.

“When we think about the next few years, we’ll be launching AMGEVITA in the United States, will be in the first wave of biosimilars for HUMIRA, and we’re excited about what that represents. And then shortly thereafter, in the years that follow, we expect to be in the first wave for STELARA, for SOLIRIS, for EYLEA. So there’ll be quite a lot going on in our inflammation franchise, including biosimilars.”

(Robert Bradway, CEO & President, at Goldman Sachs 14th Annual Healthcare CEOs Unscripted Broker Conference Call, 01/06/2022)

Improving outlook gradually and friendliness to shareholders is another great sign for growth. Amgen’s current outlook for 2021 is higher than it was just several months ago when I analyzed the company. In addition, analysts also raised their 2022 expectations during the same period. This is not new, as the company has been an overachiever over the last decade, beating the expectation, and as the CEO stated, it has resulted in significant shareholder returns.

“So if you look just at the financials in the last decade, we added $8 billion of revenues. We grew earnings per share by 2.5x. We grew the dividend like 5x over that period. We increased shareholder value by about 3.5x over that period.”

(Robert Bradway, CEO & President, at Goldman Sachs 14th Annual Healthcare CEOs Unscripted Broker Conference Call, 01/06/2022)

Risks

Competition is the first risk for every company in the pharmaceutical business. The business is capital intensive, and the companies are facing other peers also developing patented drugs that can be just as efficient. Moreover, Amgen is also dealing with generic drug competition. This is a highly competitive business where R&D spending is significant to maintain leadership over the long term.

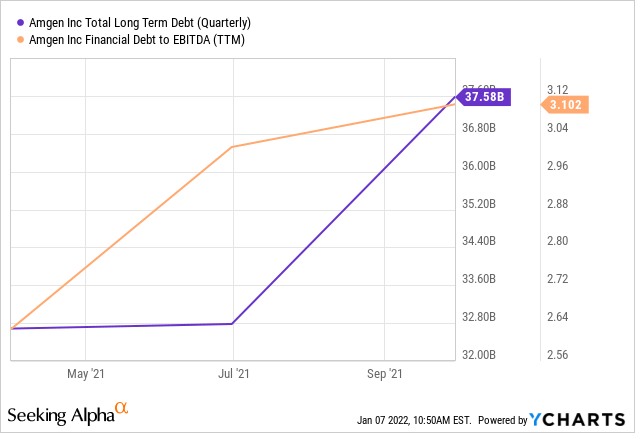

Moreover, Amgen is also dealing with a high level of debt. Since I wrote about the company, the debt level has increased by 10%. Debt to EBITDA levels have reached 3.1, also higher than what we have seen just 6 months ago. The debt may limit the company’s ability to invest heavily or engage in M&A activities, which are a significant part of its growth strategy over the last decade. The company has over $10B in cash and equivalents and may consider using some to lower its debt levels.

Interest rates are going to rise in the short and medium-term. The inflationary environment will press the Federal Reserve to raise the rates probably faster than it has anticipated just a few months ago. Higher rates for Amgen will mean higher interest expenses, which may weigh on the EPS, and limit the company’s flexibility. Most of the debt is not going to mature soon, so this is a challenge that will be addressed slowly.

Conclusions

Amgen is a great company. The management team has managed to lead it to impressive achievements over the last decade rewarding shareholders in the process. The company enjoys strong fundamentals, what I believe to be a fair valuation, and above all that it has some great growth opportunities in the future, which will lead to further revenues, EPS, and dividend growth resulting in total shareholder returns.

While the company is dealing with several risks including competition, debt levels, and interest rates, it seems like the management is well prepared to manage them. Therefore, I believe that Amgen is an attractive addition to your dividend growth portfolio as its price has stayed unchanged, yet fundamentals have improved.

Be the first to comment