Mohammed Haneefa Nizamudeen/iStock via Getty Images

Amgen (NASDAQ:AMGN) is one of the best established of the biotechnology companies. Founded in 1980, in 1989, it received FDA approval for the first recombinant anemia therapy, Epogen. For that reason, it has had time for the patents on several of its earlier blockbuster drugs to expire. That led to slow revenue growth in last decade. Currently, it has a strong pipeline and some newer drugs ramping their revenues. Amgen maintained a reasonable dividend as it rebuilt its portfolio. Altogether, I believe it has enough upside potential to recommend it to other investors, providing it fits their acceptable risk profiles.

This article will briefly review Q4 2021 results, while noting that Q1 2022 results will be released on April 27, 2022, with an analyst conference (open to all investors) at 5 PM Eastern Time. Then, I will focus on a newly approved drug, Lumakras, and on other possible significant revenue generators in the pipeline.

Analysis of Q4 2021 Results

Amgen Q4 2021 results were released on February 7, 2022. In addition, a conference with analysts and investors was held that lasted over three hours. The accompanying slideshow is easier to digest, even at 117 slides.

Revenue for Q4 2022 was $6.8 billion, up 3% y/y, and full-year 2021 revenue was $26.0 billion, up 2% y/y. GAAP net income was $1.90 billion, up 18% y/y. GAAP EPS was $3.36, up 22% y/y. Non-GAAP net income was given as $2.46 billion or $4.36 per share. Operating cash flow was $2.8 billion, leaving a cash and equivalents balance of $8.0 billion. But long-term debt was $33.3 billion. In the quarter, Amgen repurchased $1.5 billion worth of shares and distributed $1.0 billion in dividends.

Looking at revenues from individual therapies, we see the theme of old versus new. The biggest seller was Enbrel, at $1.1 billion, but that was down 13% y/y. Enbrel sales will continue to decline as newer rheumatoid arthritis drugs take market share, and as direct generic competition heats up. Prolia was second in revenue, at $873 million, but it was up 17% y/y. Prolia is used to treat osteoporosis and has patent protection through 2025, which is a cliff within view of long-term investors. The older drugs with expired or expiring patents (expiration dates differ by nation) are the main worry for Amgen investors. Another example of that is Neulasta, down 35% y/y to $351 million.

Newer drugs will likely continue to ramp revenue for years. I will discuss Lumakras separately below. Amgen itself is seeking to become a generics powerhouse with biosimilars like Amgevita, Kanjinti, and Mvasi. Repatha and Evenity are good examples of newer drugs with revenue still ramping and having long patent lives. Repatha is a PCSK9 inhibitor for high cholesterol when other treatment options fail. It was approved by the FDA in 2014 and generated Q4 revenue of $273 million, up 8% y/y. Judging from Slide 20, Amgen expects Repatha sales to grow substantially by 2030. Evenity is used to treat osteoporosis and was approved by the FDA in 2019. It generated $143 million in Q4, up 59% y/y.

With a 3% overall growth rate, the newer, growing drugs are just keeping ahead of the declining drugs. To be more attractive to investors, the pipeline not only needs to generate more approved therapies, but ones that are high-revenue generators. That increasingly looks like cancer therapies, which is why there is so much emphasis on Lumakras and other cancer agents in the pipeline.

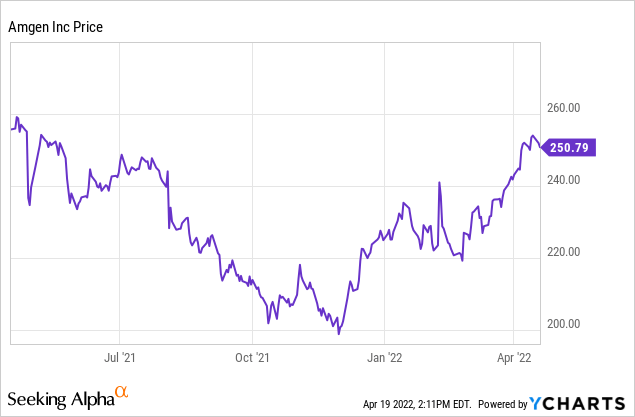

2022 guidance (Slide 19) is for revenue between $25.4 and $26.5 billion. Non-GAAP EPS is expected between $17.00 and $18.00. That should support a stock price well over the current $250 or so per share, presuming growth will be ongoing. Even though revenue is flat at the midpoint y/y, my guess guidance is conservative, and likely to trend towards the high end of the range.

Long-term guidance (Slide 18) for 2022 to 2030 includes mid-single-digit revenue growth, non-GAAP operating margin near 50%, and a non-GAAP EPS growth rate in the high-single to low-double-digits. If that is true, then I venture that Amgen’s P/E ratio will also grow during this period, providing a substantial boost to the stock. But all that depends on ongoing sales of currently approved drugs plus some boosts from what is in the pipeline, which is never guaranteed.

Lumakras

Lumakras began as AMG 510, then received the common name sotorasib. I brought it to investor attention in Amgen’s AMG 510 Targeted Cancer Therapy back in 2019. It inhibits KRAS G12C, which is involved in many solid cancers. In May 2021, the FDA approved Lumakras for the treatment of KRAS G12C mutated NSCLC (non-small cell lung cancer). Sales ramped to $45 million in Q4 2021. The label could be expanded based on current trials for colorectal cancer and in combination with other therapies in ten settings. The hope would be to make it available eventually for all KRA G12C-mutated cancers. In February, Amgen announced positive data for advanced pancreatic cancer patients from a Phase 1/2 trial, including a disease control rate of 84%.

Other Agents in the Pipeline

Tezspire (see Slides 35 and 36) is in Phase 3 trials for asthma and chronic rhinosinusitis with nasal polyps. It is in Phase 2 trials for chronic obstructive pulmonary disease and chronic spontaneous urticaria. Presuming the Phase 3 trials are positive, it will enter crowded but very high potential revenue markets.

Many of the current Amgen pipeline trials are hoping to expand the label for drugs that are already approved for at least one indication. This includes Aimovig, Blincyto, Evenity, Kyprolis, Otezla, and others. More novel is Bemarituzumab, a monoclonal antibody in a Phase 3 trial for gastric cancer and gastroesophageal junction adenocarcinoma. Following up on the success of Blincyto, a bispecific antibody for treating acute lymphoblastic leukemia, are seven other bispecifics that target cancers. Most are still in Phase 1 trials, but tarlatamab is in a Phase 2 trial in small cell lung cancer. The total number of agents in Phase 1 trials is 19. While some candidates will drop out of the pipeline at each phase of clinical trials, these 19 current early-stage potential therapies should fuel Amgen’s growth for the rest of this decade.

Conclusion

While I was writing this article, Seeking Alpha News said Jeffries raised its AMGN price target for Amgen to $295. Despite my cynicism about Wall Street analyst stock targets, I find that number quite reasonable. As I write, with a stock price around $252, the dividend yield is about 3.1%. Cash flow is great so I would expect some level of stock buybacks to continue. The problem of older drugs facing increased competition or patent expirations is a known one. I believe newer drug sales, including future regulatory new drug approvals and label expansions, will keep Amgen growing this decade. If Amgen were depending on just a few drugs in its pipeline, I would worry more, but the breadth of the pipeline should mean that any particular trial failure should have only a short-term negative impact on the stock price. While it would have been great to have bought at the 52-week low of $198.64, I think that there is still enough upside to recommend accumulating Amgen. It is also possible that the pipeline will be abundantly productive, generating multiple billion-dollar plus cancer and inflammation therapies by the end of the decade.

Be the first to comment