Wolterk

High yield investing is popular among many investors, and there is nothing wrong with that. In fact, I own a number of high dividend stocks myself, namely Ares Capital (ARCC) and Altria (MO), to name a couple. However, not all investors are attracted to big dividends and I’ve even heard of readers who don’t want to get paid a dividend, preferring a higher share price instead.

This brings me to Ameriprise Financial (NYSE:AMP), which excels at giving shareholders a strong total return, through a combination of both dividends and share price appreciation.

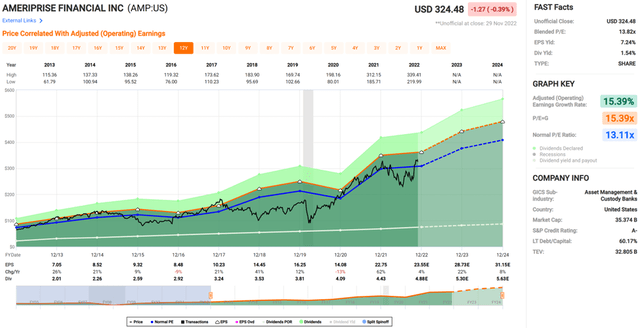

AMP has done quite well since the last time I visited the stock, giving a 38% return since July, far outpacing the 4.7% return of the S&P 500 (SPY) over the same timeframe. This article highlights whether if AMP remains a buy or hold, and the price at which I’d be interested, so let’s get started.

Why AMP?

Ameriprise is primarily a U.S. asset manager that provides advice & wealth management, asset management, and retirement & protection solutions. It was spun off from American Express in 2005, and has one of the largest branded advisor networks in the industry, with a network of ten thousand financial advisors across the U.S.

Around 90% of AMP’s pre-tax earnings are from the U.S. and its financial products include U.S. mutual and ETF funds, annuities, individually managed accounts, and property and infrastructure funds. AMP’s asset light business means that it can return more cash to shareholders in the form of dividends and share buybacks. This compares favorably to companies that need to plow ever increasing amounts of cash towards research & development and capital projects.

AMP has excelled on the shareholder return front, beating the S&P 500 on a 3, 5, and 10 year basis. As shown below, AMP has given shareholders a market thumping 558% total return over the past decade, far surpassing the 239% return of the S&P 500.

AMP Total Return (Seeking Alpha)

Like all asset managers, AMP has felt the effects of market volatility, as reflected by the 9% decline in assets under management during its third quarter, with the overall equity and fixed income markets being down by 19% and 14%, respectively. Moreover, as a global company, AMP is also feeling the brunt of a stronger dollar with the EUR and GBP being down by 15% and 17%.

While AMP is seeing this headline risk, its underlying business is strong, as it continues to attract client dollars, demonstrating client loyalty and the resilience of its business model during both good times and bad. This is reflected by robust client inflows of $64 billion in the first nine months of the year, including $9 billion during the third quarter. This helped AMP achieve a respectable 6% YoY growth in pretax operating earnings due to the aforementioned client inflows, higher interest rates, and continued expense management discipline.

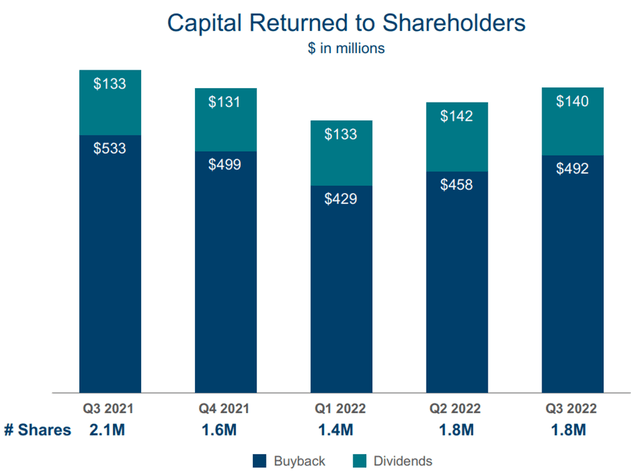

Moreover, AMP maintains a strong A- rated balance sheet and remains committed to high capital returns to its shareholders. This includes the dividend, which is well-protected by a 21% payout ratio and comes with a 9% 5-year CAGR. Notably, AMP allocates more of its capital towards share buybacks. While there is plenty of debate on whether dividends or buybacks are better for shareholders, there is no denying the tax efficiency of share buybacks (since dividends are taxed at the qualified rate).

The share buybacks include 1.8 million shares repurchased during Q3 alone, contributing to a total 27% reduction in share count over the past 5 years. As shown below, AMP has consistently repurchased shares in each of the past 5 quarters, despite high volatility in the equity and fixed income markets.

AMP Capital Returns (Investor Presentation)

Turning to valuation, I find AMP to be fully valued at the current price of $324 with a forward PE of 13.6, sitting slightly above its normal PE of 13.1 over the past decade. Also, at the current price, share buybacks are not as accretive to shareholders, at a 7.4% earnings yield for every dollar spent on buybacks. As such, value investors may want to wait for a 5 to 10% dip in the price before jumping in.

Investor Takeaway

Ameriprise remains a growing, cash-generative asset manager with a large network of financial advisors and strong client loyalty. While the current valuation may not offer much upside potential in the near term, its commitment to high shareholder returns should give investors peace of mind that they will be rewarded over the long term. Thus, while AMP is not a bargain at current levels, it is worth putting on the watchlist for value investors looking for a more attractive entry point potentially in the near term.

Be the first to comment