FeelPic/iStock via Getty Images

Introduction

In October 2018, I wrote an SA article about silver miner Americas Gold and Silver (NYSE:USAS) shortly after the company announced the purchase of the Relief Canyon gold project and I said that this property could be worthless. Well, the ramp up of production was riddled with issues and the company decided to suspend the mine in August 2021.

Americas Gold and Silver has large reserves and its market valuation is just $89 million as of the time of writing but I think that it’s overvalued as unit costs are high and the track record is unimpressive. More stock dilution seems likely in the near future.

Overview of the business and financials

The main assets of Americas Gold and Silver at the moment include the Cosalá Operations mining complex in the Mexican state Sinaloa as well as a 60% stake in the Galena Complex in Idaho’s Silver Valley district. In 2019, Canadian mining investor Eric Sprott got a 40% interest in Galena in exchange for $20 million of funding for capital improvements and operations at the property.

Americas Gold and Silver

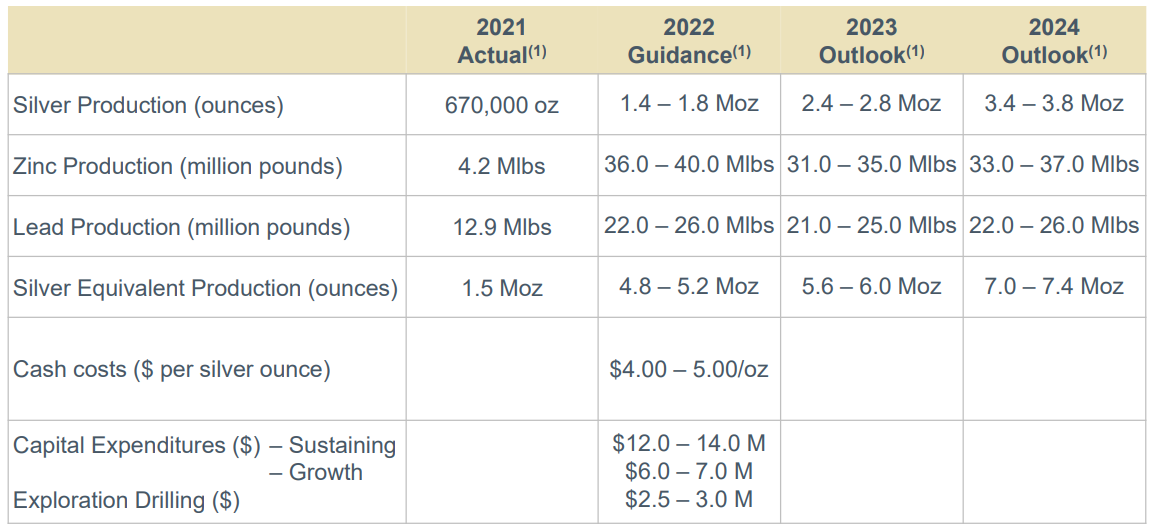

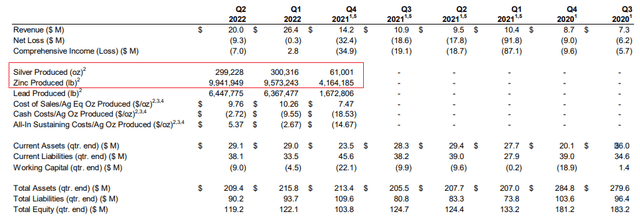

In Q2 2022, Americas Gold and Silver produced around 300,000 silver ounces and 1,343,000 silver equivalent ounces. The cash costs per silver ounce were negative $2.72 while the all-in sustaining costs per silver ounce were just $5.37. The company expects to significantly expand production in the coming years thanks to an expansion of Galena and silver equivalent output is expected to top 7 million ounces by 2024.

Americas Gold and Silver

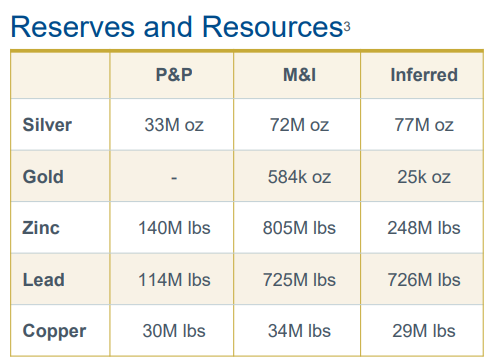

Americas Gold and Silver has silver, zinc, lead, and copper reserves of 33 million ounces, 140 million pounds, 114 million pounds, and 30 million pounds, respectively. Therefore, maintaining these high production rates for years to come seems easily achievable.

Americas Gold and Silver

However, there are several red flags here. Silver accounts for less than a third of revenues so using zinc, lead, and copper output for by-product credits to calculate the cost per ounce gives a distorted picture. In Q2 2022, Americas Gold and Silver booked a net loss of $9.3 million as revenues barely covered mining costs and G&A expenses. As quarterly silver revenues are about $6 million, silver prices would need to increase by about $30 per ounce for the company to reach breakeven. Zinc currently accounts for over half of revenues and the picture there looks grim due to high energy prices and a global economic slowdown. As zinc prices drop, the all-in sustaining costs for every ounce of silver produced rise exponentially.

It seems unlikely that higher output will improve unit costs enough for the company to get back in the black and this raises concerns that there could be significant stock dilution over the coming months. The company had just $8.8 million in cash and cash equivalents as of June 2022 and there is a concerning history of shareholder dilution over the past few years. Since the start of 2018, the share count has increased by over 230%. Production, in turn, is still far away from the 4.7 million silver equivalent ounces achieved in 2017. Bulls might argue that another capital increase is unlikely to take place in the near future as net cash generated from operating activities stood at $7 million in Q2 2022. However, this is due to a $6.7 million decrease in receivables as well as a $5.6 million increase in payables during the quarter. In addition, CAPEX for 2022 is projected to come in at between $18 million and $21 million.

Overall, Americas Gold and Silver is trading at below 0.4x consensus net asset value but the company has a history of acquisitions that have failed to generate shareholder value and I think investors should avoid this stock. A decade ago, the company was called Scorpio Mining and had a single mine in the Cosala District that had an annual output of 2.8 million silver equivalent ounces. In 2014, it acquired Galena through a merger with US Gold & Silver but all-in sustaining costs cash costs per ounce of silver produced there have always been high and they stood at $28.67 in Q2 2022. In my view, it’s just not a good mine. And then came the $56.7 million acquisition of Relief Canyon’s owner Pershing Gold in 2018. Americas Gold and Silver spent about $30 million to bring this project to first gold pour in February 2020 and the mine was shut down less than 18 months later due to carbonaceous material found in the Relief Canyon pit. This material was missed in the feasibility study and it’s unknown how much time it will take to resolve metallurgical challenges. As a result of these blunders over the past several years, I’ve lost faith in the management of Americas Gold and Silver. Add to that a history of significant share dilution, and I don’t want to take a position here are at any share price level.

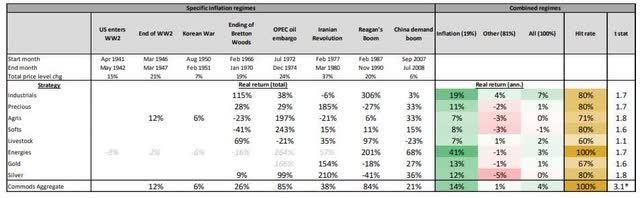

With all of that being said, I think that short-selling Americas Gold and Silver stock could be dangerous as the prices of commodities are notoriously volatile and silver, zinc, and lead don’t make an exception. Data shows that silver prices usually perform well during periods with high inflations and high silver prices could send the company’s stock soaring. According to a 2021 study by researchers from Man Group (OTCPK:MNGPF) and Duke University titled “The Best Strategies for Inflationary Times”, silver had an average annualized return of 12% in the 8 inflationary regimes in the USA since the start of World War II, during which annual inflation averaged above 5%. You can read it here.

The Best Strategies for Inflationary Times

Investor takeaway

Americas Gold and Silver is rapidly expanding its output and is currently valued at less than 0.4x net asset value based on consensus estimates. Silver senior producers, in turn, are valued at above 1x net asset value. However, the usage of by-product credits to calculate the cost per ounce of silver productions masks an unprofitable business and the company has an unenviable M&A reputation. In addition, the share count has increased by 230% since the start of 2018 and cash could run out soon.

Overall, I think risk-averse investors should avoid Americas Gold and Silver’s stock.

Be the first to comment