JohnnyGreig/E+ via Getty Images

During the early phases of post-pandemic recovery, the surge in the housing market helped American Woodmark (NASDAQ:AMWD) improve its sales growth. However, the industry was then hit by inflation and supply chain constraints, and the company was unable to maintain this momentum. As a result, AMWD’s sales growth and margins were affected, but it was able to increase its backlog. The company is improving capacity at its manufacturing facilities which should help it clear these backlogs and accelerate growth. The company is also doing share buybacks to improve shareholder value and there have been insider purchases from the CEO, CFO and Director as well. So, I believe the stock might have good upside potential.

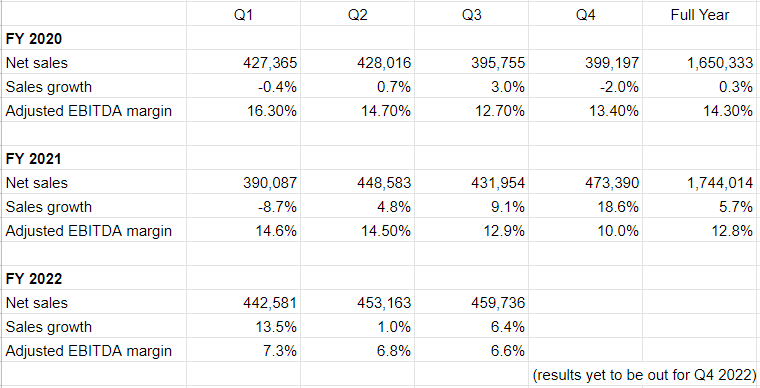

American Woodmark announced its Q3 2022 results in February, which fell short of consensus revenue and earnings estimates. The quarter’s net sales increased ~6.4% year over year, from $431.9 million to $459.7 million (vs. $470.58 million consensus estimate), while adjusted EPS fell ~61.8% year over year, from $1.57 in Q3 2020 to $0.60 (vs. $0.87 consensus estimate). The growth in sales was a result of increased pricing, a strong order backlog for new construction business and a healthy remodelling market during the period. The adjusted EPS during the quarter declined due to inflationary costs, labour shortages and supply chain constraints.

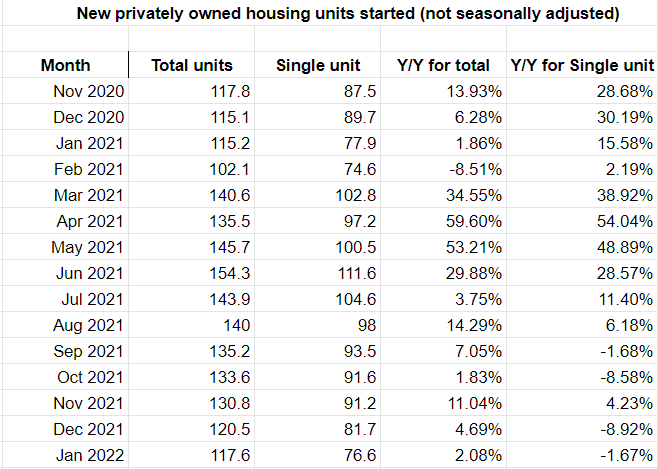

The company’s new construction sales lag the single-family housing starts by 90 to 120 days. Looking at the table below, we can see that housing demand was strong in the first six months of 2021, supporting volume and helping the company build a strong backlog. These backlog orders helped the company improve its sales even as the housing market has cooled down in recent months.

U.S. Housing Starts (US Census Bureau)

The company is also increasing prices to offset inflation and it is helping its revenues as well. The new construction sales increased 10.3% YoY growth last quarter while the remodelling sales through the home centre and dealer/distributor channels increased 4.1% YoY. Sales of AMWD’s remodelling business benefited from price increases as well as continued consumer spending on their home renovations.

Despite an increase in the total sales during the first nine months of FY2022, the adjusted EBITDA declined significantly compared to the previous year. The company tried to mitigate the inflationary costs by increasing prices during the quarter and realized approx. $30 mn plus from pricing. However, the company is still generating some revenues from the backlog which was booked at lower prices and as a result, the company was not able to completely offset the current inflationary costs. As a result of these inflationary costs, supply chain constraints, labour shortages as well as labour absenteeism from Omicron, which were only partially offset by the increased pricing, Q3 adjusted EBITDA fell from $55.7 million (~12.9%) to $30.6 million (~6.6%).

AMWD’s Net Sales and Adjusted EBITDA Margins (Company Data, GS Analytics Research)

Looking forward, housing stats are already in decline for the past several months and there should be continued pressure thanks to the rising interest rates. This will adversely impact the volume growth of the company’s new construction business. So, I am not too optimistic about the end market strength in the near term.

However, the company should benefit from the investments it is making to improve its production capacity. It recently started a new assembly cell in its Gas City plant and has started to increase output in its flat stock operation in Georgia to support its made-to-order business. This should accelerate the completion of its backlog orders and help the company post an above-market growth. Further increase in pricing is going to be a continued tailwind over the coming quarters both for the topline and bottom line. The management expects the sales growth for the full year 2022 to be in the mid-single digits, with adjusted EBITDA margins for the fourth quarter expected to be similar to the previous year’s fourth quarter.

While there is still some uncertainty attached to management’s near term margin forecast as they have missed their margin guidance for the last couple of years, I believe the company should be able to reach double-digit margin guidance once the supply chain disruption and inflationary costs subside, and the company’s pricing initiatives take hold.

If we look at the current consensus estimates, the sell-side is modelling $3.27 in EPS for the current year (FY 2022) and $6.42 in EPS for the next year (FY2023). I believe the sell-side is expecting margins to improve to low double digits by the next fiscal year. This is somewhat in line with management commentary where they have said that the company’s Q4 2022 adjusted EBITDA will be near last year’s Q4 adjusted EBITDA level of ~10%. If we extrapolate Q4 2022 margin guidance, low double-digit EBITDA margins in FY2023 seem reasonable. However, even if the company is not able to meet this target next year, I believe it will achieve this level by FY2024 as supply chain disruptions are unlikely to continue for the very long term (especially given the demand conditions in the housing industry normalizing.) So, I believe we will see a $6 plus adjusted EPS level for the company in the coming years when the conditions normalize.

At the current price of $50, the stock is trading at a high single-digit multiple of its normalized EPS. I find it attractive. The company insiders including its CEO, CFO and director have bought the stock in recent quarters in the low 50s to mid-60s range. I believe the stock is a good buy at the current levels for medium-term investors who can wait for the supply chain conditions to normalize and pricing increases to gain traction over the coming quarters.

Be the first to comment