Filling glass of water from the tap fcafotodigital/E+ via Getty Images

Dividend growth investing produces the best results when an investor sticks with what they know. It doesn’t get much simpler than the investment thesis behind the regulated water and wastewater industry, which is that the U.S. will always demand water and wastewater services. A growing population (i.e., customer base) and occasional rate hikes should serve as growth catalysts for the industry.

With operations that provide service to 14 million people across 24 U.S. states, American Water Works Company, Inc. (NYSE:AWK) is a dominant water utility. For the first time since I initiated coverage last November, let’s take an updated look at the stock’s fundamentals and valuation.

Lofty Dividend Growth Prospects Remain Intact

What makes American Water Works a particularly attractive utility is its exceptional growth profile. The stock’s adjusted diluted EPS compounded at a 9% annual rate over the past five years. This robust earnings growth allowed the dividend to grow 10% annually during that time

But can this continue going forward? I’m inclined to think yes for a couple of reasons.

American Water Works produced $4.25 in adjusted diluted EPS during 2021. Against the $2.36 in dividends per share paid last year, this is an adjusted diluted EPS payout ratio of 55.5%.

And using American Water Works’ midpoint adjusted diluted EPS figure of $4.44 ($4.39 to $4.49 according to American Water Works’ Q4 2021 earnings press release), the adjusted diluted EPS payout ratio should be 57.8% in 2022. This assumes an 8.7% increase in the quarterly dividend from $0.6025 per share to $0.6550 per share next month.

These low payout ratios give the stock room to grow the dividend slightly ahead of earnings for the foreseeable future. And with analysts anticipating 8.3% annual earnings growth from American Water Works over the next five years, I feel comfortable in reiterating my 8.5% annual dividend growth rate.

American Water Works Had An Excellent 2021

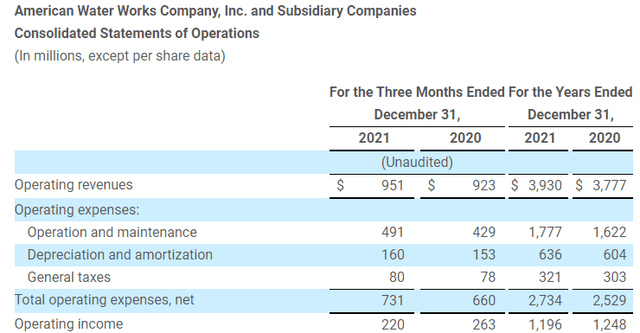

American Water Works Q4 2021 Earnings Press Release

American Water Works once again delivered superb operating and financial results to its shareholders in 2021.

The company reported $3.93 billion in operating revenue during 2021, which works out to a 4.1% growth rate over the year-ago period (details sourced from American Water Works’ Q4 2021 earnings press release). American Water Works was able to turn out a solid topline growth rate because of its continued commitment to growing its rate base through investments. The rate base is the amount of a company’s capital investment minus accumulated depreciation, upon which the utility provides services to its customers is allowed to earn a rate of return from regulatory commissions.

American Water Works’ rate base grew 8.7% year-over-year to $16.3 billion in 2021 (figures according to slide 18 of American Water Works’ Fourth-Quarter 2021 Earnings Presentation). Adjusting for the company’s sale of the non-regulated Homeowners Services Group business for $1.3 billion, its adjusted diluted EPS also happened to grow by 8.7% year-over-year to $4.25 in 2021 (data points per American Water Works’ Q4 2021 earnings press release).

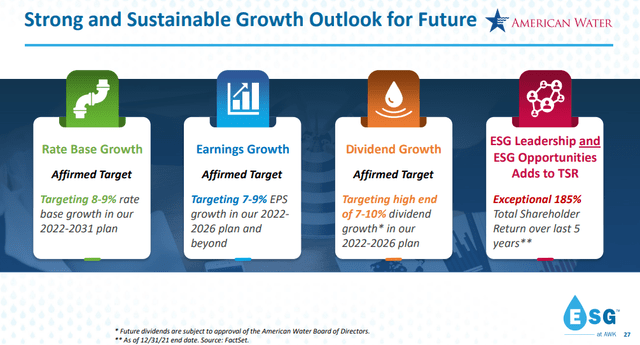

American Water Works 2021 Fourth-Quarter Earnings Presentation

Looking beyond the midpoint guidance of $4.44 or 4.5% year-over-year growth in adjusted diluted EPS for 2022, American Water Works’ anticipates a high-single-digit annual rate base and earnings growth rate in the long term (details sourced from American Water Works’ Q4 2021 earnings press release and Fourth-Quarter 2021 Earnings Presentation).

That’s because the company is forecasting $25 billion to $28 billion in investments and $3 billion to $4 billion in acquisitions over the next decade to drive its rate base and earnings higher (figures according to slide 10 of American Water Works’ Fourth-Quarter 2021 Earnings Presentation).

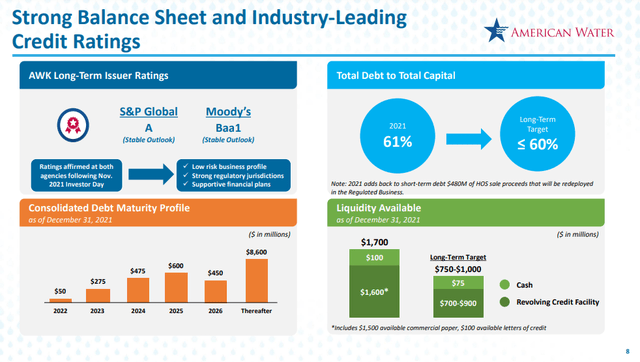

American Water Works’ 2021 Fourth-Quarter Earnings Presentation

American Water Works’ low dividend payout ratio allows it to retain a material portion of the capital necessary to fund its growth ambitions over the next decade. And thanks to its respective A and Baa1 credit ratings from S&P and Moody’s (info per slide 8 of American Water Works’ 2021 Fourth-Quarter Earnings Presentation), American Water Works can access the remaining capital needed to make its investments through the issuance of debt.

The company has $1.7 billion in liquidity available to fund its operations and future investments (detail sourced from slide 8 of American Water Works’ 2021 Fourth-Quarter Earnings Presentation). When also considering that American Water Works has no meaningful debt maturities over the next few years, it’s easy to understand why its credit ratings are investment-grade by several notches.

These factors could make American Water Works a lucrative long-term investment if shares are purchased at a sensible valuation.

More Downside Could Be Ahead

American Water Works is a quality stock. But the stock faces a couple of risks that could weigh on its upside potential in the near term and even lead to some downside.

The first risk to American Water Works is that we are in an inflationary environment. This was evidenced by the 7.9% year-over-year rise in the CPI for February.

This will almost certainly lead the company’s costs of operations and maintenance materially higher this year. And if the stock isn’t able to recover its costs through rate cases with utility commissions, this would be a hit on its financial results.

The other risk to American Water Works is tied to the first risk, which is the correlation between its stock price and interest rates. Thanks to hot inflation numbers, the Federal Reserve is expected to raise interest rates from a range of 0% to 0.25% at the start of this year to around 2% by the end of this year.

Rising rates could lead American Water Works’ stock price to fall a bit further as Treasuries become viable alternatives.

The Stock Looks Slightly Discounted

American Water Works’ fundamentals appear intact. But that doesn’t mean an investor can pay any valuation and expect their investment to do well.

This is why I’ll be utilizing two valuation models to value American Water Works’ shares.

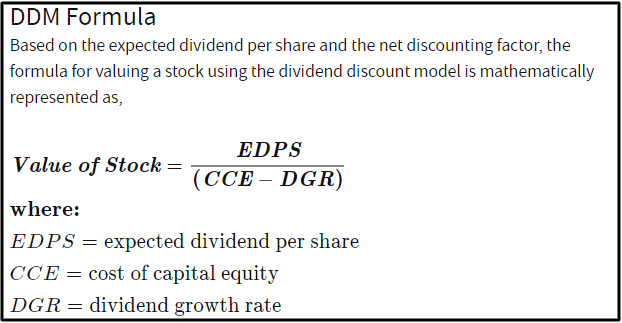

Investopedia

The first valuation model that I will use to gauge the fair value of shares of American Water Works is the dividend discount model or DDM, which is comprised of three inputs.

The first input for the DDM is the expected dividend per share, which is the stock’s annualized dividend per share. American Water Works’ current annualized dividend per share is $2.41. For the sake of conservatism, I will use this rather than the new annualized dividend rate that will be announced in about four weeks.

The second input into the DDM is the cost of capital equity, which is another term for the annual total return rate required by an investor. My personal preference is 10%.

The third input for the DDM is the annual dividend growth rate or long-term DGR.

Unlike the first two inputs into the DDM that require minimal time from an investor, accurately predicting the long-term DGR requires an investor to contemplate several elements: These include a stock’s payout ratios (and whether those payout ratios will contract, expand, or remain unchanged in the future), annual earnings growth forecasts, the strength of a stock’s balance sheet, and industry fundamentals.

As I noted in the dividend section, I will assume an 8.5% annual dividend growth rate for American Water Works’ stock.

Using these inputs, I arrive at a fair value of $160.67 a share. This implies that American Water Works’ shares are trading at a 0.7% discount to fair value and can provide a 0.7% upside from the current price of $159.60 a share (as of March 25, 2022).

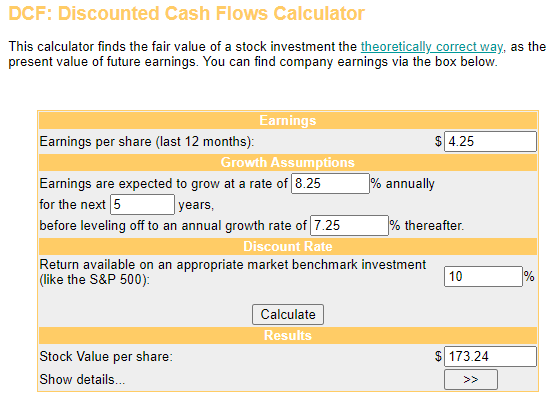

Money Chimp

The second valuation model that I’ll employ to get a fair value output for shares of American Water Works is the discounted cash flows or DCF model, which also has three inputs.

The first input into the DCF model is the trailing twelve months’ adjusted diluted EPS. American Water Works’ adjusted diluted EPS was $4.25 in 2021.

The next input for the DCF model is growth assumptions.

Based on American Water Works’ 9% annual earnings growth rate over the past five years and the forward analyst estimate of 8.3%, I believe an 8.25% annual earnings growth rate is a fair assumption. I will then assume that the law of large numbers will result in a drop-off to 7.25% annually beyond the first five years.

The last input into the DCF model is the discount rate, which means the required annual total return rate. I will again use 10% for this input.

My assumptions lead me to a fair value output of $173.24. This suggests that American Water Works’ shares are priced at a 7.9% discount to fair value and offer 8.5% capital appreciation from the current share price.

Upon averaging these two fair values together, I compute a fair value of $166.96 a share. This signals that shares of American Water Works are trading at a 4.4% discount to fair value and could provide a 4.6% upside from the current share price.

Summary: American Water Works Could Be A Buy, But Caution Is Warranted

American Water Works is a top-notch dividend growth stock with a 10% five-year annual dividend growth rate. And based on its low payout ratios and promising growth outlook, this looks positioned to continue. The fortress-like balance sheet serves as a means for American Water Works to meet its long-term growth targets.

But with six more Federal Reserve meetings this year and inflation showing no signs of slowing down, American Water Works’ stock could face some additional downward pressure. That’s why I rate shares of the stock as a hold despite my estimate that they are 4% undervalued.

Thus, investors would be best to wait for more clarity from the Federal Reserve before considering any large purchases of the stock.

Be the first to comment