bankrx

The investment thesis

Interest rate projections are still on the rise, causing most stock valuations to decline. Investors tend to look for safety and stability in uncertain times like these. While the business of American States Water Company (NYSE:AWR) is considered very reliable, buying shares of this company will not offer the stability you would want. In this article, I will explain why investors should avoid this stock at the current price level.

A stable and growing business

American States Water Company is a well-known company among dividend investors as it has been increasing its dividend for 68 consecutive years. With that, the company is proud member and leader of the Dividend Kings.

American States Water Company has been able to build such an impressive track record due to the stable nature of its business. In essence, utilities are free from competition with other public utilities and agencies within their existing service territories. Furthermore, everyone needs water and electricity on daily basis, so it is basically guaranteed that the company will generate a certain level of revenue. At the end of FY2021, American States Water Company served 262,770 water customers and 24,656 electric customers through its subsidiaries Golden State Water Company and Bear Valley Electric Service. These subsidiaries have most of their operations in Southern California and are responsible for the majority of revenue. Besides, American States Utility Services, Inc. (or ASUS) constructs and operates water and/or wastewater systems at eleven U.S. military bases at the east coast. ASUS does compete with other utilities and entities to gain contracts with the U.S. government, but the big advantage is that these contracts last 50 years.

The subsidiaries have generated stable streams of revenue over the past years, as shown in the table below.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR | |

| Revenue ($ million) | $472.1 | $465.8 | $458.6 | $436.1 | $440.6 | $436.8 | $473.9 | $488.2 | $498.9 | 0.7% |

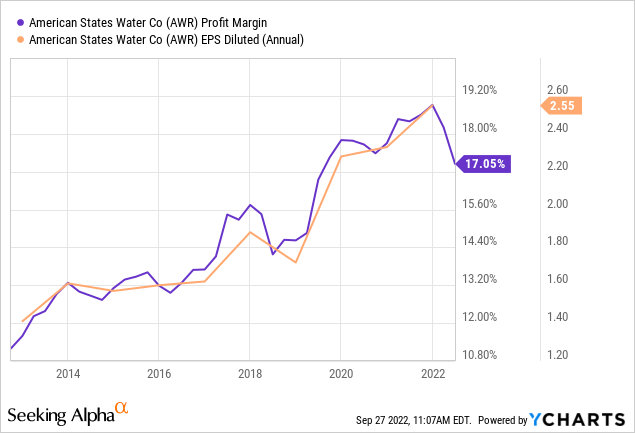

While revenue growth is far from impressive with a 0.7% CAGR, diluted earnings per share grew from $1.61 to $2.55 with a nice 5.9% CAGR over the same period through increasing operating efficiency. The following graph nicely shows how earnings per share have grown alongside profit margins.

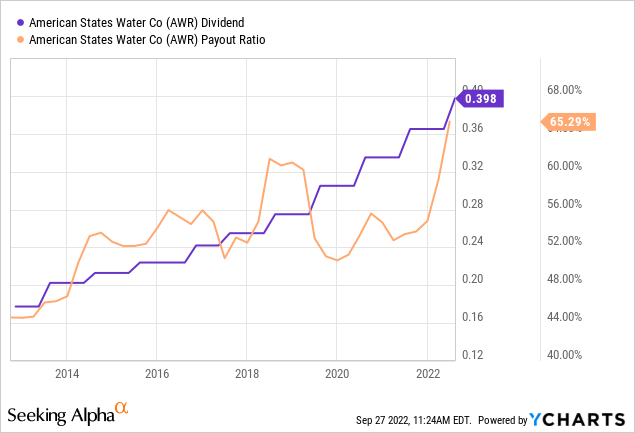

Earnings growth has resulted in increasing dividends: from FY2013 to FY2021, the dividend has grown from $0.2025 to $0.3650 per quarter with a 7.6% CAGR. As a consequence, the pay-out ratio has increased to over 60% (see the figure below). Dividend growth has been in-line with the company target of more than 7% over the long term. Especially with the recent increase of 8.9% to $0.3975 per quarter, management seems to be very confident that it can keep increasing underlying profits and so the dividend for the coming years.

Great historical total returns

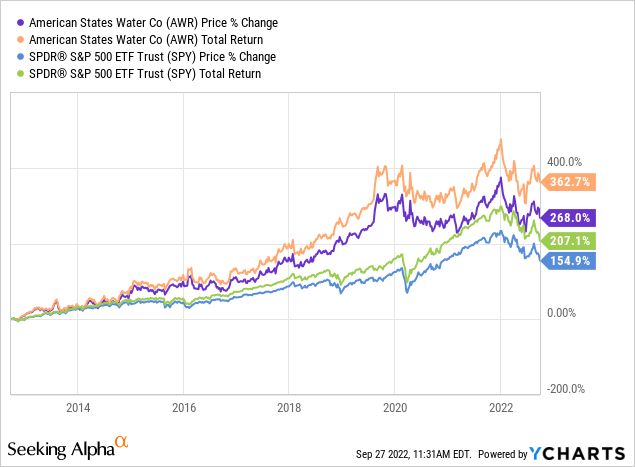

It can be seen in the following graph that over the last ten years, American States Water Company has significantly outperformed the S&P 500 index (SPY). Even without the dividends, the stock price would have outperformed the index. This is pretty remarkable considering that the revenue has been roughly flat. Of course, underlying profits have grown, but a 5.9% diluted EPS growth should not be enough to outperform an index during a bull market.

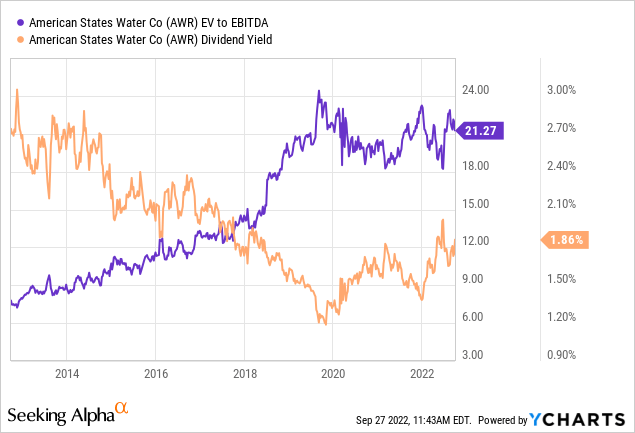

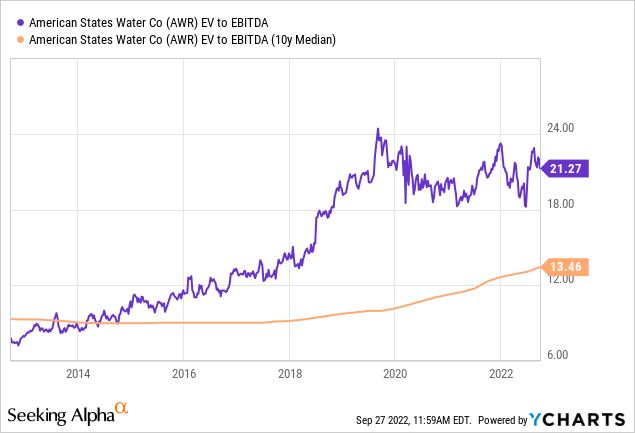

The answer to this outperformance can be found in the next graph. Over the same period as considered previously, the EV/EBITDA ratio of American States Water Company has nearly tripled. Due to this multiple expansion, the dividend yield has decreased considerably, despite mid to high-single digit increases every year. The EV/EBITDA ratio has been trading sideways since 2019 when valuation multiples peaked.

Poor prospects ahead

Looking into the future, I think the business will keep performing very well. Currently, analysts expect mid-single digit EPS growth in the coming years. This will allow management to increase the dividend at the same pace, in-line with their long-term dividend growth target.

While the business will do fine, I believe that the stock price will not continue to trend upwards. Shares have already declined more than 20% since they set an all-time high at the start of this year. But, the next graph shows that the EV/EBITDA multiple is still trading significantly above its 10Y median. If the valuation would fall to an EV/EBITDA ratio of 13.46x, this would imply nearly 37% downside for the stock price for the current fiscal year.

To be honest, I really cannot see the investment case to buy shares of American States Water Company at the current prices. Yes, it is a very stable and reliable business, but I do not think that valuations will stay at these elevated levels. Stock valuations have decreased considerably over the past months, mainly due to the Fed’s aggressive interest rate hikes. But, American States Water Company’s valuation is still near all-time highs. Moreover, the 10Y treasury yield has approached the 4% level, while American States Water Company’s dividend is only 1.9%. Based on most recent data, interest rates will stay high for a longer time than anticipated. Therefore, I believe that investors will demand a higher return on their investment, pushing valuations further down.

Assuming that valuation multiples will decrease, I can think of two possible scenarios for American States Water Company shares going forward:

- The share price will keep trading around the current levels for the coming years, which has been the case since 2019. In this scenario, valuation multiples will gradually decrease as underlying profits will increase. Analysts expect revenue to increase mid-single digits and further operating efficiencies can result in increasing profit margins. Increasing dividends will generate a total annual return of ~2% for investors.

- The share price will drop as valuation multiples revert to their long-term averages. As multiples are trading significantly higher than their historical averages, dividends will not compensate for the decrease in share price. Thus, this scenario would generate significant negative returns for shareholders.

As inflation by far exceeds the dividend yield, investors essentially lose money in both scenarios. Therefore, I believe that the stock price of American States Water Company has poor prospects ahead.

Final thoughts

The business of American States Water Company is simple and provides reliable streams of revenue, which has translated in an impressive track record of profit and dividend growth. Shareholders have been well rewarded over the last decade as the stock outperformed the S&P 500 index by a wide margin. However, this outperformance has been mainly driven by multiple expansion.

With valuation multiples still near all-time highs, I believe that shares of American States Water Company have a lot more room to fall. Despite the steadily growing dividend, investors will receive marginal returns in the best case scenario. I therefore recommend investors to avoid this stock until valuation multiples have dropped towards their long-term averages.

Be the first to comment