fizkes

Rapidly rising rents for apartments and single-family homes have been a significant contributor to our recently elevated rate of inflation. The Fed’s aggressive pace of rate hikes aimed at fighting inflation has translated to a more than doubling of mortgage interest rates, made home purchases unaffordable, and disrupted the housing markets. If a young family with kids and pets learns that they can’t afford to purchase a home, it doesn’t diminish their need or desire to occupy that house. Let’s look at how American Homes 4 Rent (NYSE:AMH), the second largest Single Family Rental REIT, is navigating the disruption.

Pumping the Brakes

The National Association of Realtors on November 18th reported that in October existing-home sales fell for the 9th consecutive month to a seasonally adjusted rate of 4.43 million units, down 5.9% from September and 28.4% from the year prior. If you consider that the median sales price rise of 6.6% to $379,100 is accompanied by a doubling of the 30 year fixed mortgage interest rate to 7%, you quickly come to understand how prospective buyers have been priced out of a purchase.

Stomping on the Brakes

On November 22nd, Redfin released its analysis of 3rd quarter investor home purchase activity which showed a 30.2% decline in acquisitions year over year. Not only are institutions facing the higher financing costs individuals are experiencing, they also must address slowing rent growth, and, potentially, falling home prices. Invitation Homes (INVH), Tricon Residential (TCN), and American Homes 4 Rent have each reduced their pace of acquisitions in the near term.

AMH, Still Growing, but Slowing

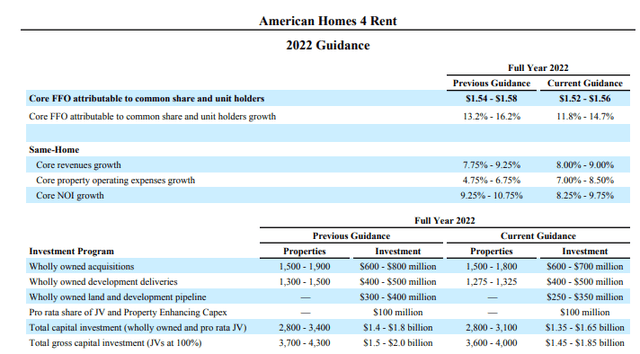

In its 3Q 22 Supplemental, American Homes moderated it 2022 guidance from previous forecasts by reducing core FFO growth and core NOI growth. A more significant change might be the reductions in both acquisitions and development deliveries.

AMH describes itself as a growth company and the market has priced it as such. At the start of 2022, AMH shares traded in the $42 range or about 34x P/FFO. A current $32 share price translates to a 20.7x P/FFO as measured against the revised guidance midpoint. Shares are cheaper, but is AMH still a growth company?

The SFR Market Today

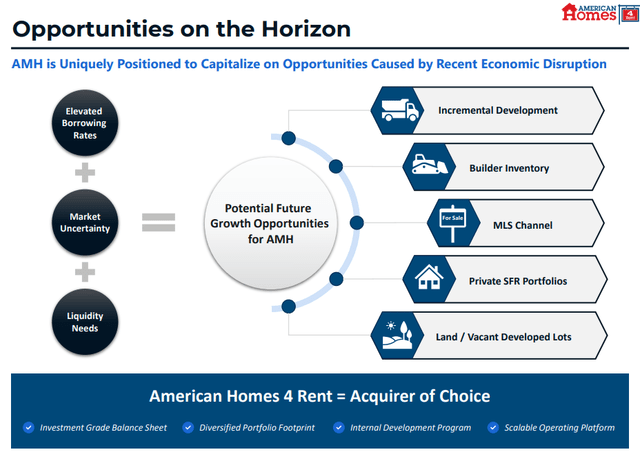

As American Homes 4 Rent sees it the current rising rate, inflationary environment presents a broad swath of opportunity for continued growth. AMH feels that they are optimally positioned to capitalize on the current conditions.

Source: AMH

I agree with this assessment, it is really just a matter of figuring out when these opportunities will be seized.

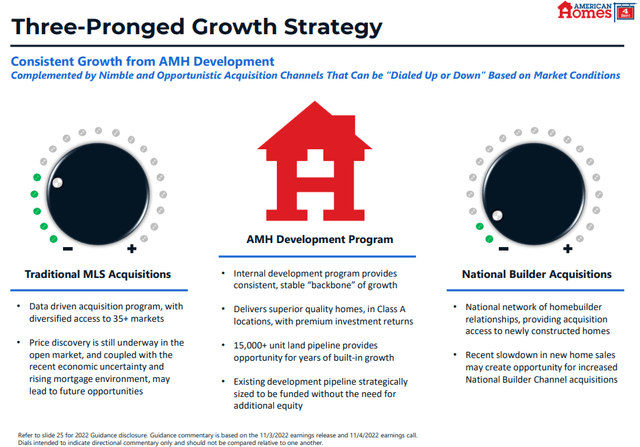

Source: AMH

AMH’s Three-Pronged Growth Strategy is designed to be nimble and opportunistic in its capacity to be “dialed up or down”. In their revised 3Q guidance they meaningfully dialed down. The economic developments the 4th quarter are playing out to make us anticipate further dialing down and the starting time for dialing up is hard to forecast.

AMH has been and will again be a growth company, but it and the other SFR REITs have been placed in an operational limbo. Until the Fed makes clear when its restrictive actions will slow, pause, or pivot, it will be difficult to confidently restart any meaningful acquisition program.

I am long AMH, but I’m not tempted to add to my position in the current economic scenario. I expect near term returns from AMH common will be tepid, but the markets have presented a compelling option.

The Dislocated Preferreds

In earlier days, American Homes 4 Rent accessed various tools available in the capital markets and that included issuance of a number of series of preferred stock. Many have been redeemed, but two series remain.

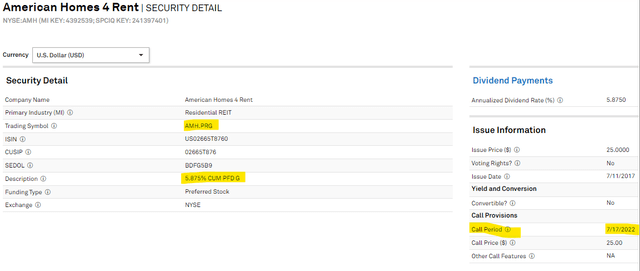

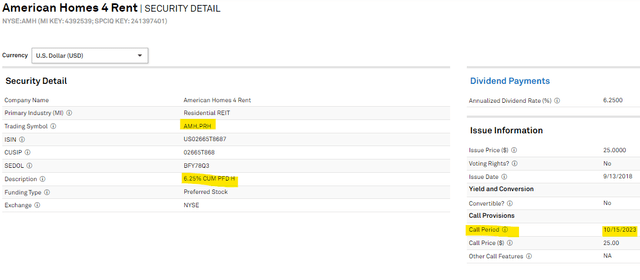

Series G

Source: S&P Capital IQ

Series H

Source S&P Capital IQ

As AMH grew, it gained access to lower cost capital and it redeemed each preferred series as it became callable. At this time last year, it was anticipated that the Series G would be redeemed when it became callable in July of this year. Well, a half dozen rate increases later and talk of redemptions has all but ceased.

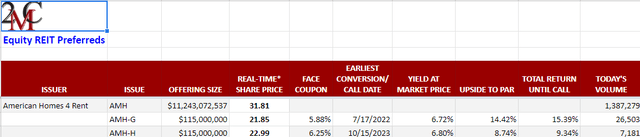

Source: Portfolio Income Solutions 11/21/2022

If you like the Single Family Rental sector, with these preferreds you can currently buy ~ 6.7% dividend yields (almost 3x the common yield) and 10% to 15% upside if/when lower cost capital lets the redemption cycle resume.

In Conclusion

Home rentals have been a standard entry point to real estate investment for centuries. The recent emergence of SFR REITs makes becoming a landlord as easy as a few keystrokes, so these REITs are here to stay.

Rampant inflation and the Fed’s remedy have caused individuals and businesses of all stripes to compromise and adjust. American Homes 4 Rent will grow again, it is just hard to pinpoint when that will start. In the interim, the preferreds’ attractive yields may be a good option while we wait.

Be the first to comment