peterspiro

A Quick Take On American Healthcare REIT

American Healthcare REIT (AHR) has filed to raise an undisclosed amount in an IPO of its common stock, according to an S-11 registration statement.

The firm acquires, develops and operates a large number of healthcare-related properties in the United States.

I’ll provide an update when we learn further details about the IPO.

American Healthcare Overview

Irvine, California-based American Healthcare was founded and expanded through a recent set of merger transactions with Griffin Capital (among others) to operate a growing portfolio of medical and healthcare facilities nationwide in the U.S.

Management is headed by Chief Executive Officer Daniel Prosky, who has been with the firm since January 2015 and was previously president and COO of Grubb & Ellis Healthcare REIT Advisor, now known as Healthcare Trust of America and has extensive business experience in the healthcare facility industry.

The company’s primary offerings include:

-

Medical office buildings

-

Senior housing

-

Integrated senior health campuses

-

Hospitals

-

SHOP – Senior housing operating properties

-

SNFs – Skilled nursing facilities

As of June 30, 2022, American Healthcare has booked fair market value equity investment of $2.5 billion as of June 30, 2022 from investors.

Management believes it has extensive industry expertise to identify and cost-effectively acquire quality healthcare and medical properties throughout the United States.

American Healthcare’s Market & Competition

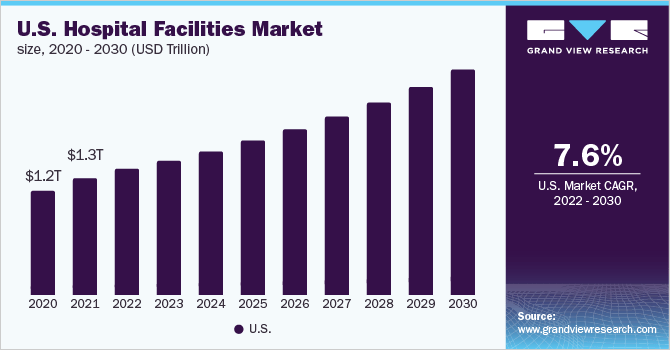

According to a 2022 market research report by Grand View Research, the U.S. hospital facilities market was an estimated $1.3 trillion in 2021 and is forecast to reach $2.55 trillion by 2030.

This represents a forecast CAGR of 7.62% from 2022 to 2030.

The main drivers for this expected growth are an increasing demand from U.S. patients for well-equipped hospitals as well as a surging elderly population due to the retirement of the ‘baby boom’ generation.

Also, below is a historical and projected future growth chart for the U.S. Hospital Facility market:

U.S. Hospital Facilities Market (Grand View Research)

Major competitive or other industry participants include:

-

Community Healthcare Trust

-

CareTrust REIT

-

Medical Properties REIT

-

Diversified Healthcare Trust

-

Universal Health Realty Income Trust

-

Sabra Healthcare REIT

-

Ventas

-

Welltower

-

National Health Investors

-

Others

AHR operates facilities in other healthcare and medical-related markets in the U.S.

American Healthcare REIT Financial Performance

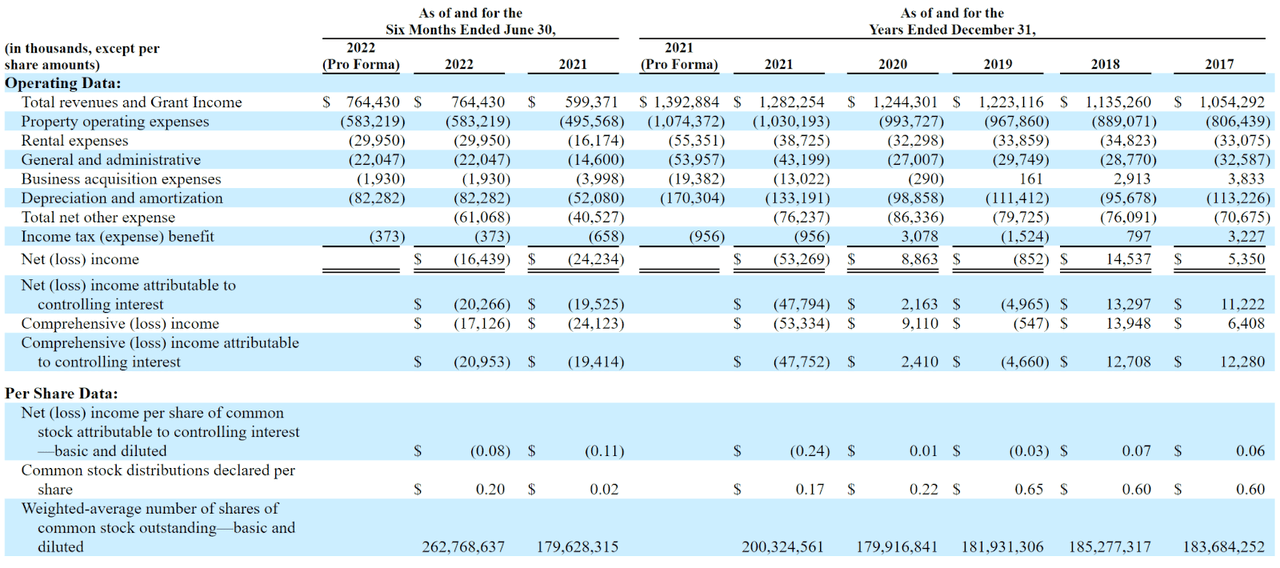

AHR’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Variable modified FFO

-

Reasonable leverage ratio

Below are the company’s operational results for the past five and one-half years:

Company Operating Results (SEC EDGAR)

(Source – SEC)

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Months To June 30, 2022 |

$ 764,430,000 |

27.5% |

|

2021 |

$ 1,282,254,000 |

3.1% |

|

2020 |

$ 1,244,301,000 |

|

|

Operating Income (Loss) |

||

|

Period |

% Variance vs. Prior |

|

|

Six Months To June 30, 2022 |

$ 151,261,000 |

72.6% |

|

2021 |

$ 213,336,000 |

-2.3% |

|

2020 |

$ 218,276,000 |

|

|

Modified FFO |

||

|

Period |

Modified FFO |

% Variance vs. Prior |

|

Six Months To June 30, 2022 |

$73,926,000 |

153.00% |

|

2021 |

$77,642,000 |

-19.7% |

|

2020 |

$96,672,000 |

|

|

EBITDA |

||

|

Period |

EBITDA |

% Variance vs. Prior |

|

Six Months To June 30, 2022 |

$ 105,686,000 |

48.0% |

|

2021 |

$ 160,859,000 |

-10.1% |

|

2020 |

$ 178,999,000 |

|

|

Comprehensive Income |

||

|

Period |

Comprehensive Income |

% Variance vs. Prior |

|

Six Months To June 30, 2022 |

$ (16,439,000) |

-32.2% |

|

2021 |

$ (53,334,000) |

-685.4% |

|

2020 |

$ 9,110,000 |

|

(Source – SEC)

Leverage Ratio (Net Debt/EBITDA)

At June 30, 2022: 14.3x

As of June 30, 2022, the company had $59.1 million in cash and $2.8 billion in total liabilities.

American Healthcare REIT’s IPO Details

American Healthcare intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We will contribute the net proceeds from this offering to the Operating Partnership in exchange for OP units. We expect the Operating Partnership to use the net proceeds received from us to repay [an undisclosed amount] outstanding under our Credit Facility, to fund external growth with potential future property acquisitions and for other general corporate uses.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not subject to any legal proceedings that would have a material adverse effect on it.

The listed bookrunners of the IPO are BofA Securities, Citigroup and KeyBanc Capital Markets.

Commentary About American Healthcare’s IPO

AHR is seeking U.S. public capital market investment to pay down debt and for its corporate expansion plans.

The company’s financials have produced increasing topline revenue, fluctuating modified FFO and reasonable leverage ratio.

The firm currently plans to pay dividends of at least 90% of its REIT taxable income, but has not yet disclosed a precise target amount.

The market opportunity for healthcare facilities in the U.S. is large and expected to grow substantially in the coming years due to an aging population and increasing demand for quality healthcare services.

BofA Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (49.5%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is a rising cost of capital environment, increasing its debt service costs while reducing the present value of its cash flows.

However, in an inflationary period, real estate assets tend to rise in value as a hedge against inflation as rents increase, so well managed REITs may be an interesting place to allocate capital for investors expecting inflation to be elevated ahead.

I’ll provide a final opinion when we learn more about the IPO from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment