magnez2/iStock Unreleased via Getty Images

Investment Thesis:

American Express (NYSE:AXP) is a global payments company that provides its customers with products to achieve their financial goals and better their lives. American Express’ main product is their credit and charge cards that they provide to customers such as everyday consumers, small businesses, and much more. I believe American Express will be a phenomenal investment in the upcoming years for a few key reasons.

In the current economic environment, as the Fed persists with aggressive interest rate hikes to tame inflation, multiple compression within the global markets is widespread, and it’s essential to buy companies that are trading at cheap valuations. American Express is trading at reasonable levels relative to their future growth, historical multiples, and quality of their business which I will dive into at a more in-depth level later.

Also, AXP’s business is simply phenomenal. They charge a fee on all transactions for the credit cards they provide. As we know, every day, people worldwide buy numerous goods with their cards, and American Express can get a piece of each of the 8 billion transactions which go through every year.

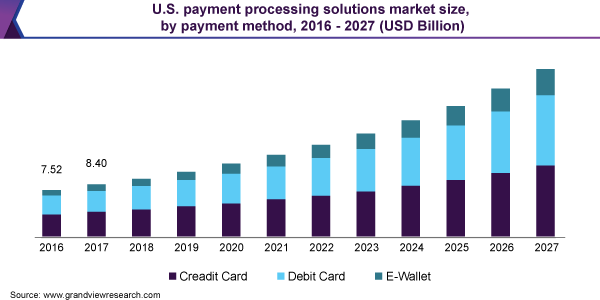

Now, although the credit space is extremely competitive with their primary rivals being Visa (V), Mastercard (MA), and Capital One (COF) who have been growing at a faster over the past 5 years, American Express still maintains significant market share within the space while the industry as a whole continues to grow at over 3% a year.

In summary, Amex has been in business for over 170 years. Although there may be some short-term headwinds due to an upcoming and turbulent recession, a time horizon of 5 years or greater will yield phenomenal returns.

Credit Card Industry Growth (www. grandviewreasearch.com)

Financial Breakdown:

AXP’s financials are in a robust state and reflect their ability to continue its operations for an extended period and in an efficient manner.

Income Statement:

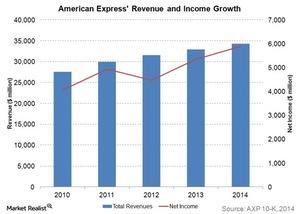

American Express has rapidly grown its business over the past few years, and it’s reflected in their income statement. Revenue has grown from 33.8 billion in 2017 to over 45 billion in the TTM, reflecting a 6.6% CAGR over the past five years. Their current revenue reflects a P/S ratio of 2.6, which is much lower than their primary competitors, Visa and Mastercard, which have P/S ratios of 15.4 and 16.25, respectively. Now it’s important to note how Mastercard and Visa have much higher margins than Amex, which is the primary factor as to why they trade at much higher multiples. Now, AXP’s operating income has grown from $7.5 billion to $10 billion, and its net income rose from $2.7 billion to $8 billion. Their stagnant operating income growth compared to their revenue is concerning as it could represent margin compression, but their free cash flow will paint a clearer picture. Additionally, they maintain a low P/E of 15, which is significantly lower than their competitors, who command multiples twice as high. Lastly, regarding their income statement, it’s vital to observe their operating and net margins relative to their competitors. American Express has maintained an operating margin of 22% in the TTM and a net margin of 17.5%, somewhat lower than Visa’s 69% operating margin and 50% net margin. The primary reason for their lower margins is that American Express also has banking as a portion of their business, which yields lower margins.

Amex revenue growth (Market Realist)

Balance Sheets:

Amex also has a strong balance sheet. They have over $25 billion of cash on hand which they can leverage to make future acquisitions and ensure that their debt remains at reasonable levels. Amex also possesses $200 billion in assets and $177 billion in liabilities, with an additional $70 billion in deposits. This represents a tangible book value of about 23 billion and a P/B ratio of about five, which is high for banking companies.

Still, considering the majority of their revenue comes from credit, it’s quite reasonable. This leaves American Express with net debt of just $14 billion, which is very reasonable for the nature of their business. Lastly, one of the most important and impressive parts of AXP’s balance sheet is their shares outstanding. Their shares outstanding have decreased a stunning 12% over the past five years from 859 million to 755 million. They also plan on continuing this aggressive share buyback program which represents how they can return significant shareholder value.

Cash Flow Statements:

American Express’s free cash flow has grown from $12.5 billion in 2017 to $14.5 billion in the TTM, showing much slower growth than their revenue but is significantly higher than their net income. Their P/FCF is just eight, which is ridiculously cheap for a company that will continue delivering significant shareholder value through their dividend and share buybacks and natural growth. Lastly, although Amex doesn’t pay a huge dividend, it’s essential to see whether they can sustain and expand it. Amex pays a 1.35% dividend of $1.56 billion or just 10.7% of their FCF. Overall, it appears they are in a solid fiscal state by virtually all metrics and are poised for future growth.

Growth Strategies:

For American Express, growth is still one of their top priorities and they have four key strategies in place to accelerate their growth going into the future. First, they want to continuously expand their market share in the premium consumer space by delivering benefits to their consumers in the form of everyday spending, borrowing, travel, and lifestyle needs. This will bolster Amex’s brand and incentivize more people to sign up from their credit cards ultimately leading to growth.

Then, they are aiming to expand their position in the commercial payments space by increasing their value proposition which ultimately leads to a distinctive competitive advantage. They aim to do this by expanding their accounts payable expense management as well as designing new innovative financial products.

Third, Amex aims to strengthen its global network with their merchants to help them navigate online and offline commerce with additional fraud protection services. Lastly, they’re developing more digital features and services to help the consumer digitize.

All of these strategies are essential to accelerating AXP’s growth in the upcoming years, and I believe with the current growth momentum they possess and well-thought-out plans, they can achieve an 8-10% CAGR for the next 5 years regarding EPS.

Valuation:

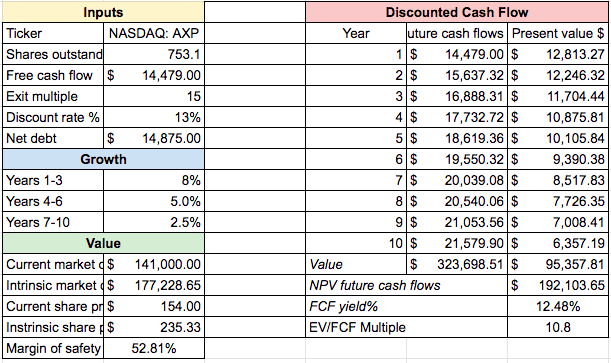

To value American Express, I will utilize a DCF model that projects the company’s cash flows for the next ten years and discounts them back to today to derive a price that we should pay for the stock to receive a 13% annualized return. First, regarding growth estimates, I believe that American Express will comfortably be able to grow at a rate of 8-10% for the next five years, while sales may begin to teeter off soon after. This comes primarily from the growth strategies they have imposed and continuous aggressive share buybacks, which will bolster EPS. Additionally, it’s important to note how management has confidence in their growth, stating they expect 18-20% growth this year and 10% growth in the long term. The below DCF model represents these assumptions but on a more conservative basis and existing financial data.

AXP DCF model (Hossin Rasoli: Seeking Alpha Financials)

As we can see, even when utilizing extremely conservative assumptions regarding the growth and discounting the stock by 13% as we aim to beat the market significantly, there is an over 50% margin of safety from today’s price. This represents extreme upside regarding American Express. Even in the event of a recession or other macroeconomic events that would significantly hurt them, there is still an ample margin of safety present that would preserve capital from being significantly impacted over a long period.

Risk Factors:

Although American Express does appear as a screaming buy at these levels with significant upside potential, there are still quite a few risk factors present that could jeopardize the long-term health of the company.

Competitive Environment:

The most considerable present risk towards Amex is the extremely hyper-competitive and capital-intensive environment of the credit card industry. As previously mentioned, their primary competitors are Visa, Mastercard, Capital One, and Discover (DFS), all of which have significant market share in the space.

Credit Card Industry Market Share (SEC filings from Visa, Mastercard, American Express, and Discover)![U.S. Credit Card Market Share - Facts & Statistics [Data Study]](https://static.seekingalpha.com/uploads/2022/6/13/saupload_2020-Credit-Card-Networks-by-Purchase-Volume_thumb1.png)

As you can see from the above chart, Visa commands the majority of the market with an outstanding 54% share, Mastercard is next at 23%, and American Express is not far behind with 19% of the sector. This represents how there are a few key competitors in the space, and with the capital-intensive nature of the industry as well as the need to maintain an excellent brand image, it could be difficult for Amex to maintain its market share.

Upcoming Recession:

We are all aware that there is now an extremely high chance of an upcoming recession within the next few months to a few years as a result of the Federal Reserve aggressively raising interest rates to tame inflation, an unstable geopolitical environment as a result of the Russia-Ukraine conflict which contributes to higher inflation in many commodities, and numerous recession indicators flashing such as the yield curve inverting and oil prices nearly doubling.

Now, if there was a recession, it’s evident that numerous businesses would be hurt, especially those who offer products with elastic demand, such as Amex. Additionally, financial services companies tend to be the hardest hit during times of recession as consumers prioritize other more essential goods such as food and housing over paying off their credit cards. That is why an upcoming recession could be another prevalent risk factor for American Express.

Final Thoughts:

American Express appears significantly undervalued with a large margin of safety to achieve an above-market rate of return. The management seems to be quite confident in the future growth of the company’s earnings as a result of the robust growth strategies they have imposed and an aggressive share buyback program paired with a nice dividend. Additionally, they are in a robust fiscal state with little debt while possessing low multiples regarding net income and free cash flow.

Lastly, some risk factors present with Amex, such as a hyper-competitive environment and fear of a severe recession which would alter the business’s health and pathway into the future. Overall, American Express appears to be a strong buy that will yield great returns in the upcoming years and can serve as a staple to a long-term investor’s portfolio.

Be the first to comment