SweetBabeeJay/iStock Editorial via Getty Images

Purpose & Introduction

While American Eagle Outfitters, Inc. (NYSE:AEO) reported earnings that didn’t meet analyst expectations, the company still has tailwinds that make it a compelling mid-cap retailer for a swing trade over the next 18 months. The company’s growth offering, Aerie, generated impressive sales momentum throughout the quarter, and AEO provided a detailed cost mitigation strategy that will reduce sales and marketing spend in the second half of the year.

My recent Q1 review on AEO showcased a bull view, and many of those important trends remain intact. While the macro environment may remain challenged as inflation remains elevated and supply chain woes drag on, AEO remains a well-run mid-cap retailer and I rate them a “Buy” with an $18 price target over an 18-month view.

Q2 Review

AEO reported $1.2Bn in revenue, flat from the prior year, while gross profit declined to $370MM. This showcased margin deterioration of ~10% vs. Q2 2021. Quiet Platforms provided a 2% revenue bump to the company, but was offset by a 2% drop in AEO clothing sales. With high expenses and flat revenue growth, Jay Schottenstein, the CEO, noted that they plan to look at the expense base in a meaningful way.

The company only generated $18MM, which means that hitting their previous guidance now looks unlikely. AEO also discounted a ton of product, reflected by seasonal selloffs to fully clear excess spring and summer goods. However, management reiterated that the inventory mix would right-size before the end of the year. AEO also decreased their CAPEX budget by $25MM, down to $250MM given the top line struggles. The company reiterated their plan to cut store counts in unprofitable areas and only increase its real estate presence if strategically suitable. The company closed 7 stores in the quarter, which reflected the aforementioned strategy.

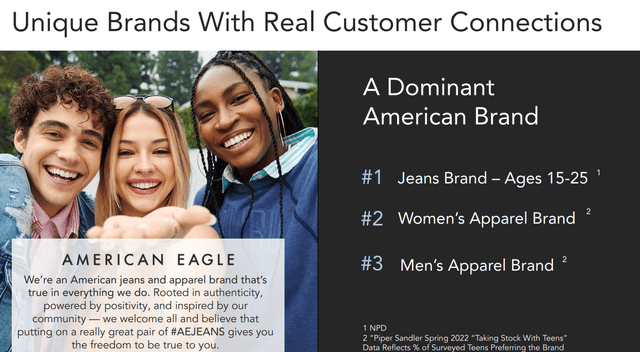

The company’s key growth brand, Aerie, saw revenue grow 11%, hitting $372MM. That brand now sports a 25% 3-year CAGR and is one of the leading brands in teen fashion. However, this success was more than offset by declines in the flagship brand, American Eagle, and digital revenue. This is concerning, as the operating margins are higher for American Eagle compared to Aerie. Quiet Platforms, the company’s supply chain subsidiary, has seen increased traffic and now fulfills a third of the company’s orders. The subsidiary continues to drive efficiencies in processing and delivery times, and AEO noted that 75% of online orders arrived in three days or less. Management sees this number increasing next year, as Quiet Platforms expands its footprint to service additional markets, which should enable nationwide next-day services.

Inventory rose 36% to $687MM, with both brands driving the increase in tandem. AEO continues to adjust its inventories to be in line with external demand trends. Q3 inventory is projected to be up in the mid-single digits, with Q4 inventory expected fall year-on-year. The company also quietly cut the dividend to preserve capital, but noted that they had returned over $250MM to shareholders over the past 12 months, which had seen strong revenue and profit. This shareholder focus remains positive.

Upside

Despite the aforementioned struggles in Q2, AEO has some key intangibles, including a seasoned management team and popular brands. AEO announced a refreshed cost mitigation plan that will spearhead a push to increase profits. Management expanded expense cuts that will focus on store payroll, corporate expenses, professional services, and advertising. These updated actions are now expected to achieve $100MM in annualized expense reductions, compared to the prior target of $60MM. This would ensure that SG&A spend remains flat compared to the prior year and would materially impact the balance sheet, given operating income was just $14MM. At a holistic level, it’s comforting to note that management has navigated difficult times before. Jay Schottenstein has been the longstanding CEO, and looking at the company’s historical share price, after every steep drop, AEO has bounced back and delivered share price gains. The brand remains uniquely impressive in the American market, and I believe as costs subside and investments in Aerie increase, the company will bounce back by the end of 2023.

Model Still Shows Upside

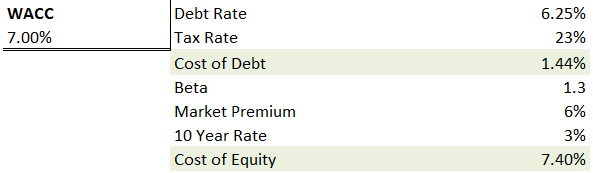

AEO’s stock price is poised to bounce back given the company’s operating efficiency and focus on reining in capital expenses. Reducing the principal on the convertible note at 3.75% earlier this year will free up interest payments and given their updated capital structure, their WACC shouldn’t dramatically rise above 7%.

Author WACC

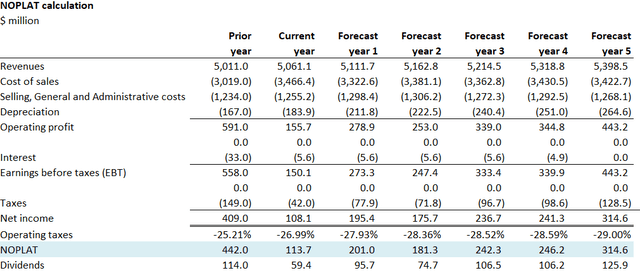

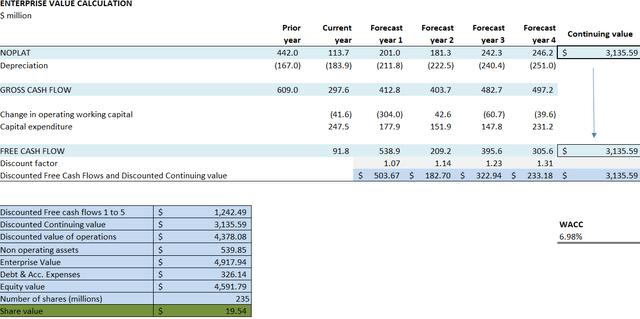

I forecast the terminal value of ~$3.1Bn, given a 1% blended revenue this year, three future years of 2% growth and a terminal growth rate of 1.25% due to concentration of just two brands in a sector that has consumer preference volatility. I still see SG&A expenses dropping 200 basis points as a percentage of revenue within a 4-year period, as synergies from the Quiet Logistics/Air Terra acquisitions start to bear fruit and management remains laser-focused on cost control. I hold all other key ratios mostly equal from the previous model, but adjust the gross margin downward to 32%. As operating profit regains strength in the next few years, I see the stock hitting $18 per share, which would showcase a 2023 EV/EBITA of 10.3. I don’t change the number of shares outstanding, as it seems unlikely that share repurchases will materially continue next quarter.

Author Forecast Author EV Forecast

Conclusion

Even though AEO reported sluggish earnings that missed analyst expectations, the company still boasts tailwinds that make it a compelling mid-cap retailer for a swing trade. The brand strength, management expertise, and shareholder focus make this stock a mid-cap retail pick for a bounce back. I see $18 a share within 18 months.

Be the first to comment