courtneyk

American Assets Trust (NYSE:AAT) is a full-service, vertically integrated, and self-administered real estate investment trust that operates high-quality office, retail, multifamily and mixed-use properties in attractive, high-barrier-to-entry markets.

The company’s portfolio comprises twelve retail shopping centers, eleven office properties, a mixed-use property consisting of a 369- room hotel and a retail shopping center.

Overview (Investor Presentation)

With its portfolio of strong properties, the company has been producing significantly attractive returns over time and still, the stock has been trading at multi-year lows.

I believe, the company is much more profitable with a well-maintained debt structure, but due to the negative sentiments for the REIT industry amongst the investors along with the current inflationary environment, the stock has dropped significantly and has been trading at a multi-year low valuation. As the economy stabilizes, the market will recognize its value, which will result in significant appreciation in the stock price. AAT is a buy.

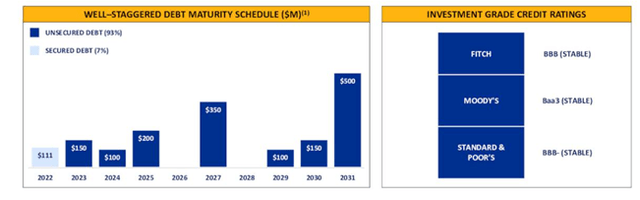

Debt and equity financing

As a REIT, the company has to pay over 90% of its taxable income through dividends. Therefore, debt and equity dilutions remain a significant source for the REIT to grow its operations and to sustain itself during adverse economic conditions. If REIT fails to generate substantial cash, it has to rely on debt and equity dilution to maintain its operations. During adverse economic conditions, raising funds becomes so expensive and challenging which might put significant pressure on the company’s financial position.

But in the case of AAT, it seems that due to its strong presence and substantial cash flow even in volatile market conditions, it has managed to raise over $500 million at a desirable rate, which will further reduce interest cost, the company’s outstanding debt as of 2022 is about $1.6 billion.

Also, with time, the company has been reissuing notes at a very attractive price; it seems that as the overall interest rates have increased in the market, the company has successfully hedged interest rates, which is the reason why interest rates for the company have not increased sharply.

Debt maturity (Investor Presentation)

It seems that the upcoming debt maturity is limited, and the company could manage to comply with it, which gives very much strength to the company’s business model, also note that the company has considerably stable financial credit ratings with a strong financial position which will further help the company to raise funds going ahead.

Strength in the business model

As per the management states in the annual report, the company’s most of the properties are located in such a place where developable land is scarce, and the current regulations are restricting new development, which provides AAT a substantial pricing power over its tenets and helps to increase the rent as the demand rises; these places will not see any significant increase in capacity due to the regulatory restrictions, which will provide the existing player with a strong moat around its castle and a desirable rental revenue over the very long period. Along with that, the management’s capital allocation strategy regarding asset buying and selling helps the company achieve better margins.

Furthermore, the company has a portfolio of financially strong and stable customer base like Google LLC, LPL Holdings, and Autodesk, which represents approximately 30.9% of the total annualized base rent from the office portfolio and Lowe’s, Nordstrom Rack, and Sprouts Farmers Market, representing about 11.3% of our total annualized base rent of the retail portfolio. Having such a solid customer base brings the surety of consistent payment with no significant defaults. Over time, management could get new rental contracts at even higher prices.

Also, the company’s CEO, Mr. Rady owns about 35.2% of the beneficial interest in the company; It seems that his shareholdings have remained substantial despite significant dilution. It is because Mr. Rady has been buying the company’s shares, which shows he believes in the long-term prospect of the company and AAT’s robust business model.

Note that the ability to increase margins for the company totally depends on increased occupancy and its ability to sign new contracts at higher per-square-foot rent. In 2021, the company entered into lease contracts for its office segment for about $50 per sq ft and retail unit for about $59.59 per sq ft, which shows that the company could sign new contracts at a higher price.

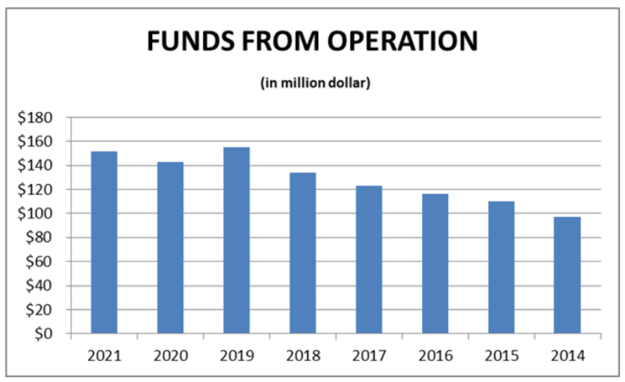

Historical performance

Since its IPO, revenue has been growing at the rate of about 10%; and with the revenue growth, gross margins have been growing consistently, but over the period, growth in revenue and business couldn’t translate into growth in shareholders’ returns.

Over the period, the stock has not given any significant returns, primarily as a result of consistent equity dilution which has resulted in a substantial reduction of shareholder’s per-share earnings despite revenue growth.

The real estate business is very much capital-intensive and needs substantial money to grow its operations, but as a REIT company is required to pay most of the taxable earnings as a dividend, so the sole source for CAPEX and the acquisition remains from debt and equity dilution, so the investor must keep in mind that whenever the company plans CAPEX or acquisition it will have to dilute substantial shares or has to incur huge debt.

Also, to expand the business, management has acquired and developed many properties over the period, like the expansion of Torrey point in 2015, and the acquisition of la Jolla commons, which has led to a substantial increment in property assets and overall rental income.

FFO (author)

As the net income remained volatile, funds from operations kept on increasing due to its consistent acquisitions and developments. but investors must recognize that since its inception, the company has taken substantial debt and has diluted significant equity over the period for acquisition and Capex purpose, as a result, as the company kept on increasing its asset base, its outstanding shares also increased by nearly the same percentage, which is the reason why in spite of significant growth in the business, per share growth remained sluggish.

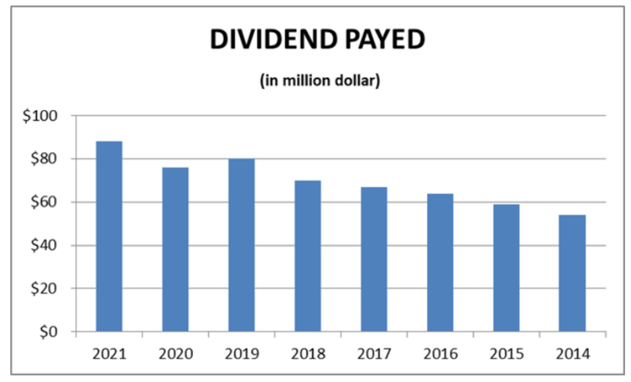

Dividend history (author)

Over the period, dividend payment seems increasing but due to significant dilution, this effect of dividend increase couldn’t translate into per share dividend. Therefore, investors cannot see any major growth in per-share dividends.

Risk factors

The company has most of the properties in strictly regulated areas, and according to these regulations, rebuilding is restricted in most of the regions, therefore any damage to the properties will lead to significant losses because the company will have to face significant regulatory restrictions for building those properties.

Also, as the current economic conditions are worsening, it might take longer for the stock to appreciate in value. Currently, the risk of permanent capital loss seems low because the company’s overall CFO is intact and has been producing stable and strong earnings.

Recent development

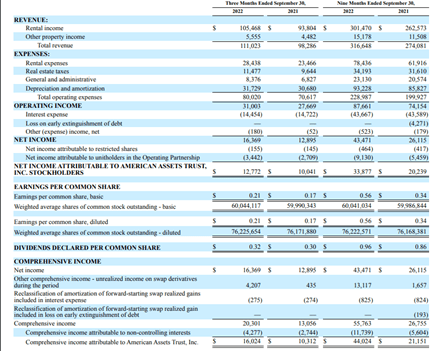

quarterly results (quarterly report)

In the latest quarter, the company reported net income of about $12.8 million and $33.9 million for the three and nine months ended September 30, 2022, respectively, also Funds from Operations increased 11% year on year basis in the last three months and over 23% over the previous nine months. Also, Same-store cash Net Operating Income increased 10.7% year-over-year for nine months ended September 30, 2022. Also, management has increased 2022 FFO per diluted share guidance to a range of $2.30 to $2.34, showing that the company has retained its ability to produce significant Funds.

Furthermore, Due to the pandemic, the stock dropped in November of 2019, from its all-time high price of about $48, since then the stock couldn’t reach its previous levels, it is because due to high inflation and adverse economic conditions. as the economy was flourishing in early 2021 stock soared more than 55% but again dropped significantly and currently trading at multi-year low valuation despite a strong Portfolio of diversified assets and considerably stable earnings compared to its peers.

It seems that the company is trading for about 12 times its FFO, whereas historically it was trading at a significantly higher multiple, I believe as a result of the current inflationary situation, the stock has fallen substantially undervalued levels, and from this price, the stock offers a significant upside potential and considerably low risk of capital loss, AAT is a buy.

Be the first to comment