Drew Angerer

While higher costs remain a problem for any business, American Airlines Group (NASDAQ:AAL) and the airline sector have generally been able to hike fares along with rising costs. The airlines stocks shouldn’t trade at yearly lows as revenues are headed to top 2019 levels on far less flights here in 2022. My investment thesis remains ultra-Bullish on the airlines stocks with a prime focus on those taking unnecessary hits by the market due to debt fears such as American Airlines.

Fare Hike Capacity

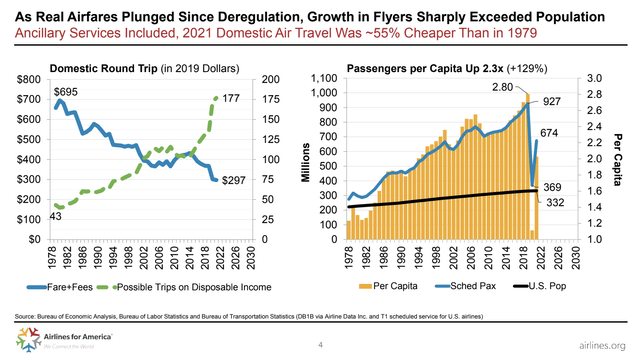

While air fares have soared this year due to higher fuel costs, the market doesn’t appear to understand that 2021 domestic air fares were ~55% cheaper than in 1979. In 2019 dollars, the average fare has fallen from $695 in 1979 to only $297 last year. Consumers could afford 117 round trips with disposable income now versus only 43 back in 1979.

In essence, fares aren’t a huge expense these days. Some large increases in fares aren’t burdensome enough to keep consumers from paying additional costs for higher fuel costs, especially considering the reduced travel over the prior two years.

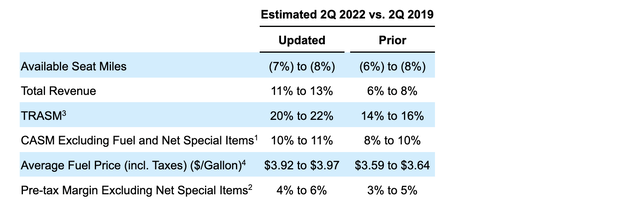

Back in early June, American Airlines had already highlighted how revenues were expected to top 2019 levels by ~12% despite capacity being down up to 8%. The airline was set up for a strong Summer.

The main issue with the numbers going forward are the higher salary expenses for pilots due to several high-profile issues including the recent system glitch that canceled pilot assignments for 12,075 flights. American Airlines already has a tentative deal with the pilot union for a 17% pay hike through 2024. The deal would provide a 6% raise on signing and then 5% raises in 2023 and 2024.

On top of these hikes, the airline has reportedly offered triple pay to existing pilots to pick up additional flights in July to cover those under the system glitch where pilots were allowed to drop flights. While the airfares were hiked for the higher jet fuel prices, the additional costs for pilots in July weren’t part of the plan when customers purchased tickets.

Not So Burdensome Debt

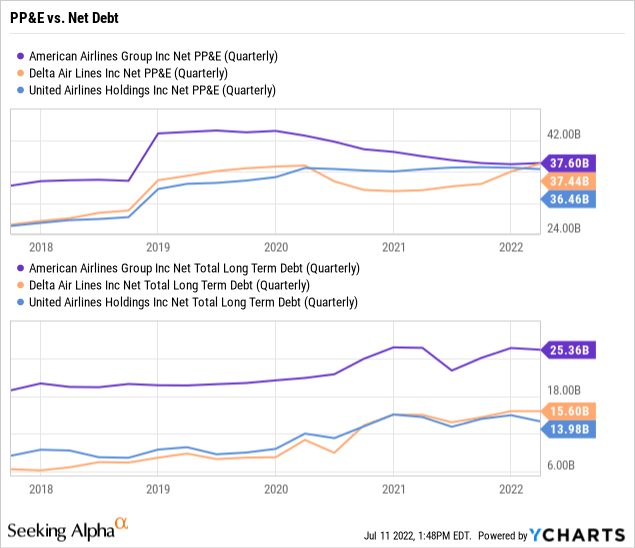

American Airlines clearly has a ton of outstanding debt, but the market always wants to ignore the reason for this debt. The airline has $37.6 billion in net Property, Plant & Equipment due to purchasing modern aircraft and other equipment via the use of debt.

The other legacy peers have similarly large PP&E amounts. Both Delta Air Lines (DAL) and United Airlines (UAL) have ~$37 billion in related aircraft assets and equipment.

In these regards, these airlines are well equipped to handle very large debt levels. While American Airlines has $25.4 billion in net debt, the airline has $12.2 billion of PP&E in excess of net debt. The other legacy airlines are in better positions with PP&E in excess of net debt at ~$22 billion.

These airlines don’t have burdensome debt with revenues set to reach record levels and equipment in excess of net debt levels. Of course, American Airlines needs to generate consistent positive cash flow in order to cut debt levels and reduce interest expenses. Lower interest expenses will feed to higher cash flows.

As even Argus Research points out when turning negative on American Airlines, the stock only trades at 7x 2023 EPS targets. On historical norms, the airline stock trades at a typical valuation, yet American Airlines had ~$220 million in additional interest expenses in Q1’22 and just cutting these expenses to pre-COVID Q1’20 levels of $236 million, the airline would save $880 million in interest expenses or over $1 per share in additional earnings.

The timeline to reduce net debt levels to pre-COVID levels in the $21 billion range is unclear, but the airline could generate the cash flows over the next few years to achieve this target. American Airlines plans to reduce the overall debt levels $15 billion by 2025, but a lot of this reduction is from using excessive cash balances of nearly $13.5 billion when including restricted cash.

Takeaway

The key investor takeaway is that American Airlines clearly faces a period of higher costs, but the airlines have easily hiked airfares due to the relatively cheap cost of flying in the 2020s. The stock is crazy cheap at 6.5x 2023 EPS targets while those estimates are set to soar with debt reductions and further growth in years ahead.

Be the first to comment