Justin Sullivan

Chip stocks have been on a steady recovery since the start of the second quarter, despite worsening signs of an economic slowdown – especially in the consumer end market. The Philadelphia Exchange Semiconductor Index (PHLX) has gained more than 20% in July, after plummeting close to 40% in the first half of the year. To a similar extent, AMD (NASDAQ:AMD) has also rallied in July, outperforming the PHLX slightly during the period, though still underperforming the benchmark on a year-to-date basis. The rally’s momentum sustained, despite industry leader and key rival Intel’s (INTC) weak showing on its quarterly results and forward guidance last week.

Investors are becoming increasingly bullish on AMD’s resilience after Intel’s latest shortfall raises clues that the former is becoming an increasingly prominent player within both the high-performance PC and data center CPU market. As mentioned in our recent coverage on AMD, the company’s EPYC server processors are making meaningful inroads within the data center and high-performance computing (“HPC”) segments, while its powerful next-generation PC processors like the Radeon GPUs and Ryzen CPUs are also putting Intel on notice.

While most chipmakers that have reported second quarter results so far are sounding the alarm about a possible slowdown in demand and inventory build-up – particularly on consumer-centric products like memory chips used in consumer electronics – the market for semiconductors used in data centers, auto, and premium electronics like enterprise workstations remain strong. This accordingly makes favourable tailwinds for AMD, as it bolsters its technological edge across both hardware and software offerings pertaining to data center, premium performance PCs, automotive, and more recently, telco infrastructure opportunities.

Current market trends, which support a robust demand environment for AMD’s core data center end market, as well as signs of solid market share gains also point to a continuation of the chipmaker’s running streak of sales and earnings beats. The following analysis will dive deeper into three main considerations supporting AMD’s long-term upsides and outperformance amid the near-term industry challenges – 1) weakening consumer spending, 2) data center strength, and 3) robust fundamentals.

AMD is now trading at about 5.5x forward EV/sales, which is still a significant discount to the mean of approximately 5.9x observed across the fabless semiconductor peer group given its high-growth profile. Considering the stock is also underperforming the PHLX still, AMD remains a favourable investment at current levels. With investors handsomely rewarding those that have demonstrated resilience this earnings season – as demonstrated through last week’s robust big tech earnings results which helped the tech-heavy Nasdaq 100 add $1.5 trillion in market value in July – the highly anticipated strong quarterly showing for AMD makes a favourable near-term catalyst in jumpstarting the stock for sustained upward momentum ahead.

1. Weakening Consumer Spending

Industry alarms about slowing chip demand from consumer end markets, particularly those used in consumer electronics like smartphones and PCs, are growing louder, echoing earlier investors’ concerns of a slowing semiconductor cycle following a multi-year boom.

Global PC shipments have already shown accelerating declines in the first half of the year – first quarter volumes dropped by 6.8% compared to the prior year to 78 million units, while second quarter volumes dropped by more than 15% to 71 million units, as consumer discretionary spending power weakens due to rising inflationary pressures. Global PC shipments are on track towards a 9.5% decline this year, led by an estimated 13.1% drop in consumer PCs and 7.2% drop in enterprise PCs. As a result, related chip demand is expected to contract by more than 5% this year. Meanwhile, chip demand from smartphone makers are expected to increase by just slightly above 3% this year, a significant slowdown compared to the 25% expansion observed in 2021.

Yet, despite signs of a slowing consumer end market as households cut back on discretionary spending due to near-term economic uncertainties, AMD’s growth in this segment is expected to remain resilient given its limited direct exposure. The chipmaker remains optimistic on its ability in defying near-term headwinds, given observations that the current PC market is shifting to “higher end [and] more premium segments”, buoyed by corporate purchases to accommodate the idea that “hybrid and remote work is the new reality”. Specifically, resilient enterprise demand for high-performance workstations to support a “location-agnostic” work reality is expected to partially offset any near-term impacts on AMD’s consumer-centric gaming PC sales due to unfavourable macro challenges ahead within the consumer end market.

This expectation is further corroborated by recent results reported by PC makers like Microsoft (MSFT), which confirmed that sales volumes for its Surface devices in the second quarter have been largely resilient thanks to robust enterprise demand. Other PC makers like Dell (DELL) have also reiterated similar observations in the strength of enterprise demand due to the increasingly urgent need for “modernizing the technology infrastructure” to ensure “intelligence, automation, cyber-resiliency and multi-cloud flexibility” in the new normal of remote collaboration.

Although AMD has opted to stay on the conservative side with regards to PC opportunities for the current year, guiding a year-on-year decrease in “negative high single digits” for related sales, the company is expected to recoup some market share by selling its premium, more expensive models. AMD also has a “number of commercial systems” in the pipeline this year, including the recent launch of the “Ryzen 6000 Series” processors for premium laptop application, which underpins solid PC performance for 2022 despite a broad slowdown in the market. Paired with seasonal demand in the second half of the year from back-to-school and holiday purchases, AMD remains on a positive track for further PC market share gains.

2. Data Center Strength

Accelerating demand for data center processors is also expected to cushion some of the PC-related risks for AMD. Global demand for data center processors will remain elevated in coming years, as cloud-computing continues to be a critical need in the corporate sector with no signs of slowing in adoption. Specifically, the market for data center processors is expected to expand by at least 20% this year, more than offsetting any consumer-related slowdown that AMD might experience due to near-term macroeconomic weakness.

The favourable trends are further corroborated by the increasing urgency of enterprise migration to the cloud to support a new era of remote-working as mentioned in the earlier section. More than half of corporations are expecting cloud adoption to account for a significant portion of investments in the next two years, driving the global cloud-computing market towards a market value of more than $800 billion by 2025. Meanwhile, the market for supporting AI hardware, such as data center chips like AMD’s EPYC server processors, is expected to expand at a CAGR of 43% towards $1.7 trillion by the end of the decade.

These statistics continue to support a robust demand environment for both cloud service providers and chipmakers like AMD, even under a potentially tightening economic environment in the near term. And AMD’s continued commitment to innovation also contributes to bolstering its presence and expanding its market share in data center opportunities over the longer-term. AMD’s EPYC server processors have been a flagship product in leading the company’s break-out growth and data center market share gains in recent years. The EPYC CPUs are now onto their fourth generation, featuring a family of four chips spanning “Genoa”, “Genoa-X”, “Bergamo”, and “Siena”, all of which are tailored to optimize performance across different use cases ranging from cloud-computing to communications infrastructure and telco deployments.

The powerful server processors have evolved into one of the fastest and most powerful chips used in HPC architectures today. AMD’s EPYC processors are also now found in 73 of the world’s “Top 500 Fastest Supercomputers” list, a three-fold increase from 2020. The EPYC processors’ dominant presence on the “Green500” list is also a testament to its power efficiency for complex workloads. To date, 80% of the world’s most efficient super-computers are also powered by AMD’s EPYC processors, putting the company’s HPC competency on par with legacy rival Intel’s. AMD’s growing prowess in data center and HPC opportunities is also corroborated by key rival Intel’s acknowledgement of “server market-share losses” last week, providing substantiated support to AMD’s sustained long-term growth trajectory. Meanwhile, AMD’s Gen 4 EPYC server processors are also well-positioned to benefit from Intel’s delayed roll-out of its next-generation Sapphire Rapids server processors, threatening to erode the latter’s market share further.

Looking further ahead will be AMD’s planned debut for its 5th Gen EPYC processor in 2024, codenamed “Turin”, which will continue to cover general to cloud-optimized applications. The 5th Gen EPYC processors are expected to feature the 4nm and 3nm manufacturing processes to unlock new performance capabilities. AMD has also expanded its foray in data center GPUs in recent years, with new and improved technology like the CDNA 2 Architecture bolstering its market share gains within a realm it has historically played a smaller role in.

3. Strong Fundamentals

AMD has staged a consistent streak of positive sales and earnings surprises over the last seven consecutive quarters. And we expect a repeat of this strong showing for AMD’s 2Q22 results, with its top- and bottom-line expansion supported by continued market share gains and production ramp-up of new products to scale.

From the top-line perspective, AMD continues to demonstrate an ability in capturing share gains within the increasingly competitive sector by bolstering its technological capacity to attract demand, while also expanding its total addressable market (“TAM”) through recent acquisitions like Xilinx and Pensando. Specifically, added technological capacities through the integration of Xilinx and Pensando are expected to unlock new synergies when paired with AMD’s existing expertise in CPU and GPU processors, catapulting the chipmaker into new forays to diversify its revenue portfolio:

- Telco Infrastructure Opportunities: For instance, the recent expansion of AMD’s family of Gen 4 EPYC server processors with “Siena” marks a strategic development built on both its existing expertise in server processors and Xilinx’s leadership in FGPA solutions for communications infrastructure application. The Siena EPYC processor is designed for optimized “intelligent edge and communications deployments”, and marks the newest addition to Gen 4 EPYC’s other three offerings – “Genoa”, “Genoa-X”, and “Bergamo – each specifically designed to accommodate general purpose, relational database and technical computing, and cloud-optimized workloads, respectively. AMD’s recent introduction of the Siena EPYC processor also aligns with our predictions prior to the completion of the Xilinx acquisition, which alluded to potential synergies between Xilinx’s strong pipeline of communications accounts and AMD’s growing prominence within the network infrastructure sector, underscored by its recent win from Nokia to power the latter’s 5G network servers with EPYC processors. Xilinx effectively opens the door for AMD to the global 5G enterprise market, which is expected to expand rapidly at a CAGR of 28.5% over the next five years towards a market value of $10 billion, marking significant growth opportunities ahead.

- Extended Premium PC Opportunities: Leveraging Xilinx’s industry-leadership in FPGA and SoC technologies, AMD has also introduced its newest “XDNA Architecture” to enable optimized performance and energy efficiency for application in complex workloads such as AI and signal processing. The AMD XDNA IP is scheduled for debut in 2023, beginning with the integration into the AMD Ryzen series processors used primarily in powering desktop/notebooks. The performance gains enabled by AMD’s latest XDNA architecture is expected to further its penetration into enterprise opportunities characterized by increasing demand for premium workstations as discussed in earlier sections.

- Extended Data Center Opportunities: In addition, Xilinx also furthers AMD’s reach into burgeoning data center opportunities, given its reputation in programmable solutions for the segment. FGPAs are widely used in emerging technologies like cloud data center and communications infrastructure applications considering its adaptive nature and ability in enabling low-latency AI acceleration. The global FPGA market is forecasted to grow at a CAGR of 8.5% over the next five years, as rising adoption of emerging technologies continues to bolster demand.

- Market Penetration via Provision of End-to-End Solutions: Meanwhile, AMD’s recent acquisition of Pensando will also catapult AMD into software and data processing units (“DPUs”), and bolster its competition against peers like Nvidia and Broadcom, which have been driving share gains via the provision of end-to-end solutions, covering both hardware and software needs across the technology stack.

And on the bottom-line front, AMD currently boasts gross margins of close to 50%, no less than key PC and data center CPU rival Intel, and fast-approaching those of top industry gainers like Nvidia (NVDA), Texas Instruments (TXN), and Broadcom (AVGO). And there is still a lot of room for AMD’s margins to improve, as it continues to ramp up and scale production on its new products, such as the latest family of Gen 4 EPYC server processors and others based on its newest chip architectures (e.g. RDNA 3, CDNA 3, XDNA), and complete the integration of newly acquired businesses.

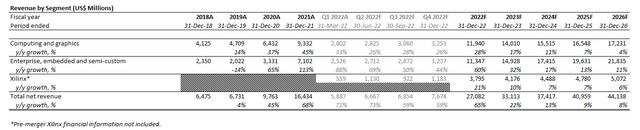

AMD Revenue Forecast (Author)

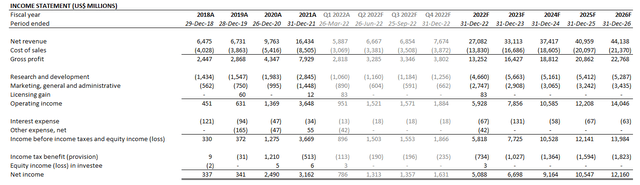

AMD Financial Forecast (Author)

AMD_-_Forecasted_Financial_Information.pdf

Is AMD a Buy Before Earnings?

While some chipmakers have in fact started to experience a dent in performance due to softening demand in consumer end markets, others such as AMD have continued to benefit from resilient demand in non-consumer verticals like data center and automotive end markets. However, global macroeconomic uncertainties are heightening investors’ concerns on the performance of the entire semiconductor sector altogether, regardless of the extent of each chipmaker’s respective exposures to weakening consumer spending. This has accordingly weighed on the valuations of the broader semiconductor sector over the past year, overshadowing the strength of even those that are actually uniquely positioned to benefit from recession-resistant, secular trends.

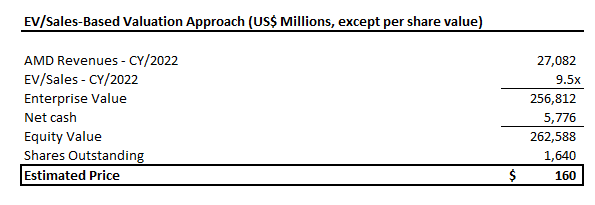

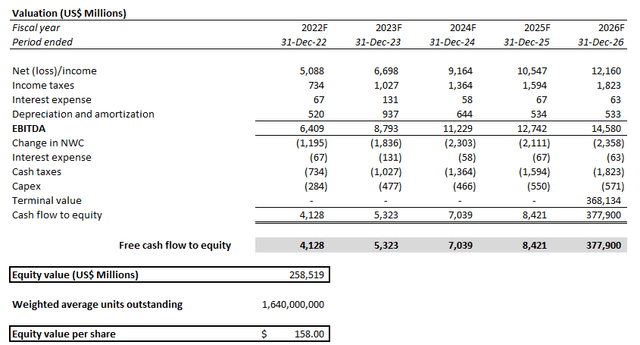

Although downside risks like ongoing industry-wide supply constraints, and new acquisition integration and ramp-up costs specific to AMD cannot be discounted, the respective burdens on the chipmaker’s margins are expected to be temporary. Meanwhile, the long-term growth trajectory AMD has paved via the strategies discussed in the foregoing analysis will be comparatively sustained and contribute to its continued share gains over coming years. We believe the ongoing market volatility in response to near-term macro uncertainties has created a compelling entry opportunity in AMD as a long-term investment, with the anticipated demonstration of resilience in its upcoming 2Q22 results underpinning a strong re-emergence from this year’s sell-off towards greater sustained upside ahead. As such, we are maintaining our near-term price target of $160 on the AMD stock, which would represent upside potential of close to 70% based on the shares’ last traded price of $94.47 on July 29.

AMD Valuation Summary (Author)

AMD Multiple-Based Valuation Analysis (Author)

AMD DCF Analysis (Author)

Author’s Note: Please see here for key assumptions and methodology applied in the valuation analysis above.

Be the first to comment