JHVEPhoto

Thesis

Share prices of Advanced Micro Devices (NASDAQ:AMD) have been brutalized by a combination of its own cyclicality and the recent chip export regulations. To wit, its share prices have lost nearly 2/3 compared to their peak level of around $152 at the beginning of the year. And there are still considerable headwinds ahead in the near term, which could keep causing mixed financial results and large price volatilities.

However, long-term investors should not be afraid of deeply cyclical stocks like AMD. The deep cyclicality and extreme volatility we are experiencing now only provide rare buying opportunities for long-term holding. And it is the thesis of this article to look beyond the near-term troubles and focus on its long-term prospects. In particular, I see four key areas that the market has either misunderstood or overacted to its current headwinds. Correspondingly, I see the following strong reasons to be a long-term investor now and the remainder of this article will elaborate on these reasons.

- I see its recent margin contraction only as temporary. AMD has been expanding its margin rapidly in recent quarters. However, in the most recent quarter, due to the PC market slowdown and the inventory write-off of about $160 million, its gross margins have contracted to 42% compared to 46% in the previous quarter. I see these issues as only temporary. Thanks to its strong product mix and the shift towards data centers, which are far less cyclical than PC and enjoy a far higher growth curve by the secular shift from on-premises to cloud computing, I see AMD best poised to resume margin expansion when the contracting phase is over.

- Well-executed operation. Its asset utilization has been dramatically higher than other major chip makers by more than 2x on average historically. It is true that the chip cyclicality is causing a sharp decline in its asset utilization. But the market has ignored the fact that its current utilization is still very competitive when compared to close peers. And furthermore, the benefits from the acquisition of both Pensando and Xilinx have not been fully exploited yet.

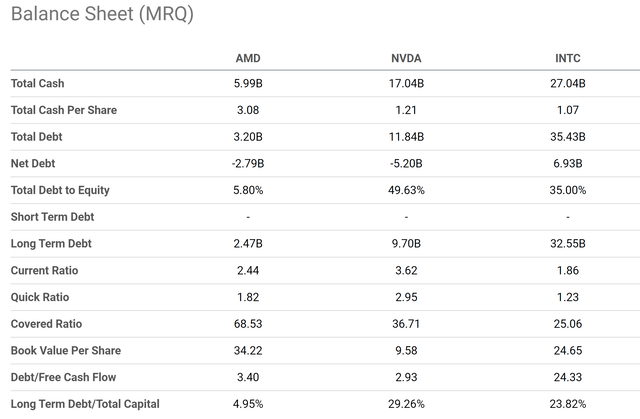

- Strong financial strength. A key to surviving the chip cycle is to maintain good financial strength. And AMD boasts the strongest balance sheet among the major chip makers such as Intel (INTC) and Nvidia (NVDA).

- Wide margin of safety. Its valuation is currently extremely compressed and leaves a margin of safety of at least 40%.

Reason 1: margin expansion

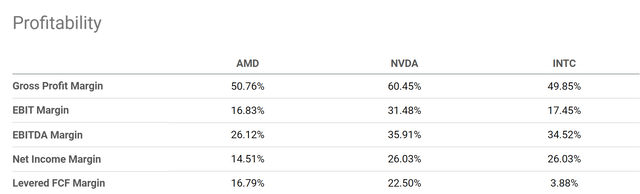

The next chart shows the current profit margins of AMD to a few other major chip players including INTC and NVDA. And as you can see, AMD does not stand out as the most impressive player. For example, its gross profit margin is currently 50.7%, on par with INTC’s 49.8% but lower than NVDA’s 60.4% by more than a whole 10%. In terms of the bottom-line margin, the profit margin for AMD is 14.5%, substantially below both INTC and NVDA (which are both on the 26% level).

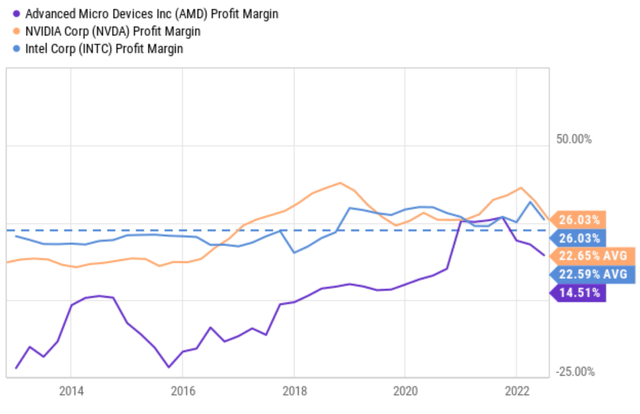

However, the above comparison does not show the trend of margin expansion, which in my view is the key. As can be seen from the next chart, AMD’s profit margin has been rapidly expanding in recent years. In contrast, INTC and NVDA’s margins have been largely stale and Fluctuating around an average of around 22% to 26%. To wit, AMD’s net profit turned positive in 2018~2019. And since then, its margin started to rapidly expand to a peak of around 27% in later 2021, surpassing INTC and NVDA’s long-term averages. Then all the headwinds came and its margin contracted to the current level of 14.5%.

Other chip stocks’ margins contracted too as you can see from the chart. It is just AMD’s margin contracted more. A key reason in my view is AMD’s reliance on products with higher Average Selling Prices (“ASP”) in recent quarterly, such as its RyzenTM processor and its high-end graphics products. Such reliance hurts its margin more during a contraction, but I foresee it expanding more also when the contraction is over.

Reason 2: strong asset utilization and execution

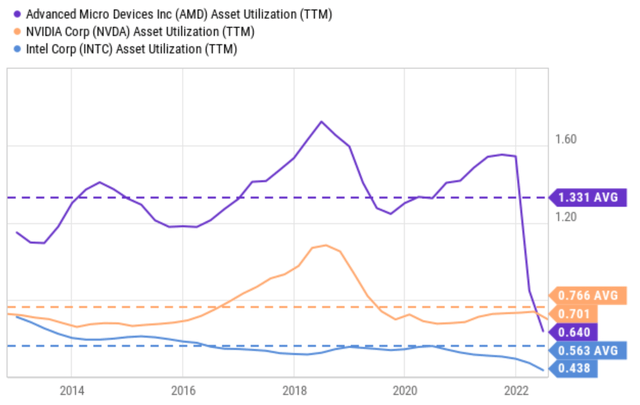

Next, AMD’s larger gyration in profit margins is more than made up by its strong executions. In the next chart, you can see that AMD’s asset turnover rate (“ATR”), or asset utilization rate, is on average 1.33x. It is almost 1.75x higher than NVDA’s 0.76x and more than 2x higher than INTC’s 0.56x.

Yes, again here we see AMD’s deeper cyclicality. Its ATR plunged from about 1.5x a quarter ago to the current level of 0.64x, while INTC and NVDA only showed a mild slowdown. However, even after such a large slowdown, its current ATR is still higher than INTC by almost 50% (0.64x vs. INTC’s 0.43x) and about on par with NVDA.

Looking forward, I again see its ATR returning to average quickly once the contracting phase ends. And I further anticipate its ATR to come back even stronger than its 1.33x historical average.

In particular, the Pensando and Xilinx acquisition should add both scale and scalability to AMD as the integration continues to amplify the synergistic benefits. The Xilinx acquisition has already been benefiting substantially from its acquisition of Xilinx. It added diversified revenue streams and enabled differentiated solutions for heterogeneous computing. It also expanded its addressable market across data centers, communications, and embedded markets. I anticipate the Pensando deal to further expand its data center portfolio with a high-end processing unit and software stack. It will enable a broader portfolio of computer engines to better serve its customers.

Reason 3: strong financial position

A key to surviving and thriving in a deeply cyclical business is always to keep a deep pocket, especially when during the contracting phase. And this is precisely what AMD is doing as you can see from the following chart. Currently, AMD has about $6 billion of cash on its ledger, translating into about $3 per share (or a sizable 5.4% of its current stock price). It only has $3.2B of total debt. As a result, AMD has about $2.8 billion in net cash.

In contrast, NVDA and INTC (especially INTC) are much more leveraged. NVDA has a net cash position too, but the net cash position is much smaller in relative terms compared to AMD. And INTC has a much larger debt burden and a net debt of $6.9B. The Long Term Debt/Total Capital ratio is only 4.95% for AMD, compared to 29.26% for NVDA and 23.82% for INTC. Such a strong financial position allows greater capital allocation flexibly for AMD to navigate through the downturn and potentially also benefit from it.

For example, AMD repurchased nearly one billion dollars’ worth of its stock during the past quarter alone. And management has not indicated any plans to slow down the buybacks. Repurchasing its stocks at such a compressed valuation is highly accretive to shareholder returns in the long term, as elaborated on immediately next.

Reason 4: extremely compressed valuation

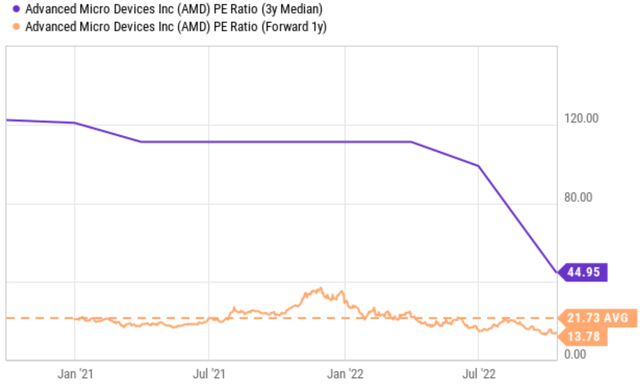

Finally, the market sentiment has gone too far to the fear extreme in my mind, resulting in a secular valuation bottom. As you can see from the following chart, the P/E ratio of AMD has been compressed immensely in one year or so. You can see that by the sharp downturn of its 3-year medium P/E around July 2022. At that time, its 3-year medium P/E still hovered around 100x.

Its current FW PE stands at only 13.78x, a far cry from its historic averages. And when even compared to its averages since 2021, its current FW P/E of 13.78x is almost 40% discounted from its average of 21.73x.

Projected return potentials

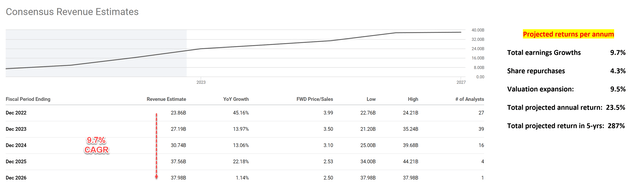

The combination of profitability expansion, growth potential, and valuation contraction has created a very asymmetric return profile as shown in the chart below.

In this projection, I am assuming a total growth of 9.7% per year for the topline in the next five years according to consensus estimates. And I am assuming its profit margin remains compressed at the current level so that total net profit grows at 9.7% CAGR too (which I think is on the conservative side based on the analysis of its margin expansion). As aforementioned, it’s actively repurchasing its shares. And its current buyback yield is about 4.3%, which is assumed to continue. Lastly, by assuming a valuation reversion to the mean of 20x PE in the next 5 years or so, valuation expansion would contribute another 9.5% to the total return.

All told, these return drivers could create a 23.5% annual return, leading to the potential to almost triple the investment in 5 years.

Source: Author based on Seeking Alpha data

Risks and final thoughts

There is no doubt that AMD, together with the chip sector, is facing strong headwinds in the near future. Its lower-than-expected June-quarter earnings only serve as a reminder of some of the headwinds afoot. The macroeconomic conditions will remain challenging with inflation persisting, the global supply chain still remains congested, and the effects of chip export control are unfurling. At the same time, its recent acquisition and synergy costs will keep weighing on its bottom-line.

However, the extreme volatility caused by these short-term issues only provides buying opportunities for long-term investors. If you have a time horizon of 5 years or longer, I see oversized return potentials at these current prices. I see annual return potential exceeding 20% driven by margin expansion potential, its strong execution, and valuation reversion. And its strong financial strength will ensure its survival in this downturn so that investors get to see the other end of the tunnel.

Be the first to comment