Justin Sullivan

In somewhat of a shock, Advanced Micro Devices (NASDAQ:AMD) reported a massive preliminary revenue cut for Q3’22. The chip company faced a massive inventory correction in the PC market that isn’t reflective of the revenue opportunity ahead. My investment thesis remains ultra-Bullish on the stock, especially after this irrational dip below $60.

Inventory Correction

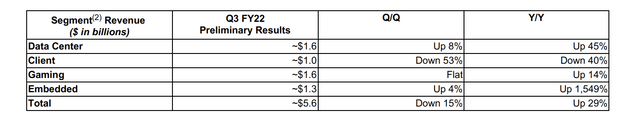

AMD made a perplexing pre-announcement for Q3 earnings last week. The chip company announced quarterly revenues of $5.6 billion missing prior targets of $6.7 billion by a whopping $1.1 billion.

Source: AMD Q3’22 preliminary release

The Client segment revenues fell 53% QoQ to only ~$1.0 billion. The segment generated $2.15 billion in revenues in the prior quarter

The PC sector was known to be very weak following the covid pull forwards and limited desire by corporations to purchase new equipment prior to a global recession. The shocking part was the level of the dip considering AMD had provided no indication the company would be overly impacted by the slowdown due to taking market share.

The company made some pretty key statements in the preliminary Q3 release. Per CEO Lisa Su, macro issues and an inventory correction caused the slumping sales:

While our product portfolio remains very strong, macroeconomic conditions drove lower than expected PC demand and a significant inventory correction across the PC supply chain. As we navigate the current market conditions, we are pleased with the performance of our Data Center, Embedded, and Gaming segments and the strength of our diversified business model and balance sheet.

The Client segment saw revenues dip by $1.15 billion sequentially to only $1.0 billion. A PC inventory correction can definitely account for this scenario with customers cutting off orders due to having too much inventory and buying below actual demand.

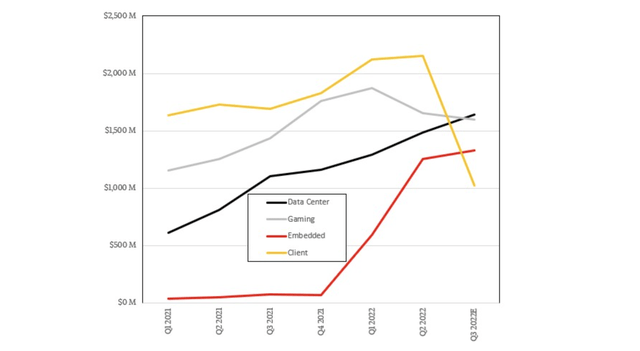

The below chart highlights the situation facing AMD. The largest division saw a huge short fall in sales, but the business wasn’t exactly fed by huge pull forward demand over the last couple of years.

AMD spent the last couple of years struggling to meet demand in the PC segment due to a focus on data center and gaming chips. One has to wonder if a large part of the inventory correction problem was due to OEMs having far too many Intel (INTC) chips. AMD hasn’t been able to fully supply the segment questioning how OEMs could have too much inventory from the smaller player.

Snapback

My previous research had focused on investors not getting stuck on 2022 numbers. Even without this PC inventory correction, the segment revenues were forecast to decline reducing the opportunity for AMD to generate extra sales.

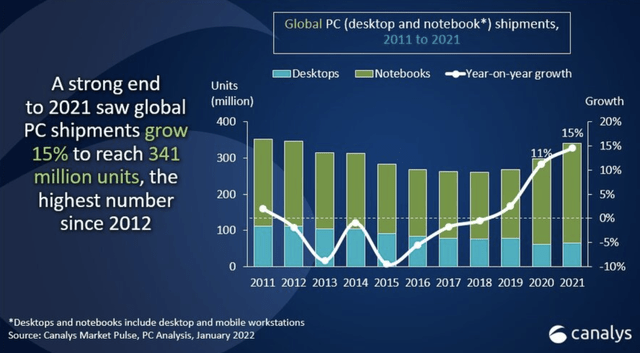

IDC estimated Q3 PC unit shipments at 74 million units, actually up from the Q2’22 level of only 72 million units sold. The PC market had seen a massive pull forward in 2021 to reach unit sales of 341 million units.

A pull back was expected, but the unexpected was a massive inventory correction for AMD. PC sales were probably only down 20% YoY in Q3, nowhere close to the 50% sequential correction in AMD sales. Remember, AMD had Client sales of $2.15 billion for the June quarter when PC units sold were 72 million and the Q3 sales were likely very similar unit totals.

The biggest fear is one where data center revenues face an inventory correction as well. The Next Platform doesn’t see such an outcome for AMD with the upcoming Geno and Bergamo 9000 series chips taking market share with Intel pushing out Sapphire Rapids chip sales.

AMD is far stronger in the data center space, though a similar scenario in PCs was supposed to cushion the blow for the company.

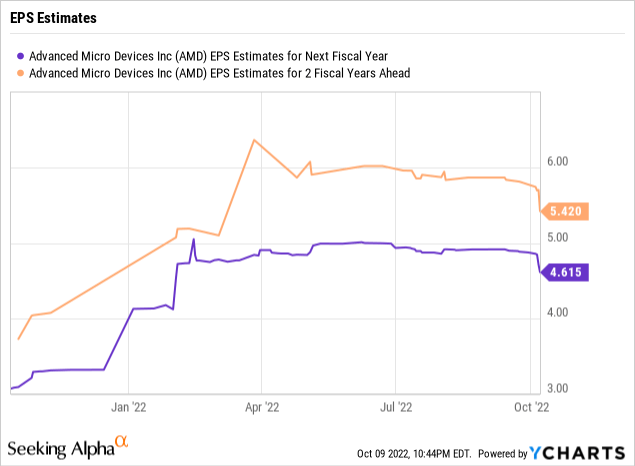

Analysts have started lowering 2023 and 2024 EPS targets, but such a move appears a mistake. The inventory correction doesn’t alter future demand and likely sets up a scenario where OEMs have to end up boosting orders to catch up with more normalized demand for AMD chips.

Either way, AMD now trades for only $58 and the 2023 EPS target is still $4.60 and the 2024 target of $5.42 appears an overreaction to cut those numbers at all.

Our previous EPS targets of $6+ remain intact. The Q3 warning by AMD provides no indication of a material altering to the long-term view. The global recession fears will disappear next year and normalized PC spending will return as units bought in 2020 and 2021 start turning old.

Takeaway

The key investor takeaway is that whether AMD hits a $6+ EPS in 2023 or 2024 is irrelevant with the stock price below $60. The chip company remains on the path to take market share from competitors and investors should use this massive weakness to load up on the stock.

Be the first to comment