bernie_photo/E+ via Getty Images

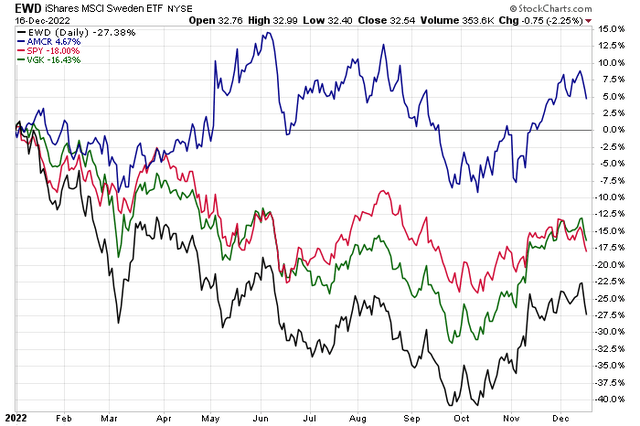

Swiss stocks have been a lousy spot in the global equity market. While the Europe region features slight alpha versus the S&P 500 this year, the iShares MSCI Sweden ETF (EWD) is down a massive 27.5%. One of the nation’s Materials sector names has bucked the trend, though. Is there more upside to come in shares of Amcor? Let’s check it out.

Swiss Stocks: A Hole In The Global Market

According to Bank of America Global Research, Amcor (NYSE:AMCR) generates approximately $14.5bn in annual revenues. The company’s business is organized and presented in two reportable segments: Flexibles and Rigid Packaging. Flexibles make up 77% of sales, while Rigid Packaging makes up the remaining 23%. Amcor nearly doubled the size of its Flexibles business with the acquisition of Bemis, completed in June 2019.

The Switzerland-based $18.0 billion market cap Containers & Packaging industry company within the Materials sector trades at a high 22.0 trailing 12-month GAAP price-to-earnings multiple and pays a high 4.1% dividend yield, according to The Wall Street Journal.

Back in early November, the company reported in-line earnings with a top-line beat. Amcor is also active on the capital deployment plans in terms of capex – over the last few months there have been investments in ePac, PulPac, and the team opened China’s largest flexible packaging plant. These moves could be taken as a signal of management’s optimism despite macro headwinds likely in 2023. And even with the cash outlays, AMCR’s balance sheet is among the higher-quality ones in the industry per BofA. Price volatility in the materials packaging commodities niche is a risk, however.

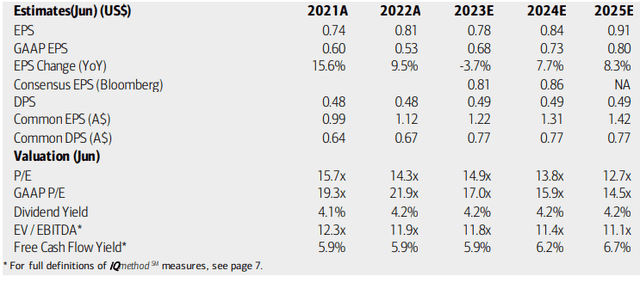

On valuation, analysts at BofA see earnings pulling back modestly next year after a solid 2021 and 2022. EPS growth returns in 2024 and 2025. The Bloomberg consensus forecast is slightly more sanguine than what BofA expects. Dividends, meanwhile, are expected to hold at $0.77 in the years ahead even with positive free cash flow. With a mid-teens operating and GAAP P/Es and a near-market EV/EBITDA ratio, the stock looks good on valuation given the earnings growth outlook through 2025.

Amcor: Earnings, Valuation, Free Cash Flow Forecasts

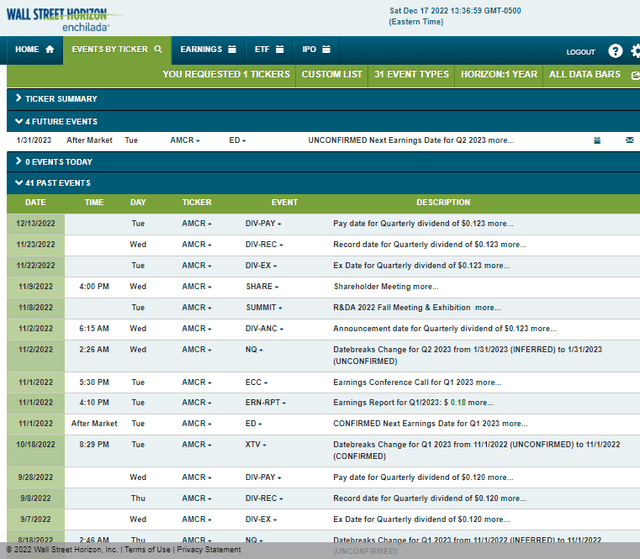

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Tuesday, January 31 AMC. The calendar is light aside from that though.

Corporate Event Calendar

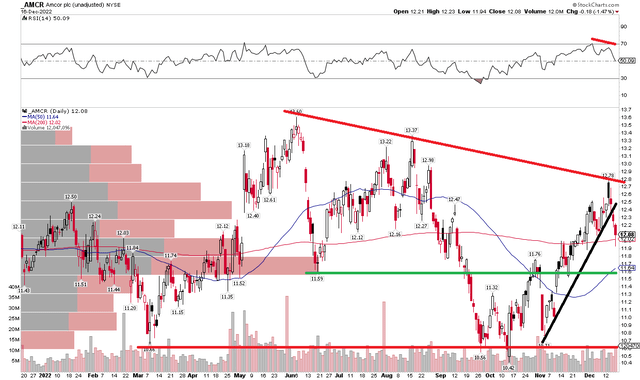

The Technical Take

With impressive relative strength so far this year, what does the absolute chart of AMCR suggest? I see risks of a further pullback. Notice in the chart below that shares ran right up into resistance off the all-time high notched in the second quarter. Since AMCR has broken its near-term rate of trend, I see downside risks to the $11.50 to $12 range – notice how there is a big amount of volume by price at that level as well as the range being a key battleground for the bulls and bears dating back to May. Finally, take a look at the RSI at the top of the chart – there is clear bearish divergence, further lending credence to a pullback. On the positive side, though, the $10.40 to $10.60 looks like good support.

AMCR: Shares Fall From Resistance, Nearing Support

The Bottom Line

Overall, I like AMCR since the stock is so close to support and the valuation is decent. Buying a dip under $12 looks like a good play. Meanwhile, you can collect a solid yield and capture international diversification with this name.

Be the first to comment